As Fly noted this morning, China “retaliated” against Trump’s $60 billion in tariffs with a proposal to slap $3 billion in U.S. imports with tariffs of their own. We all had a good laugh at how limp-dicked that was – but turns out, that was just in retaliation for Trump’s steel and aluminum tariffs!

Adding to their potential response, China’s ambassador to the U.S., Cui Tiankai noted that China may scale back purcahses of Treasurys in response to the tariffs:

“We are looking at all options,” he said, when asked whether China would consider reduced purchases of Treasuries. “That’s why we believe any unilateral and protectionist move would hurt everybody, including the United States itself. It would certainly hurt the daily life of American middle-class people, and the American companies, and the financial markets.”

Second – Citi noted that Hu Xijin, editor-in-chief of state-controlled Chinese newspaper Global Times tweeted “I learned that Chinese govt is determined to strike back,” adding “Friday’s plan to impose $3b tariffs is to retaliate tariffs on steel and aluminum products. China’s retaliation lists against the 301 investigation will target US products worth $ tens of billions. It is in the making.”

I learned that Chinese govt is determined to strike back. Friday's plan to impose $3b tariffs is to retaliate tariffs on steel and aluminum products. China's retaliation lists against the 301 investigation will target US products worth $ tens of billions. It is in the making.

— Hu Xijin 胡锡进 (@HuXijin_GT) March 23, 2018

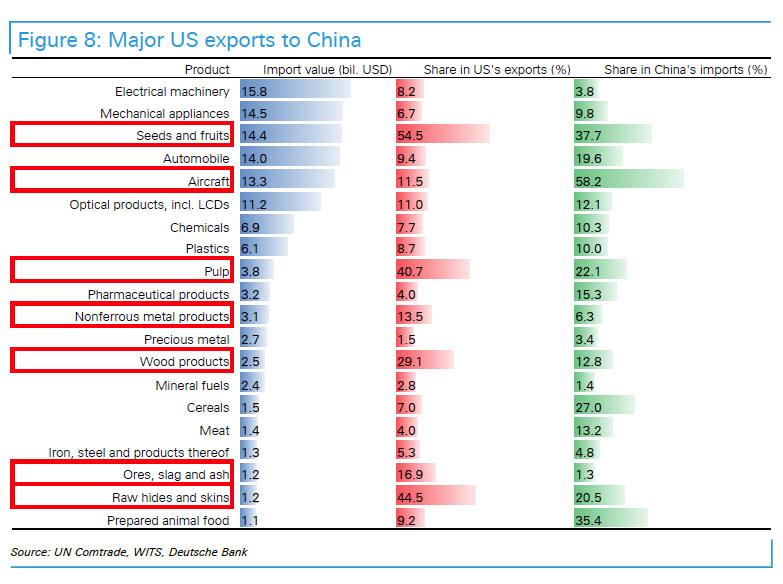

The United States exports roughly $115.6 billion to China, according to official data. Affected goods in this week’s $3 billion proposal include wine, fresh fruit, dried fruit and nuts, steel pipes, modified ethanol and ginseng – according to China’s commerce ministry. Those products would see a 15% duty, while U.S. pork and recycled aluminum goods could see a tariff of 25%, according to the ministry’s statement.

U.S. agricultural products – particularly soybeans, have been flagged as a particular item of interest in President Xi Jinping’s crosshairs – affecting a $14 billion per year business.

That said, half of U.S. soybeans exported to China were already set to fail Beijing’s new quality control regulations which went into effect Jan 1, so focusing the new tariffs on a commodity which was already at risk makes China’s $3 billion in new tariffs seem even more milquetoast.

“China does not want a trade war with anyone,” the Chinese government said through their Washington embassy on Thursday. “But China is not afraid of and will not recoil from a trade war.”

Trump slapped China with retaliatory tariffs on up to $60 billion in imports, following a so-called 301 investigation into China’s potentially unfair trade practices spearheaded by U.S. Trade Representative Robert Lighthizer.

Lighthizer told the Senate Finance Committee on Thursday that the new tariffs on Chinese imports will apply to aeronautics, modern rail, new energy vehicles and high tech products.

Trump will consider further actions against China in two weeks, based on the effect of the first phase of the tariffs, CNBC reported Wednesday, citing sources. The president is reportedly concerned about the severity of the new measures’ impact on American universities.

The Trump administration has regularly highlighted China’s $375 billion surplus with the U.S. as evidence of an unfair trade relationship.

In an opening statement to the House Ways and Means Committee this week, Lighthizer said that long-term trade deficits “to some extent reflect market distortions” and they are “having a negative effect on U.S. workers and businesses.” –CNBC

House Ways and Means Committee chairman Kevin Brady told CNBC that Trump should be cautious on slapping tariffs on Chinese goods.

“The challenge for every president is how to do it in a way that doesn’t punish Americans for China’s misbehavior,” Brady said. “So, you’ve really got to narrow these and target these. It is a very discerning line to do that.”

Lighthizer also suggested that the U.S. may take action against the World Trade Organization for its alleged failures on promoting a fairer trade landscape. The Wall Street Journal reported Tuesday that the Trump administration is weighing the possibility of a lawsuit against the WTO policies that cover Chinese trade. –CNBC

Meanwhile as ZeroHedge reported last night, President Trump has decided to exclude multiple nations (and The EU) from steel and aluminum tariffs through May 1st – but not China or Japan.

This action confirms what Ambassador Lighthizer suggested earlier in the evening, which perhaps explains the negligible response to this modest retreat in the trade war.

Meanwhile, American officials have been raising their concerns about China’s IP practices since Bill Clinton was president, and Beijing has repeatedly failed to deliver on promises to reform, but now, as Bloomberg reports that the order will target more than 100 different types of Chinese goods, according to a person familiar with the matter, who spoke on the condition of anonymity.

The value of the tariffs was based on U.S. estimates of economic damage caused by intellectual-property theft by China, the person said.

Lastly – lest us not forget, China will begin trading its petroyuan futures contract next week (3/26), so while the $3 billion “retaliatory” tariffs may seem like weak sauce – China may find other ways to mess with the West.

As ZeroHedge also noted in January, China has been planning this for a number of years and given rising tensions, now seems like a good time for China to flex a little.

The Shanghai International Energy Exchange, a unit of Shanghai Futures Exchange, will be known by the acronym INE and will allow Chinese buyers to lock in oil prices and pay in local currency. Also, foreign traders will be allowed to invest — a first for China’s commodities markets — because the exchange is registered in Shanghai’s free trade zone. Even Bloomberg admits there are implications for the U.S. dollar’s well-established role as the global currency of the oil market, as Sungwoo Park sums up some of the key questions…

1. When will trading begin?

According to the Shanghai-based news portal Jiemian, which cited an unidentified person from a futures company, trading is expected to start Jan. 18. Multiple rounds of testing have been carried out and all listing requirements met. The State Council, China’s cabinet, was said to have given its approval in December, one of the final regulatory hurdles. The push for oil futures gained impetus in 2017 when China surpassed the U.S. as the world’s biggest crude importer.

2. Why is this important for China?

Futures trading would wrest some control over pricing from the main international benchmarks, which are based on dollars. Denominating oil contracts in yuan would promote the use of China’s currency in global trade, one of the country’s key long-term goals. And China would benefit from having a benchmark that reflects the grades of oil that are mostly consumed by local refineries and differ from those underpinning Western contracts.

3. How do oil futures work?

Futures contracts fix prices today for delivery at a later date. Consumers use them to protect against higher prices down the line; speculators use them to bet on where prices are headed. In 2017, oil futures contracts in New York and London outstripped physical trading by a factor of 23. Crude oil is among the most actively traded commodities, with two key benchmarks: West Texas Intermediate, or WTI, which trades on the New York Mercantile Exchange, and Brent crude, which trades on ICE Futures Europe in London.

4. Why didn’t China begin trading futures until now?

Lower crude prices have played a part. Chinese oil futures were proposed in 2012 following spikes above $100 a barrel, but prices in 2017 have averaged little more than $50. There’s also concern over volatility. China introduced domestic crude futures in 1993, only to stop a year later because of volatility. In recent years, it repeatedly delayed its new contract amid turmoil in equities and financial markets. Such destabilizing moves have often prompted China’ government to intervene in markets in one way or another.

5. What’s China’s track record in commodities?

Nickel was the last major commodity to be listed there in 2015; within six weeks, trading in Shanghai surpassed benchmark futures on the London Metal Exchange, or LME. In China, speculators play a far greater role, boosting trading volumes but making markets susceptible to volatility. In early 2016, the then-head of the LME said it was possible some Chinese traders did not even know what they were trading as investors piled into everything from steel reinforcement bars to iron ore. Steep price rises relented when China intervened with tighter trading rules, higher fees and shorter trading hours.

6. Will foreigners buy Chinese oil futures?

That remains to be seen. Overseas oil producers and traders would need to swallow not just China’s penchant for occasional market interventions but also its capital controls. Restrictions on moving money in and out of the country have been tightened in the past two years after a shock devaluation of the yuan in 2015 prompted a surge in money leaving the mainland. Similar hurdles have kept foreign investors as bit players in China’s giant stock and bond markets.

7. Could the yuan challenge the dollar’s dominance in oil?

Not any time soon, since paying for oil in dollars is an entrenched practice, according to some analysts. Shady Shaher, head of macro strategy at Dubai-based lender Emirates NBD PJSC, says it makes sense in the long run to look at transactions in yuan because China is a key market, but it will take years. Bloomberg Gadfly columnist David Fickling argues that China doesn’t have “nearly the influence in the oil market needed to carry out such a coup.” On the other hand, paying in yuan for oil could become part of President Xi Jinping’s “One Belt, One Road” initiative to develop ties across Eurasia, including the Middle East. Chinese participation in Saudi Aramco’s planned initial public offering could help sway Saudi opinion toward accepting yuan, which is used in only about 2 percent of global payments.

The era of the petro-yuan is at hand.

Of course there are questions on how Beijing will technically manage to set up a rival mark to Brent and WTI, or whether China’s capital controls will influence it. Beijing has been quite discreet on the triple win; the petro-yuan was not even mentioned in National Development and Reform Commission documents following the 19th CCP Congress last October.

What’s certain is that the BRICS supported the petro-yuan move at their summit in Xiamen, as diplomats confirmed to Asia Times. Venezuela is also on board. It’s crucial to remember that Russia is number two and Venezuela is number seven among the world’s Top Ten oil producers. Considering the pull of China’s economy, they may soon be joined by other producers.

Yao Wei, chief China economist at Societe Generale in Paris, goes straight to the point, remarking how “this contract has the potential to greatly help China’s push for yuan internationalization.”

It ain’t over till the fat (golden) lady sings. When the beginning of the end of the petrodollar system – established by Kissinger in tandem with the House of Saud way back in 1974 – becomes a fact on the ground, all eyes will be focused on the NSS counterpunch.

If you enjoy the content at iBankCoin, please follow us on Twitter

It goes to show how hollowed out US economy is – exporting bird seeds to China and bringing back value-added manufactured consumer/industrial goods.

God damn it’s fucking quiet here. Infowars must be giving a better deal on ghostwriting than Fly’s traffic bonus incentive eh

Looks like the troll farm got raided.

Good riddance.

Which ETF do you recommend to expose future of China/Asia? Thank you!

Made in China crap.

It’ll happen quickly.

We no buy anymore…

Hey China.. Blink. I double dog dare you.

Hehehe

How did sarc come back???? What did he did he do to deserve these halls?

Looks like China and bringing back value-added manufactured consumer/industrial goods.

Good riddance.

Start your home business right now. Spend more time with your family and earn.Start bringing 55$/hour just on a computer. Very easy way to make your life happy and earning continuously………….www.worksbaar.com

Fubo TV Connect is a popular streaming service that offers live sports, entertainment, and news channels. It provides access to a wide range of sports content, including major leagues, tournaments, and events. FuboTV also offers a variety of entertainment channels, including those for TV shows, movies, and news

Fubo.tv/connect

Come join me on this exciting adventure! Drift Boss