UK Prime Minister Theresa May’s gambit to secure more Conservatives in parliament via ‘snap’ election has backfired, and with it the chances of the expedited Brexit she was hoping for.

UK Prime Minister Theresa May’s gambit to secure more Conservatives in parliament via ‘snap’ election has backfired, and with it the chances of the expedited Brexit she was hoping for.

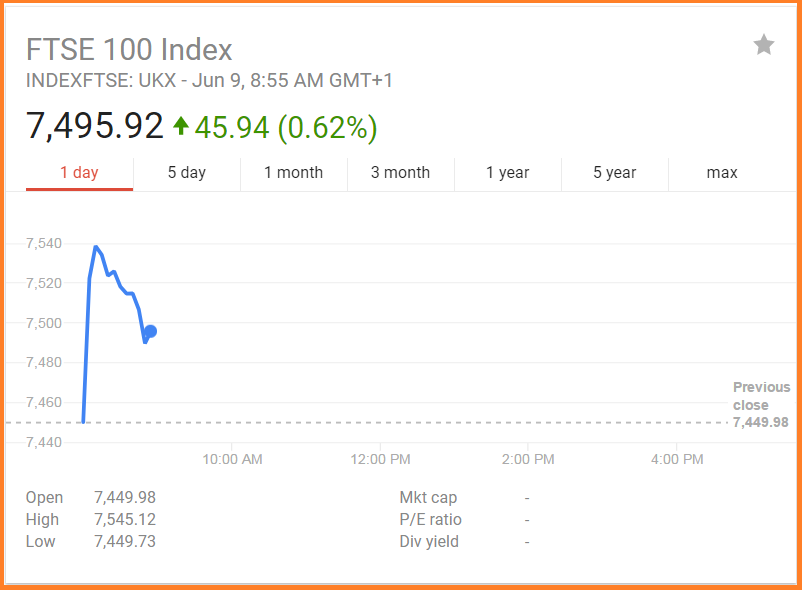

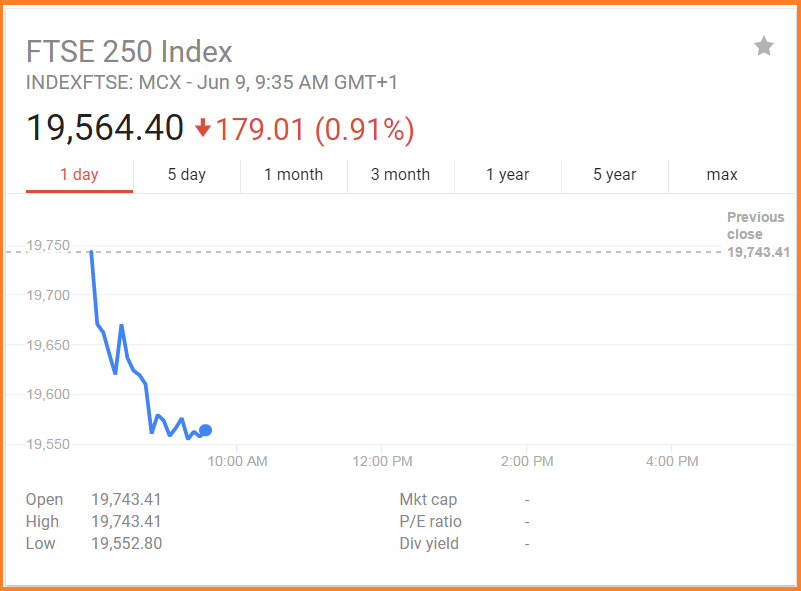

On the news of May’s drubbing, and the prospect of a worst case ‘hung parliament’ which means there is no majority party – the British Pound (GBP) fell over 2% against the US Dollar, while the UK’s FTSE 100 Index opened strong – up 1% before moderating. The broader FTSE 250 is down, and US futures are up slightly as of right now.

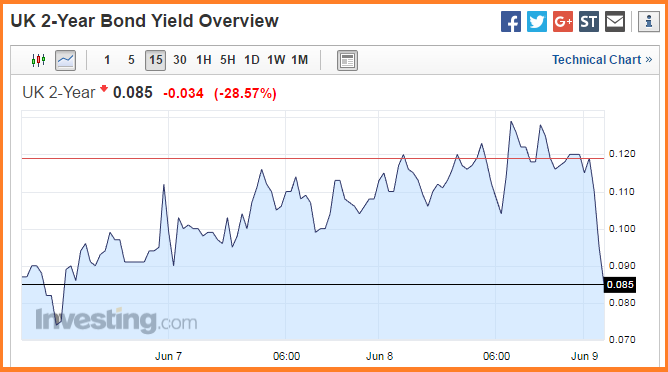

Shorter duration UK bonds have gone crazy – with the yield on the 2 year note down over 28%.

[Of note, the FTSE fell over 8% on June 24th, 2016 – the day after the UK voted for Brexit.]British Pound (GBP)

FTSE 100

FTSE 250

2 year bond yield

No red tape (for now) = green market?

While Brexit was set to liberate the UK from the shackles of bailing out Greek tax cheats and other EU Ne’er-do-wells, it’s clear that investors weren’t looking forward to the complicated breakup.

Not only have several UK industries begged the government to stay in the EU, there are miles of red tape in just about ‘every sector’ according to the Financial Times.

Almost every sector you can think of. Take for example the chemicals industry that is heavily regulated by Brussels, with a huge EU rule book covering tens of thousands of substances. Since the regulations in effect allow producers to trade in Europe, industry watchers say a tailored British equivalent of the EU rule book will eventually be needed — with a new regulator to oversee it.

However, that is just one sector. In banking, the government will have to decide who rules on capital definitions for UK banks — the Bank of England, the Treasury or parliament. In agriculture, who will be responsible for approval of genetically modified crops or other products? Will the UK abide by all EU pharmaceuticals approvals? Will it maintain the same patent protections for drugs, even if it pushes up costs for the National Health Service.

So while Brexit is clearly good for borders, language, and culture – it appears the market is presently looking forward to the prospect of continued economic integration with the European Union and the stability that accompanies bending over just a little longer.

If the Brexit Secretary is considering putting the single market back on the table then the whole process is now seriously damaged. pic.twitter.com/vQccR0xesU

— Nigel Farage (@Nigel_Farage) June 9, 2017

Sorry UK Conservatives…

If you enjoy the content at iBankCoin, please follow us on Twitter

The more information is available regarding this “political blunder”, the more I am convinced this was the plan all along and Brexit is not happening:

https://tinyurl.com/yagmdr8v