Bond King Jeff Gundlach dropped a bombshell at Vanity Fair’s New Establishment Summit when he told an audience member “I’m not a big fan of bonds right now,” adding “and I haven’t really been for the past four years, even though I manage them, and institutions have to own them for various reasons.”

Gundlach manages a $116 billion bond portfolio out of his Los Angeles-based firm, DoubleLine Capital – of which he casually joked “I’m stuck in it,” adding that he views his job “to get them [clients] to the other side of the valley” – referring to upcominginterest rate hikes. “I’ll feel like I’ve done a service by getting people through,” he said. “That’s why I’m still at the game. I want to see how the movie ends.”

Vannity Fair‘ s William D. Cohan writes:

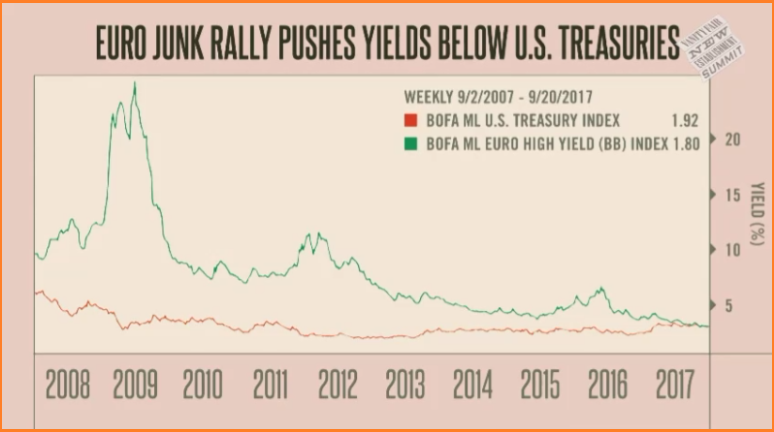

To illustrate his point about the risk in owning bonds these days, Gundlach shared a chart that showed how investors in European “junk” bonds are willing to accept the same no-default return as they are for U.S. Treasury bonds. In other words, the yield on European “junk” bonds is about the same—between 2 percent and 3 percent—as the yield on U.S. Treasuries, even though the risk profile of the two could not be more different. He correctly pointed out that this phenomenon has been caused by “manipulated behavior”—his code for the European Central Bank’s version of the so-called “quantitative easing” program that Ben Bernanke, the former chairman of the Federal Reserve, initiated in 2008 and that Mario Draghi, the head of the E.C.B., has taken to heart.

After explaining that European interest rates should be much higher, Gundlach pointed out that once Draghi realizes this, the order of the financial system will be turned upside down and it won’t be a good thing.

“It will mean the liquidity that has been pumping up the markets will be drying up in 2018 . . . Things go down. We’ve been in an artificially inflated market for stocks and bonds largely around the world.”

Gundlach thinks “the day of reckoning is probably five or six years away, I think, and it has to do with these things I talked about with the entitlements”

Vannity Fair also notes that fixed-income guru James Grant of Grant’s Interest Rate Observer cited two recent examples of bond insanity in his Sept. 22 issue.

Grant noted that a senior unsecured bond, due in 2022, issued by Carrefour S.A., the world’s second-largest food retailer after Walmart, yields just 50 basis points, or half of 1 percent annually. Period. While it is true that Carrefour has a modest debt-to-cash-flow ratio of a little more than two times, the yield on the bond suggests the company is virtually risk-free, which is almost certainly not the case. Grant also mentioned a senior unsecured bond, due in 2018, of Toys “R” Us, the toy retailer that recently filed for bankruptcy. The bond, he noted, “spent the summer vacation lounging in the vicinity of 95 cents on the dollar” before “[e]arly September rumors of a debt restructuring interrupted that idyll.” The bond now trades at 26 cents on the dollar. “Like the flu, mispricing is communicable,” Grant wrote.

Watch the entire interview below:

If you enjoy the content at iBankCoin, please follow us on Twitter

This same argument exists and has been valid since 2007 when QE started. Gundlach is not such a guru or being that profoundly insightful. I mean, who would be when the usual synagogue suspects at the FED are rigging all markets, especially bond markets, daily and suspended all common sense. How else can gov’t bonds be at 0% with unrepayable debt?