Not talking about having a new President here. There was a change over far more important to my livelihood and that was switching from Exodus to Stocklabs. If you stumbled into this blog expecting more election fodder you can leave now (and hopefully never come back). My stated purpose is to consistently extract as many fiat american dollars out of the global equity complex as I can while blogging about how I do it.

Things you will not find here

- assigning reason to stock market movement

- jokey banter in a New Jersey accent

- pump articles about five lettered tickers

- quick money schemes

If hubris emerges it is usually in the form of vanity or insatiable lust.

Anyhow, the regime change I am coping with is one I have struggled with in the past. New software. The world of active trading does not look kindly onto those who do not adapt though. The death of the pit trader, for example. Therefore I must continue to refine my ability to adapt and reinvent. Never resting on my laurels, no matter how well things are going.

Exodus flagged hybrid oversold on Wednesday, October 28th, nearly nailing the swing low to.the.day.

I did not see it because I transitioned to Stocklabs on the 25th. This type of event can cast doubt on the psyche of a weaker man. Then, in the heat of action, I might feel the urge to close Stocklabs and open Exodus. Then if it has conflicting signals I’m like fuck. My brain gets all its wires crossed and I start losing a sense of direction. Then there suddenly feels like there is no air in the room. There’s no air in here. I can’t breathe. I can’t breathe (RIP George Floyd). Whether these thoughts are real or imagined does not matter. You are not in a position to make objective decisions.

There are various institutions and organizations that seek to make you to feel that way. Why do you think fucking pig cops have those wretched flickering lights and blinding spotlights? They seek to disorient. When we lose our faculties we are easier to control. When layer-after-layer or bureaucracy are heaped upon a project the cognitive load is designed to deter anyone unorganized from making progress. When cable news outlets use trigger words in their headlines and fill the screens with argumentative noise while scrolling more and more information along the bottom and side they seek to evoke a panicked attention.

While there is no organization attempting to control me after I choose to use a new software, I am wrestling with the most powerful sparring partner of all—the man in the mirror. The E-G-O.

I intend to cope how I do best. Unwavering commitment, but more-so like how I commit to lines at the grocery store. The mind can run wild in the grocery queue can it not? The lady two ahead of you drops her paper coupons and they scatter across the floor. Two lines over is just a couple of dudes holding styrofoam clam shells full of prepared food. The cart behind you is fidgedy and right on your heels. They’re a member of the great american religion. The church of anxiety. We either stay in our lane, or if it becomes abundantly clear there is a better option, we make the shift. We do not jump from one line to the other then another then grimace as the line we originally chose flows better.

Well I feel better after writing all of that out. I feel bad for anyone who has even read this far. Enough of that.

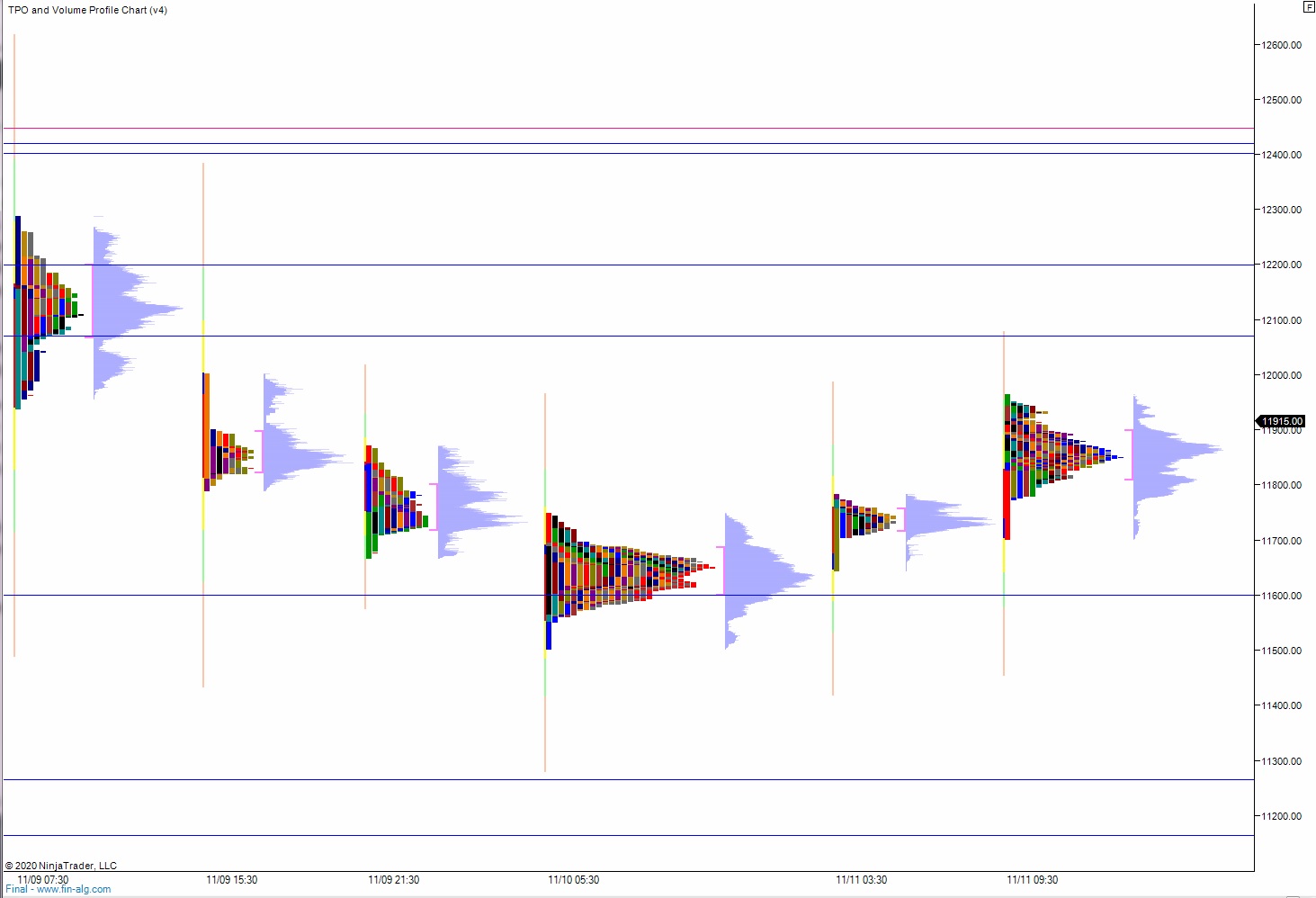

The job is to plan and the plan is to trade opening bell on the NASDAQ-100. Work the open gaps in prior day range. Use the IndexModel bias to determine which direction to trade. Write a primary hypo and stick to it unless new information renders it false. Then we have a 50/50 chance of picking the right hypo from 2 or 3. Go for overnight range break and initial balance break only if a valid hypo still exists. Defend the mid if it makes sense.

Never sell the long term investments. Immortal institutions like Tesla and Amazon. Twitter and Square.

Last week alls I did was buy more bitcoin, Twitter and Costco.

There are signs of excess. The market could correct soon. We don’t know when these corrections will happen. The relief comes from knowing that they don’t matter. What does matter? Jack Dorsey. Google. Daddy Elon Musk. Progress in the name of progress and to hell with the old ways.

I’ll end on that note. Be sure to drop by in the morning and cheers to banking coin.

Raul Santos, November 8th, 2020

And now, the Weekly Strategy Session. Enjoy.

I. Executive Summary

Raul’s bias score 3.5, medium bull*. Markets settle into a calm drift until Thursday morning when Fed Chairman Powell speaks. Expect markets to find direction late in the week after the Fed speak and carry the move into the weekend.

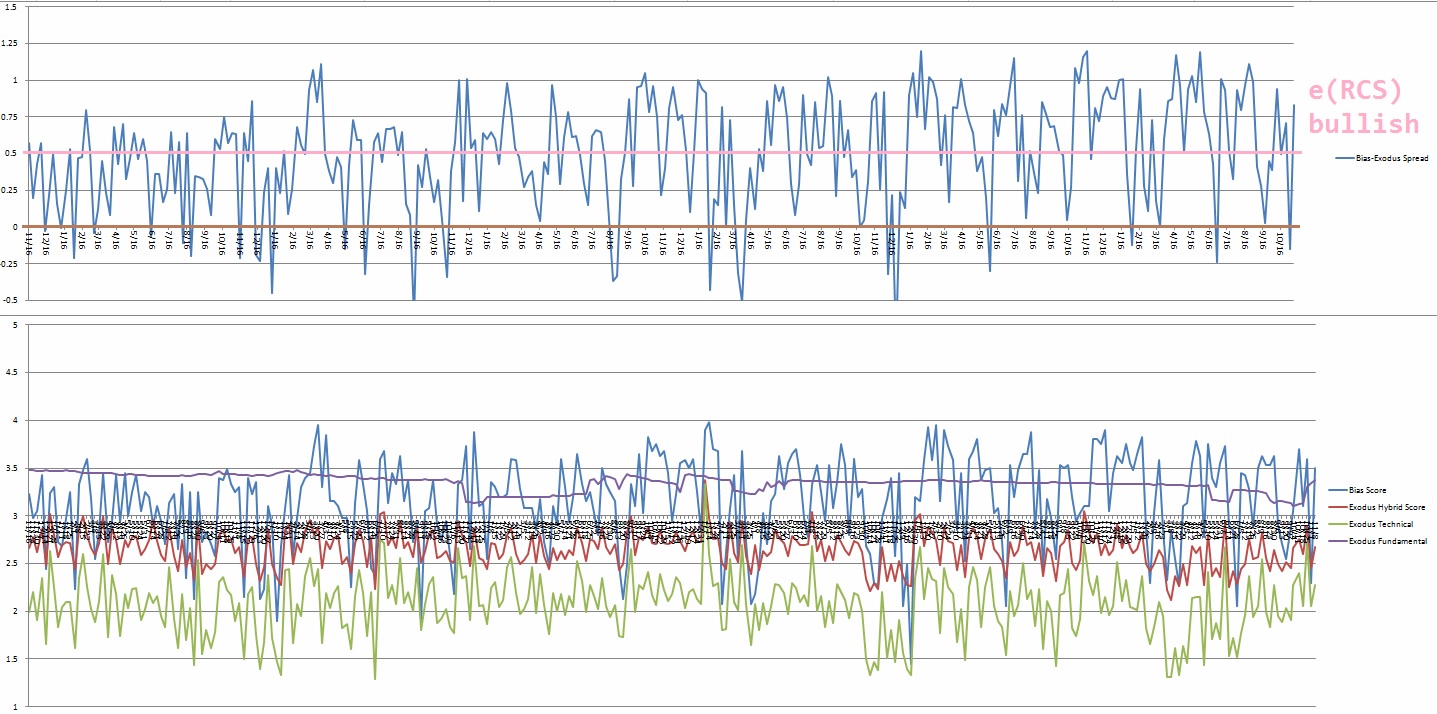

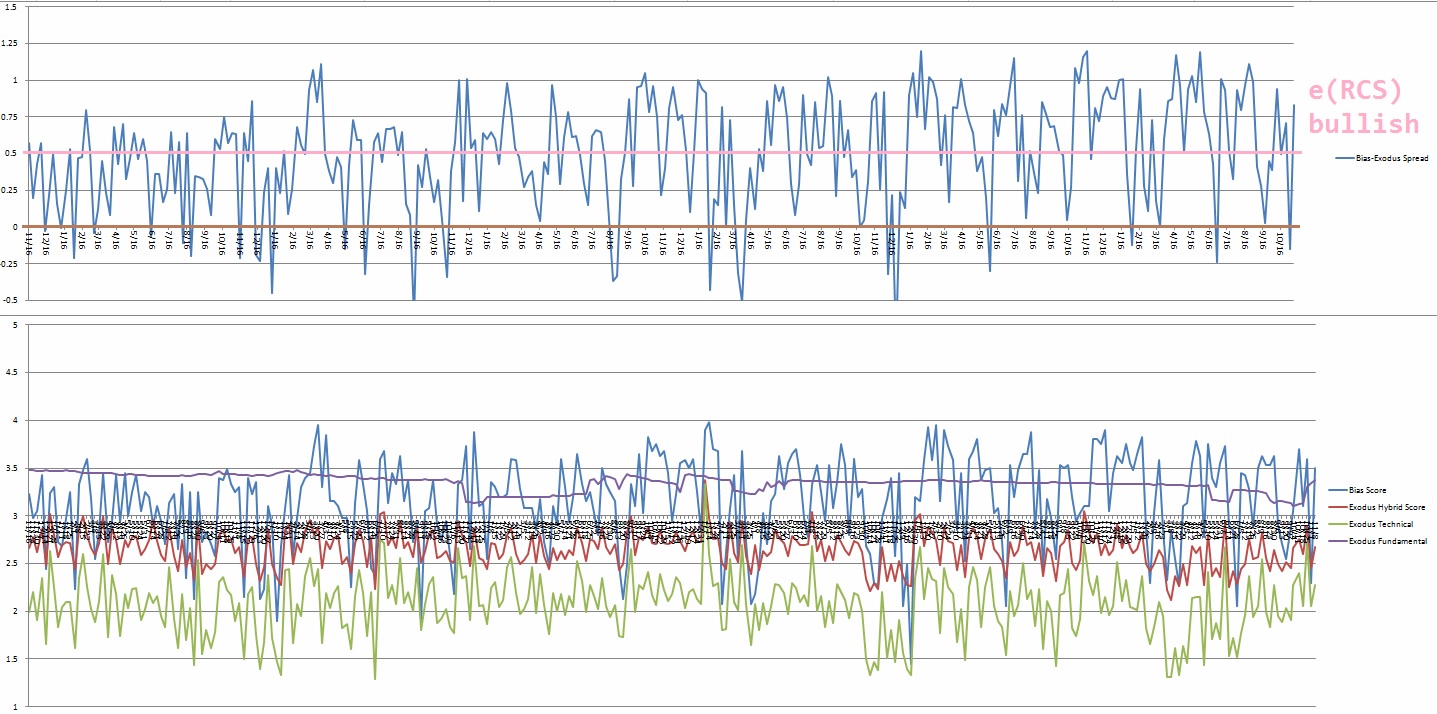

*IndexModel triggered extreme Rose Colored Sunglasses bullish bias. See Section V.

II. RECAP OF THE ACTION

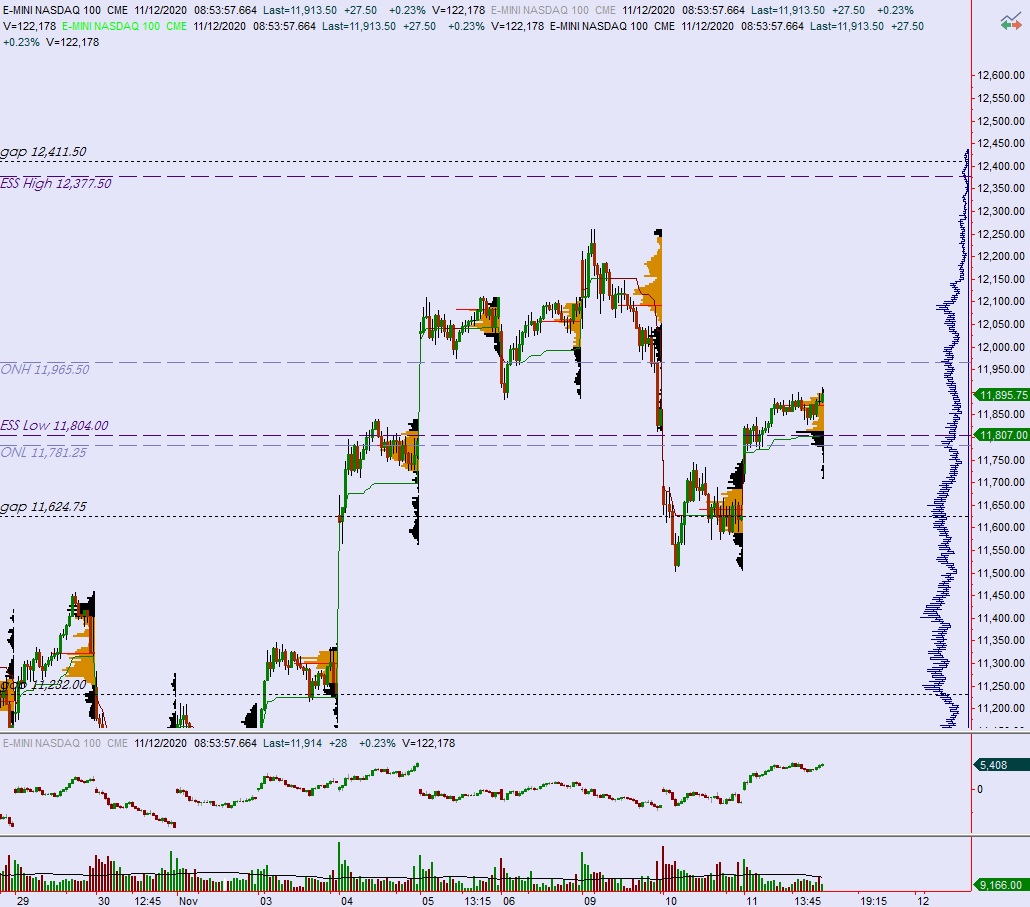

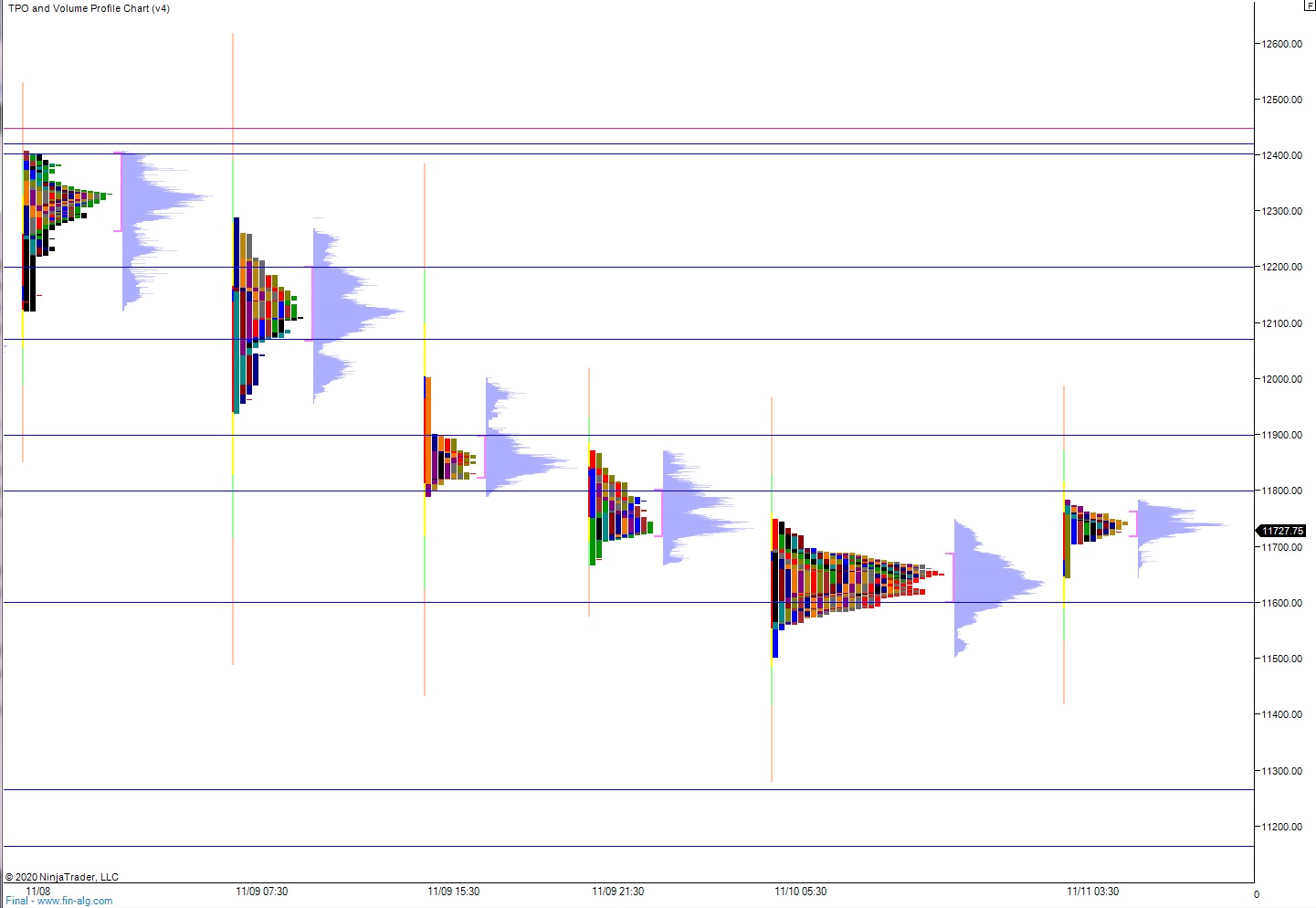

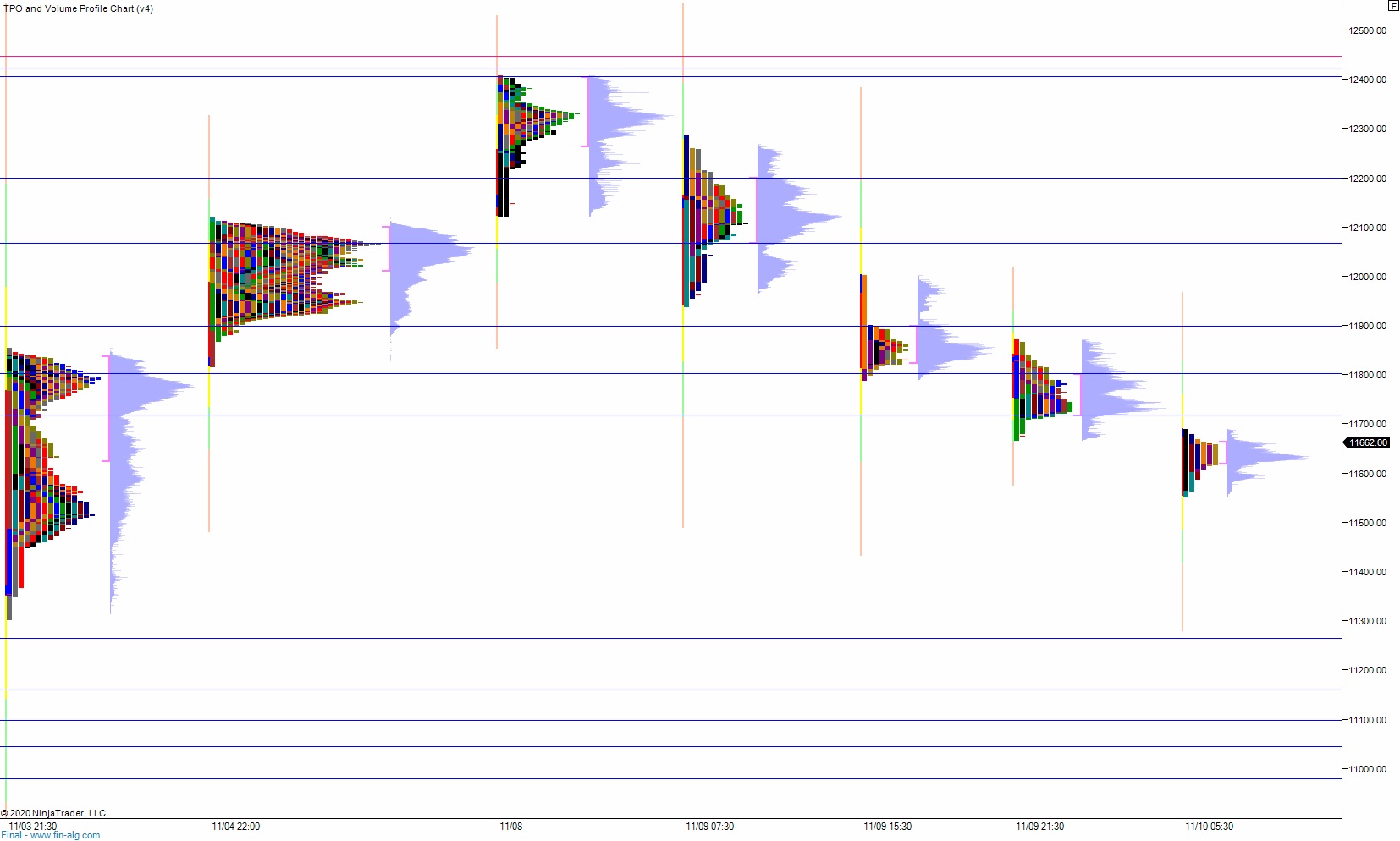

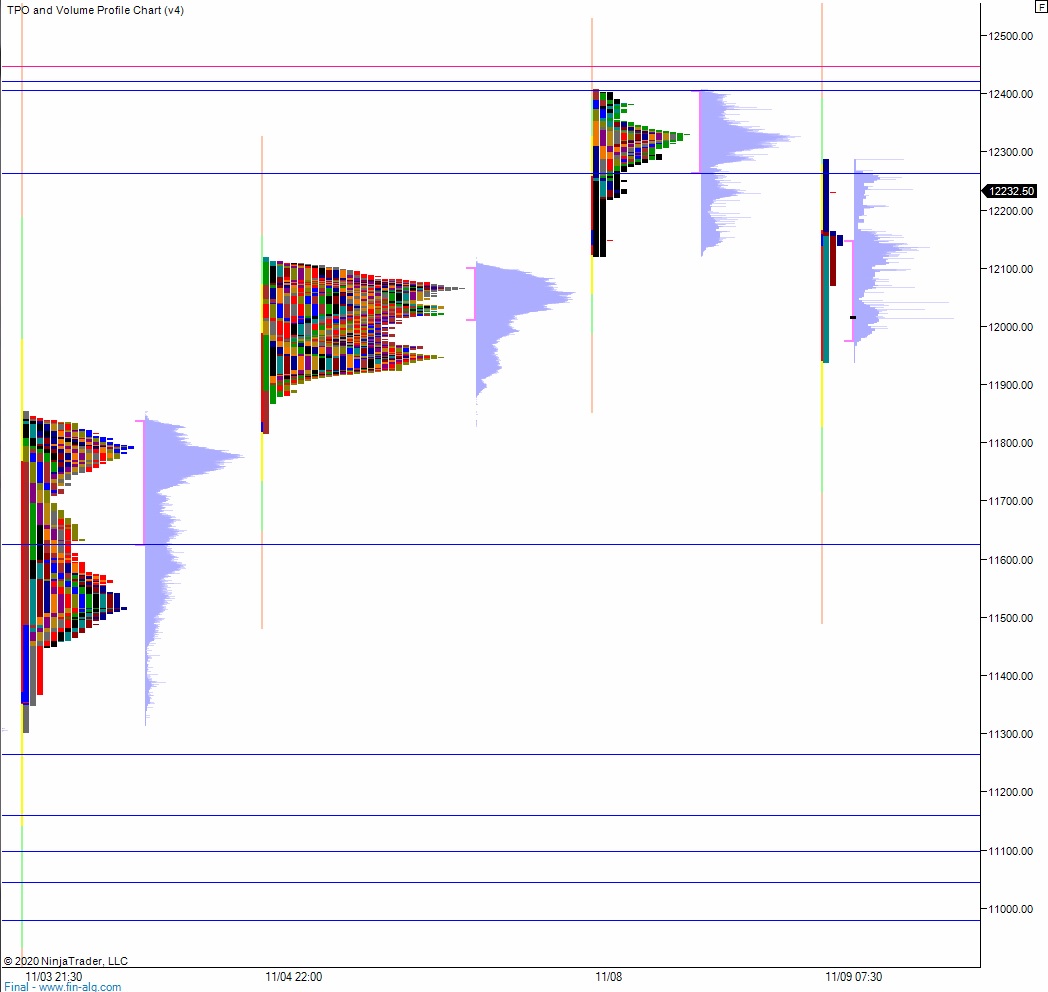

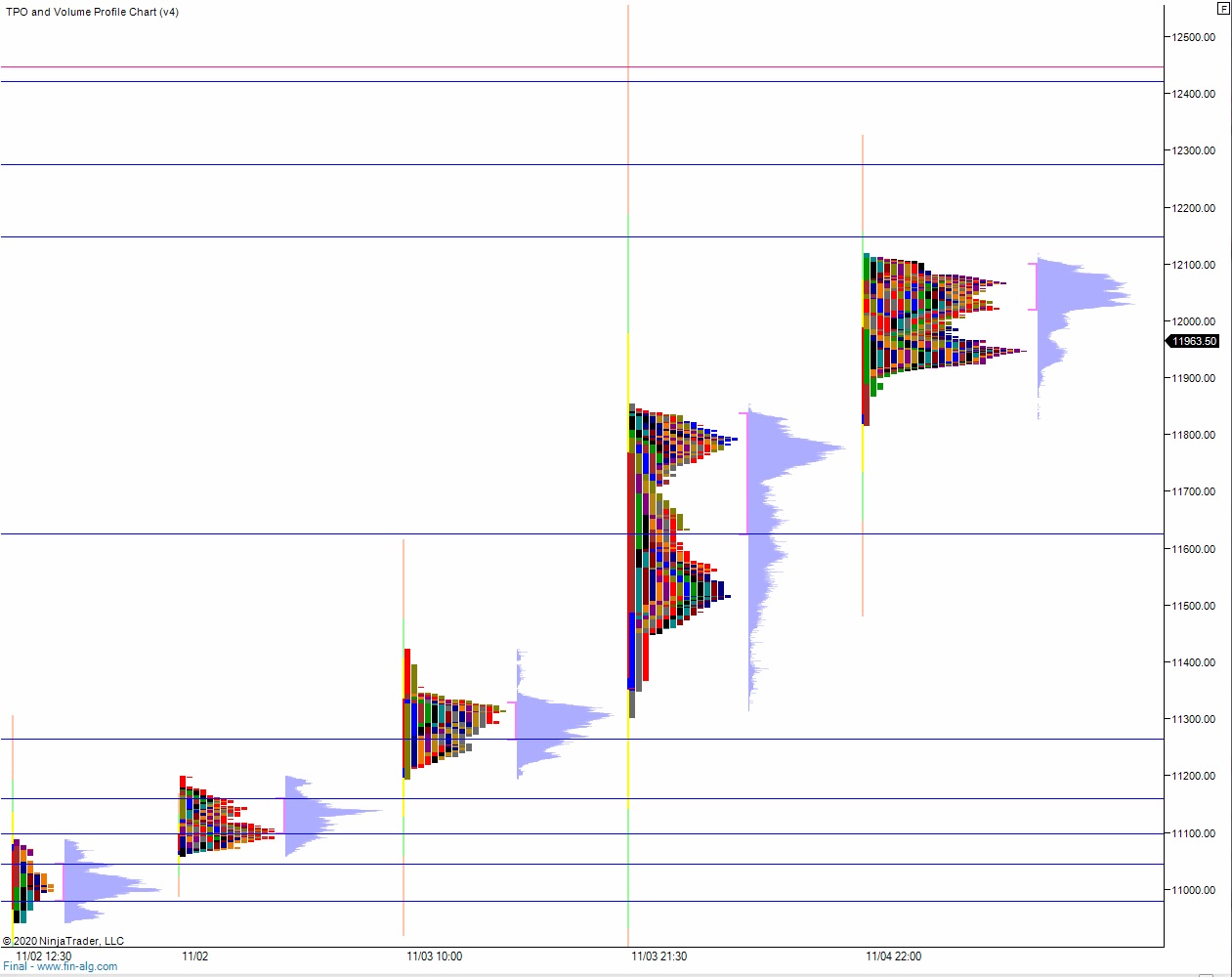

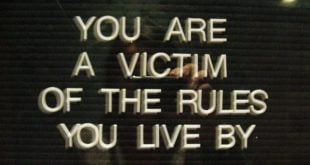

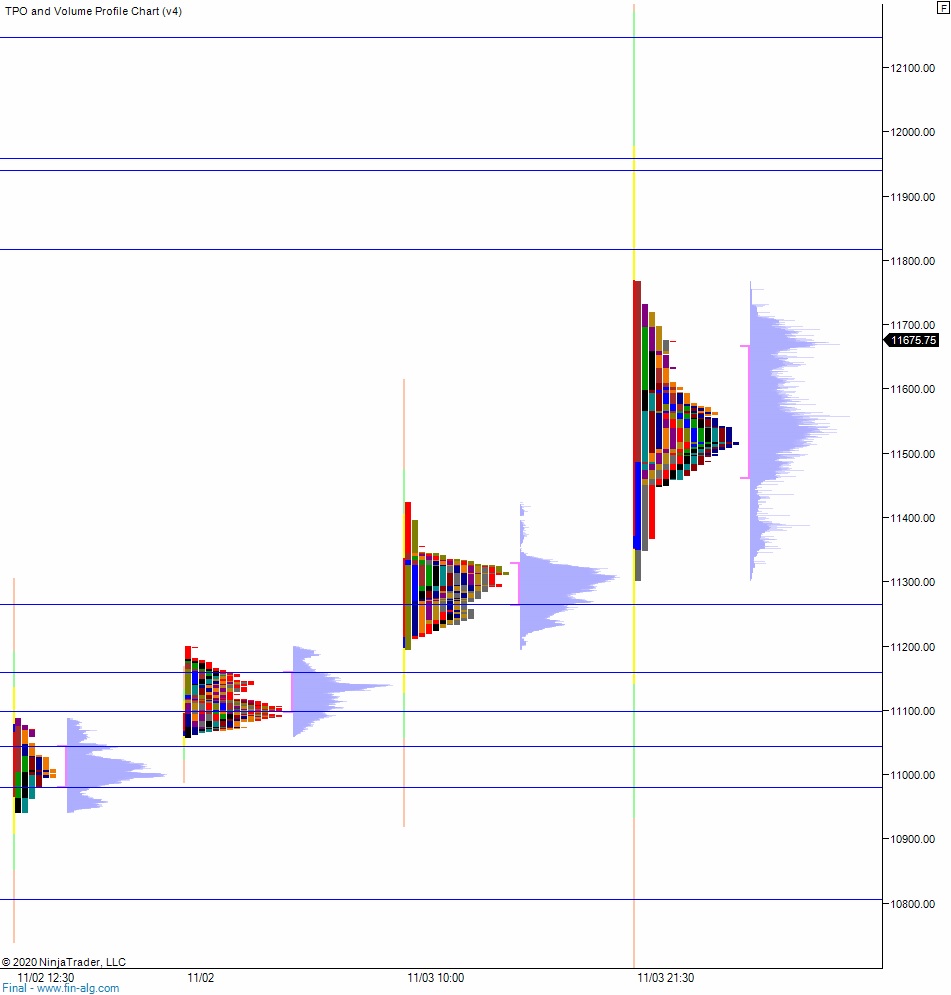

Gap up Monday is faded. Sellers press until late Monday then a strong rally takes hold. A series of breakaway gaps higher carry the rally through end of Thursday. Friday morning sees a sell spike that is consumed by a strong bid which eventually leads to a rally into the weekend.

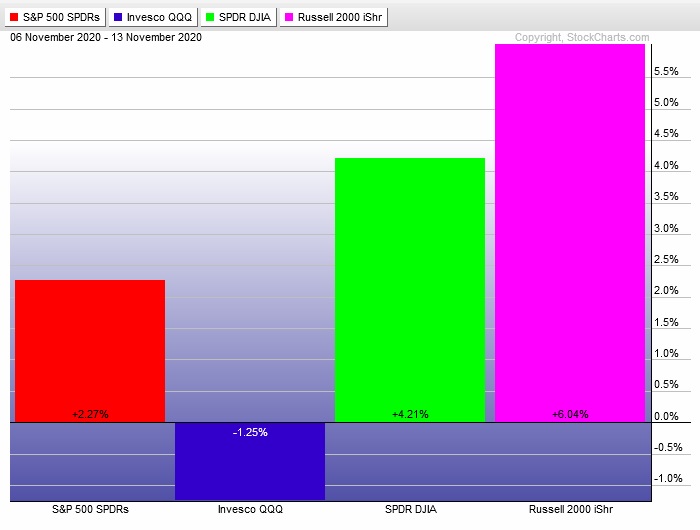

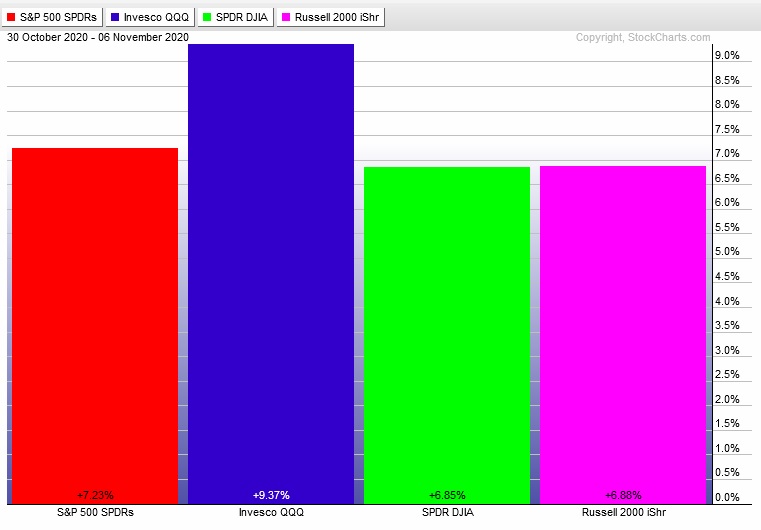

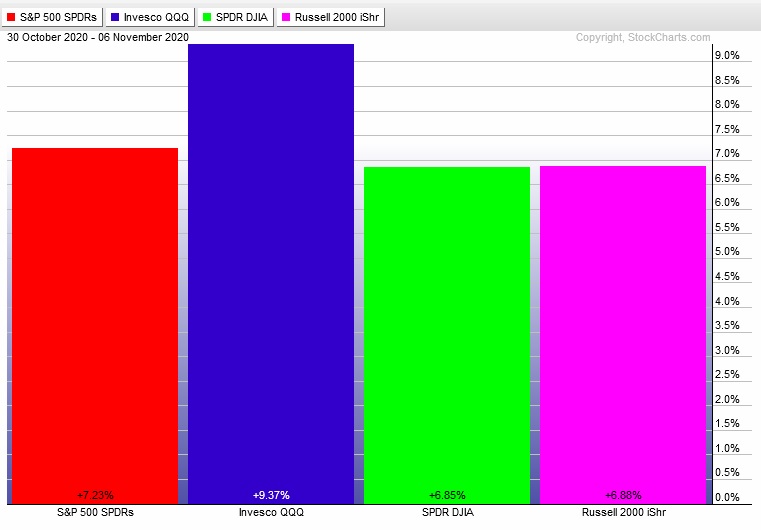

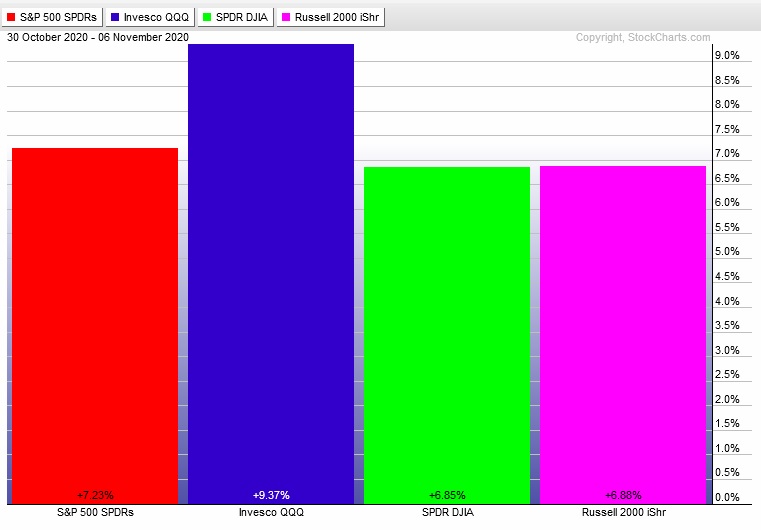

The last week performance of each major index is shown below:

Rotational Report:

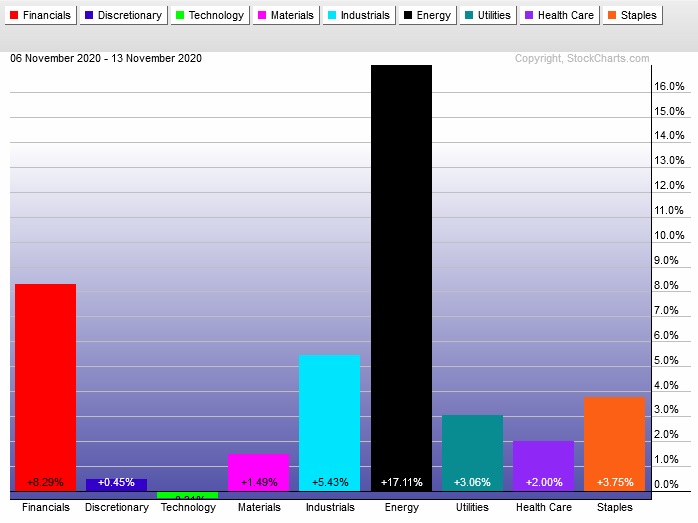

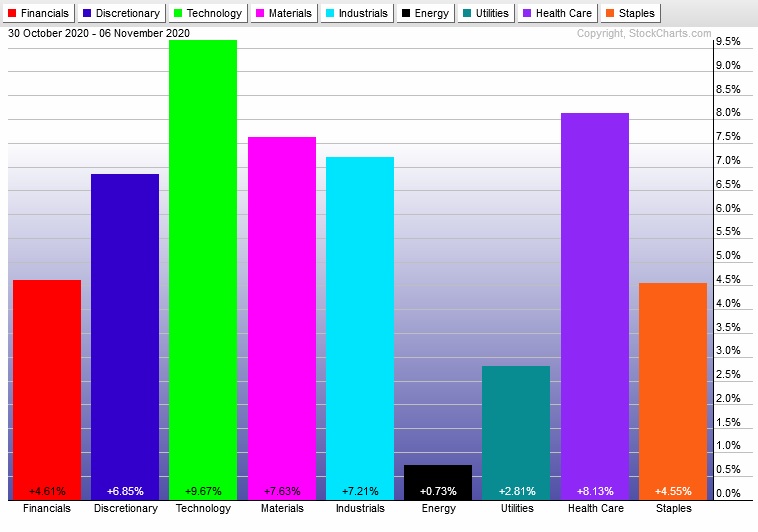

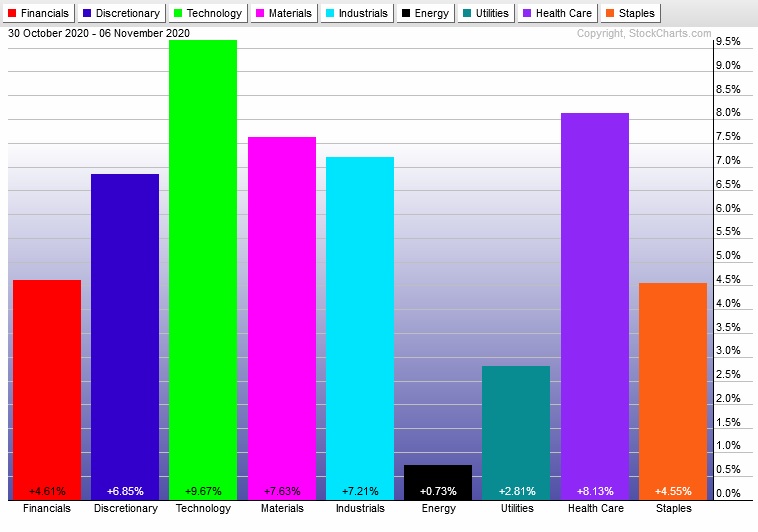

Tech leads the way as we see a strong risk on rotation back into equities after three consecutive weeks of risk off behavior. Utilities and Staples lagging which suggest risk appetite remains strong.

For the week, the performance of each sector can be seen below:

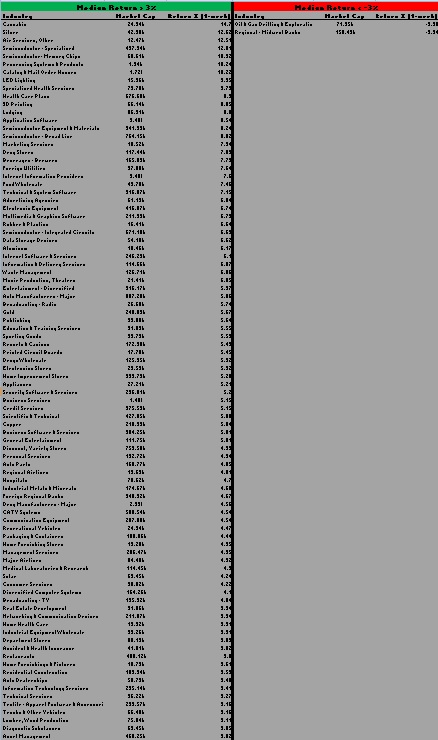

Concentrated Money Flows:

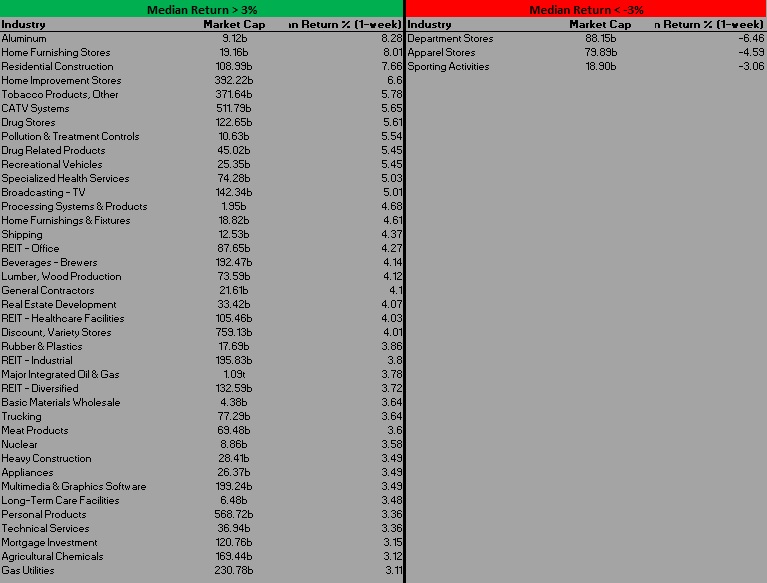

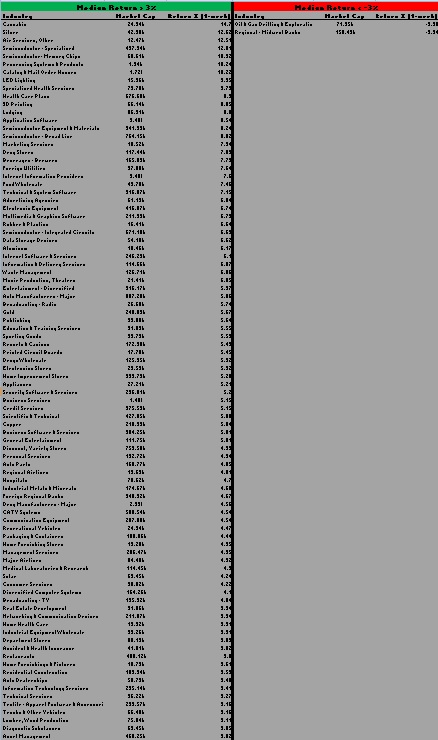

Industry flows skewed heavy bullish after being extremely bearish the week prior. Several semiconductor industry groups up near the top of the list suggest the rally included quality areas and not just garbage like cannabis—which outperformed all other industries last week.

Here are this week’s results:

III. Exodus ACADEMY

Transitioning into acceptance

Last week I observed several fintwit accounts expressing feelings of chaos. Loss of understanding. Disbelief. Types of emotions associated with domicide or some other form of loss. These were mostly Donald Trump supporters. However the market bewildered many a speculator as it rallied hard during the slower than usual presidential election process.

Denial can be a real risky emotion when trading.

Whether that denial continues into next week will likely in a large part be determined by the behavior of Trump. If he denies the legitimacy of the election process, his devote base is likely to do the same. Eventually, there will be a shift away from denial and into acceptance.

Our job is not to cast judgment on these contextual observations, but merely to do our best to objectively keep them in or perspectival framework while trading.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Markets settle into a calm drift until Thursday morning when Fed Chairman Powell speaks. Expect markets to find direction late in the week after the Fed speak and carry the move into the weekend.

Bias Book:

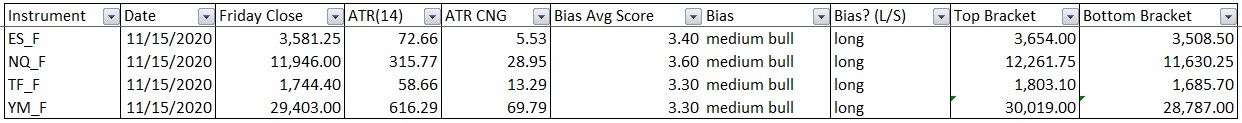

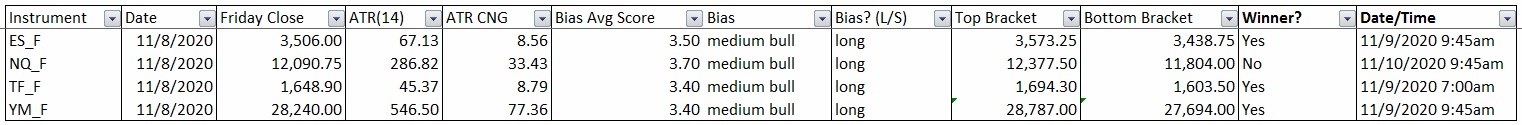

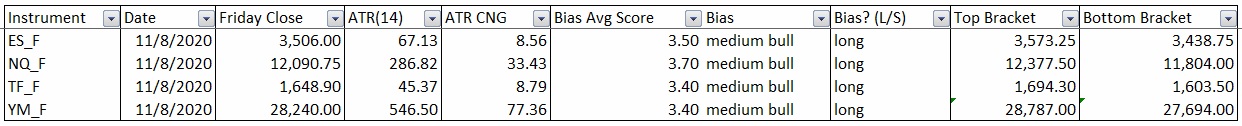

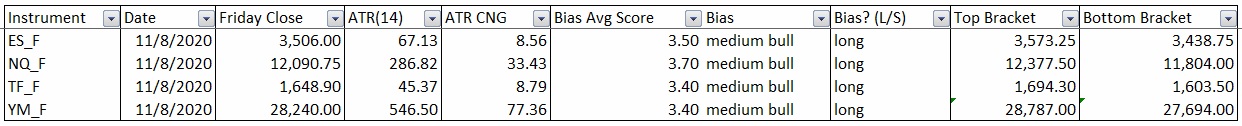

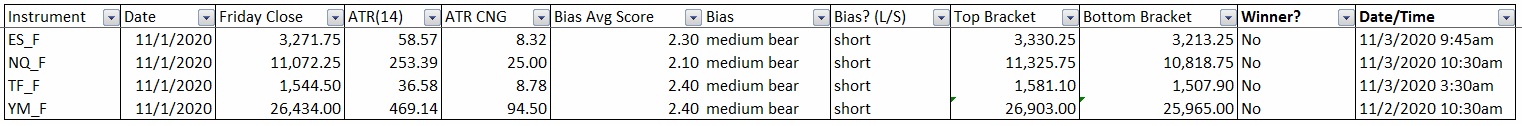

Here are the bias trades and price levels for this week:

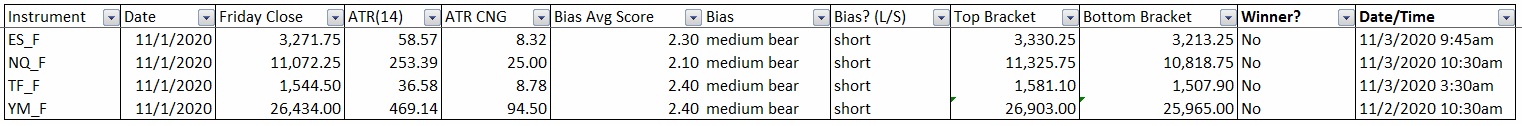

Here are last week’s bias trade results:

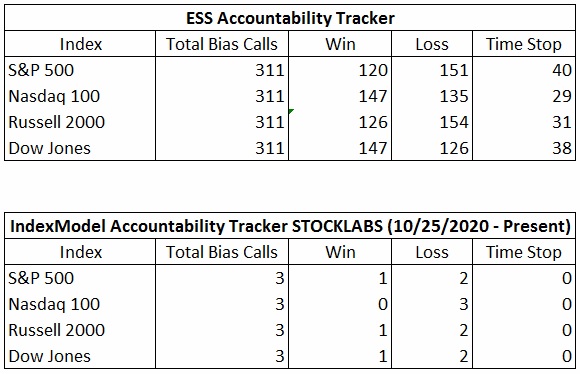

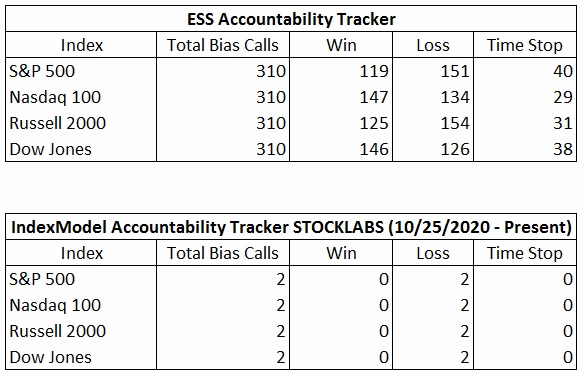

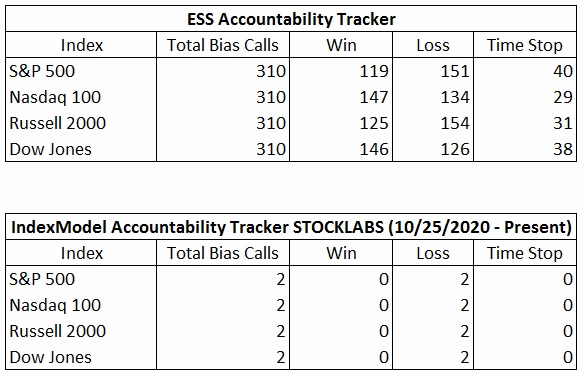

Bias Book Performance [11/17/2014-Present]:

Semiconductors press into potential support, same for Transports

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports bounced off range low and appear to be compressing. If this compression continues, it will start to build energy. The eventual break could send price out of the larger multi-year balance. This is a lot of “ifs. For now, the call for balance remains.

See below:

Semiconductors found a strong bid down at their support cluster for formed a strong fourth thrust higher. Discovery up continues. The fourth thrust can be tricky. Either this could mark the end of the rally, or be the start of something much bigger.

See below:

V. INDEX MODEL

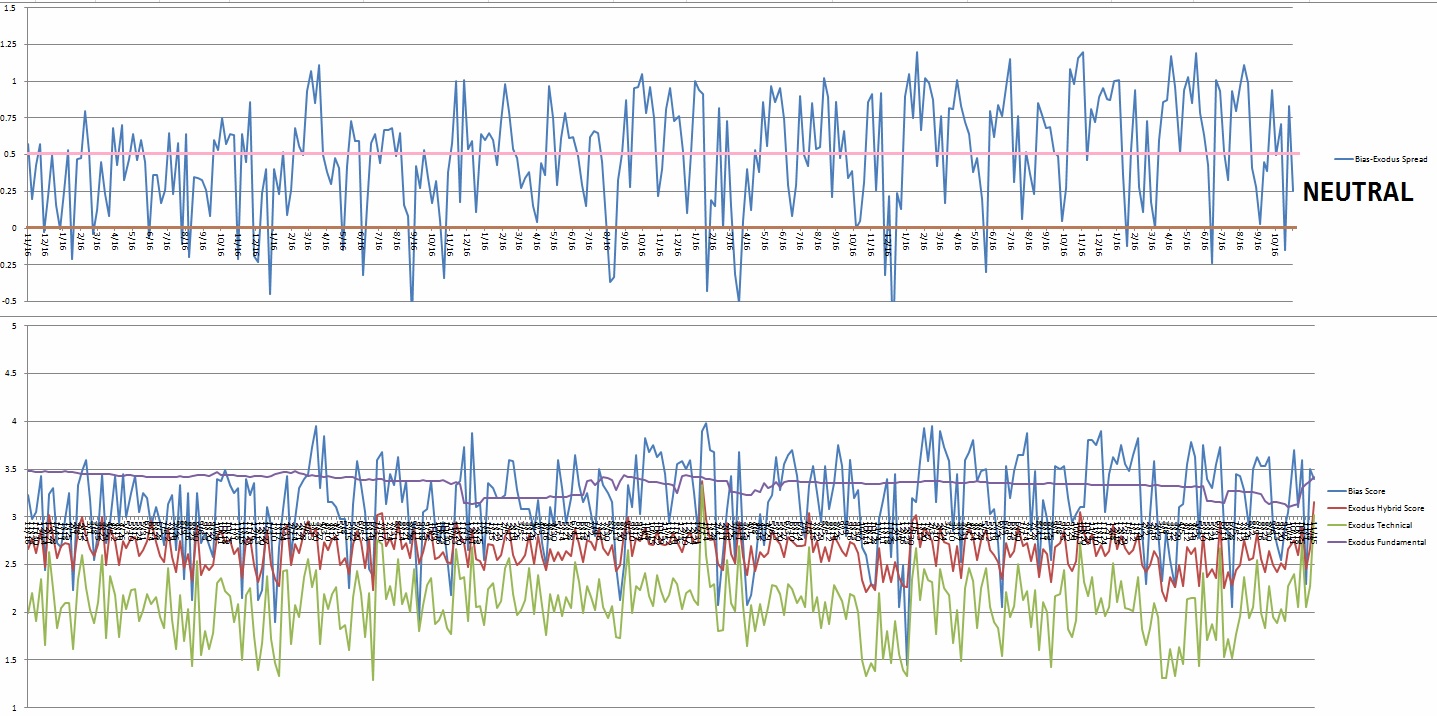

Bias model is signaling extreme Rose Colored Sunglasses. The signal calls for a calm drift, perhaps with an upward bias.

VI. QUOTE OF THE WEEK:

“Except our own thoughts, there is nothing absolutely in our power.” – Rene Descartes

Trade simple, discipline of the mind, trade the plan

Comments »