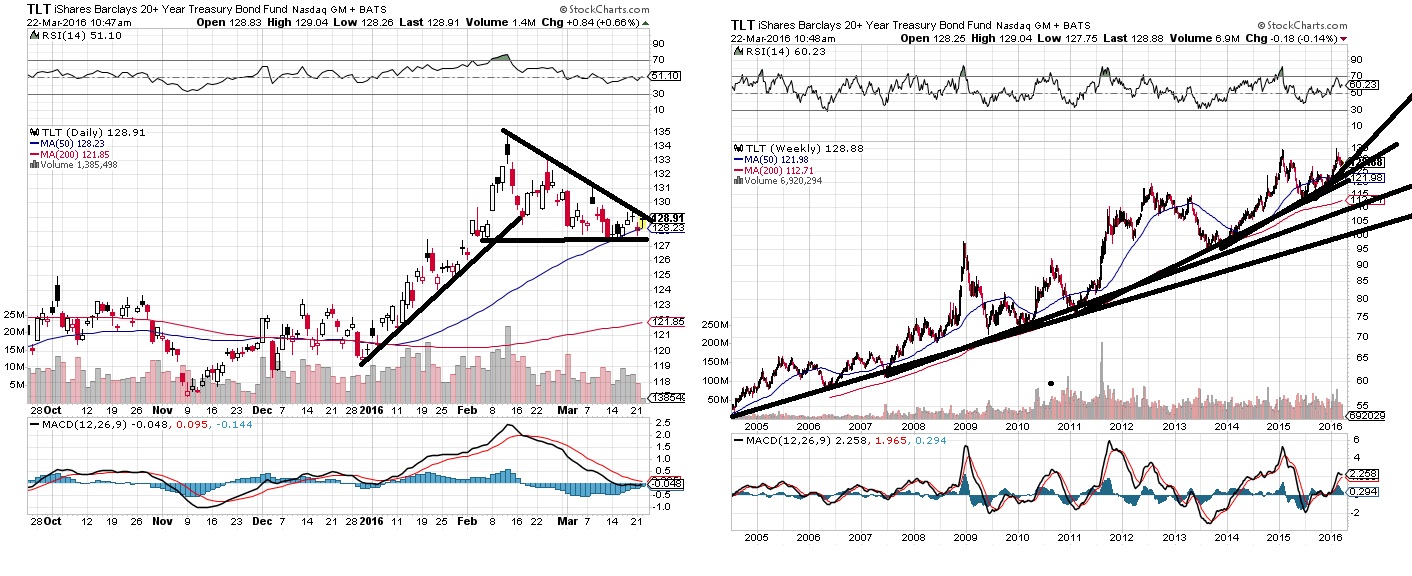

On the “weeks to months” time frame, TLT may be making a topping pattern. You have a huge concentration of capital culminating in a enthusiastic type of move. You have an equal low made, and the next rip offers a manageable entry. You’ll know pretty quickly if you’re wrong, and it’s possible it’s just setting up for the next leg higher as you could interpret it as a wedge pattern as well. The enthusiastic move above makes me think lower for now.

However, the longer term time frame shows the makings of a developing parabolic market with a steepening trendline. Maybe that topped out in 2015 and simply retested that top in early 2016. Maybe not.

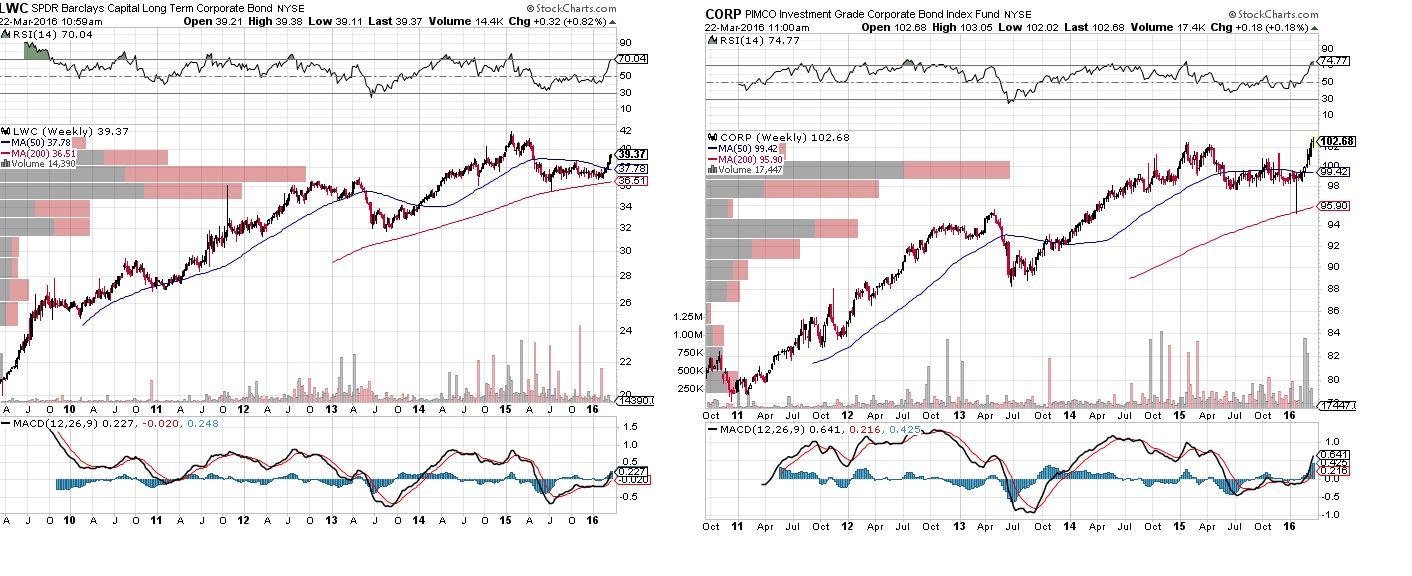

Meanwhile, corporate bonds are breaking out, seeing capital inflows

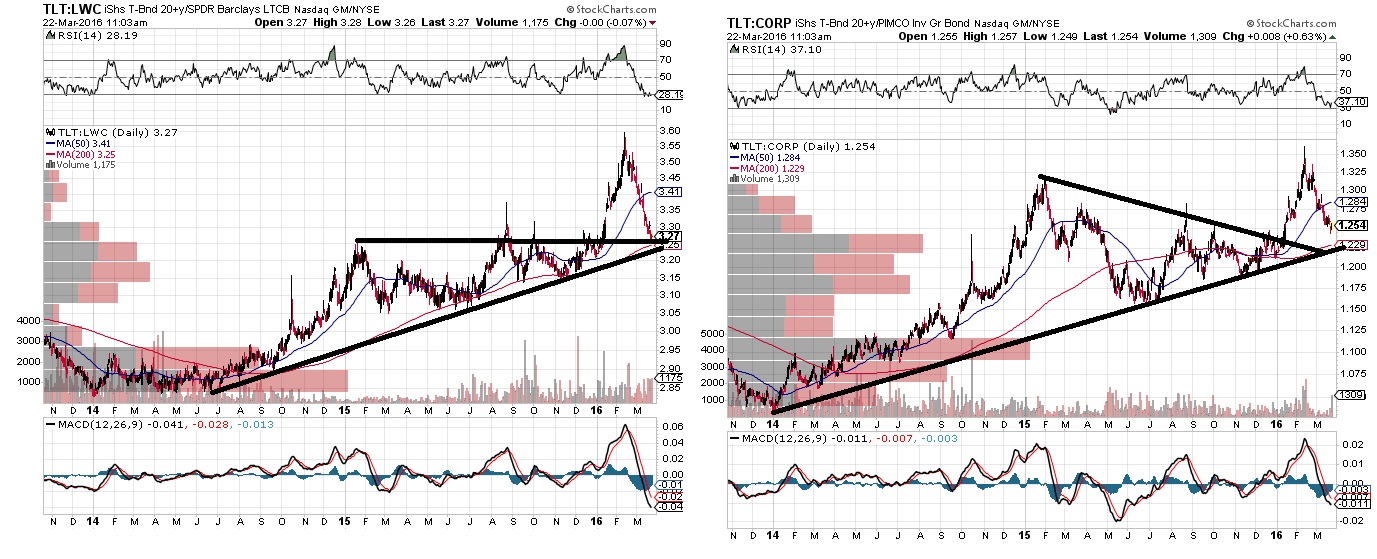

The ratios of TLT to corporate bonds shows it may just be temporary, and pulling back to the trendline. If the trendline holds, you would see TLT outperform corporate bonds as the ratio trends higher.

Nevertheless, there’s a huge amount of capital that is moving to and from bonds, depending both on capital flows as well as potentially indicating inflation of capital and leveraging up, or deleveraging, so it will be an important development to watch.

From time to time bonds flips correlations with stocks as well. Either both bonds and stocks trade up in a bull market of growing wealth and increased leverage in the system. Or bonds is the “flight to quality” or “risk off” trade during tough times, while stocks tend to be the “risk on” trade. If the treasury bond markets gets too saturated on this generational cycle, it’s possible that everything we know about the relationships between stocks and bonds will eventually flip for the first time since the early 1980s. The flip would be the first time bond yields reversed a downtrend and began an uptrend since the 1940 low. 1942 was the first higher low since the 1933 low. Both stocks and bond yields trended higher (bonds prices lower) from 1942 to around 1969. A bull market with rising interest rates may result. Corporate paper or just cash may be the flight to quality trade instead… But perhaps that doesn’t happen for longer still.

If you enjoy the content at iBankCoin, please follow us on Twitter