As usual, I start with a list of optionable stocks with available weeklies and look for some kind of setup. Usually I am looking for a 1-2-3 reversal.

A bullish 1-2-3 setup will form a low (1), break the longest downtrend from highest high (2) while ideally forming an equal high, and then set up by dipping to form some kind of dip or consolidation (3), which will also usually be consistent with an “aversion” type of setup.

A bearish 1-2-3 setup will form a high (1), break the longest uptrend from lowest low (2) while ideally forming the first equal low, and then set up by ripping or forming some kind of consolidation towards support (3), which may be consistent with a “subtle warning” on sentiment chart.

—————–

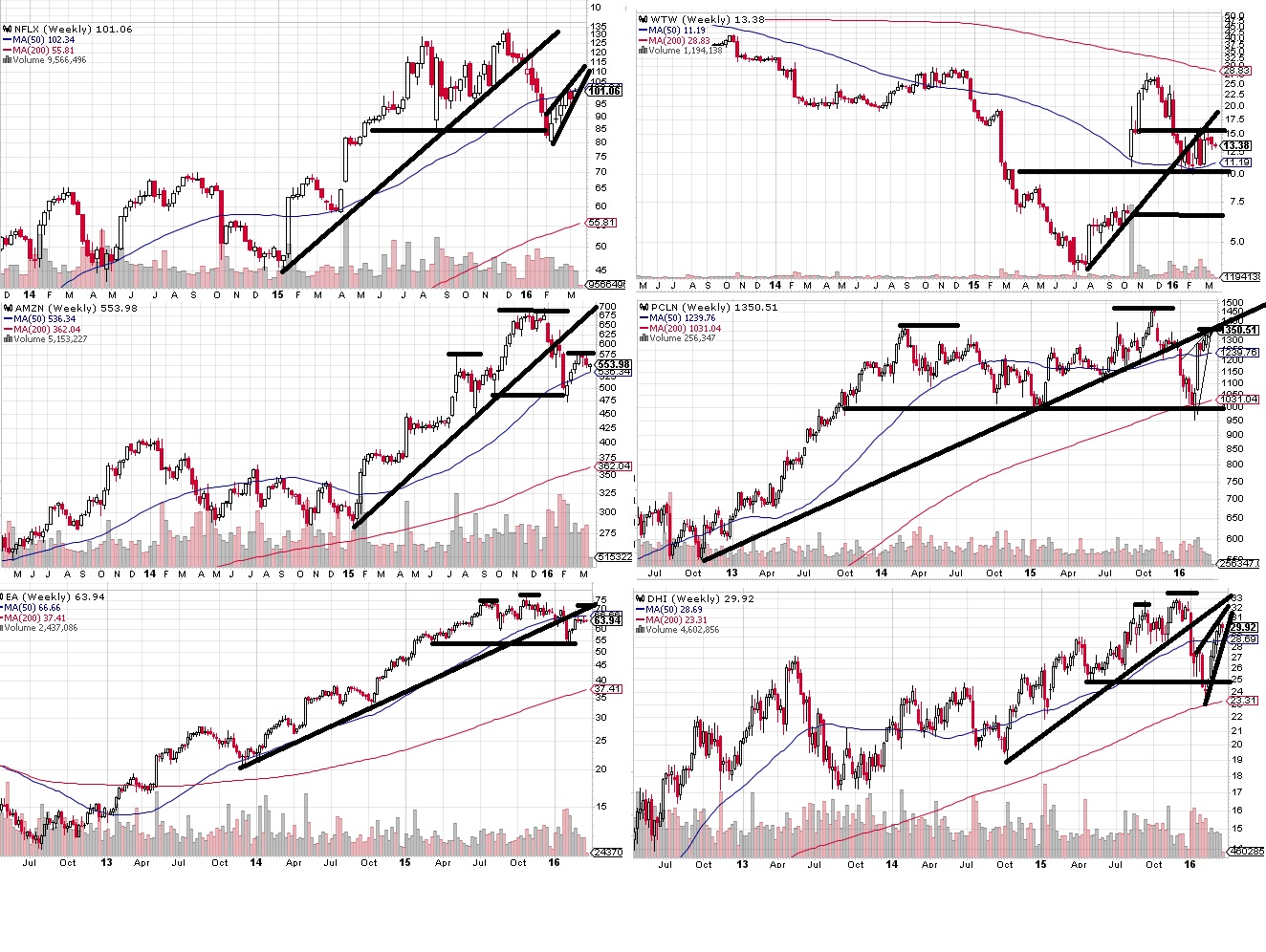

a few bullish setups

Some of these bullish setups have not yet broken the longest term downtrend from the highest high, but are either consolidating some kind of triangle bottom, or at least have broken a shorter term downtrend and have set up.

I still have more to look through but for now here are some potentially bearish setups

Some of these are just potentially setting up for a secondary correction within a longer term bull market as they have not yet broken the trendline from the lowest low, and I haven’t yet looked at every shorter term chart to verify the setup, or looked at volume profiles just yet. I will try to look through a deeper list to come up with a better bearish list on Tuesday or Wednesday if I have time.

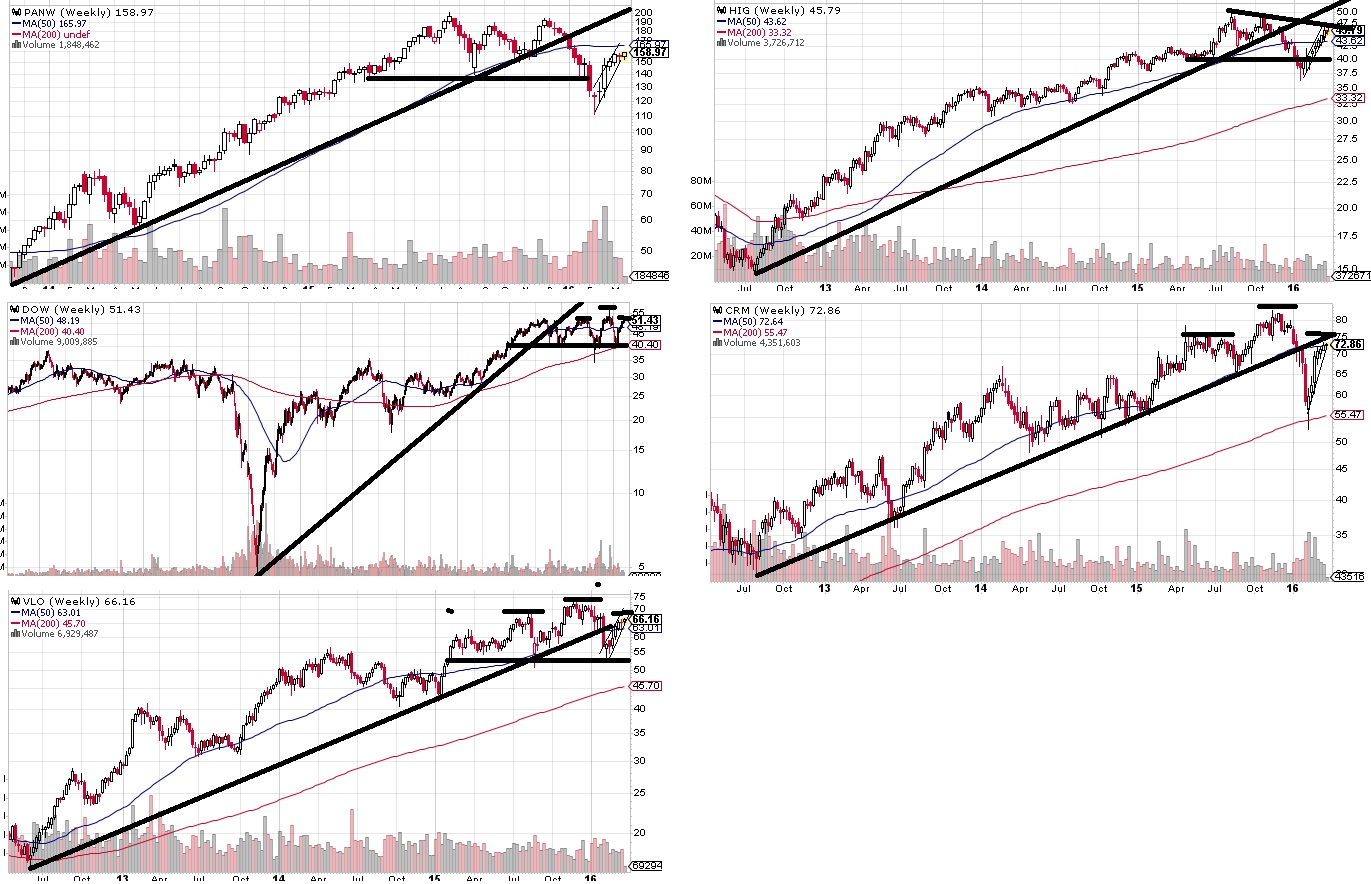

edit 3/22: here’s a few more bearish setups.

Added panw,hig,dow,crm,vlo to link above

If you enjoy the content at iBankCoin, please follow us on Twitter