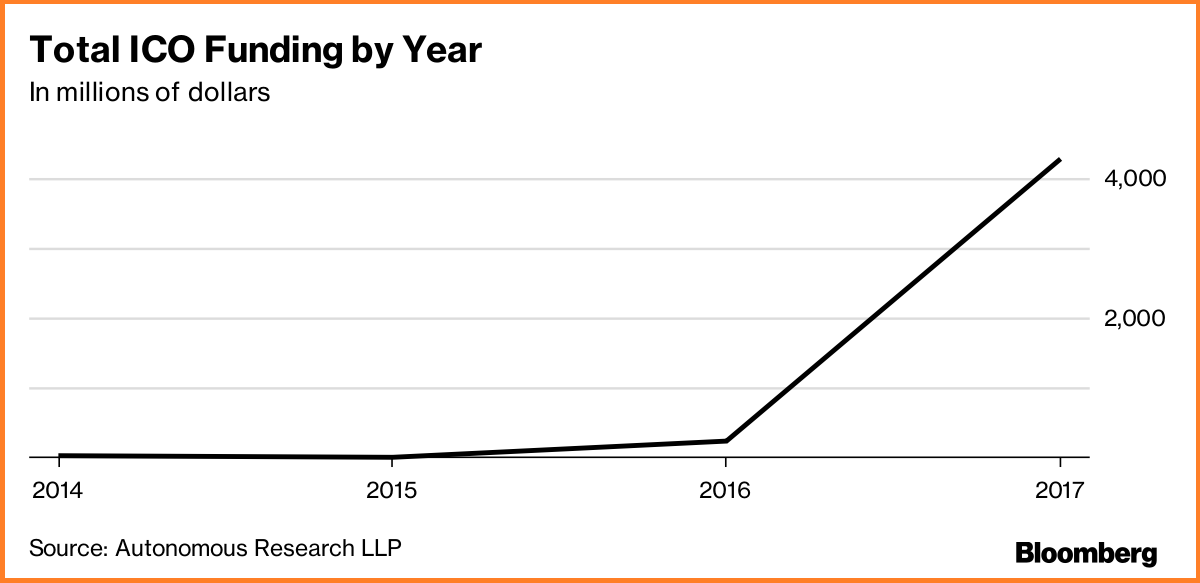

2017 has been a year of retarded gains. Not only has the S&P 500 returned over 20% YTD in what was predicted to be a dismal Trump-inspired rout by idiots wearing ill-fitting Jos. A. Bank attire, billions have been raised out of thin air in ICOs of various cryptocurrencies – over $4 billion in fact, according to data from Autonomous Research, LLP.

The SEC’s Jay Clayton reiterated Monday that cryptocurrency sales should be regulated by the agency, adding that investors should be on high alert for promotors who claim to offer crazy returns, along with ICOs that don’t comply with securities regulations.

While Bitcoin’s market value now exceeds the GDP of over 130 countries (probably more since that was written), and the overall Cryptocurrency market cap exceeding half-a-TRILLION dollars – John McAfee’s dick grows safer by the day.

The top 5 ICOs by amount raised in 2017 are below:

I think it’s time for Fly to issue iBankCoins…

If you enjoy the content at iBankCoin, please follow us on Twitter

The pool of fools is bottomless.

sarc – The fool of pools is bottomless as well, if you really think about it.

Penthouse in Miami…. price 33 bitcoins, only taking Btc!

https://www.redfin.com/FL/Miami/480-NE-30th-St-33137/unit-2206/home/43370743

If enough people lose money on these the SEC is gonna bring the homo hammer down hard. It’ll take a while for the SEC to get their act together, but ICOs are the greatest fraud tool since snake oil, so it’s coming.

No way they will classify them as anything other than securities and a fancy way to avoid accredited investor status.

So what happened thanks to the dot.com boom is that lots of comapnies went bankrupt, but laid out the infrastructure for high-speed interent before they went.

Simirlarly, loose CB policy has produced a lot of “liquidity”, and the ICO market is the mop. This should end up the same way: a trial by fire with a lot of losers, but at least a good cahnce that good ideas will get funded.