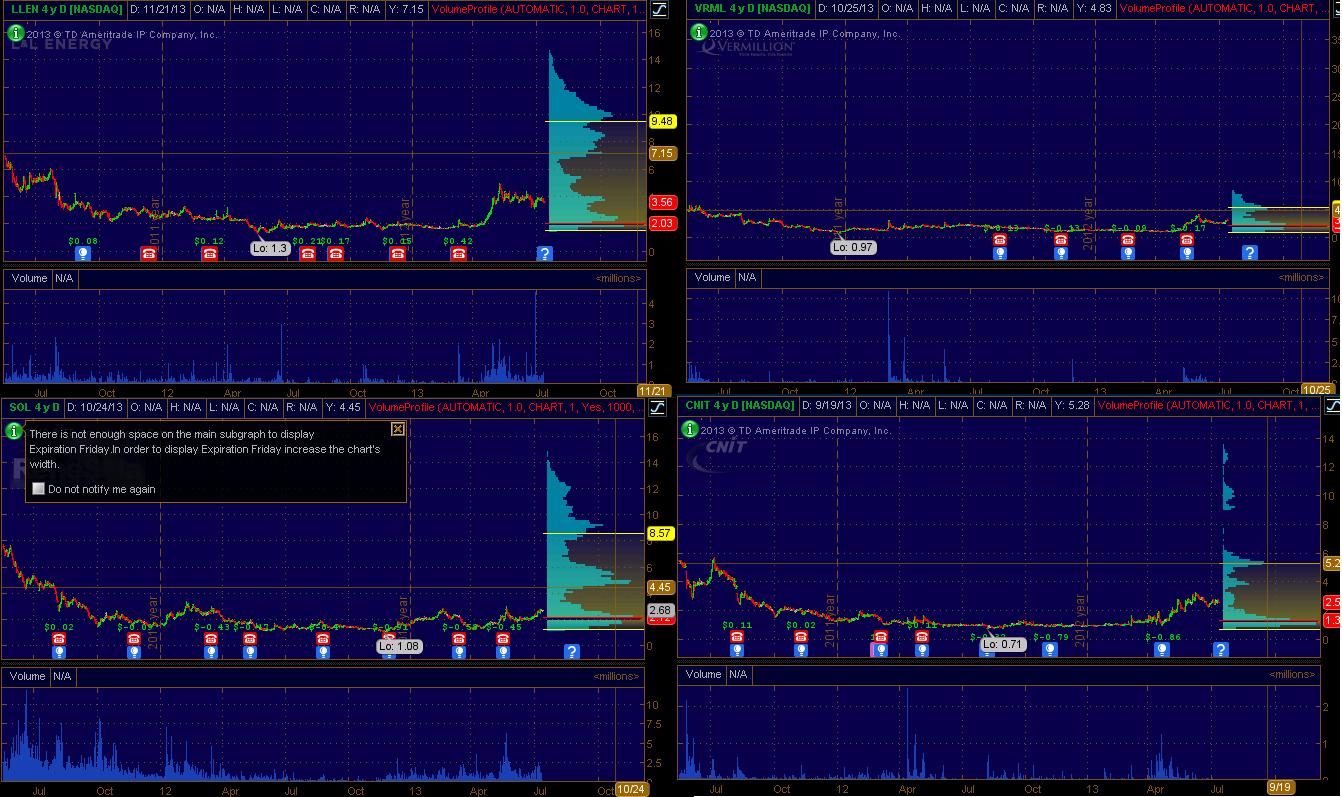

Continuing from the high tight flag volume pocket watchlist…

Step 3) build a watchlist. Okay I didn’t do this yet, I just haven’t had the time to go through all of the names. I tried to remove those that are no longer relevent but may not have got them all.

I’ll slap a few more down but you can do the work on getting up the charts on these yourself. I’ll get you started on the first pair only.

Remaining:dang,tsl,alim,biod,acls,mtor,csun,invn,rmbs,ceco,gtxi(removed),eng(removed)

And last post I ended with this list

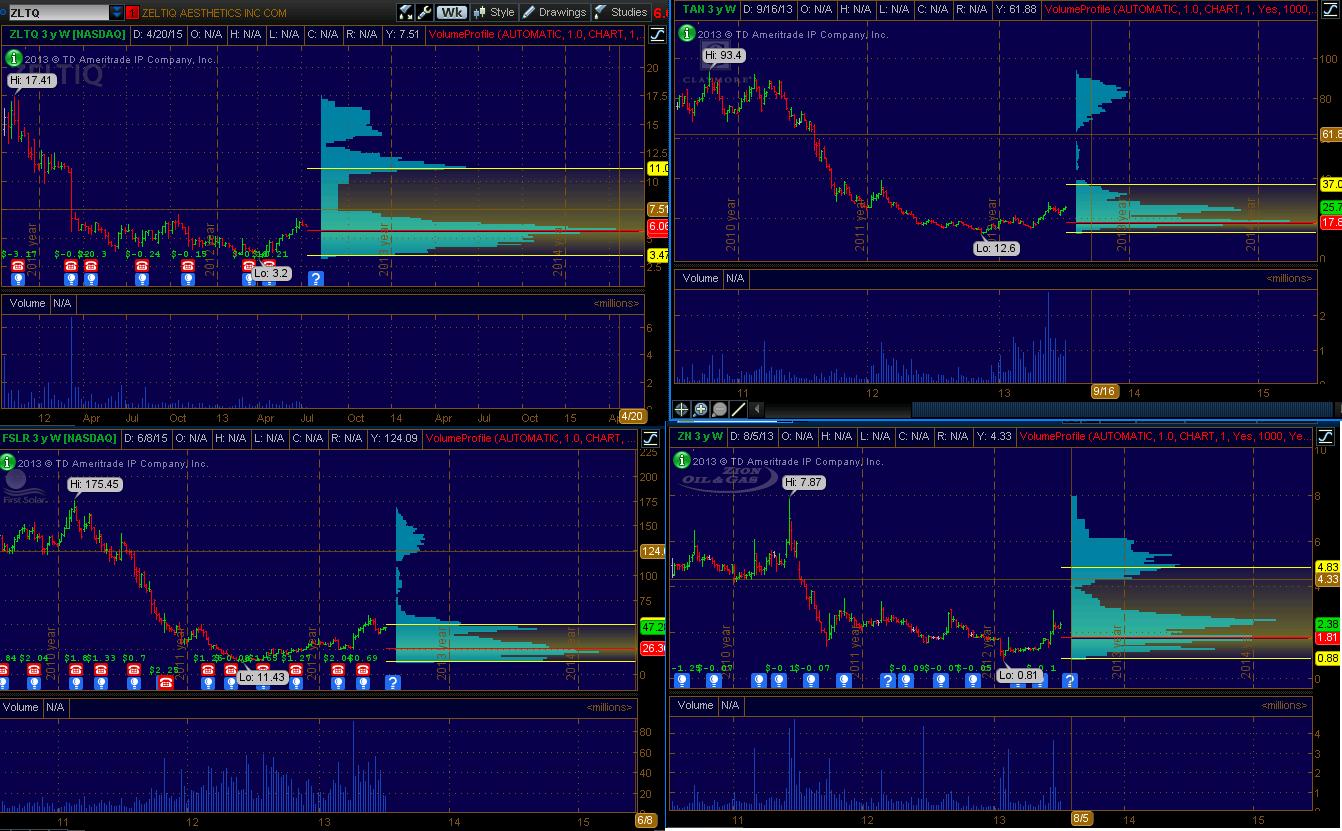

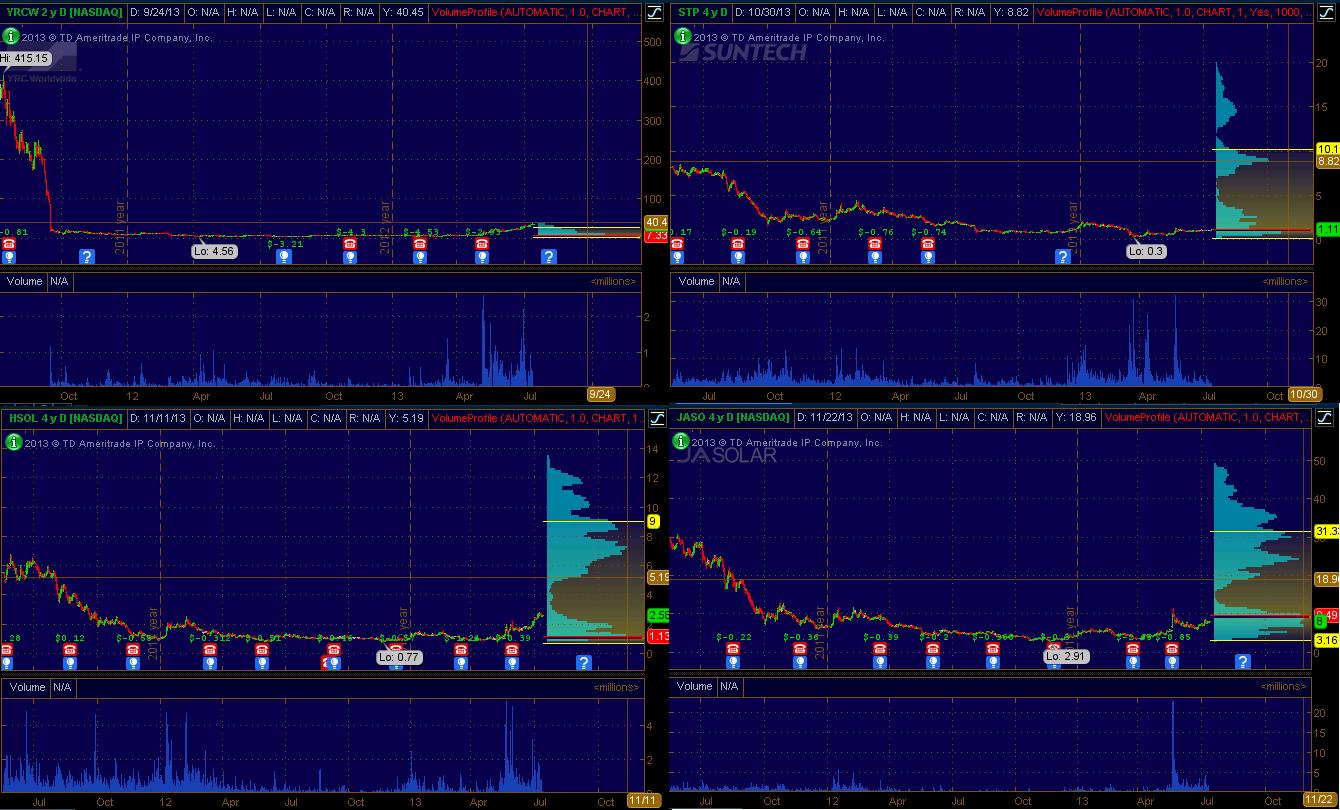

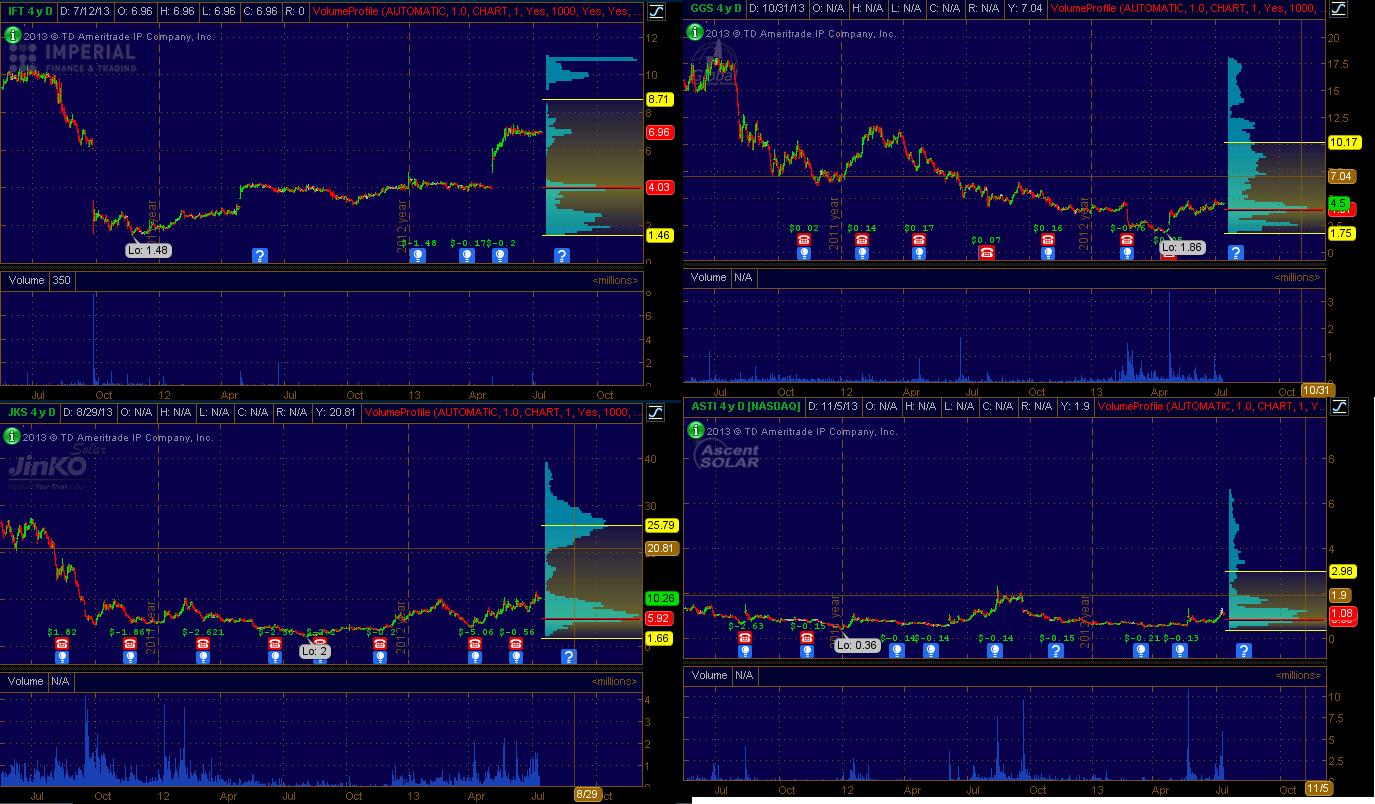

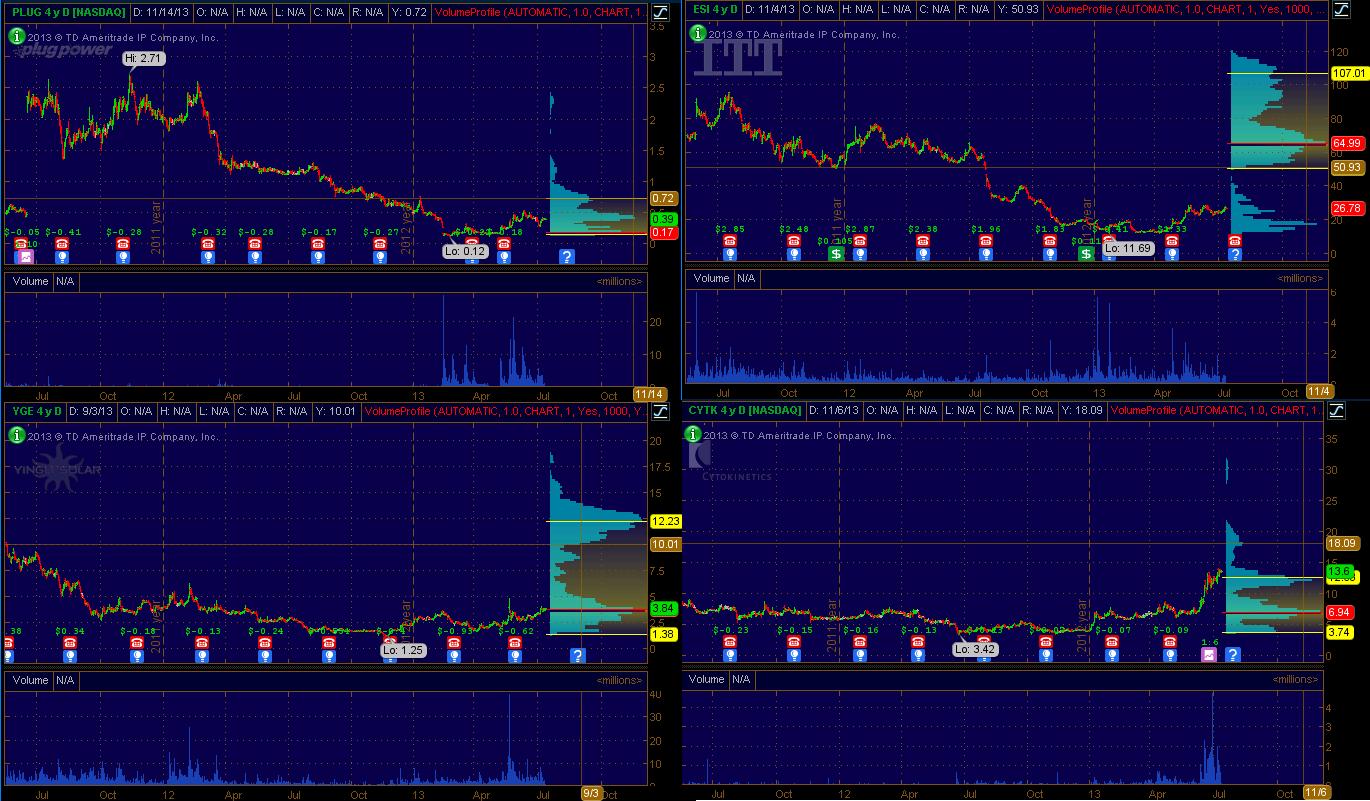

tan,fslr,zltq,zn,yrcw,hsol,stp,jaso,ift,jks,ggs,asti,plug,yge,esi,cytk

Notice all the solar names overall. Also notice that some of the names more so than others in order to get into volume pockets

Non Volume pocket ones to look at near 4 year highs (if not all time highs).

qcor,smrt,staa,acad,rh,evc,ostk,ppc,nxst,pcyg,aegr,regi,dwre,thrx,gtn,isis,cldx,qihu,wtsl,stmp,mcri,ades,rptp,lgnd,alny,prsc,tear,camp,wwww,irbt,mtsn,bont,tvl,dave,avg,sgbi

Then there are a few more

immu,sri,unis

and

vrml,mnkd,psdv,halo,p,bbx,vvtv,amd

(vnda)

There are some massive short squeeze plays that may or may not be a high tight flag: tsla,spwr,acad,thrx,scty,alny

Note that some of these volume profiles are much difference. Some would require a significant run before the volume pocket even is in play. For these you are really looking for a bullish situation, such as the whole sector and/or industry setting up nicely for the same type of bullish action with volume profile weak to the upside(like Solar). Or you are looking at the low chance of the very high upside to offset the lower probability (compared to the other setups) of the stock getting there. It’s all a mathematical trade off between probability and potential to both the upside (reward) and the downside (risk).

Step 4)Have a well thought out plan that has strong evidence of working. A 20% trailing stop on all of these works… More on this later perhaps.

I think that if you have the price reach around 50% you should remove the trailing stop and just sell most of the time unless it’s just hitting the volume pocket. If you have a stock clear it’s volume pocket I would also sell. The entry criteria could be done early based upon candlestick patterns and such, or bought at support, or a break above the consolidation region, or a break to relative highs. The strategy should be lined up and pretty straight forward.

Step 5)Set Alerts that notify you that the potential entry is lined up. Or, perhaps you take them all put them in finviz, check the charts every couple days, highlight the setups that are close to breakout, and watch those throughout the day and stalk the stocks until entry point.

Step 6)Consider buying options or stock depending on what works for you and what the premium is and everything else

Step 7) Position Size Correctly

Step 8)Test, tweak, etc. I like a baseline strategy but I have developed an ability to “call audibles”. The ability to call audibles basically requires an analytical and mathematical approach at the core, otherwise you will get in the way of yourself.

Calling an Audible:

1)Know your win rate. You may increase it slightly if you sell early because it’s more likely for a stock to go to 10% than to 40%, but do not overestimate your win rate.

2)Know your average loss using your stop loss or exit rules if the trade were to have turned out a different way.

3)Be able to calculate the minimum win rate OR W/L ratio to break even given your change of strategy. This is important because many people think “oh I’m up, I can sell” not factoring in that the trade won’t always be like this and overtime their actions to sell early may cost them. Consider both possible outcomes when determining if selling is acceptable or not.

4)Be able to know your annualized expectation if you don’t touch the system and let it work, and calculate the estimation of the result if you “call an audible”.

5)Determine if this chart is a “special example” and the odds are significantly different from the typical chart. Really, you probably should have considered whatever you are fearing BEFORE you took the trade. Once you are in it, you probably should let it run. Only if the math is relatively close to begin with, or in my favor for selling early, would I consider calling an audible.

6)The rest is the 10% to 20% that you can’t really easily put into words, but that you may develop over time with experience.