Originally published by ZeroHedge | 10.24.17

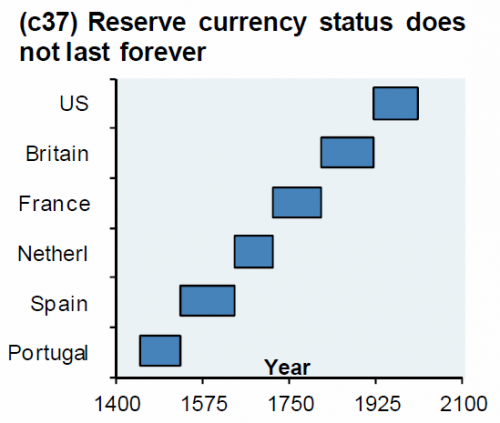

As a reminder, nothing lasts forever…

The World Bank’s former chief economist wants to replace the US dollar with a single global super-currency, saying it will create a more stable global financial system.

“The dominance of the greenback is the root cause of global financial and economic crises,” Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank.“The solution to this is to replace the national currency with a global currency.”

The writing is on the wall for dollar hegemony. As Russian President Vladimir Putin said almost two months ago during the BRICs summit in Xiamen,

“Russia shares the BRICS countries’ concerns over the unfairness of the global financial and economic architecture, which does not give due regard to the growing weight of the emerging economies. We are ready to work together with our partners to promote international financial regulation reforms and to overcome the excessive domination of the limited number of reserve currencies.”

As Pepe Escobar recently noted, ‘to overcome the excessive domination of the limited number of reserve currencies’ is the politest way of stating what the BRICS have been discussing for years now; how to bypass the US dollar, as well as the petrodollar.

Beijing is ready to step up the game. Soon China will launch a crude oil futures contract priced in yuan and convertible into gold.

This means that Russia – as well as Iran, the other key node of Eurasia integration – may bypass US sanctions by trading energy in their own currencies, or in yuan.

Inbuilt in the move is a true Chinese win-win; the yuan will be fully convertible into gold on both the Shanghai and Hong Kong exchanges.

The new triad of oil, yuan and gold is actually a win-win-win. No problem at all if energy providers prefer to be paid in physical gold instead of yuan. The key message is the US dollar being bypassed.

China’s plans for oil futures trading go back more than two decades, with the government introducing a domestic crude contract in 1993 and stopping a year later amid an overhaul of its energy industry.

But in 2013, we first hinted at the birth of the petroyuan was looming…

In doing so China is effectively lobbing the first shot across the bow of the Petrodollar system, and more importantly, the key support of the USD in the international arena… setting the scene for the petroyuan.

And now, we are within two months of it becoming a reality as China prepares to roll out a yuan-denominated oil contract within the next two months…

“Approval of the trading rules by the securities regulator marks the clearance of a major hurdle toward launch of the contract,” Li Zhoulei, an analyst with Everbright Futures, said by phone.“The latest rules raised entry threshold for investors from the draft rules, which shows the government wants to avoid volatility when it first starts trading.”

Which, according to Adam Levinson, of hedge fund manager Graticule Asset Management Asia, will be a “wake up call” for investors who haven’t paid attention to the plans.

A Yuan-denominated oil contract will be a “huge story” in the fourth quarter.

“The contract is a hedging tool for Chinese oil companies. We’re convinced Chinese oil companies will be anchor investors in the Aramco IPO.”

All of which fits with recent comments and actions from Russian and Venezuelan officials…

“Venezuela is going to implement a new system of international payments and will create a basket of currencies to free us from the dollar,” Maduro said in a multi-hour address to a new legislative “superbody.” He reportedly did not provide details of this new proposal.

Maduro hinted further that the South American country would look to using the yuan instead, among other currencies.

“If they pursue us with the dollar, we’ll use the Russian ruble, the yuan, yen, the Indian rupee, the euro,” Maduro also said.

Additionally, Levison warns Washington that besides serving as a hedging tool for Chinese companies, the contract will aid a broader Chinese government agenda of increasing the use of the yuan in trade settlement… and thus the acceleration of de-dollarization and the rise of the Petro-Yuan.

“I don’t think there’s any doubt we’re going to see use of the renminbi in reserves go up substantially”

Levinson was even more sanguine about China’s growing credit exposure.

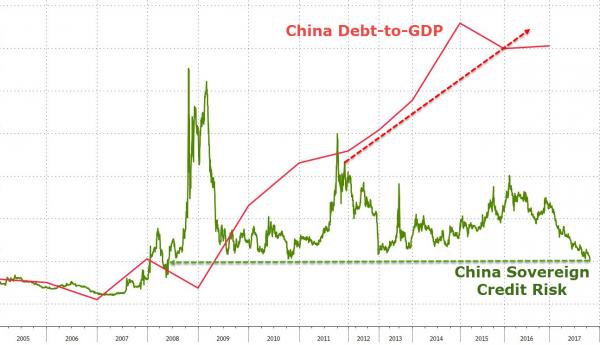

While Chinese debt-to-GDP continues to rise, we note that Chinese sovereign credit risk has collapsed to 9 year lows…

Which as Levinson notes, “All the issues in China are occurring without fully understanding the asset side of the balance sheet.” He is not concerned about China credit issues in the near-term, defining the near term as the next two years, as “the capacity of the sovereign to deal with an issue, should it occur, is pretty significant and therefore important.”

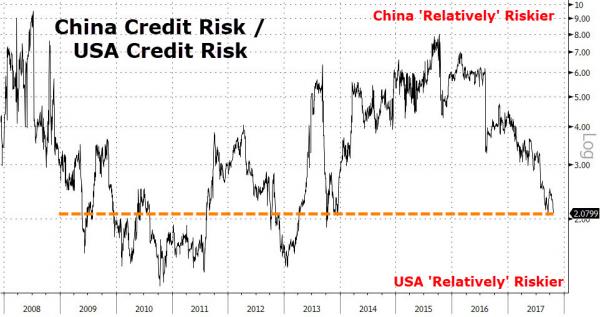

Which appears to the market’s perspective as China is now the least risky relative to US in four years…

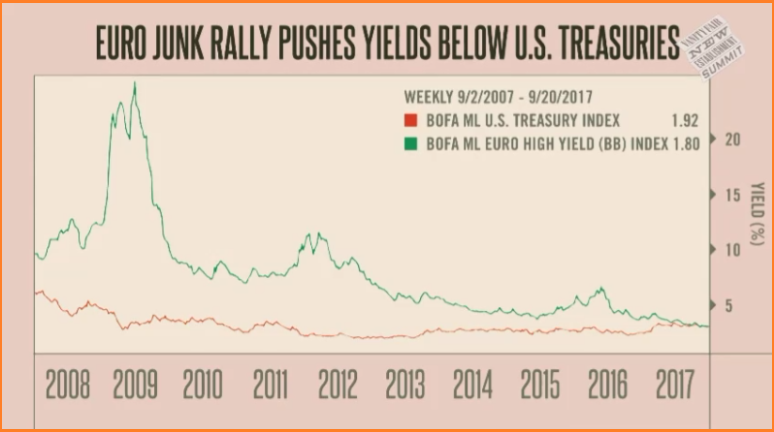

Finally, while he is less concerned about China’s credit, Levinson warns that the lack of volatility as stocks and bonds rally is the “scariest part” of global markets…

“If I am concerned about anything it’s where the level of implied volatility trades,” Levinson said in an interview in Singapore on Tuesday.“It is extremely low. If there is something to be concerned about in global markets, it’s the endogenous level of where implied volatility is trading.”

Small market declines could escalate quickly, Levinson said.

“You don’t know when an event or an issue is going to present itself,” he said.“But when it does, the nature of the volatility construct in markets today is such that if you have a modest correction it will turn into a much more severe one in a short period of time, because of the entrenched structural short-selling of volatility.”

Any increase in market turbulence could trigger dramatic selling and the biggest of those events could be a broader adoption of China’s PetroYuan contract… as Levinson says “will be a huge story” in Q4.

Comments »

While Robert Mueller’s investigation is ostensibly focused on the Trump campaign – conducting a surprise raid on Paul Manafort’s home in July, it will be interesting to see if the Special Counsel chooses to delve into the bevy of documented ties between the the Podesta brothers and Russia.

While Robert Mueller’s investigation is ostensibly focused on the Trump campaign – conducting a surprise raid on Paul Manafort’s home in July, it will be interesting to see if the Special Counsel chooses to delve into the bevy of documented ties between the the Podesta brothers and Russia.