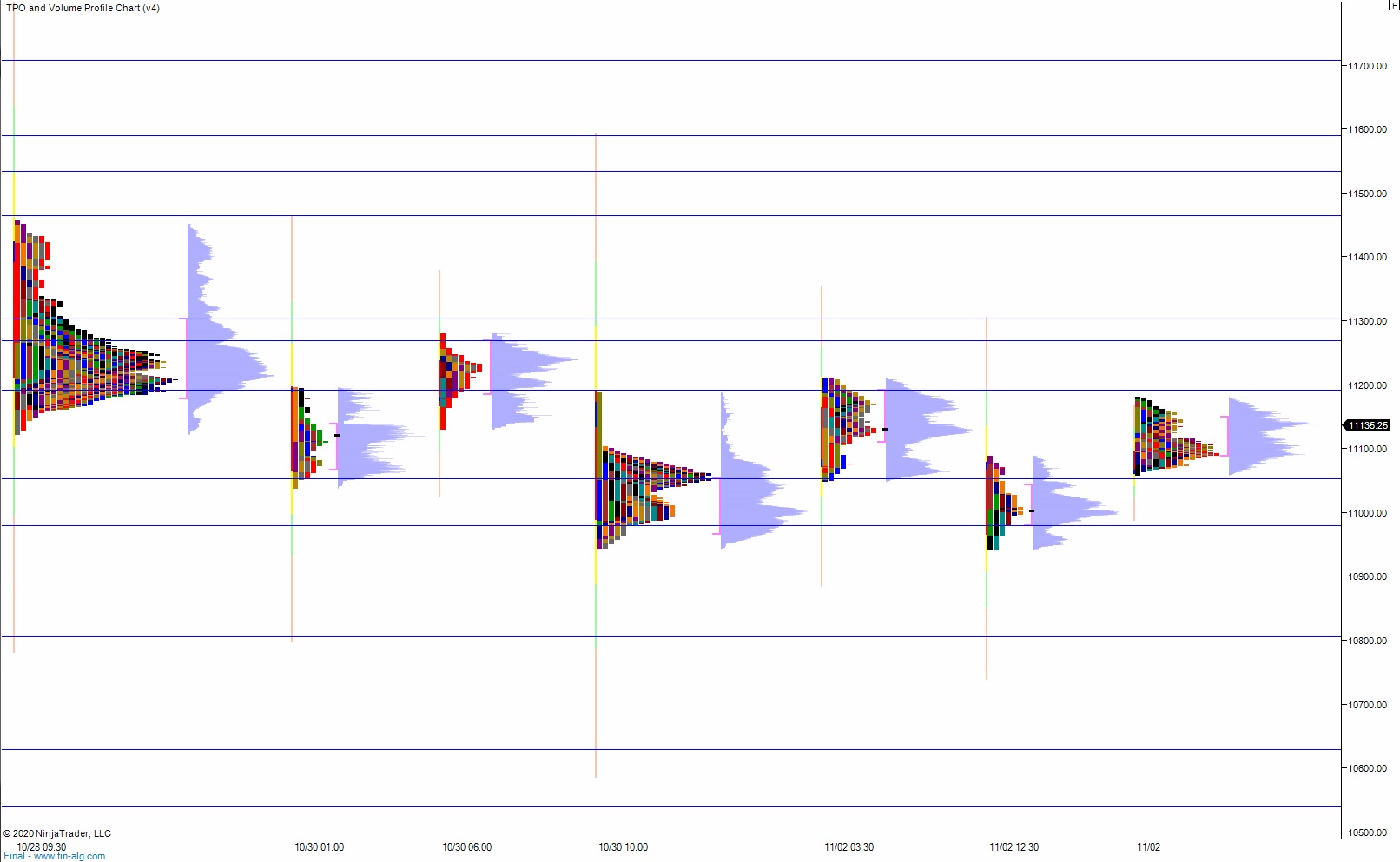

NASDAQ futures are coming into election day with a slight gap up after an overnight session featuring elevated volume on extreme range. Price was balanced overnight until about 3:45am New York when buyers stepped in and broke range higher. The buying stalled before taking out the Monday high, and as we approach cash open, price is hovering about 60 points above the Monday midpoint.

On the economic calendar today we have factory orders at 10am followed by a 52-week T-bill auction at 11:30am.

The major event today is the U.S. Presidential election. As the results begin to crystallize this evening we may see an uptick in volatility.

Yesterday we printed a double distribution trend down. The day began with a gap up in range. The first half hour was spent gap-and-go higher but buyers stalled out two-ticks beyond the overnight high. This mini failed auction would mark session high. It was seller controlled for the next several hours—closing the overnight gap and eventually taking out overnight low and eventually taking out the Friday low by a few points. Then it appears another failed auction took hold, and from about 2:45pm onward we rallied back to the midpoint and ended on it.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 11,072.25. Look for buyers below at 11052.75 and for two way trade to ensue.

Hypo 2 buyers gap-and-go higher, trading up through overnight high 11,181.50, tagging 11,191.25 before two way trade ensues.

Hypo 3 stronger sellers trade down to 10,980 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: