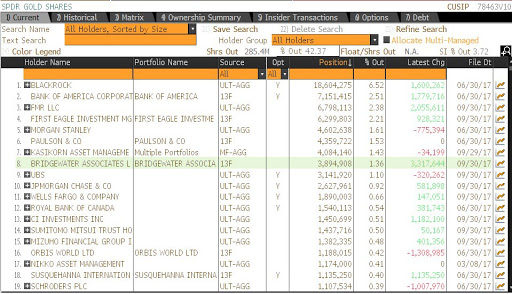

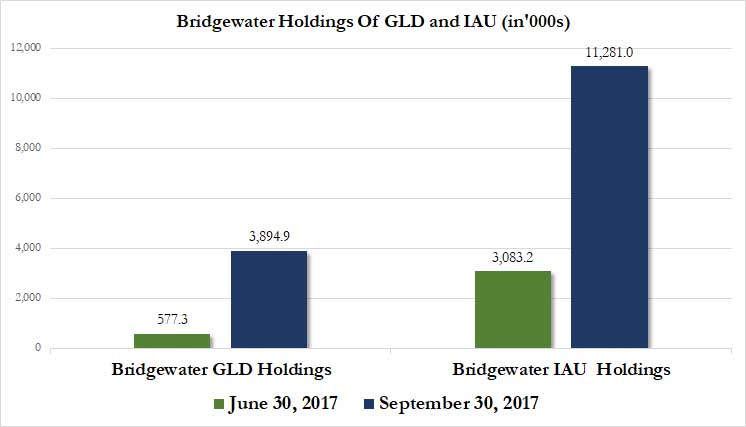

Connecticut-based hedge fund Bridgewater Associates just loaded up on gold – buying 3.3 million shares of the the SPDR ETF, GLD ($GLD), bringing his total position to 3.894 million shares of the paper derivative, worth around $473 million.

The shift into precious metals by the world’s largest hedge fund follows comments by founder Ray Dalio, who urged investors to buy gold in August in case “things go badly.” Until last quarter, Bridgewater didn’t own precious metals, until dipping their toes into Gold with a $68.1 million position in GLD, along with a $36.8 million position in Silver via the ETF $IAU.

Dialo increased his position in the Silver ETF, IAU by a whopping 266% from 3.1 million shares to 11.3 million.

That’s nice and all Ray, but I’d rather have 1/2 billion dollars of physical gold and silver bars in a vault…

Tax cut play?

If it hits the fan won’t they all be in the funnel to get out of this ETF? I’m a novice, but I think this is a trade, not an actual end of days strategy.

Inconsequential. Unless he takes delivery. Which he won’t. Another stupid paper play.

Ray knows that. It’s got to be a directional bet. Does anyone really think the party’s going to stop anytime soon and we get some catastrophic event? Like big Gary Cohn and Steve Mnuchin wouldn’t take the helicopter out until the rotors fall off. They’ve had a decade to sort out contingencies for the next time SHTF.

Yes, there are those that think the party will stop very soon. Like 2018. War. It will start with a false flag. But it wont be Mossad, wink wink. That’s why all this ‘divide and conquer’ ruse…. left/right, straight/queer, christian/muslim, men/women(feminazi), conservative/liberal, etc. so we’re busy fighting each other while the usual synagogue suspects collapse the financial system, put the blame on disorderly population, slink away and bring us their NWO solution from new HQ in that Satan’s den, Greater Israel.

So lets say you renewed your home insurance last year. You sent the insurance company a check for say maybe $3,000. OK now it’s a year later and you house didn’t burn down. Are you pissed? Well shouldn’t you be? After all you just squandered 3K with nothing to show for it. You’re out $3,000 and now the modern day carpetbaggers (nowadays referred to as an insurance company) want $3,400 to insure the exact same house for next year. Thank god there’s no inflation. But what if your house doesn’t burn down next year? Now you’re out $6,400 and again with nothing to show for it cause the damn thing is still standing and along comes the insurance company and now they want $3,900 to insure your house for another year. Talk about throwing good money after bad.

You do see where I’m going here? You insure your home, car, or other items to protect yourself against an unforeseen event. You’re just trying to cover yourself in the event of a major, unforeseen event which would or could cause major financial hardship. You can’t even begin to know what that event might be. It could be a hurricane, tornado, lightning strike, electrical fire, hell who knows. You’re simply putting on a hedge.

Gold is really no different. People buy it to cover themselves in the unlikely event that an unforeseen event arises which would or could cause significant financial problems. The one difference with Gold vs regular insurance is that you only have to buy it once. You’ll never get a renewal policy letter in the mail.

“take the helicopter out until the rotors fall off.” And yet, similar aeronautical efforts, have failed. Yen is at 113 to the dollar, today.

If the last decade has taught us anyfuckingthing, it’s that they will not use the helicopter. Helicopter cash gets dispersed among the many, they prefer a nice clean rifle shot – – directing money only to the chosen.