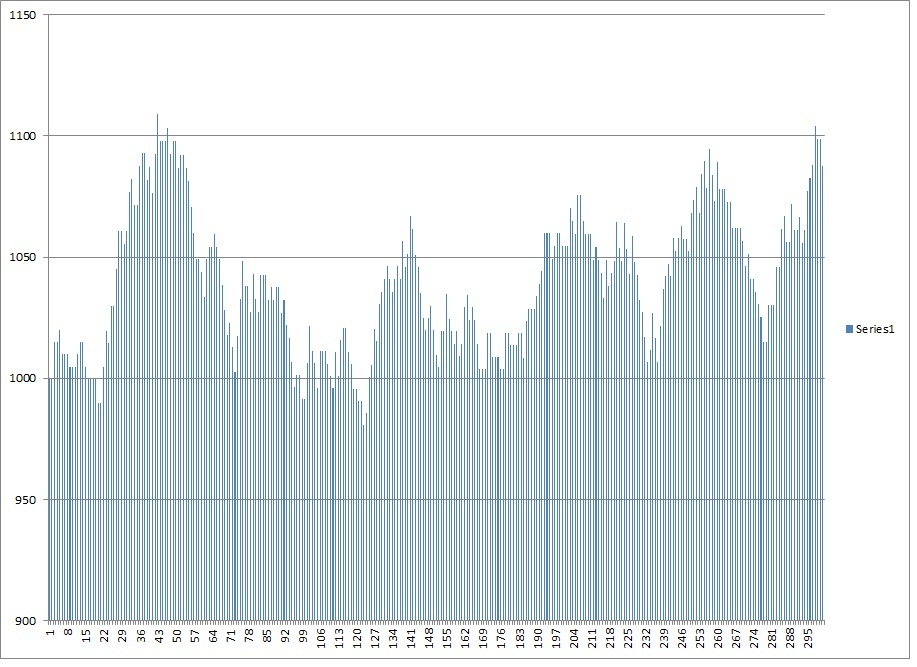

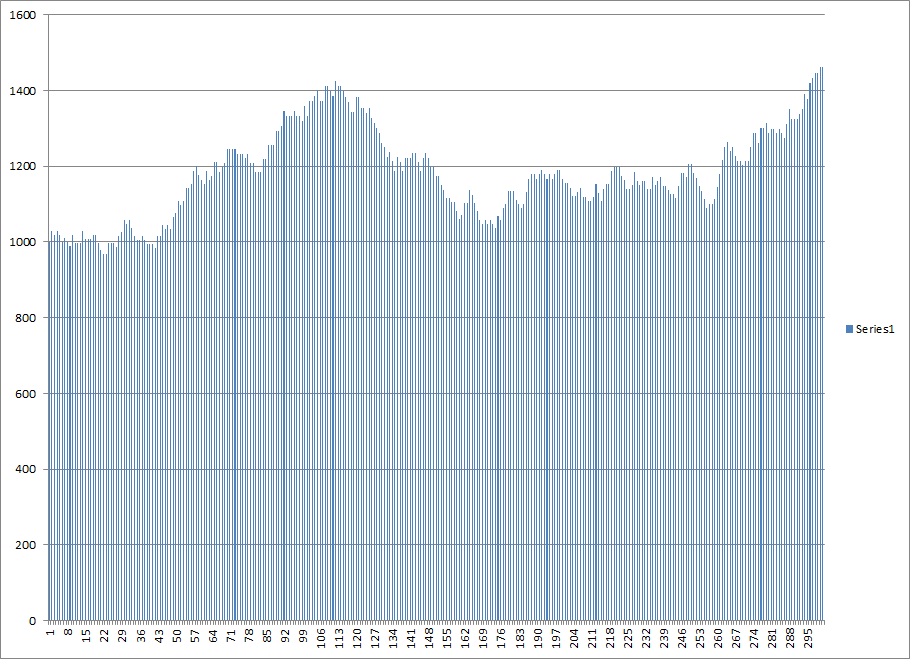

Silver dipped below 31.50 so I bought calls because I feel it is on the verge of doing something soon. A long term chart shows silver coiled up here. Since it is a long term pattern a daily close below support would not be that significant, but a monthly close would be. As we approach the end of the month, I decided to play the dip by buying in anticipation of a bounce.

Do not confuse this with a long term play as below support there lurks danger.

1)I think bulls will defend this month and try to keep gold above 30.50. If they defend successfully, we could rally strongly here.

2)If they fail to defend (as it looks like we are headed for if we do not get a change in trend) I suspect they still attempt a short lived rally right here or in a day or two before we trade lower to close out the month. The downside move in the short term, likely has played out or is close to it (unless we are on the verge of a long er term breakdown.).

3)Worst case scenario for weekly calls is we dip below 30.50 and rally to close the day just above it to give a signal that we will likely see new highs in the future or near it to give really a lack of a clear signal.

4)I bought calls instead of SLV because I feel that we potentially could crash very hard in a very short amount of time if/when we breakdown and I wanted to limit exposure. A lot of the buyers that want to buy for the time being have done so leading up until the peak (and the peak of gold)

5)In hindsight, I am having buyers remorse a bit. Not that I regret buying but I bought weekly calls in addition to april calls. I should have probably only bought the APR calls because then I still have enough time left come first trading day of April to determine if the bulls defended successfully or not, and to get out of the trade with still some premium, and I can still sell a short term bounce if I nail the bottom here. APR calls probably offer the most flexibility. If you are after stability per dollar risked, you need to buy longer term calls s there always is a healthy time premium if trade goes against you. This way, your percentage loss is less, even though your percentage gain is limited. I am not aggressively loading up on calls here, just a few extra calls beyond what I would have to replace the underlying if I were to buy SLV here.

I will reevaluate come April 1st for potentially rolling options to a longer term hold, or playing the downside with longer term puts.

A little bit backwards technical analysis is done here as the downside target was around 31.50-32 in silver and we are at these levels and typically that is a signal to get out of any bearish bet. I did use some GLD and SLV puts as a hedge but I took off the trade earlier this week. Bulkowski’s research (in his book Encyclopedia of Chart Patterns

) on technical analysis gave me an interesting idea of flipping it on it’s head. A lot of stocks might breakdown an average of 20% with a particular pattern but then they on average, once the trend reverse I believe every pattern would end up higher than the breakdown point. So either accumulating a position as it breaks down or buying if it reaches the downside target actually MAY be a good decision, although it generally lacks the clear need of support and where to sell making it difficult to manage. So I rarely plan on doing this, but the move is coiled up and near support so it is manageable and makes sense to me. I also like the idea of buying a business or commodity at a LOWER price as a result of technical analysis even for a dip buy, but the clear problem in many cases is management of the trade.

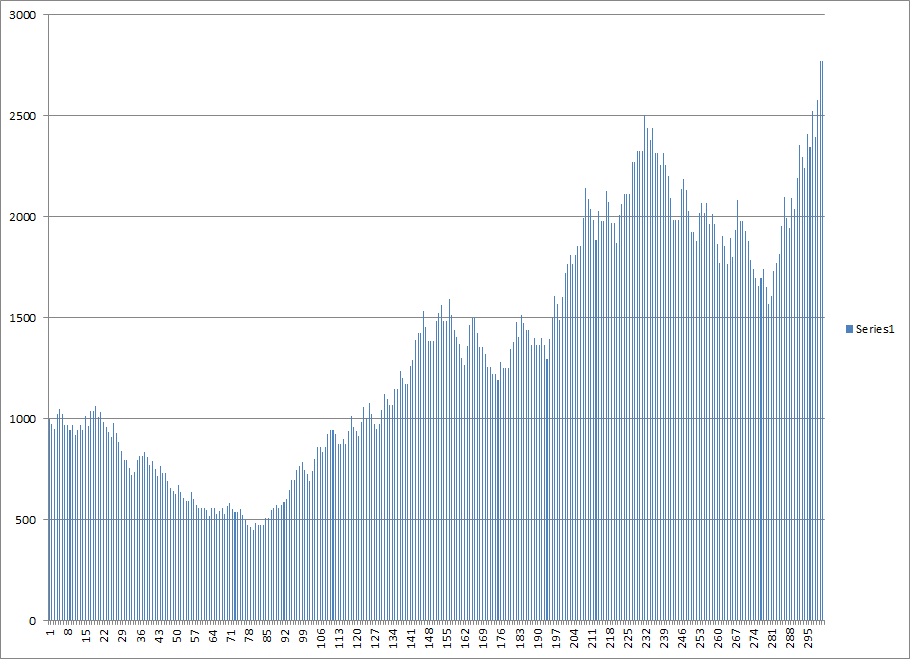

Personally, in the grand scheme of things I prefer a monthly close below 30.50. The reason is, a breakdown lasting until most of 2012 (August is est. time frame for end of the move with possibility it spills over into early 2013 not outside the range of possibilities) would be excellent for managing my trades. Even though I am hoping for a dip in stocks before I get too aggressive with my cash hoard, with the VIX low I am content to place a small amount of capital in options and play the upside. But while doing so, I feel exposed, and if I could hedge with some SLV or GLD puts every now and then it would allow me to get more aggressive. Additionally, I feel a strong correction in 2012 will be helpful as it will flush a lot of buyers out, work off the overbought levels and set the stage for a run up in gold over the next several years, because nations around the world are in trouble and all the money in bonds has to go somewhere, especially when every bond printed is also a dollar that pays interest and accumulates more debt as a result. The higher interest rates will result in higher debt payments when the DEBT is rolled. FYI Spain and Portugal will roll their debt in 2012 here. It is not just Europe, but JAPAN has a very poor debt to GDP scenario as well and the US has lots of unfunded liabilities, although debt to GDP is not as bad as other parts of the world. I don’t know who started the idea that higher interest rates were “bearish”. This is sometimes true perhaps, but when Japan has lowered interest rates for decades as their stock market declined, or the lowering interest rates during 1929-1932 (yes they hiked it at one point then immediately started easing. Whitney Tilson and others have shown that stocks tend to be more bullish with rising interest rates. Robert Prechter, and others showed how major depressions and declines happened during periods of falling interest rates. Rising interest rates means MONEY is in demand and people are willing to pay up for it, and are not willing to accept low yields with money on sidelines while there are so many other places to put the money.

Well I am getting off on a tangent now like I do too easily, but for now there is a ton of speculative excess still in gold and silver markets that could potentially be squeezed out even though a significant part of that move has happened. If we rocket higher from here instead, in the long run, I think silver and gold will top out sooner, and crash harder for longer, and be less predictable. A healthy correction would be favorable in my opinion. I may be getting a tad overzealous here and it may be more prudent to wait until April 2nd to place a trade in precious metals when we know whether or not we hold monthly support here around 30.50

If we break down, the initial breakdown of the longer term chart gives a target is around 25. secondary target could even be as low as 15. but I suspect we will set up another pattern by then if we breakdown

If we hold, initial pattern doesn’t face resistance until nearly 35 with huge upside if we break resistance from there, which I suspect will happen (IF we hold the monthly level significantly above 30.50).

I would say this month is pretty much do or die for the bears on whether or not we will see a deeper, healthy correction this year.

Comments »