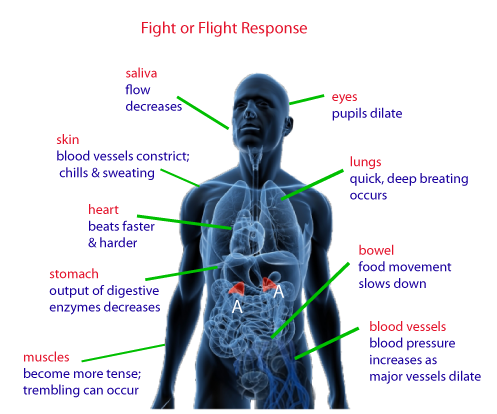

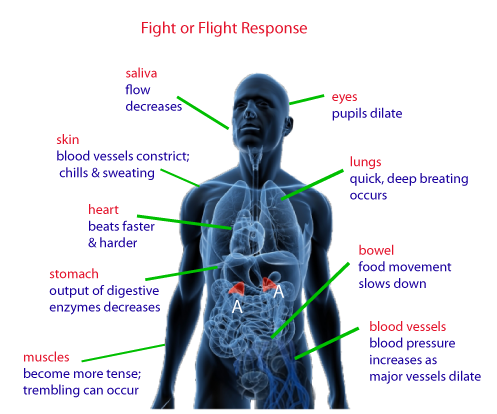

You may not know this, but the human autonomic nervous system is not wired to handle stressful mental activities when there is any sort of perceived threat. The fight or flight response occurs as a means to avoiding physical threats, but stress and fight or flight can be activated simply based on any threats such as mental or financial ones. Any stress physical or mental is likely to affect your body the same way. Perhaps it is a stressful work environment. Can you deal with the threat the same way that an uncivilized society would? Probably not. If a boss is putting pressure on what needs to be done, you probably have to resist the urge to fight or run away. If you’re a professional QB while 300 pound lineman are rushing at you, stress happens. If you are sitting in a chair playing poker trying to bluff, stress happens. If you are sitting in front of a computer screen watching price go down and account value erode, perceived threats are still there. Once your fight or flight response hits, you won’t always behave logically and rationally.

source:http://www.thinklikeahorse.org/images3/fight%202.png

After the fact you will have hindsight bias and recognize how obvious it was that you made a mistake. Not only will you know you shouldn’t have done that, but it’s possible you may have reminded yourself not to before you did anyways. Fight or flight makes it so your autonomic nervous system doesn’t care about your past logically sound plans. We make decisions first, and justify them afterwards. This is why poker players will say “I knew I shouldn’t have done that” why capable, talented professional QBs will still occasionally make an INT throw that is so bad that a 5 year old can see it was the wrong decision, and why intelligent traders can blow up their accounts or make a series of very bad decisions.

A bit on the psychology of it.

Fight or flight response is triggered in the brain which releases certain chemicals and hormones into the bloodstream, triggers increased blood pressure and anxiety, and redirects the blood flow towards your legs where you can take a defensive fighting position or be prepared to flee. In fact, the rapid rush of blood out of just about everything especially the skin and directing it towards the muscles, particularly the legs can lower skin temperature on our hands dramatically in seconds. This is actually what deception experts may use as an additional filter to detect deception. They may shake someone’s hand before and after they grill someone on something and detect extreme stress caused by lying, or not. It is unavoidable.

Although in some cases, fight or flight can increase awareness; it also makes you focused on identifying a threat to the point of being hypersensitive and irrational. Particularly if the right chemicals aren’t released to absorb the adrenaline and cortisol in the brain. The fight or flight relies on the reactive (instinctive) parts of the brain, rather than the reflective (logical). It diverts conscious awareness and kicks in subconscious via the autonomic nervous system. The subconscious is focused on alleviating the short term pressures of stress, rather than make decisions consistent with your long term financial well-being.

The primary jobs of the amygdalae are to screen the environment for a potential threat. Neurons in the amygdalae are activated even before we are consciously aware of a threat. In the face of real danger, this is a good thing, however, in modern life, most of the time there is no real danger, leading to feelings of self-doubt and therefore, undermining our attempts for survival by setting us up to ignore that one time when the danger is real.

Although the hypothalamus is the sensory switching station, where it sends visual information to the visual cortex, sounds to the auditory cortex, etc., that information is filtered through the amygdalae before it continues on to its final destination. If the amygdalae sense danger, it immediately activates the brain’s emergency response system. This causes us to react even before we consciously know why (by releasing excitatory hormones into the bloodstream, raising our heartbeat, breathing faster and shallower, sweaty palms, etc.), followed by conscious thought (the information being interpreted and analyzed)

http://www.neilslade.com/Papers/stimulation.html

In English, we will react to a perceived threat instinctively, not logically. Any attempt to explain why we behaved in a way was only done afterwards, never in the moment. This is why a trader might make a decision and regret it, he is only functioning as he is wired to. This is why someone will wrongly try to justify their reasons for holding. You must associate following a preconceived set of rules with survival, or your beliefs will prevent you from behaving properly.

People who are able to remain calm in an emergency situation and act appropriately without panicking, and in the process save their and other’s lives (or prevent injury to whomever involved) will benefit. They have the ability to activate their prefrontal cortex. That allows them to analyze, judge, reason, plan, solve problems, make decisions, and control impulses. What a powerful combination: activation of the brain’s emergency response system (to get us ready to fight or flee) and the prefrontal cortex to help us strategize and control dangerous impulses.

The neurophysiological mechanism as researched by Dr. T.D.A. Lingo at his research lab in Colorado, also called the amygdalae clicking technique results in the ability to activate the prefrontal cortex at will. With enough practice, the user will automatically activate the prefrontal cortex in all activities, including those instances where the amygdalae have activated the brain’s emergency response system. The amygdalae will be so busy activating all necessary systems that it won’t have time for any kidnapping J!! The prefrontal cortex also helps in control such dangerous impulses.

People who are able to remain calm in an emergency situation and act appropriately without panicking, and in the process save their and other’s lives (or prevent injury to whomever involved), have the ability to also activate their prefrontal cortex with its abilities to analyze, judge, reason, plan, solve problems, make decisions, and control impulses. What a powerful combination: activation of the brain’s emergency response system (to get us ready to fight or flee) and the prefrontal cortex to help us strategize and control dangerous impulses.

Brain hack resource:http://www.neilslade.com/chart.html

Brain hack resource:http://www.neilslade.com/art/Brain/brainrev2.html#%22Greetings

When things are going well and stocks are holding up just fine, we actually will enter into more of a relaxed state, stimulated by computers and a still body that sits dormant in a desk. In fact, there have been some that conclude that television and computers puts you in a relaxed state

Scientific study looking at alpha (relaxed) brain wave state and television

http://www.thedryingroom.com/tv/Brin%20Wave%20Measures%20of%20Media%20Involvement%20-%20Herbert%20E.%20Krugman.pdf

As a result, you probably are less aware of and concerned with potential threats when stocks are doing well, and are hypersensitive to them when they are doing poorly. You may not stop out as early as you should because you get complacent when you should be vigilant and prepared to act, and then you may be triggered into “survival mode” and sell immediately when you are most fearful to alleviate the stressors. In other words, you may as a trader, behave exactly the wrong way because you are hardwired to do so.

When our fight or flight system is activated, we tend to perceive everything in our environment as a possible threat to our survival. Our impulses quicken. Our perception of pain diminishes. By its very nature, the fight or flight system bypasses our rational mind—where our more well thought out beliefs exist—and moves us into “attack” mode. This state of alert causes us to perceive almost everything in our world as a possible threat to our survival. Our thinking is distorted. We see everything through the filter of possible danger. We narrow our focus to those things that can harm us. Fear becomes the lens through which we see the world. Making clear choices and recognizing the consequences of those choices is unfeasible. We are focused on short-term survival, not the long-term consequences of our beliefs and choices.

Our fight or flight response is designed to protect us from the proverbial saber tooth tigers that once lurked in the woods and fields around us, threatening our physical survival. At times when our actual physical survival is threatened, there is no greater response to have on our side. When activated, the fight or flight response causes a surge of adrenaline and other stress hormones to pump through our body. This surge is the force responsible for mothers lifting cars off their trapped children and for firemen heroically running into blazing houses to save endangered victims. The surge of adrenaline imbues us with heroism and courage at times when we are called upon to protect and defend the lives and values we cherish.

In most cases today, once our fight or flight response is activated, we cannot flee. We cannot fight. We cannot physically run from our perceived threats. When we are faced with modern day, saber tooth tigers, we have to sit in our office and “control ourselves.” We have to sit in traffic and “deal with it.” We have to wait until the bank opens to “handle” the bounced check. In short, many of the major stresses today trigger the full activation of our fight or flight response, causing us to become aggressive, hyper-vigilant and over-reactive. This aggressiveness, over-reactivity and hyper-vigilance cause us to act or respond in ways that are actually counter-productive to our survival.

Wired To Win – Putting Psychology In Your Favor

“Hacking” Your Mind For Success

Perhaps the simplest, best way to turn down the activity of our fight or flight response is by physical exercise. Remember that the natural conclusion of fight or flight is vigorous physical activity. When we exercise, we metabolize excessive stress hormones—restoring our body and mind to a calmer, more relaxed state. We release mood enhancing neurochemicals that absorb the excess adrenaline in our bloodstreams and result in returning our mental state back to normal.

Exercise increases our natural neurochemicals, which help us to feel better. When we feel good, our thoughts are clearer, our positive beliefs are more accessible and our perceptions are more open. When we feel tired and physically run down, we tend to focus on what’s not working in our lives—similar to a cranky child needing a nap. It is difficult to be, feel or think positive when we are exhausted, sleep deprived or physically out of condition

However, this may be an insufficient response if the person is lacking the brain chemicals to respond normally. Proper brain functioning can be “hacked” also by nutrition. Optimizing mental health through nutrition means getting enough of the amino acids to support synthesis of neurochemicals. Diet should have a significant role in mental health. In other words, with the right foods, your body will make a proper balance of brain chemicals to support sound mental health. However, you still will need the exercise to “trigger” your body to resolve the stressful situation. Survival in uncivilized times required man to handle the threat. One possible explanation is simply evolution of civilization at a rate faster than the human genome.

Since the mental faculty tends to be temporary impaired when dealing with “fight or flight”, and most behavior tends to be “subconscious“, another one of the ways to deal with it is by getting into a subconscious habit of reading a checklist or flow chart that determines the actions for you before trading. When you are not in fight or flight you can set up all the logical systems you can imagine needing to come up with the correct and logical conclusions. You can practice it in an unemotional environment such as paper trading until it becomes automatic. Once you are looking at a screen and are prepared to act, you can refer back to your checklist notes verbatim and have your past logical systems stand in since your current ones may be temporary impaired. This will help you determine if the decision is rational or not since you will not personally be able to be a good judge at the time if any sort of stress or adrenaline is involved.

Another area for hacking your mind for higher level of functioning and focus will be a bit more controversial as it can be very dangerous is “nootropics” or “smart drugs”. Most common nootropic is caffeine followed by other stimulants. They can range from simply using certain vitamins and amino acids in supplementation to prescription drugs. The dangerous side of course is those who use drugs intended for people with anything from A.D.D., alzheimers and narcoleptics when they don’t actually have those conditions. Nootropics will likely not help the underlying cause of stress which requires a biological response coupled with sufficient production of neurochemicals to resolve it.

Capitalizing Off of Psychology

The good news is that other traders are also “wired to lose” at trading. This means that if you can come up with methods for bypassing the instinctive responses, you can actually have a substantial advantage.

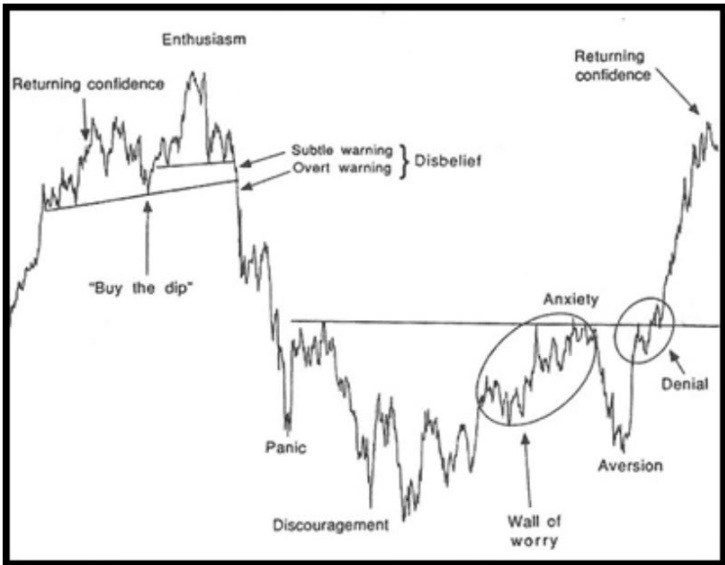

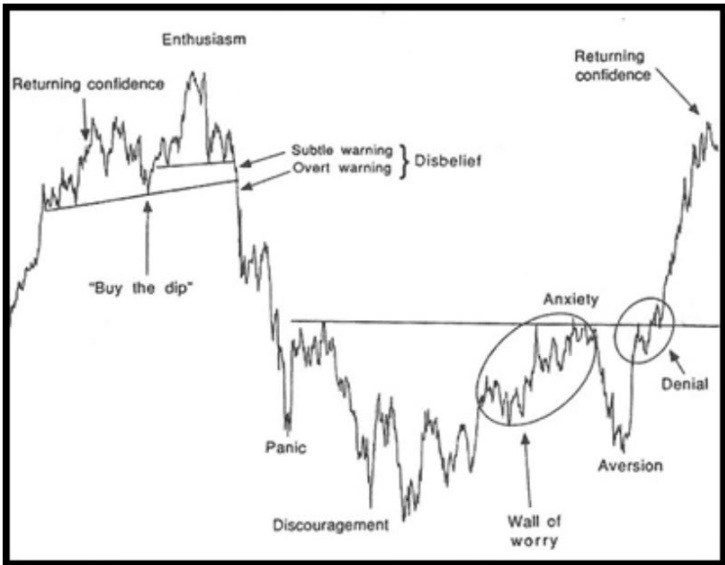

Many of you may have recognized Jeff “Option Addict” pulling up the sentiment chart:

Original Source: The Nature of Risk: Stock Market Survival and the Meaning of Life by Justin Mamis (1991).

This shows how a market’s behavior displays the emotions that go on when trading. That is another way to be one who capitalizes and recognizes the market’s emotion and responding to it, rather than being a part of it and reacting with it. I certainly have noticed that it helps get you into a stock and sometimes avoid the emotions other people are feeling altogether. At a minimum it helps you recognize your own weaknesses, and by doing so, be a bit more patient. Knowing your perceived threat is not “real”, but instead your own emotional response to an imagined threat can allow you to wait it out. With less uncertainty about the process, there is a bit more comfort, particularly if you have a logical, structured plan that you believe in. At other times it can help you recognize more objective decisions about what the market is going to do next based upon the emotional cycles of the other traders and prevent you from becoming fearful or emotional to begin with.

Using Statistics as a Mental Hack

Statistics can be a great tool to help with psychology but it doesn’t always work for everyone entirely. The first problem with statistics is getting a large enough sample size. It’s important to realize that individual seasonality may be extremely relevant data as it applies to one particular stock, but probably does not have a large enough sample size to provide you with confidence that your past performance wasn’t just due to randomness. Conversely, look at the entire sector of technology during October outperforming. It gives you hundreds or thousands of data points every year verifying each year that over half of all of the individual stocks not only traded higher on average over several years for a particular month, but outperformed the market as well.

Resources:

http://Charts.equityclock.com

Http://seasonalodds.com/

Candlestick can be analyzed over thousands of stocks over only a year and you still will have millions of data points that can be entirely objective if you make sure to define the candlestick pattern a specific way.

Individual price patterns are usually pretty subjective, but can be defined and analyzed statistically anyways, but individual bias or hindsight bias may still get in the way. Also, developing a program that can datamine the markets for chart patterns isn’t very easy.

See Thomas Bulkowski’s books: Encyclopedia of Candlestick Charts and Encyclopedia of Chart Patterns for reference. Also be aware that statistical patterns tend to also be cyclical. What worked well in 2002-2006 may not have worked well in 2007-2009 or in 2010-2014. Still, having the statistical background as ONE filter for selecting stocks can add objectivity and skew the confidence range of possible outcomes to be more in your favor.

Statistics help you think of stocks more objectively rather than “what feels right” as well, but for some people that won’t work. Poker players for example may know decisions that are mathematically correct but still battle the internal conflicts of their own emotions and make incorrect decisions. Math and statistics may help decision making when there is no stress. It may also help you to avoid thinking about results in a way that are too short term focus and it may reduce some of the pressures. However, it won’t help you avoid stress completely and probably won’t help you deal with it entirely either. Fortunately though it may reinforce the idea that the threat is imagined. If you are aware that your emotions are just hypersensitive because of fight or flight, it may allow some to rationalize and over-ride them, as uncomfortable as it may be.

Remember your subconscious is looking for a solution to the stress, the same as your conscious mind, but it prefers to make a decision that ends the stress, rather than just “deals with it and remains long in the position”

Disassociating Your Threats

The first picture of the saber tooth was very scary and perhaps you may have even noticed your heart racing, even though consciously you know that it is impossible for the image to jump out of the computer screen. Unfortunately your brain is hardwired to fire off when it recognizes any pattern that may be a threat. This one you’ll notice is almost comical. This is because the perceived danger has been disassociated in multiple ways. It is a picture of an object with a picture on it, and the picture itself is not seen as threatening. The problems can be disassociated in your mind to appear less threatening in a similar manner. Memories and imaginations of things can be transformed to become less traumatic through visualization as well.

Your conscious mind uses mental representations of reality to perceive and understand the world, rather than perceiving reality itself. Anything you think you see is really just a mind’s projection after taking in the input sent to your brain from your eyes and providing it in your “mind’s eye” and is not a direct feed of what your eyes see which is why you have blind spots and optical illusions that can work. You see with the brain, not with your eyes.

Your mind actually filters out as much as 50% of the information your eyes still take in to make processing more efficient. Famous psychological experiments involving inverted glasses with mirrors that flip the information taken in upside down was done and the result is that eventually the mind adjusts. Even with the glasses with mirrors on them where everything should be upside-down, they will learn to see things right side up again. After weeks when they have acclimated, once the glasses are off, things appear upside down again (until days later when the effect subsided). This is further proof (if you need it) that your eyes don’t see, they merely are the messenger to the brain. Optical illusions provide evidence as well. Since the subconscious cannot distinguish from a real and imagined event, visual imaginations can help re-frame and reduce any effect a situation psychologically has on you.

This is what’s behind another interesting tool to relieve stress or uncomfortable feelings and associations you may have from any ongoing event or memory of an event is the following mental exercise to disassociate from the situation.

Metal Exercise for Disassociating From Emotion

The way you can disassociate a memory or visual input you have is imagining a picture of yourself in an image rather than seeing exactly what you saw. This is a mental exercise psychologist and NLP modeler Van Tharp introduces to trading. This puts you from the perspective of “seeing someone else” reacting the way and being able to be more objective about the situation. Then you can also picture yourself as someone more consistent with the way you would like to be (in this case, imagine how a very profitable mistake-free winning trader would behave). You can imagine the body language and the way he does things. Then you can imagine stepping into that person and becoming them and then going about your day behaving in that way. It may help some people if they walk away from their desk and physically “step back in” into the image so they are “becoming” that person.

If you lack confidence, you can imagine yourself more confidence and also imagine a trumpet fanfare or whatever sound makes you feel more confident. If it is a physical emotion you can imagine the feeling spinning in one direction and you can imagine pulling something spinning out and turning it around so it spins in the other direction and imagine it going back into the old spot and supposedly this makes you feel different about the experience if you are a more kinesthetic based thinker.

Some people may prefer a routine of sorts getting them in the proper state of mind to trade at their peak abilities. It’s all a question of how important you are willing to make it to you and what works best for you. You may want to approach this as a scientific experiment trying a month or two doing a different routine and determining results compared to the others by measuring the number of mistakes made (trading without respect to a particular plan, violating your position sizing principals,etc). Once you can trade a few months with zero mistakes, you’ve found something that works very well for you.

The primary purpose of this post was not to get wrapped up in the different ways to deal with it, but is more about getting you aware of it and giving you a few examples that can help. I hope this article was enlightening and can help you to refrain the way you approach or think about trading to understand that there are some basic challenges that every trader faces by no fault of their own, because of the way they are wired.

sources/citations:

http://en.wikipedia.org/wiki/Fight-or-flight_response

http://www.cracked.com/article_20432_5-illusions-that-prove-your-sense-reality-full-s232125.html

http://www.scientificamerican.com/article.cfm?id=when-blindness-is-in-the-mind

See also this wired to lose document.

Comments »