Took a heady dose of nitrous oxide Thursday morning, pretty much first thing after some coffee (no breakfast). At the dentist, of course. I have my teeth cleaned every three months…for the nitrous. I gives me the added benefit of having extra squeaky clean teeth. But I am all about that higher consciousness.

Anyhow the NOS calmed me down a bit. I’ve been real buggered lately by the lockdown, notably because I usually take off from the murder mitten during the bleak winter months. I have many dear friends in places much fairer than here who are happy to house me. In the mountains, in the clubs and on the west coast. But why go anywhere? So here I sit, in the grey stew, hunkered down for the sake of the devil knows what.

Fine.

I read a nice Jerry Garcia quote this morning and while the feller hardly seems like the Wall Street type he certainly rode his fair share of waves. I’ve never been a fan of Grateful Dead music, but if I understand correctly they sort of do these long form shows that build and build then release. Which is a common approach today in the techno house scene, and is definitely a wave, man. You know when a DJ is doing it right because the flow adapts to the crowd and the crowd begins the sync and everyone is just vibing.

The Garcia quote is at the bottom of this week’s strategy session, and I dare say it has everything to do with the world of speculative finance. Undifferentiated weirdness. That is all this game is. You can get your fill of bullshit whys from the heads at CNBC entertainment news or any number of popular twitter accounts that have proven to be wrong year-after-year-after-year-after-year-after-year and yet grown more-and-more-popular and more-and-more-vocal and more-and-more-retweeted. Or…or you can put your blinders up, write a trading plan, wrap some risk around it and show up every day ready to work your way through the undifferentiated weirdness.

It may seem sometimes like I harbor a clairvoyance. I mean, I’ve been banging the drums for years-and-years-and-years-and-years-and-years-and-years-and-years-and-years-and-years regarding Tesla. But look, even I sold a third of my hard accumulated Tesla shares back when we hit 1,000 (pre-split). It was just another example of not assigning too much meaning to the weird pudding that is high finance.

And fuck finance to be totally frank. This industry is so chock full of greedy bastids who’d just as soon sell you up shits creek as they would leave you holding the bag. A bunch of measly skunks I tell ya. Our job is not to befriend any of these big shot douche bags. Fuck’em. Our job is to execute our plan and consistently extract fiat american dollars. That’s it.

You start assigning some big meaning to this-or-that move or this-or-that big shot douche bag and you know what’s gonna happen? The Big Machine is going to zero you out and smash your ego with a cinder block. Maybe that’s a good thing. It can be a positive experience. Anything can be. Look at me…I live in a van down by the river loving life.

This is not the kind of game that rewards truth seekers or folks teeing up for that one big life changing trade. That sort of against the odds bullshit only works in hollywood scripts. It has been beaten into the conscious of the American that the individual can defy great odds, with some heroic bravery and luck and fling themselves out of the thick minutia of middle class existence.

Almost certainly this agnostic belief set will end up in ruin. Show up and work. And then work some more. Nobody cares. Look at me. Nobody cares about me except for like two good dudes on Twitter.

Doesn’t matter. I am not here to find a sewing circle, nor am I here to impress any of yous. Extract fiat. Build cool shit. That’s it.

RIP Chuck Yeager.

Raul Santos, December 13th, 2020

And now, the 316th edition of Strategy Session. Enjoy:

I. Executive Summary

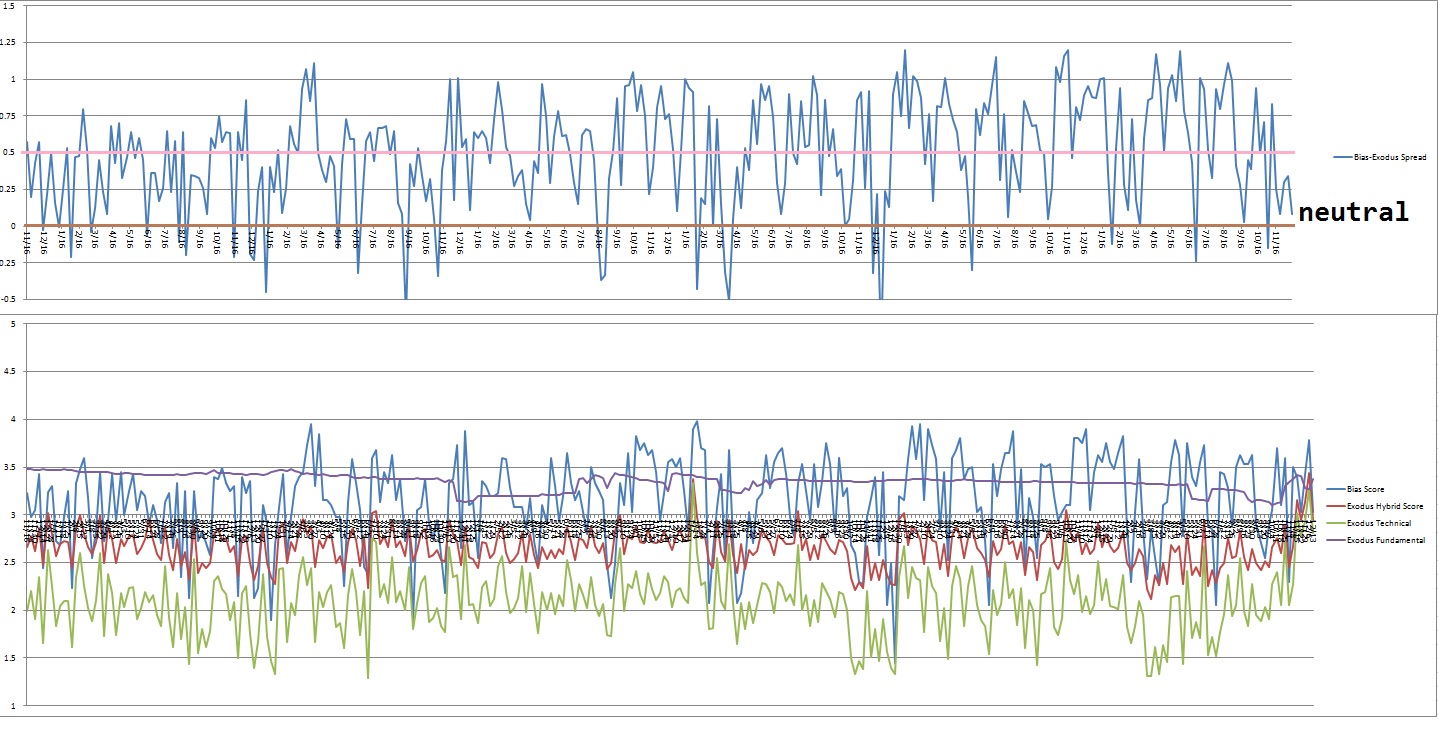

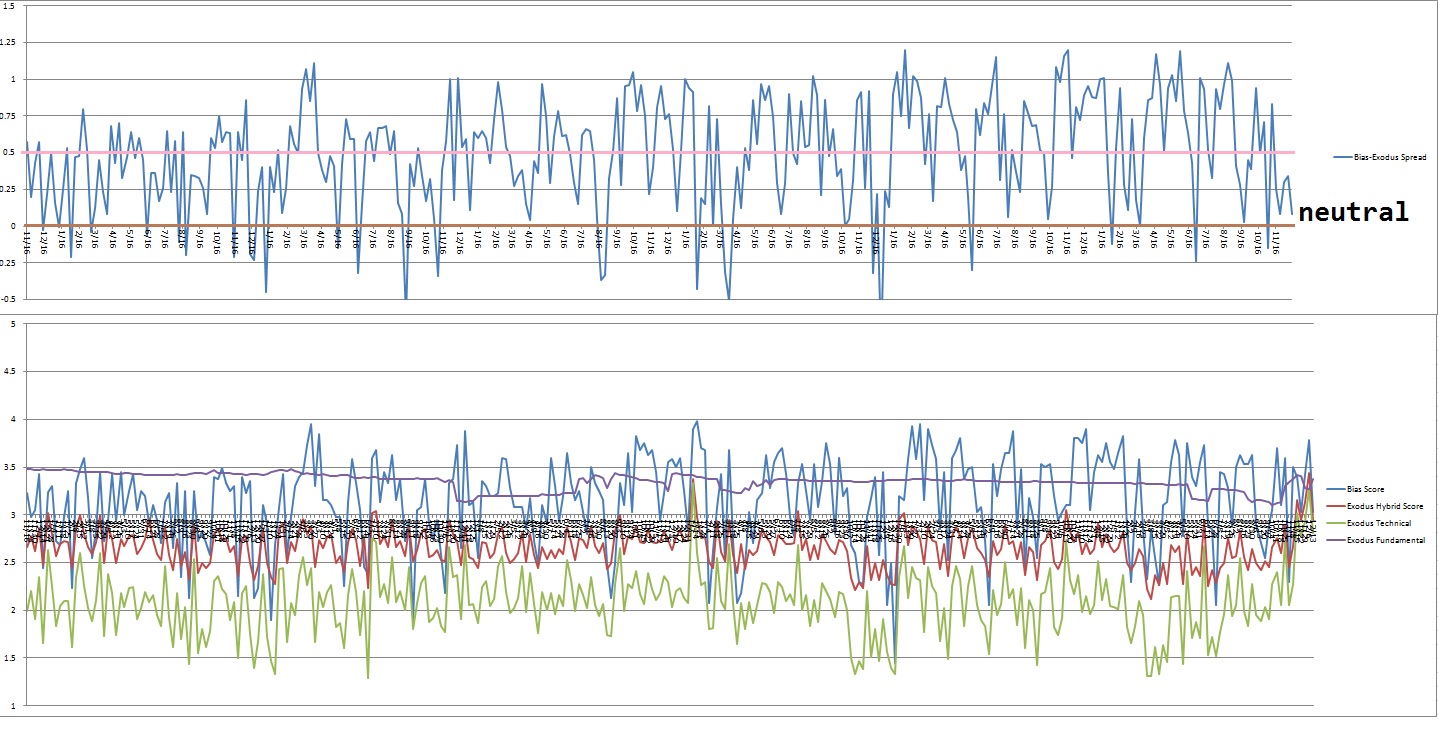

Raul’s bias score 3.03, neutral. Buyers re-emerge and control the tap through Wednesday afternoon. Then watch for the third reaction to the FOMC announcement to provide direction into the second half of the week.

II. RECAP OF THE ACTION

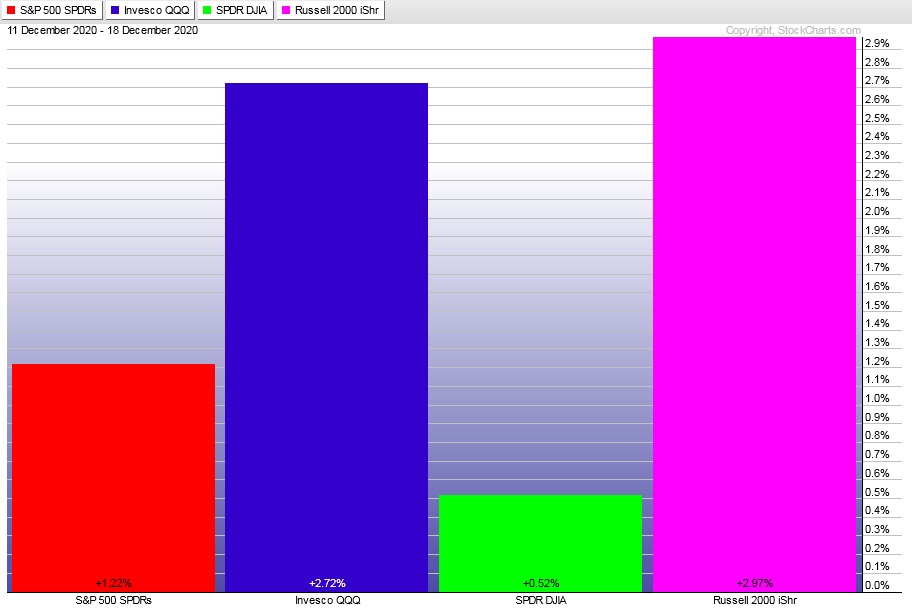

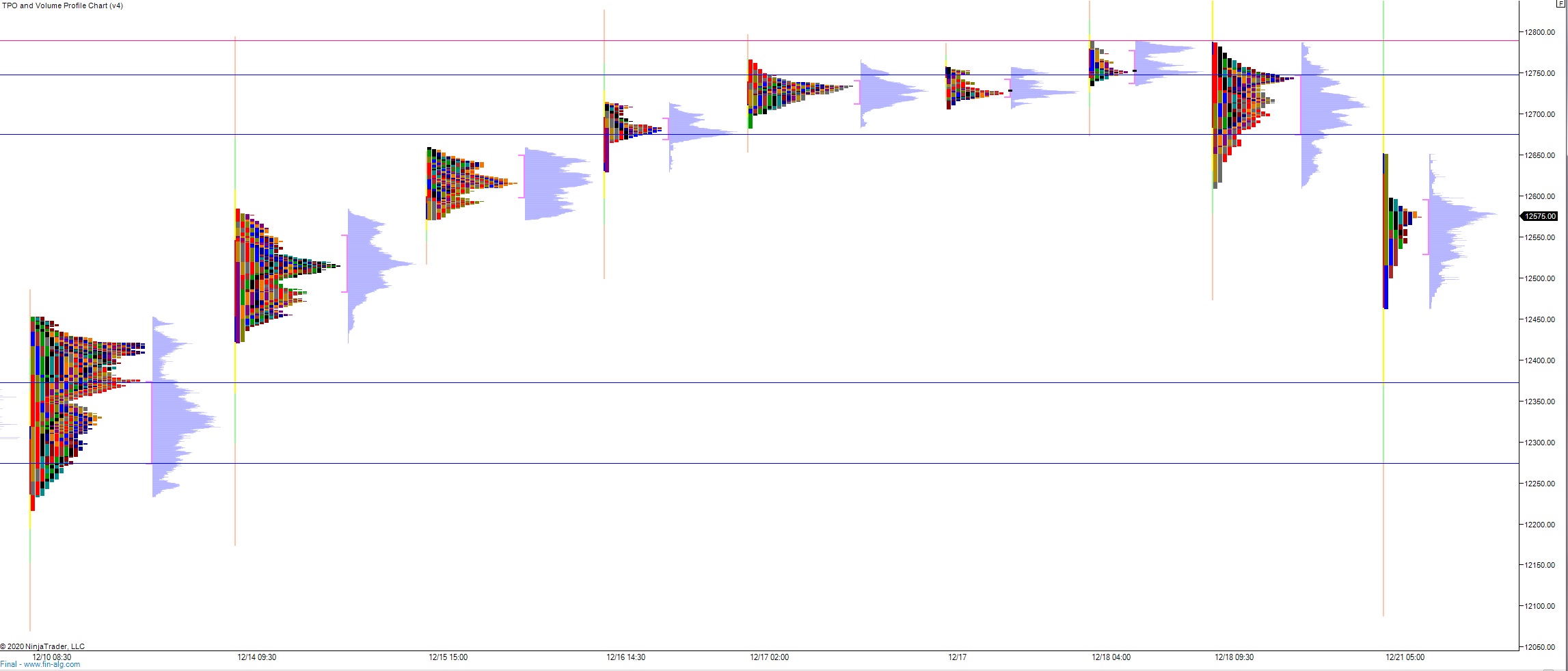

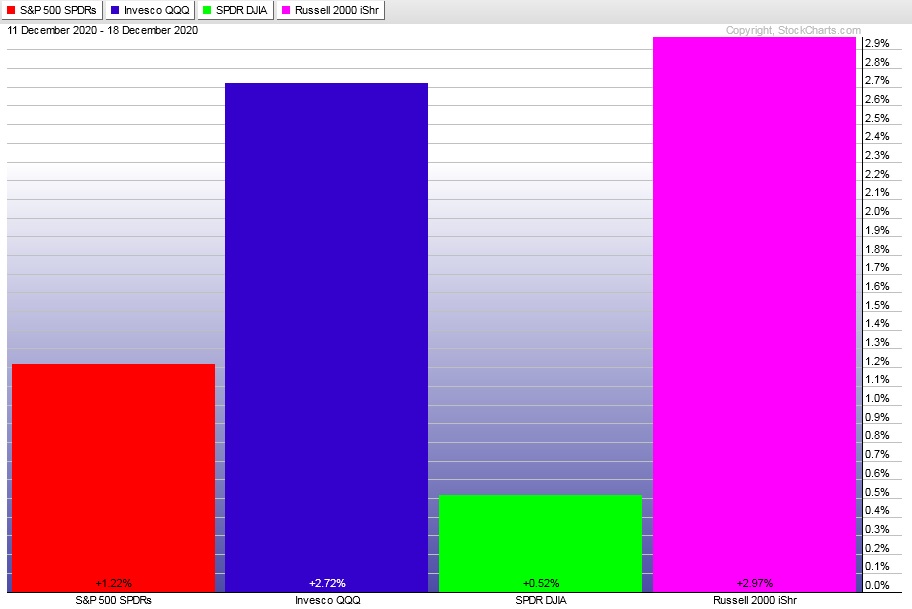

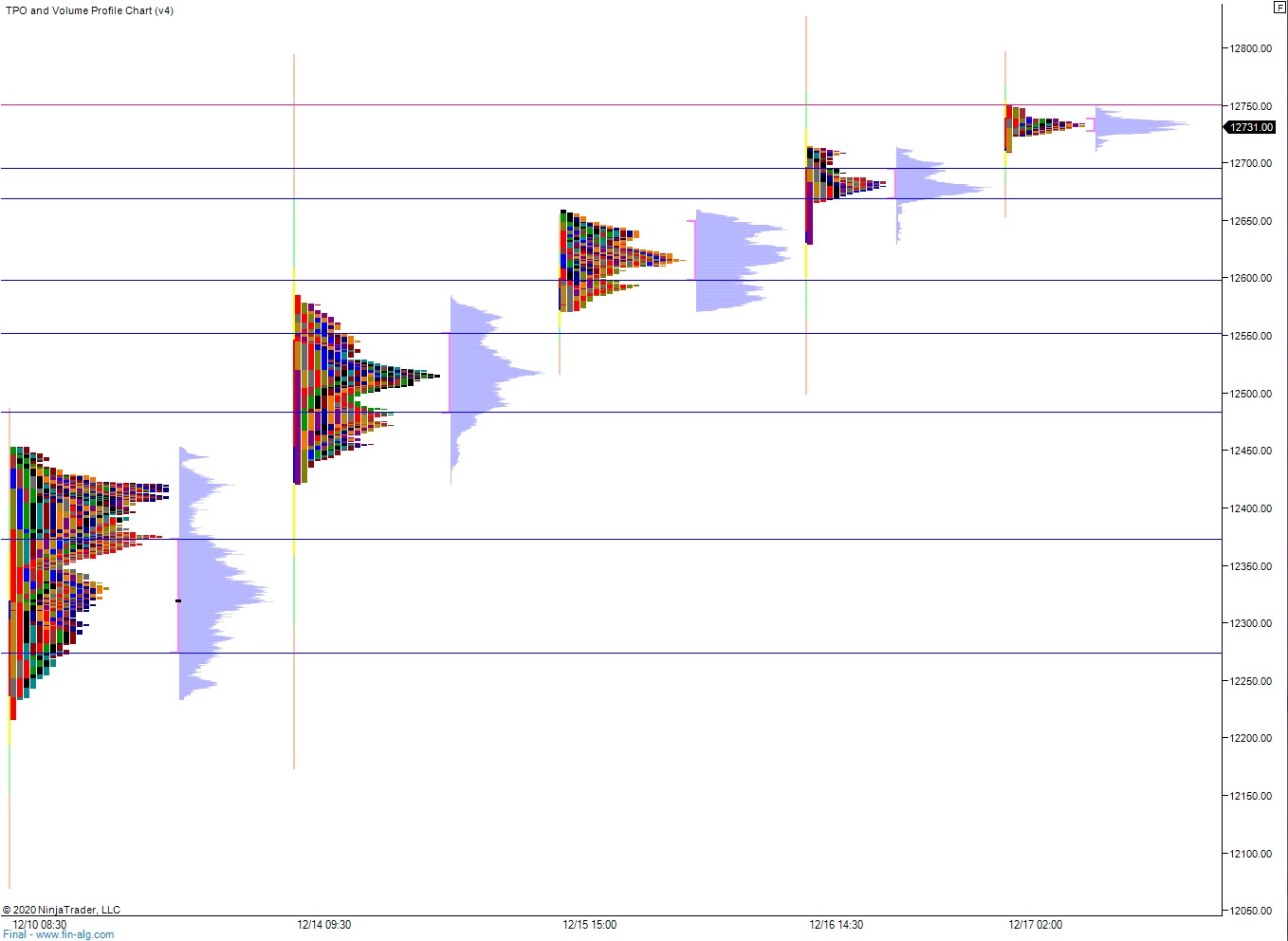

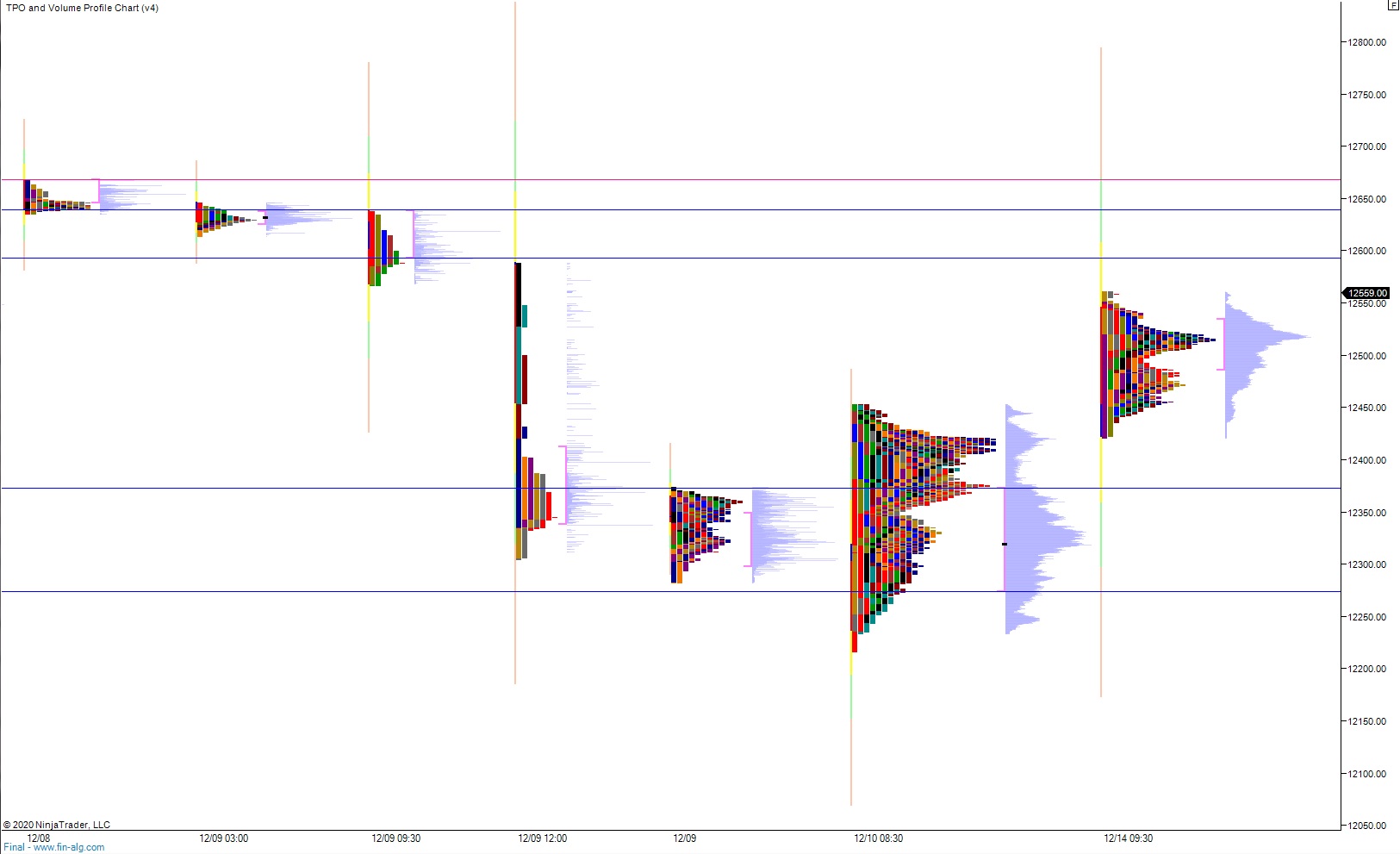

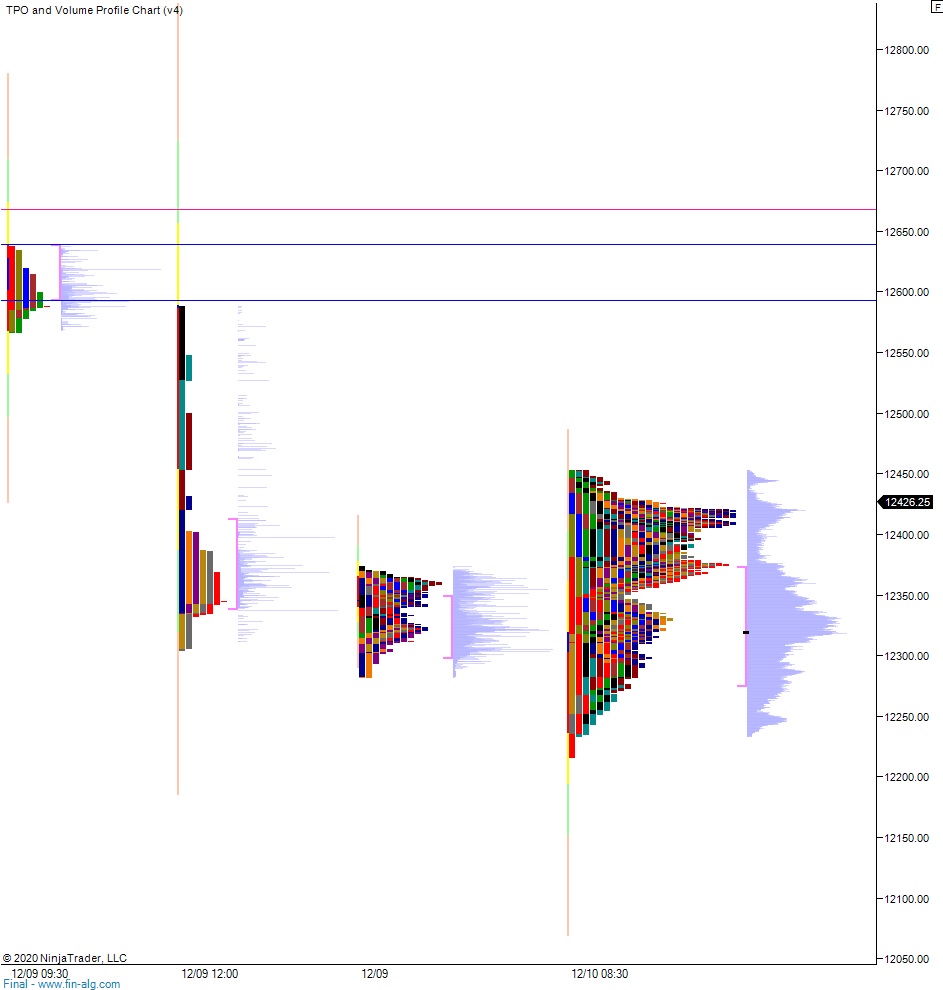

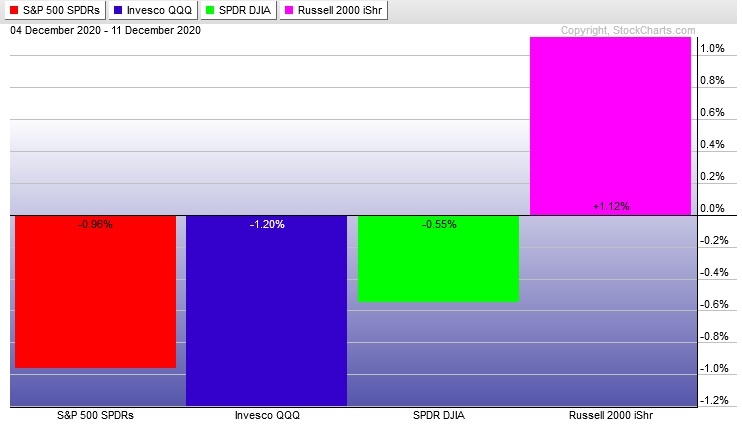

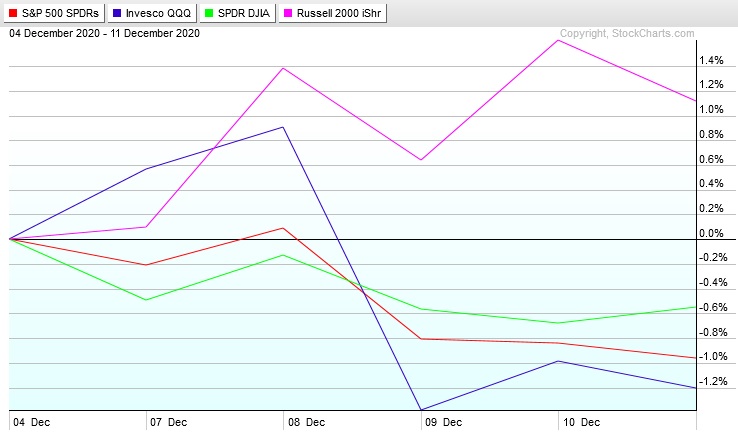

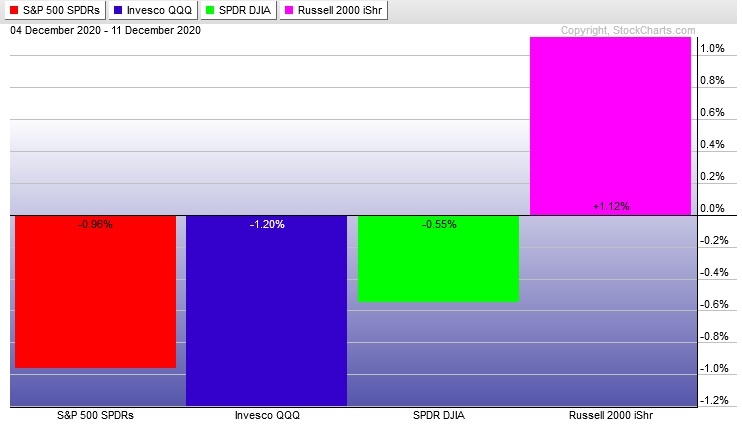

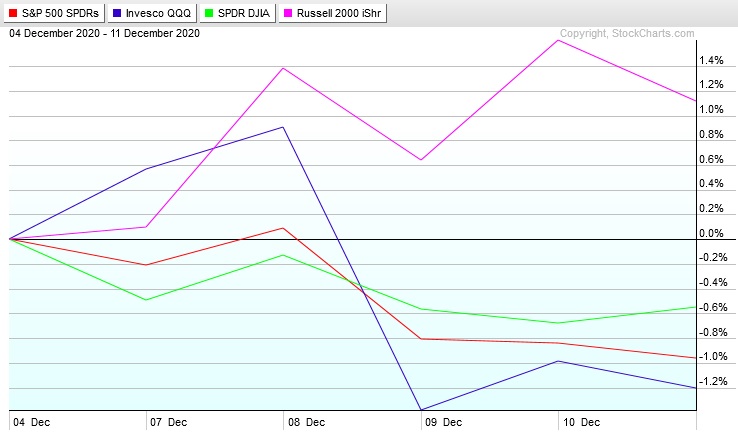

Rally through early Wednesday morning, then hard selling Wednesday. Some consolidation selling during the rest of the week but no real follow-through. Divergent strength from the Russell 2000 suggests risk tolerance remains strong.

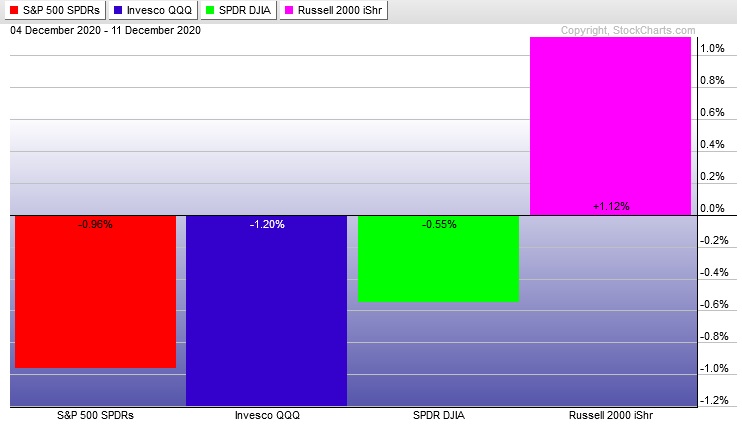

The last week performance of each major index is shown below:

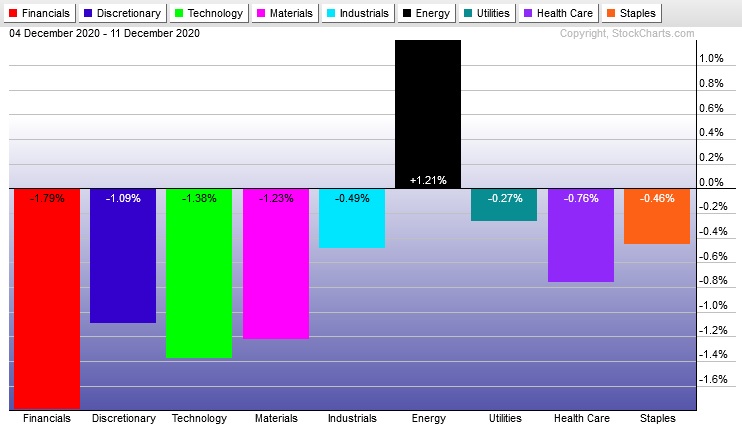

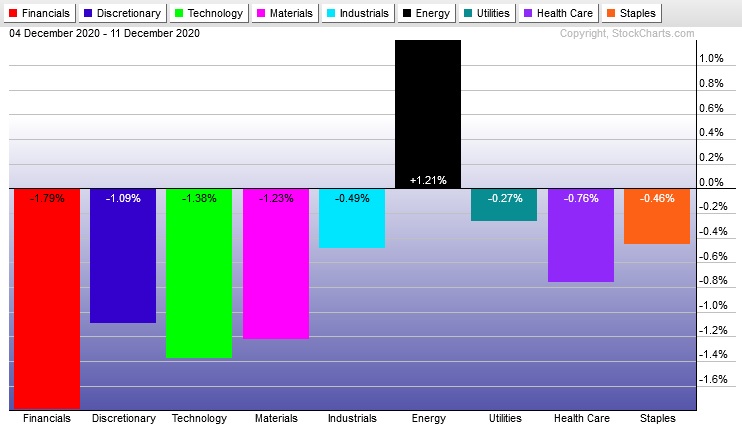

Rotational Report:

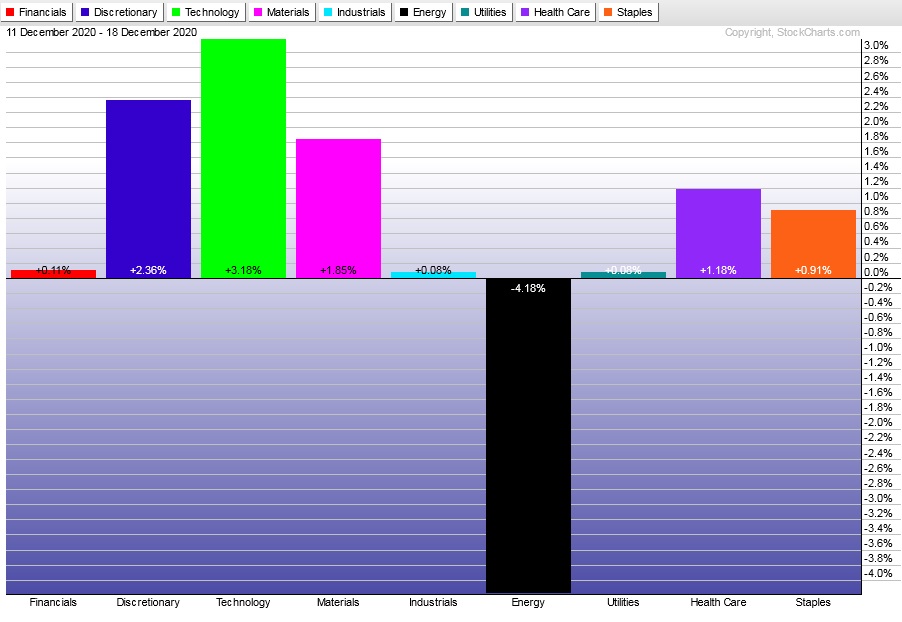

Energy independently bucks the selling. Everything else rotates lower. Tech being the second weakest sector is not something bulls want to see.

bearish

For the week, the performance of each sector can be seen below:

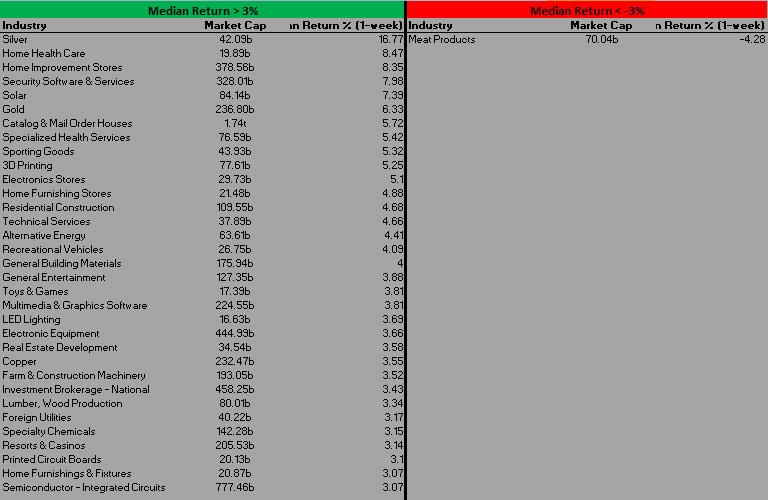

Concentrated Money Flows:

Industry flows somewhat neutral after two weeks skewing bullish.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

Still a bullish cycle

We are continuing to operate in a bullish overbought cycle until Friday the 18th. Expectations remain to the upside.

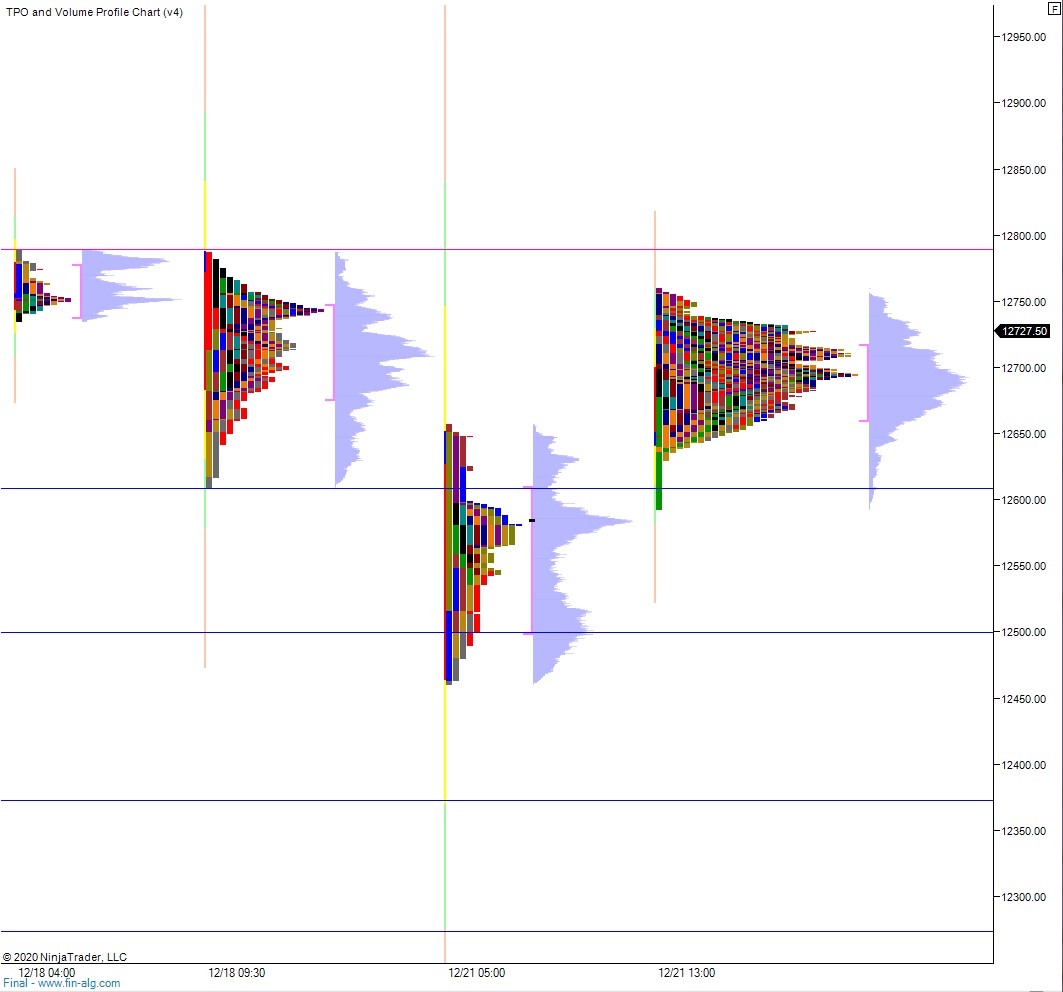

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

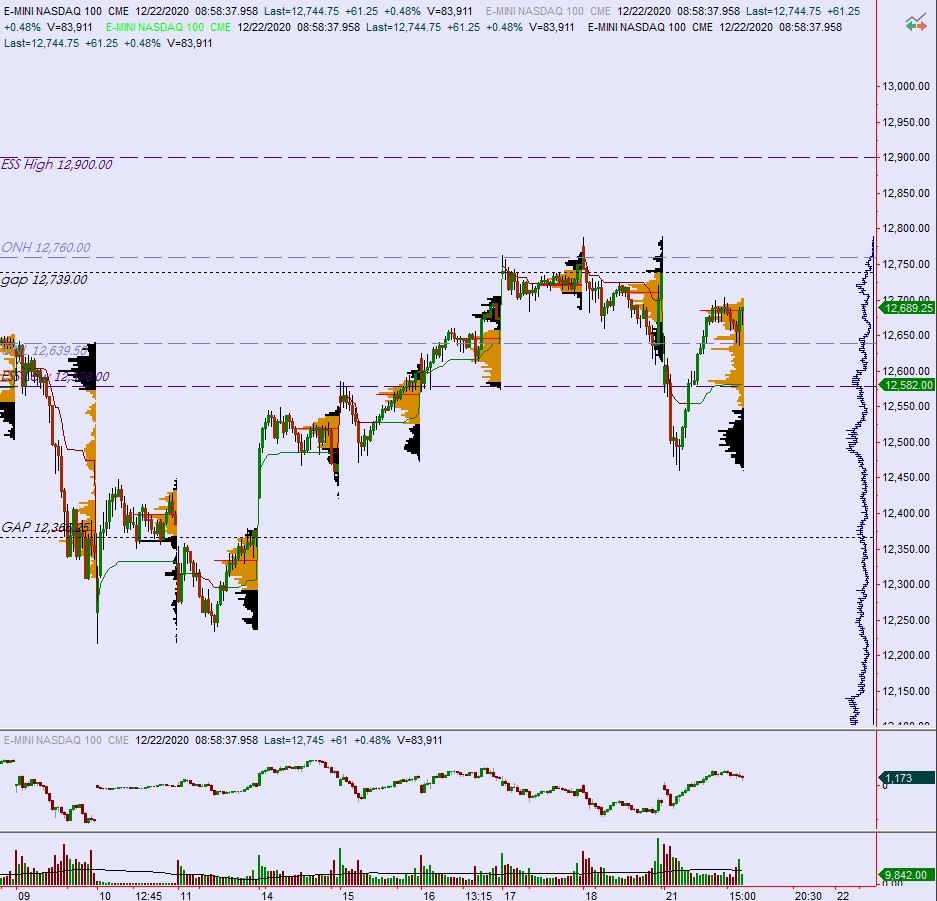

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Rally through early Wednesday morning, then hard selling Wednesday. Some consolidation selling during the rest of the week but no real follow-through. Divergent strength from the Russell 2000 suggests risk tolerance remains strong.

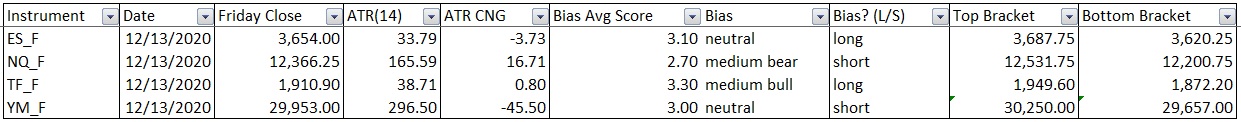

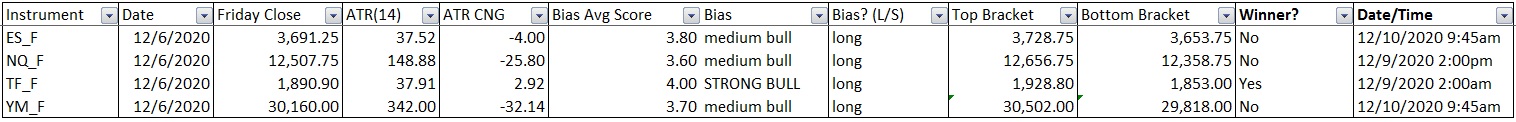

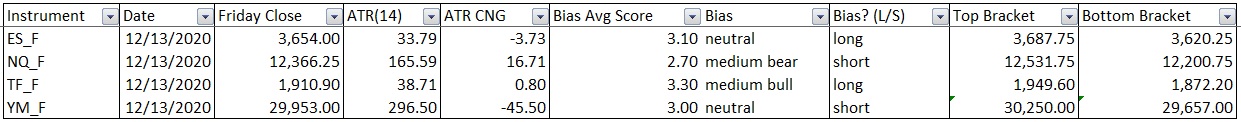

Bias Book:

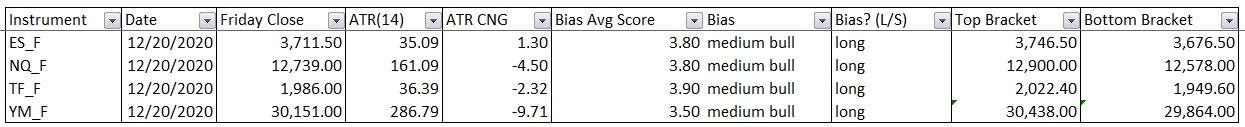

Here are the bias trades and price levels for this week:

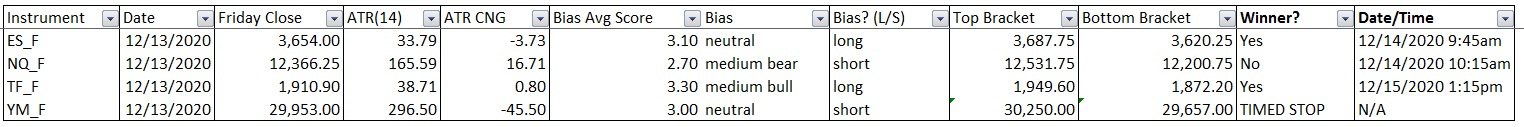

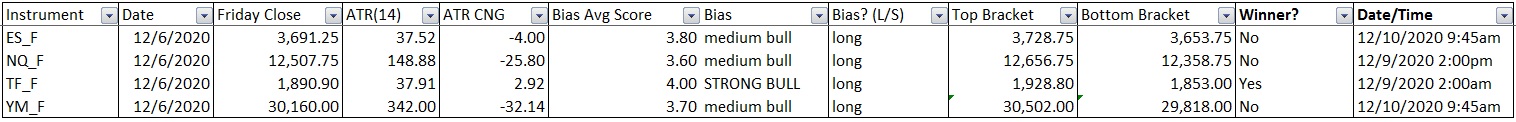

Here are last week’s bias trade results:

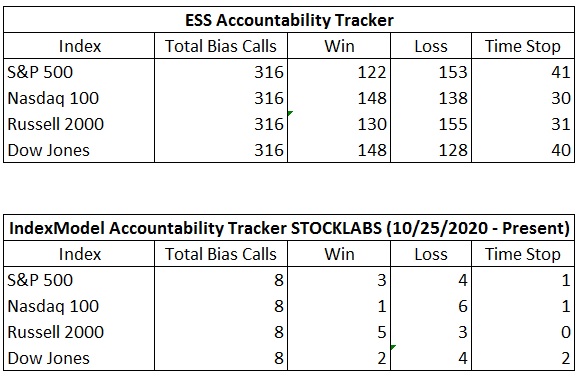

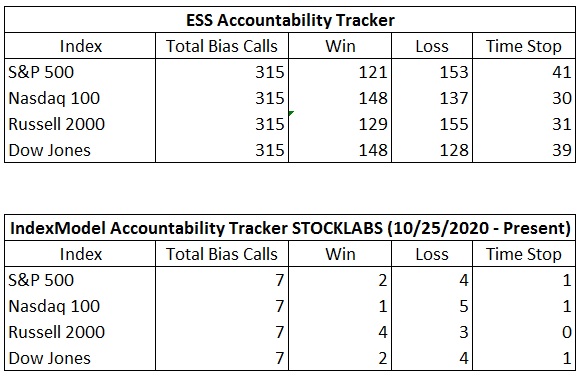

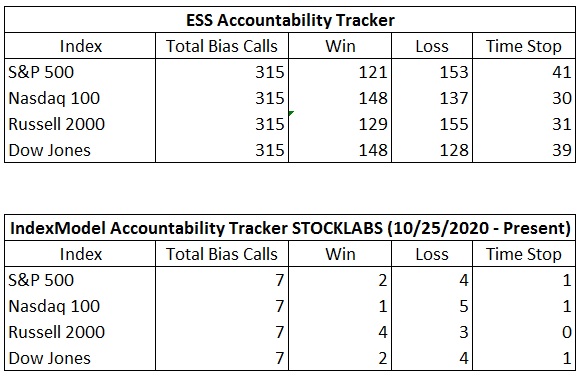

Bias Book Performance [11/17/2014-Present]:

Semiconductors go parabolic, Transports not acting like a failed auction

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports are lingering along the high after initially looking like they may print a failed auction. The longer this index can stick up here, the less likely a hard sell is to materialize and more likely we are to see a fresh leg up.

Watch FedEx earning due out Thursday after market close to perhaps tip this index one way or another.

See below:

Semiconductors really look sketchy for the bulls. After blasting higher out of the ascending wedge, the wedge which formed during the 4th rotation higher of the current discovery phase, they quickly have given back much of the move.

If this index falls back down through the wedge it could be the start of a discovery down phase.

See below:

V. INDEX MODEL

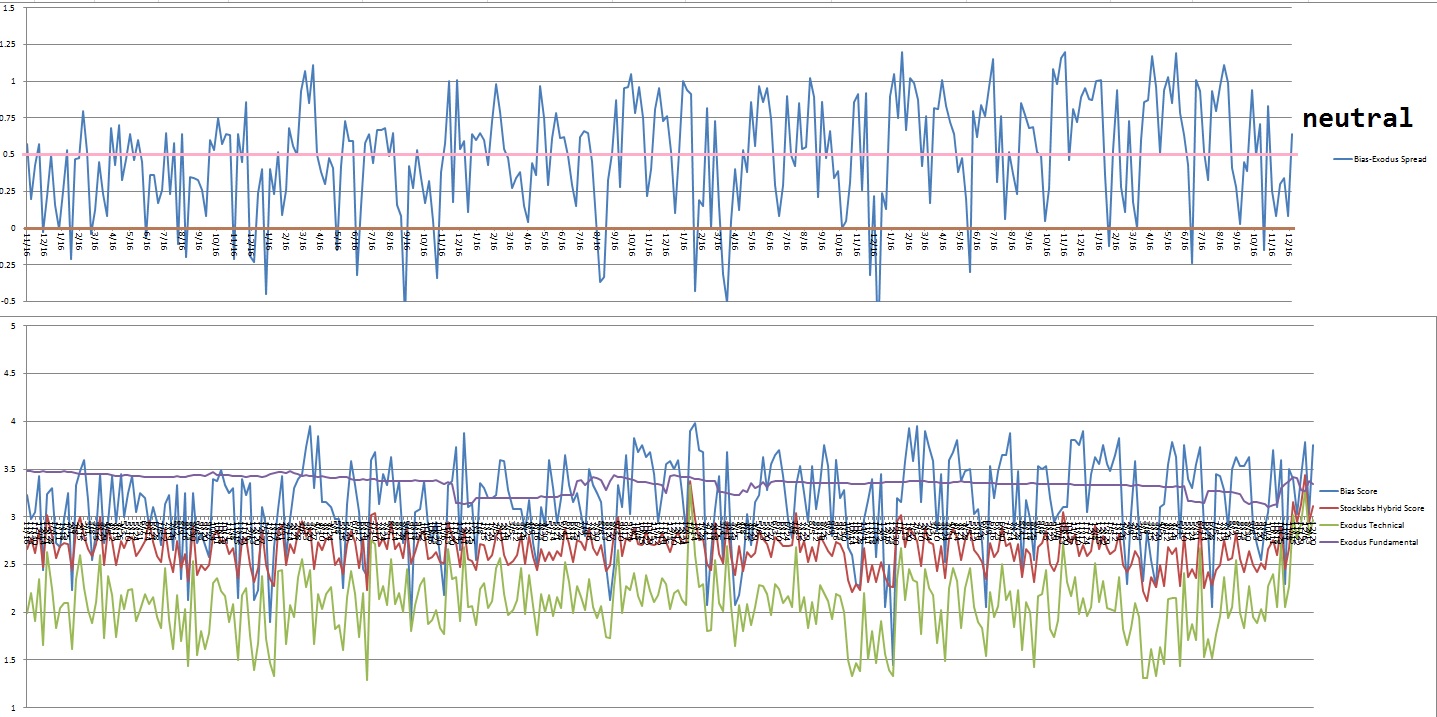

Bias model is neutral for a fifth consecutive week. No bias.

VI. Stocklabs HYBRID OVERBOUGHT

On Friday, December 4th Stocklabs signaled hybrid overbought. This is a bullish cycle that runs through Friday December 18th, end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“It’s pretty clear now that what looked like it might have been some kind of counterculture is, in reality, just the plain old chaos of undifferentiated weirdness.” – Jerry Garcia

Trade simple, eschew seeking higher meaning

Comments »