This weekend the whole pandemic really started triggering me. Your humble market practitioner and adventurer RAUL has survived some exterme-ose events in his day. High speed skateboard wrecks, scaling buildings without alerting the law-dogs, Hawaiian rip-tides, mountain plane crashes and so on. My thirst for adventure is rarely quenched. I thrive outside the comfort zone and sitting around watching the hecking Netflix is b-o-r-i-n-g. I need something higher octane or I risk the old mistake of seeking thrills in the financial markets.

Do you know how dumb it is to try and catch a jag from trading? I can most certainly assure you that will result in financial ruin.

Trading is trading is trading. You sit down. Plan your trades, trade your plan then you go eat lunch. There is nothing exciting about it.

I regularly salvage a day—going from down 5-600 bucks to ending up 1600. It does nothing to me emotionally or physically. I’d feel the exact same if the day ended right where it was initially, down -600. Money is merely a means to politely being able to say no to people. I can turn a trick just as easily downtown, or pour some cement or design a plant wall. Diversify your income streams lads. Do this as early and often as possible. It goes miles towards cultivating the indifferent strength of a hardened speculator.

Capitalism is the game. It is not perfect. But it rewards the callous. You don’t have to be a dick. You’re better off being a crocodile. Go experiment with looking like a log for a few days then snapping into high speed action—making to kill your prey in short order. Capitalism.

Switching over to Stocklabs from here on out. I had the pleasure of catching up with our dear pal The Fly last week via telephone. He gave me the grande tour and I’ll tell you what—StockLabs is the nuts and the shaft. Thursday afternoon, after closing out the SQQQ position taken early Monday, I’m sitting inside Stocklabs, on the Livefloor, watching sentiment in real time, and it became abundantly clear a bid was about to press into the market. The data is intuitive. I traded the bounce and that was it. I’m hooked.

This week’s Strategy Session looks mostly the same as any other one except now it is powered by Stocklabs. I may add some information to the report in the future, but for now I am tiredt.

I am bullish into month-end, into the full-moon halloween, and I am considering dressing up like some kind of real horror show and terrorizing the locals.\

As always, TBD.

Raul Santos, October 25th 2020

And now, the 309th edition of Strategy Session. Enjoy.

I. Executive Summary

Raul’s bias score 3.60, medium bull*. Expect a calm drift, perhaps with a slight upward bias. Then watch for GDP Thursday morning then big tech earnings Thursday afternoon to put some direction into the markets heading into the weekend.

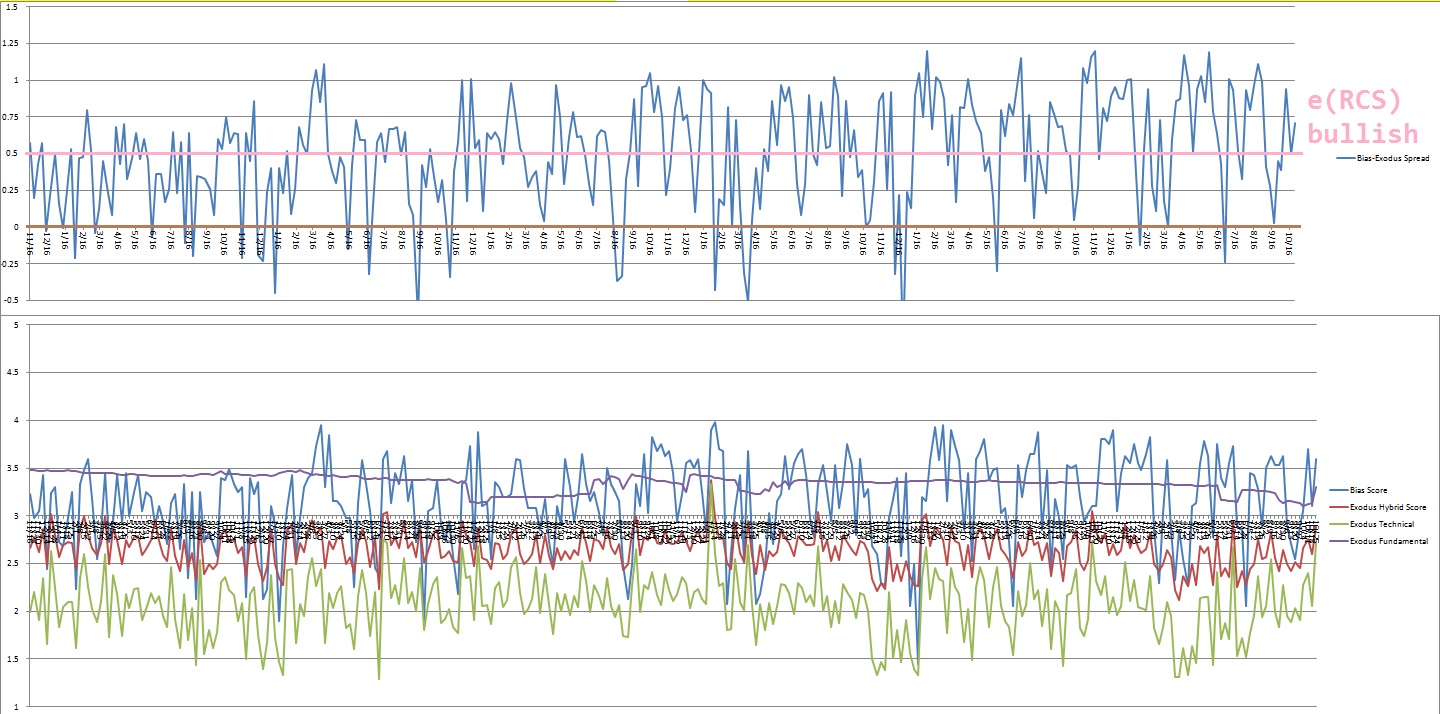

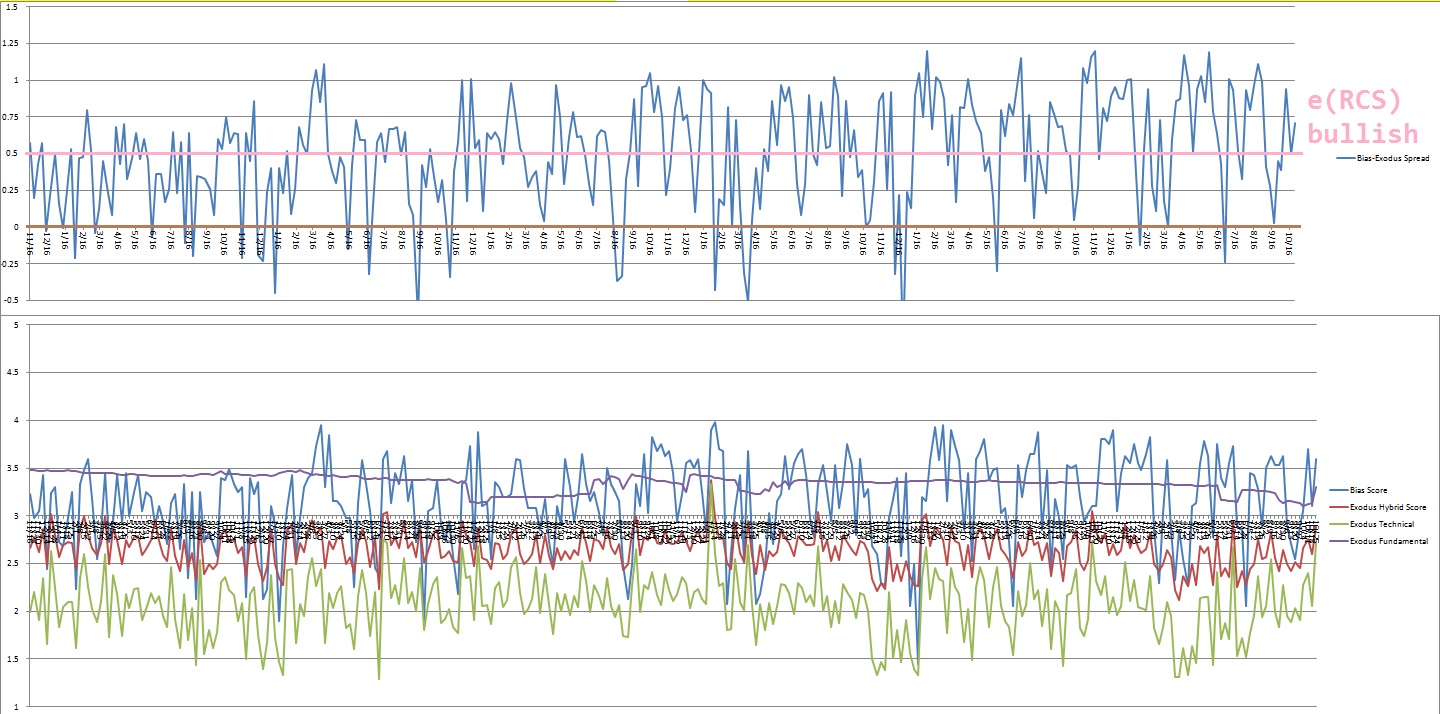

*extreme Rose Colored Sunglasses [RCS] BULLISH bias triggered, see Section V

II. RECAP OF THE ACTION

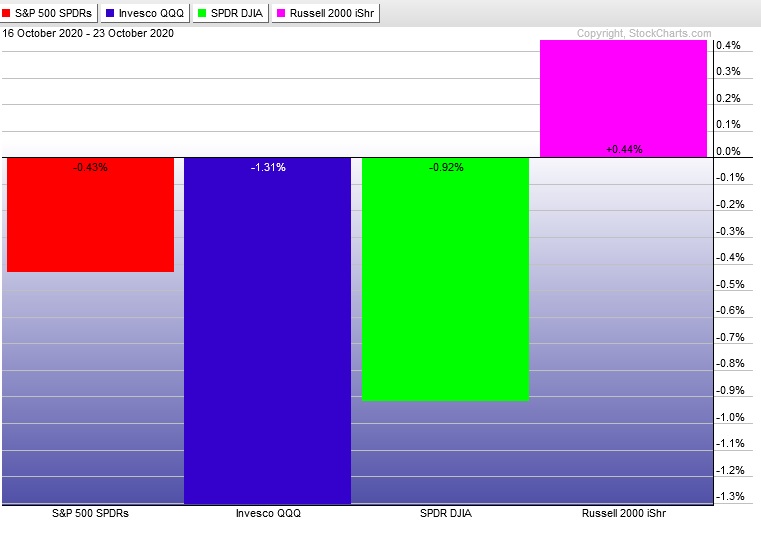

Big sell Monday. Downward pressure through Thursday morning then a minor relief rally into the weekend.

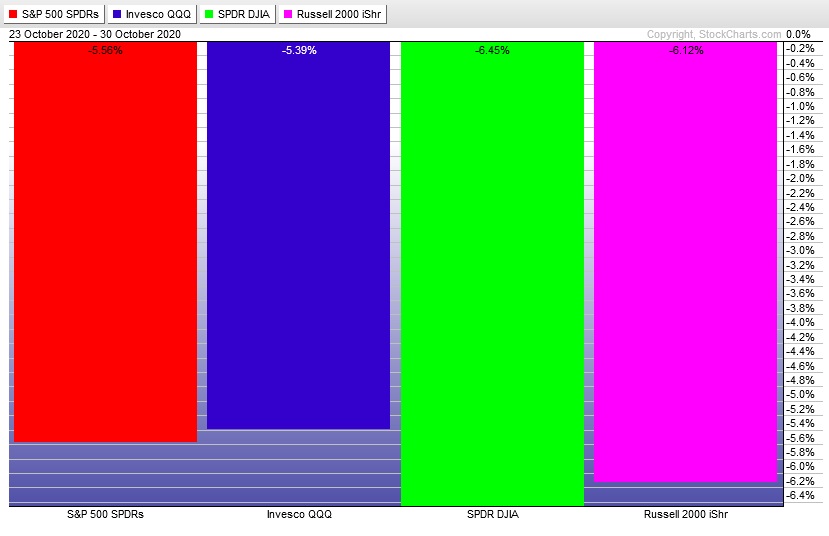

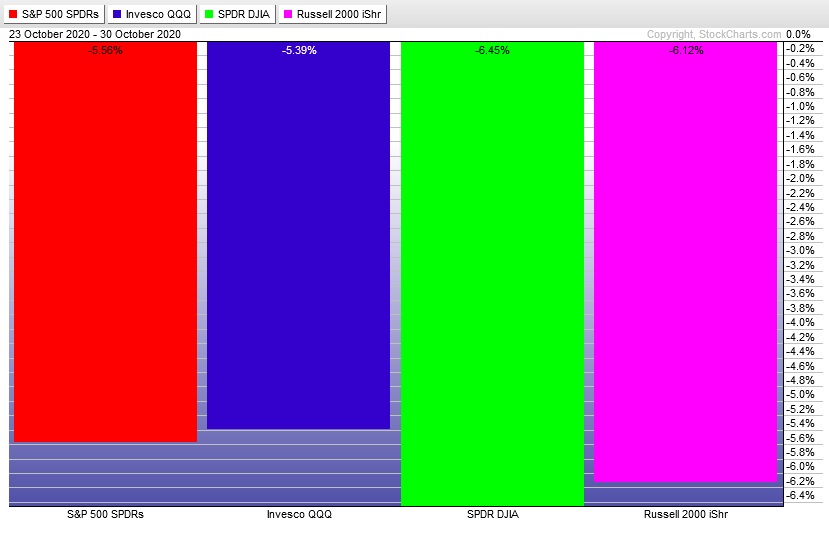

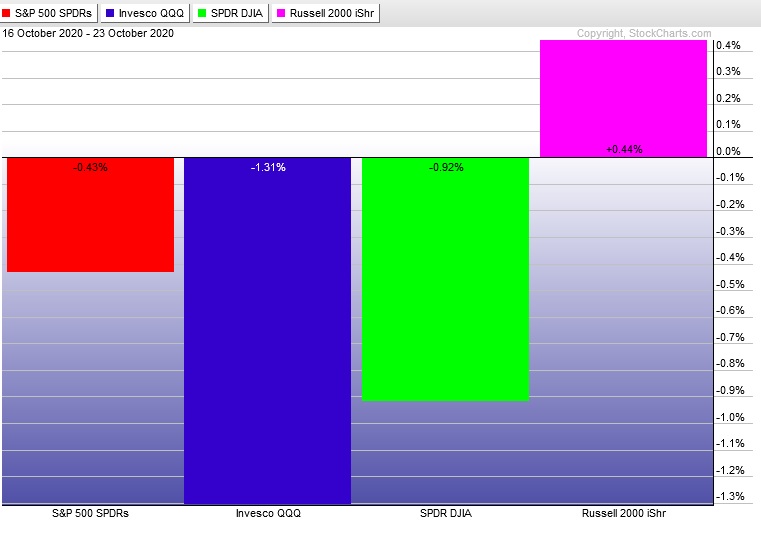

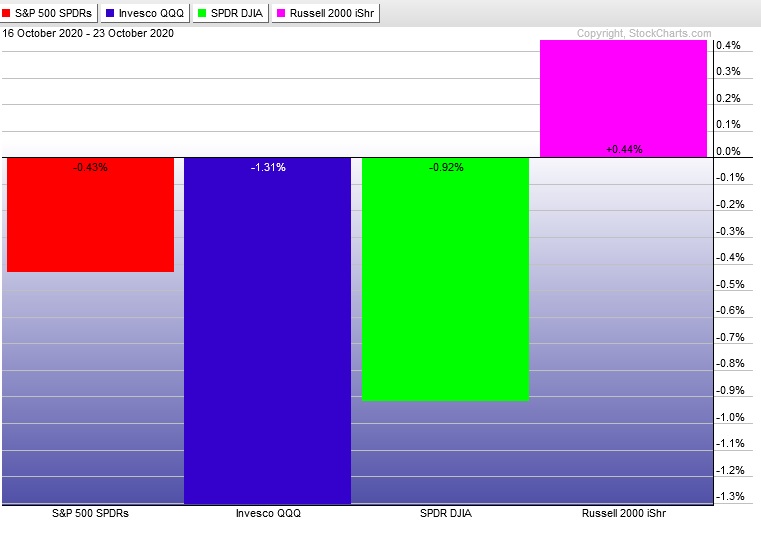

The last week performance of each major index is shown below:

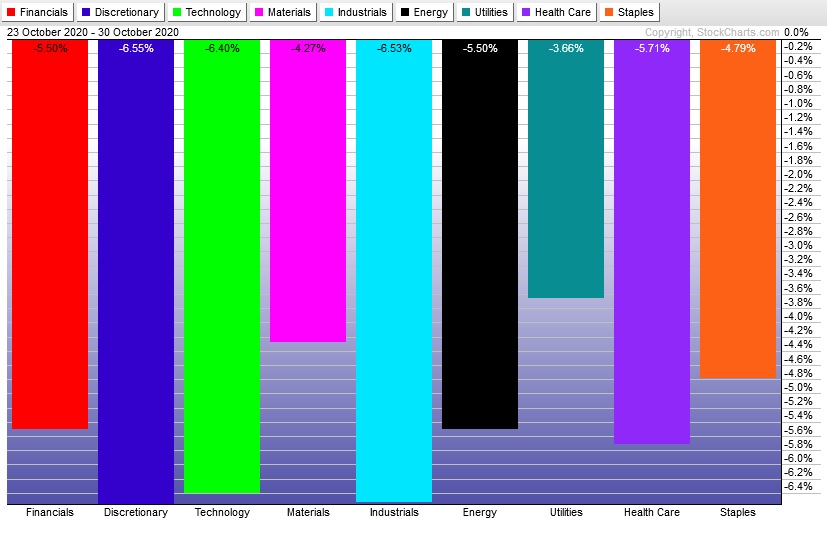

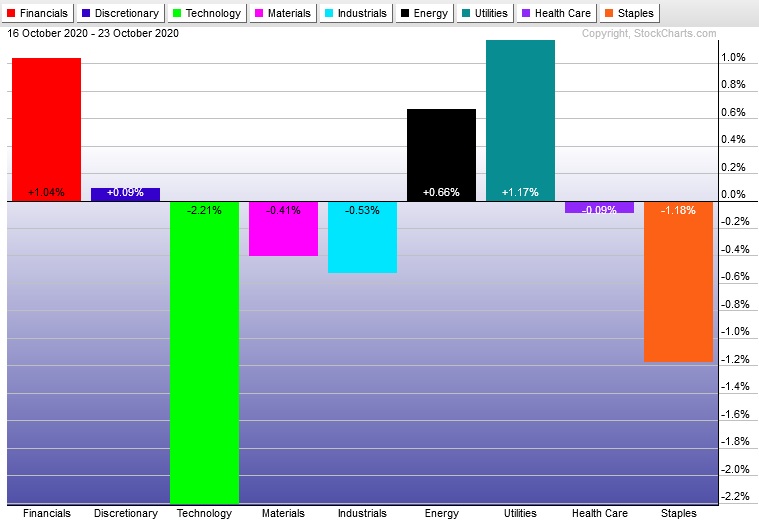

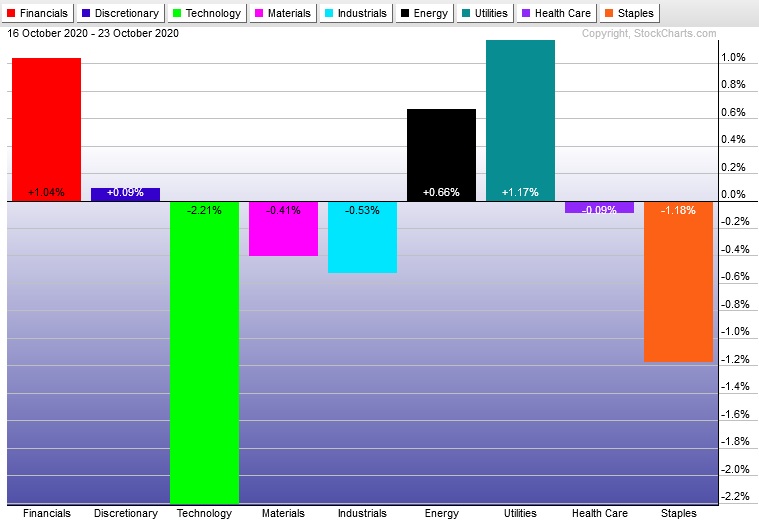

Rotational Report:

Rotations bearish for a second week. Key Tech sector under pressure while Utilities see strength.

caution bulls

For the week, the performance of each sector can be seen below:

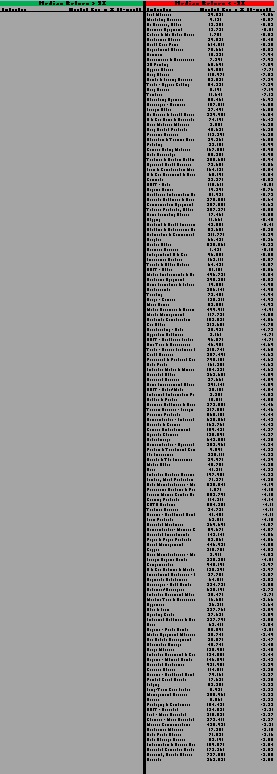

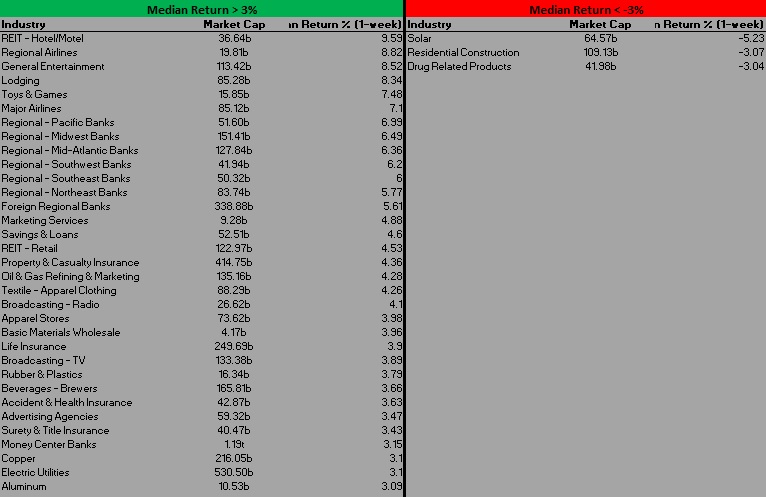

Concentrated Money Flows:

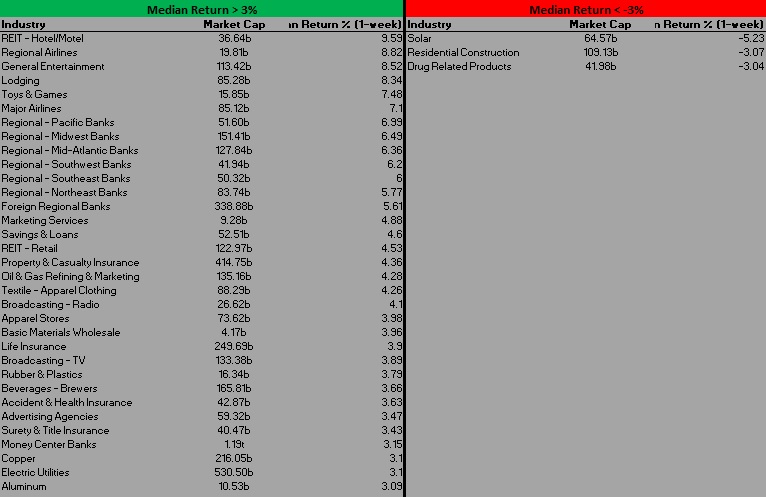

Exodus [PPT 2.0] streamlines how we can research the individual behavior of each industry and how it pertains to overall market sentiment.

Using the Industries screen, we can filter for the Median Return [1 week] of each industry. I have established an arbitrary -/+ 3% cutoff for qualifying industries of interest.

Money flows skewed bullish.

Here are this week’s results:

III. Exodus ACADEMY

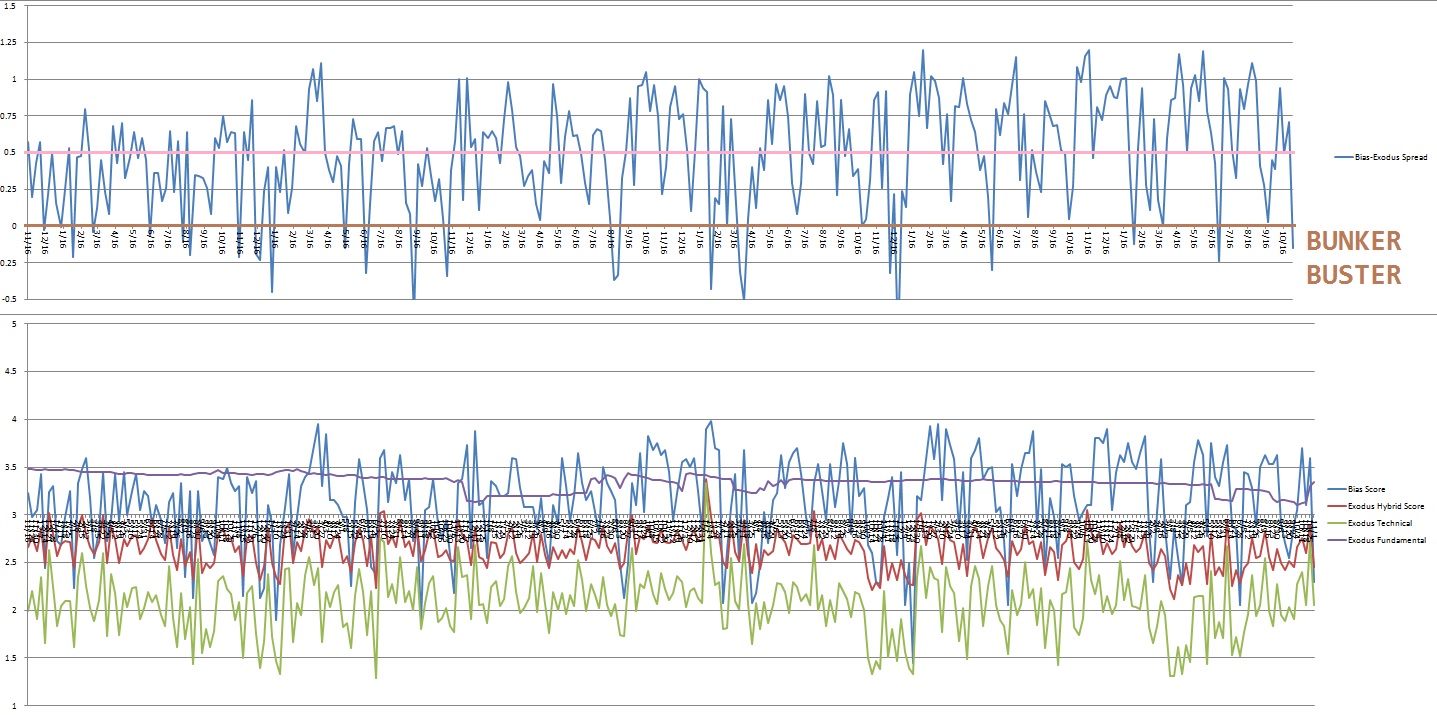

Clear bullish bias into month-end

IndexModel is flagging eRCS bullish after being bearish last week. There are no other conflicting signals coming out of the Exodus quant. Clear bullish bias into month-end.

Note: The next two sections are auction theory.

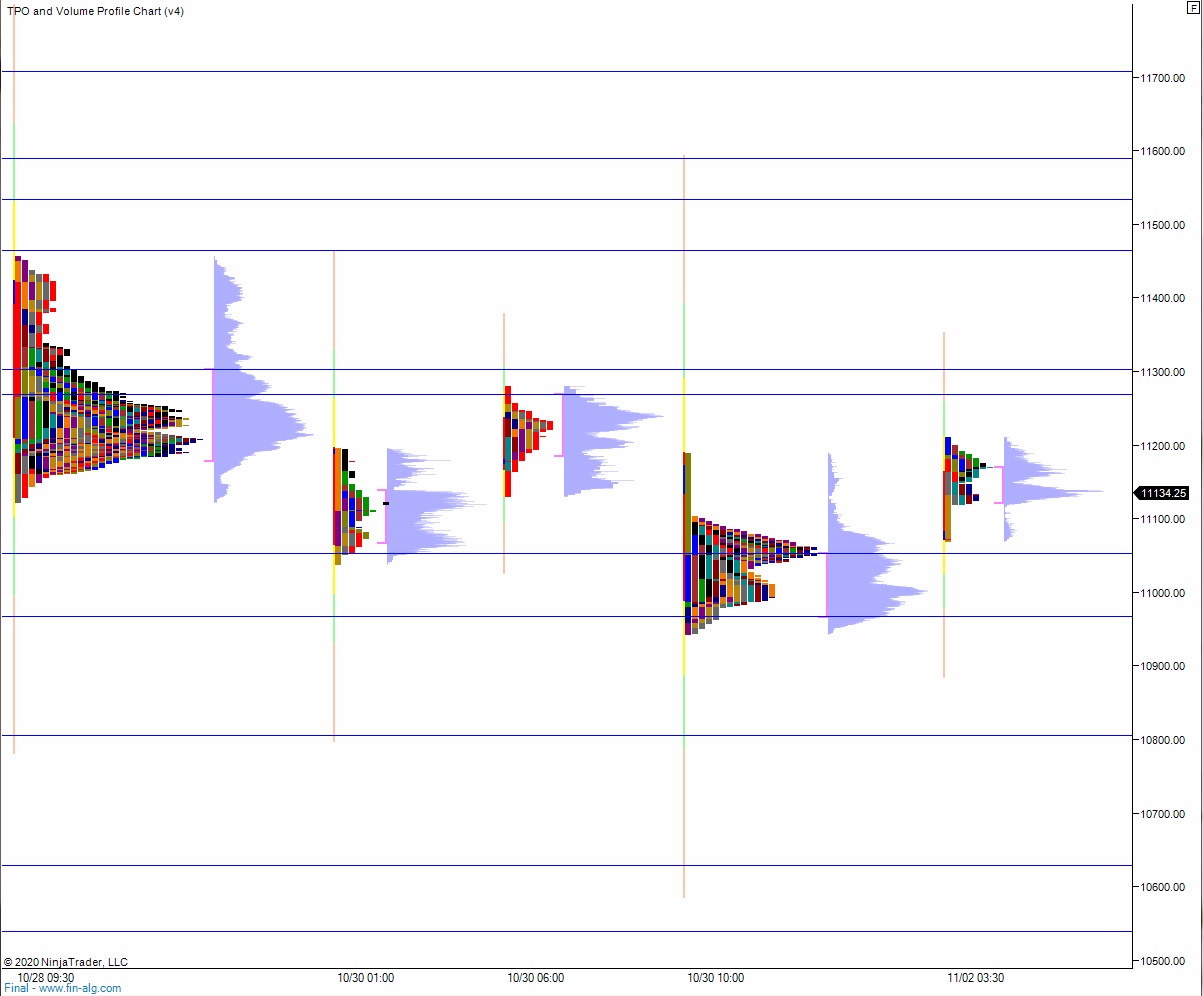

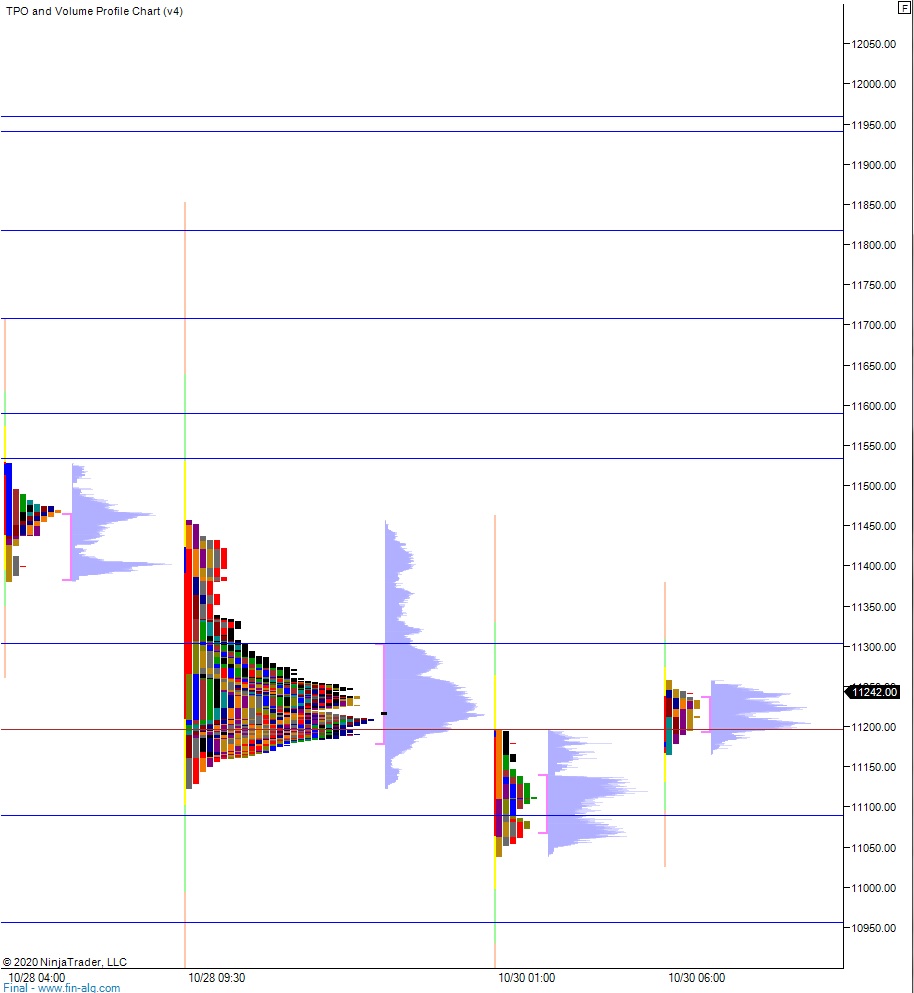

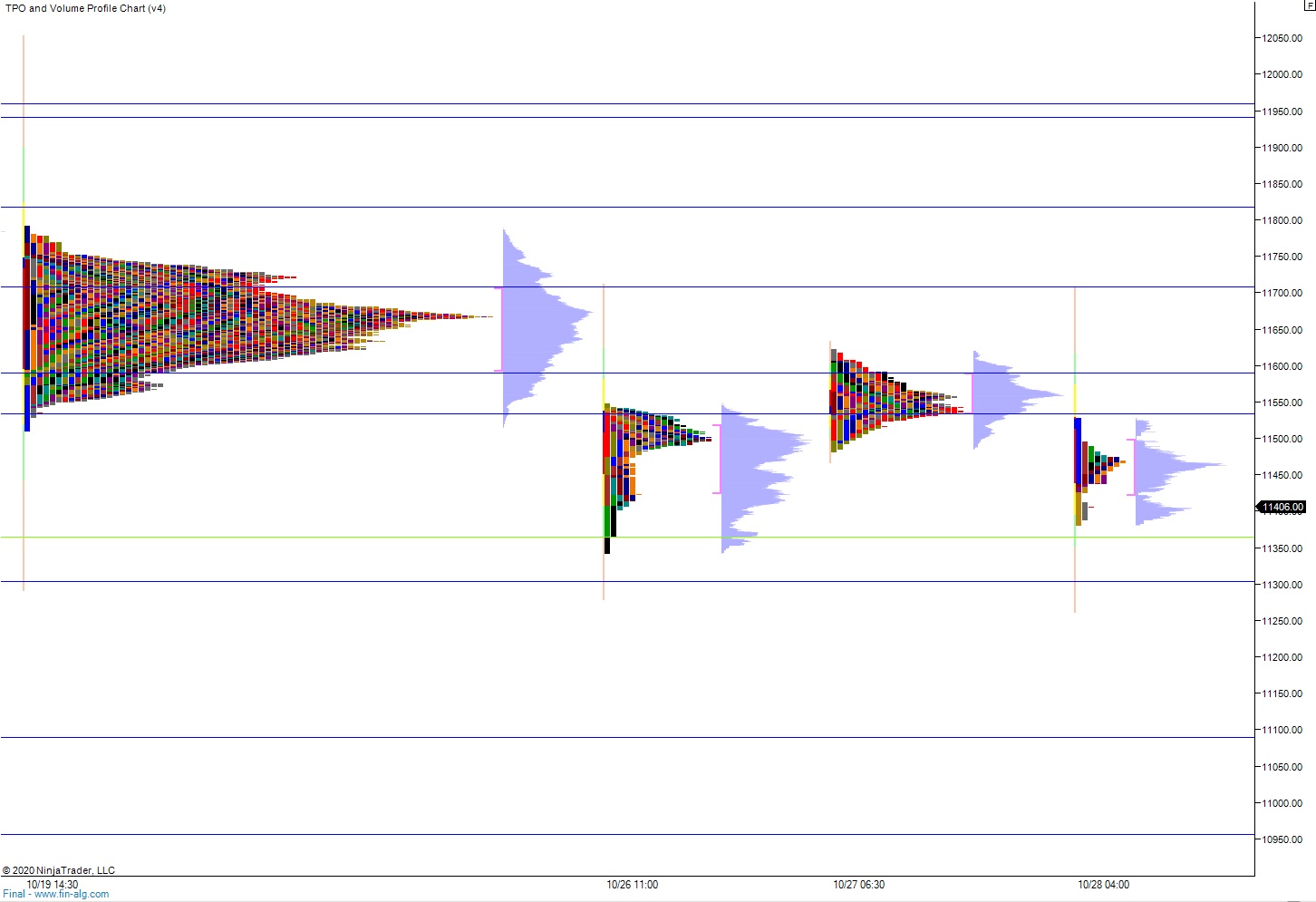

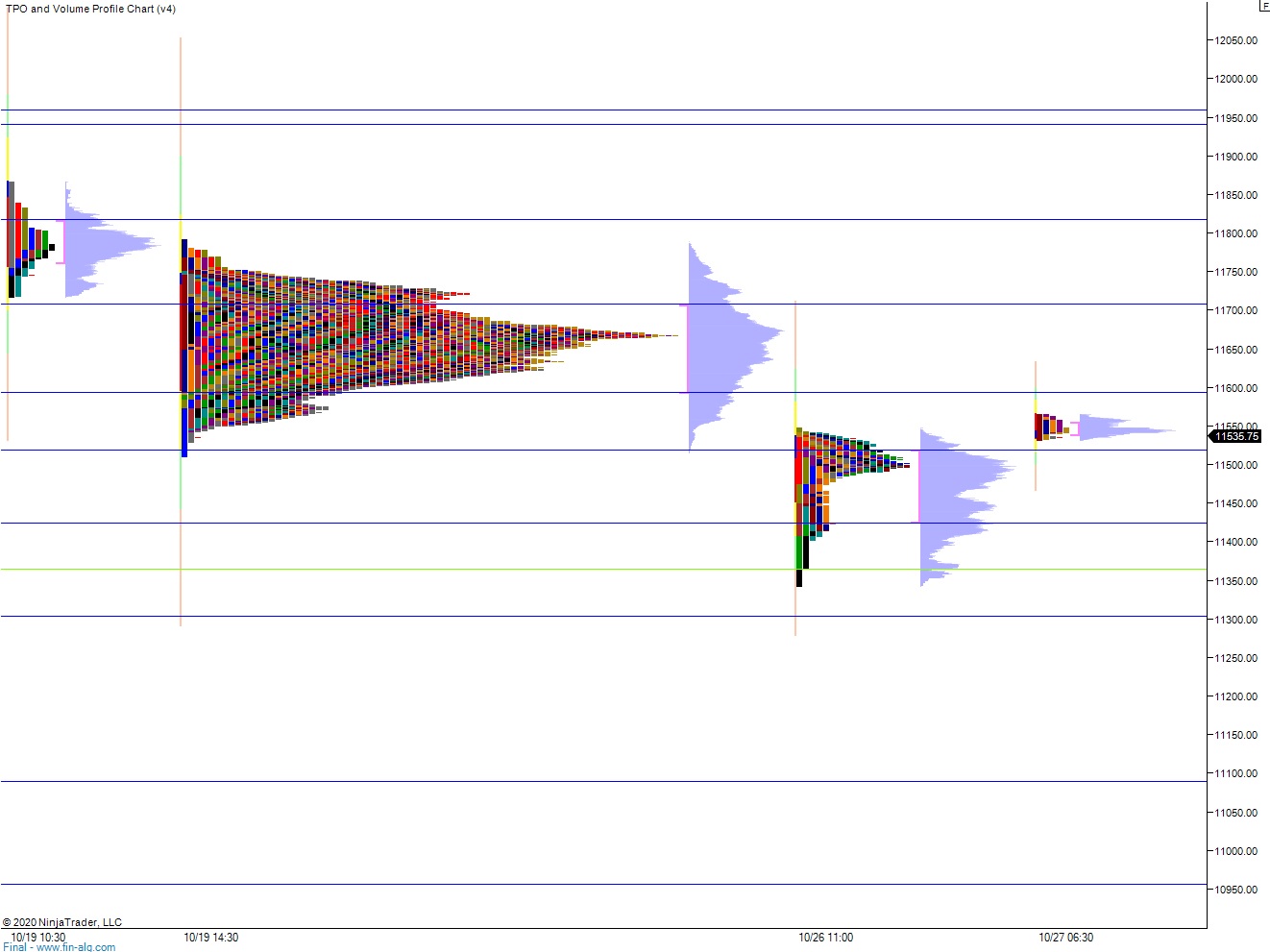

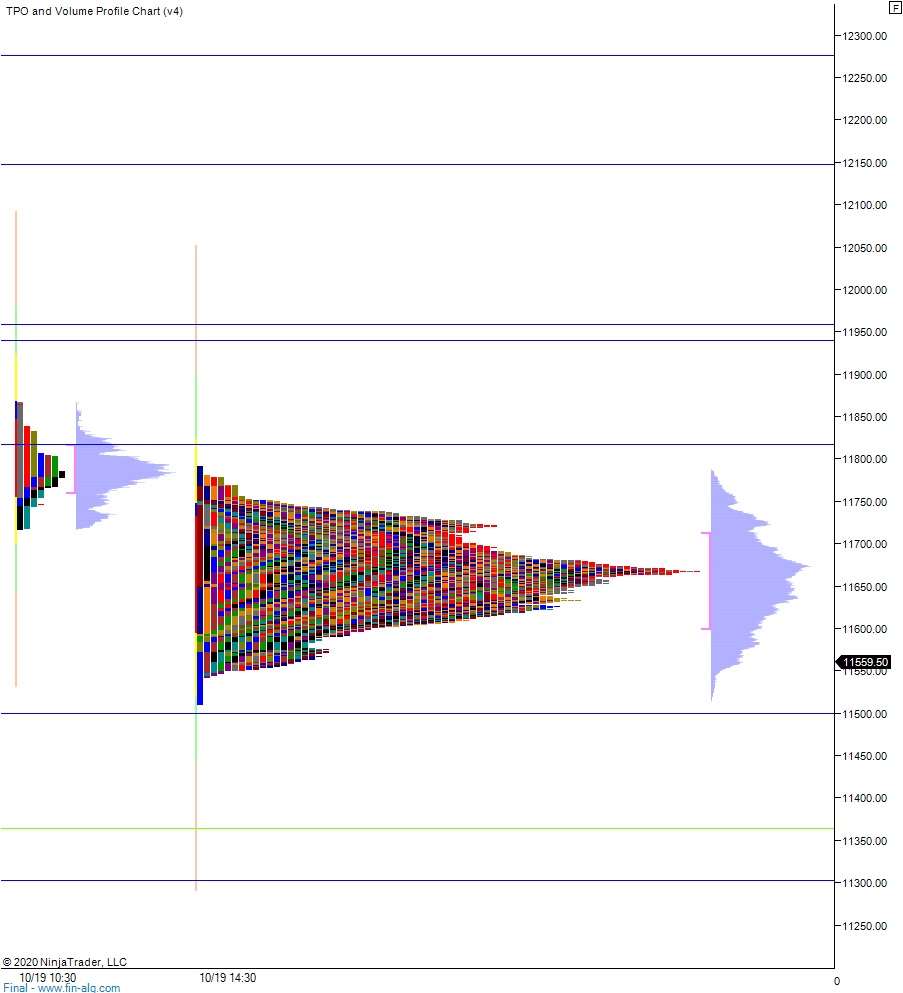

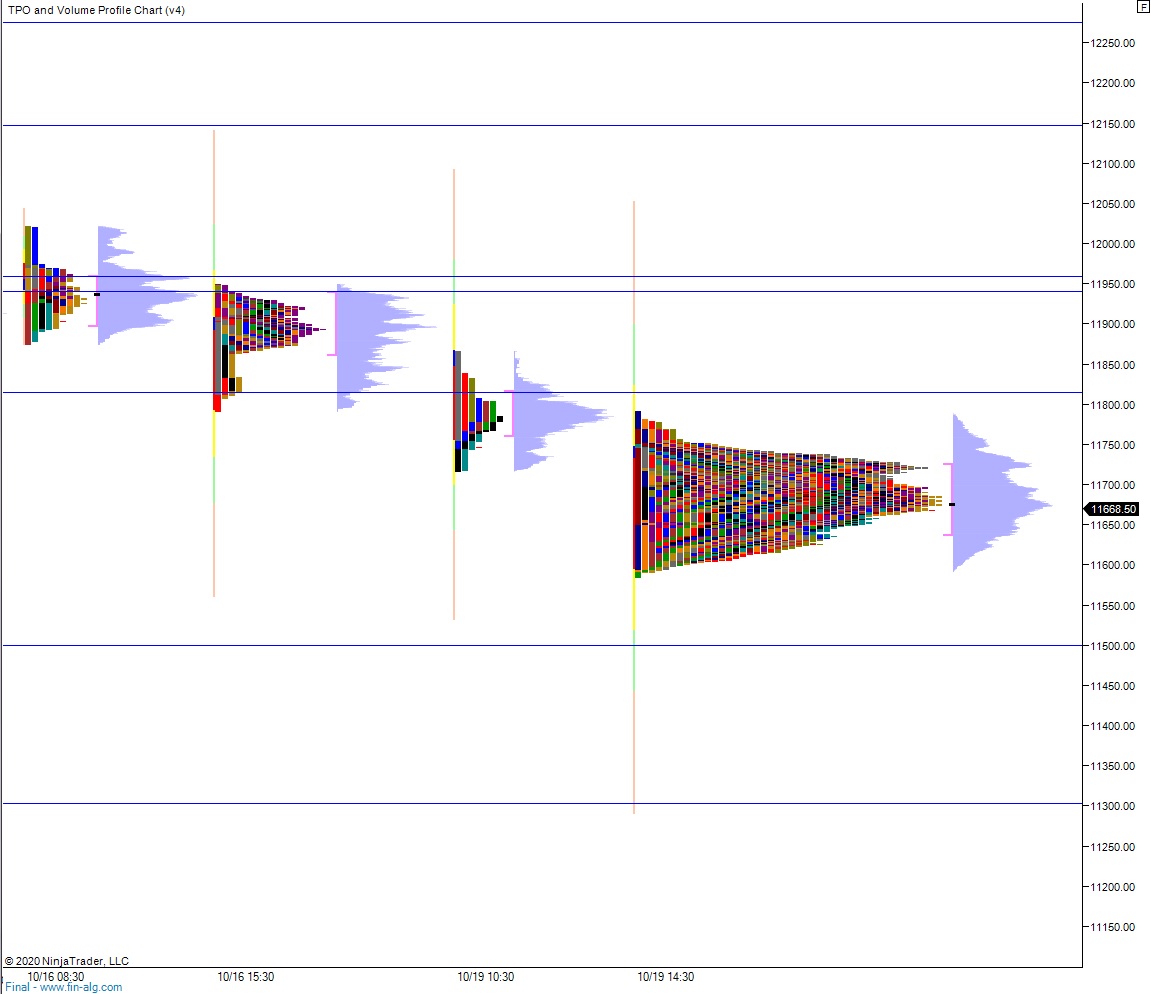

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

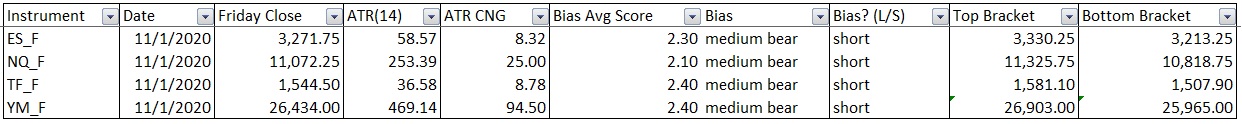

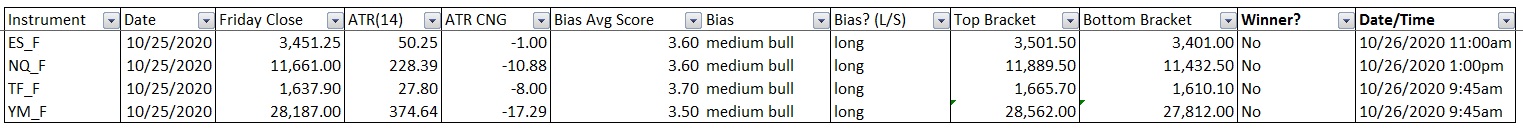

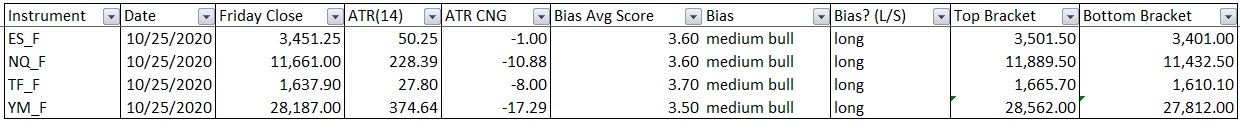

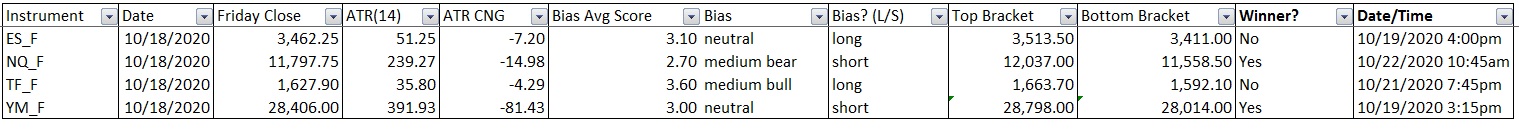

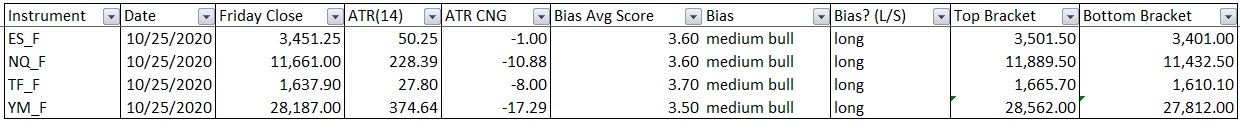

Bias Book:

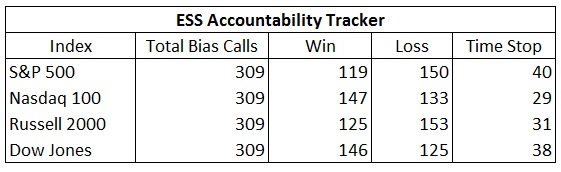

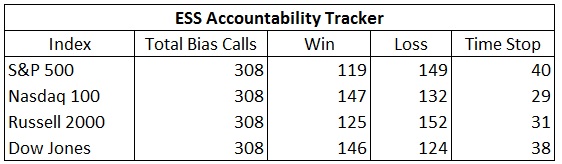

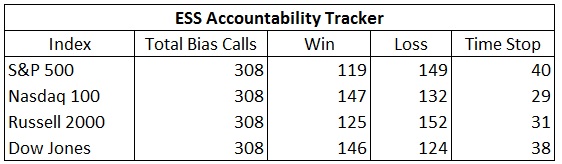

The following biases were formed using basic price action and volume profile analysis. By objectively observing these actual attributes of the market we gain a sense of the overall market context. To quantify the effectiveness of this approach, each of the 4 equity indexes (/ES, /NQ, /YM, and /TF) has been assigned a fixed long/short target using a standard 14-period ATR. Each week there will be an outcome of win, loss, or timed stop on all four indexes. The first bracket level hit is deemed the winner in the event that both sides are tagged. This will be tracked and included in the Exodus Strategy Session.

Here are the bias trades and price levels for this week:

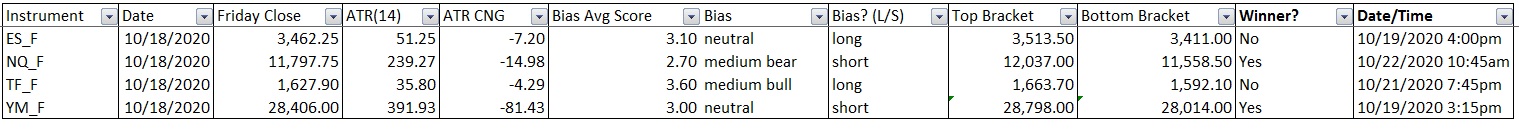

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

Semiconductors continue leg up, Transports continue balance

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Nothing new for Transports. They remain balanced.

See below:

Semiconductors are consolidating, slightly drifting lower, but there appears to be some logical support below and discovery up continues to be the call.

See below:

V. INDEX MODEL

Bias model is signaling extreme rose colored sunglasses. This bullish bias calls for a calm drift, with a slight upward bias.

VI. Exodus hybrid overbought

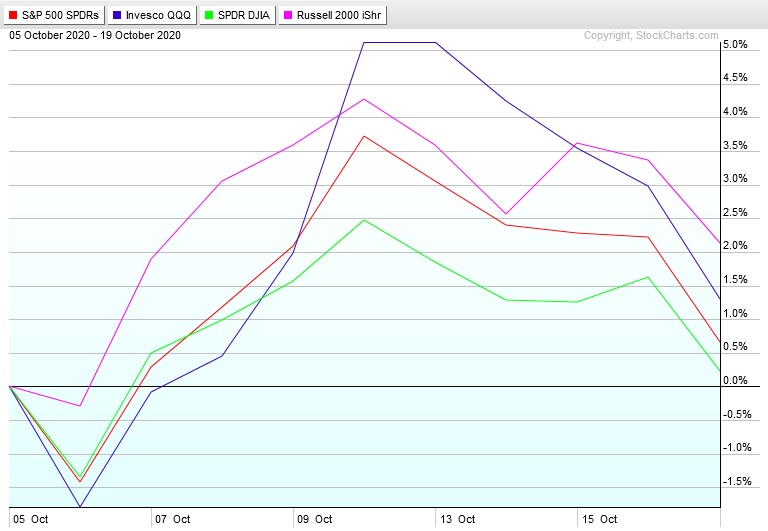

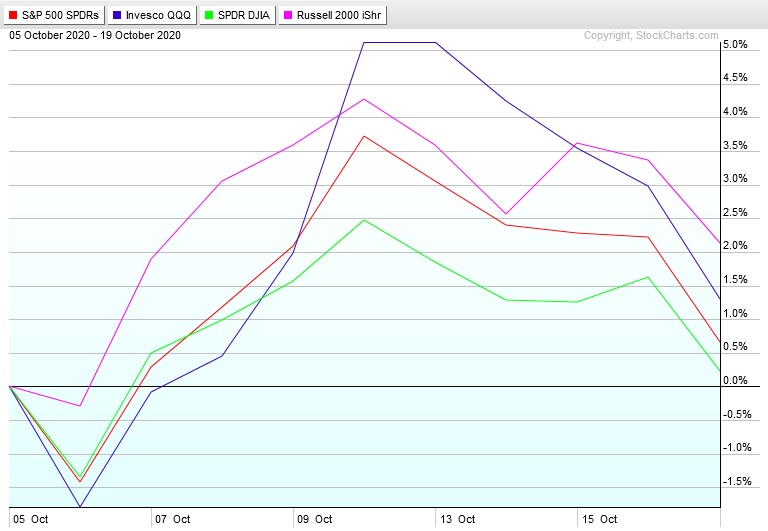

On Monday, October 5th Exodus flagged hybrid overbought. This is a bullish cycle that runs through Monday, October 19th end-of-day.

The performance of each major index thus far is shown below:

VI. QUOTE OF THE WEEK:

“All cruelty springs from weakness.” – Seneca

Trade simple, examine your anger

Comments »