Well I’m back from the north shore of Lake Superior—a land so majestic and free, it makes a man feel whole a-gain. No bears or moose or Canadians made to kill me, in fact Mother Nature was quite kind to this perfectly-formed flesh sack I inhabit. The days were warm and sunny, the evenings a breezy 10 degree Celsius, and the mosquitoes were mild, all things considered…

And it looks like I picked a nice week to be in the solitude of nature, algorithms were really hewing it up all week, chopping along in an ultra-violent manner, essentially marking time. Then late Friday we had some trade wars panic action that I couldn’t care less about because I already know how the Great Trade Wars of the ’20s plays out:

The USA government is compromised by corporations whose interests do not align with the people. Putting a deranged businessman at the top of the military’s chain of command has revealed that America is, in essence, a weakening illusion—sort of like when David Copperfield made the Statue of Liberty disappear—you can only run effective propaganda when you control all the viewing screens/angles, and since we’re allowed to have Twitter, there is no way in hell the USA government can maintain their status as Number One Charlatan.

China can. They fuck their citizens’ heads ten ways to Sunday. Their manner of structuring society is an odd variation of a termite mound. The mound itself is more intelligent than the individuals, and they are fed a series of inputs to keep them obedient to the Greater Cause, and to hell with human dignity. They are playing the long game—America is still babying the babied boomers.

So after China wins, and America assumes a beta role in the global economy, we will be exactly where we are today, or at least where we can be today if we choose to—completely fine and doing whatever the heck we want.

There is a funny sort of dream that if we obtain some number in a bank account or some quantity of green papers wrapped in a burlap sack that we can then stop worrying about money. That’s bullshit. Being miserable in advance is a character trait carried by many a folk, especially people in the odd world of finance. I think we were all drawn to this industry for one reason or another, but greed and fear are high on the list. Fear of not being secure enough for some looming bad news or something that might happen soon.

This is silliness. There is no point worrying about every possible outcome. At best, you are wasting time and mental energy. At worst, you could be putting your heath at risk and compromising your ability to take advantage of opportunities. A person of action has not a need to worry about money, we’re too busy doing!

There’s an old stoic exercise that some of you probably think is too extreme, but I find it helps re-align the soul. Spend a few days being homeless. Sit outside of a gas station and ask everyone for money. Collect aluminum cans or scrap metal out of the garbage. Sleep in a ditch. You come to realize it is not as scary as you might imagine. It may knock your ego down a peg-or-two while you’re at it—for the better.

Me, I don’t worry about much but I have been blessed from birth. There are two ways of winning the lottery at birth, either born to rich parents or with genetic advantages. I was born really, extremely good looking. Life is much easier for me because everywhere I go people are so happy to see something so beautiful. It makes their day better, sort of like a golden retriever. Of course I leverage this strength, and that is fine. Most finance people are not beautiful, I understand that. Most of my readers are hermits, unkempt and of weak physiological shape. We cannot all outshine the Statue of David, but we can recognize where we do have an advantage over others and press that edge.

Like this guy I bought a used washing machine from last week. He only has one leg, the other one is some robotic spring appliance. Lost his leg in a motorcycle accident. Now he hustles used appliances. The dude is part man, part machine, and mechanics run through his blood. He makes deals with the Lowe’s and Home Depot delivery guys. They drop off old machines to his shop for pennies on the dollar and he rebuilds them and sells them at good prices. This is good business! He keeps machines that would otherwise end up in our landfills operational, and offers quality machines at a third of their new issuance cost. I love a this country! You find advantage, you press advantage, then you make your way through the world, no ones master no ones slave.

When I say I love this country I do not mean I love the set of documents and the lines on maps that say THIS IS AMERICA. What I love is free market capitalism. What these corporations are doing, with policy and lobby effect to create protectionism makes me sick, but I do not worry about this. Like Chinese leaders, these corporations are easy to thwart. Their size creates all sorts of blind spots. Those blind spots are where ruthless profiteers like your old pal RAUL resides, gathering fiat american dollars.

Said fiat American is regularly converted into real assets like tractors and other machinery. Land as far north as my constitution allows, away from the masses and their psychosis. Said fiat is also converted into electronic money backed by proof of work, not by silly american Federal Reserve. These archaic banking institutions are petering out of existence, likely in my mortal lifetime. Google is immortal and omnipotent, the closest thing to what Christians call The Father. Banks are more like the squid—it will always exist but mostly out of sight, deep beneath the surface, only occasionally washing ashore, dead.

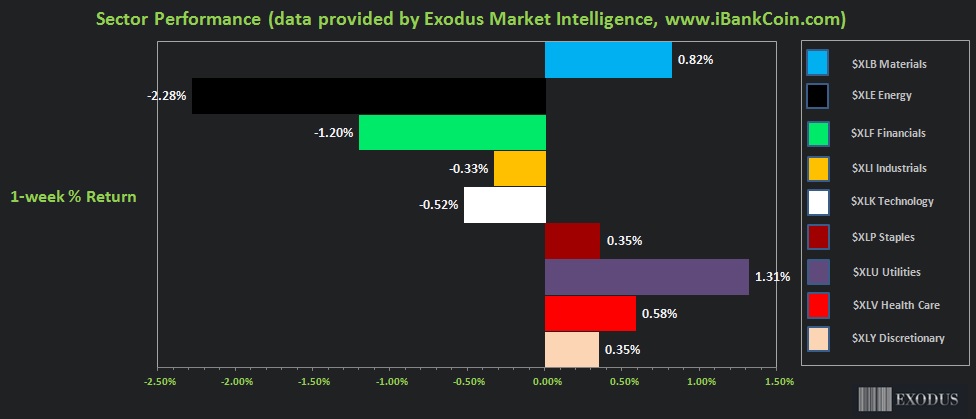

There’s a reason the Tech sector (as measured by $XLY) is up more than +25% year-to-date while the Financials ($XLF) are only up +10%. It’s because the power is clearly shifting away from nation states, and their banker friends, to immortal technology firms. Believers in the technological revolution will be positioned nicely heading into the roaring ’20s, insulated from the chaos and carnage that comes with america losing their status as number one. Because while China will be made to think they are Number One, real hitters will know it is Facebook, Google, Amazon, Tesla, and so on who rule the world and beyond.

So why you worry so much? Try worry less, you live longer ^-^

Raul Santos, August 25th, 2019

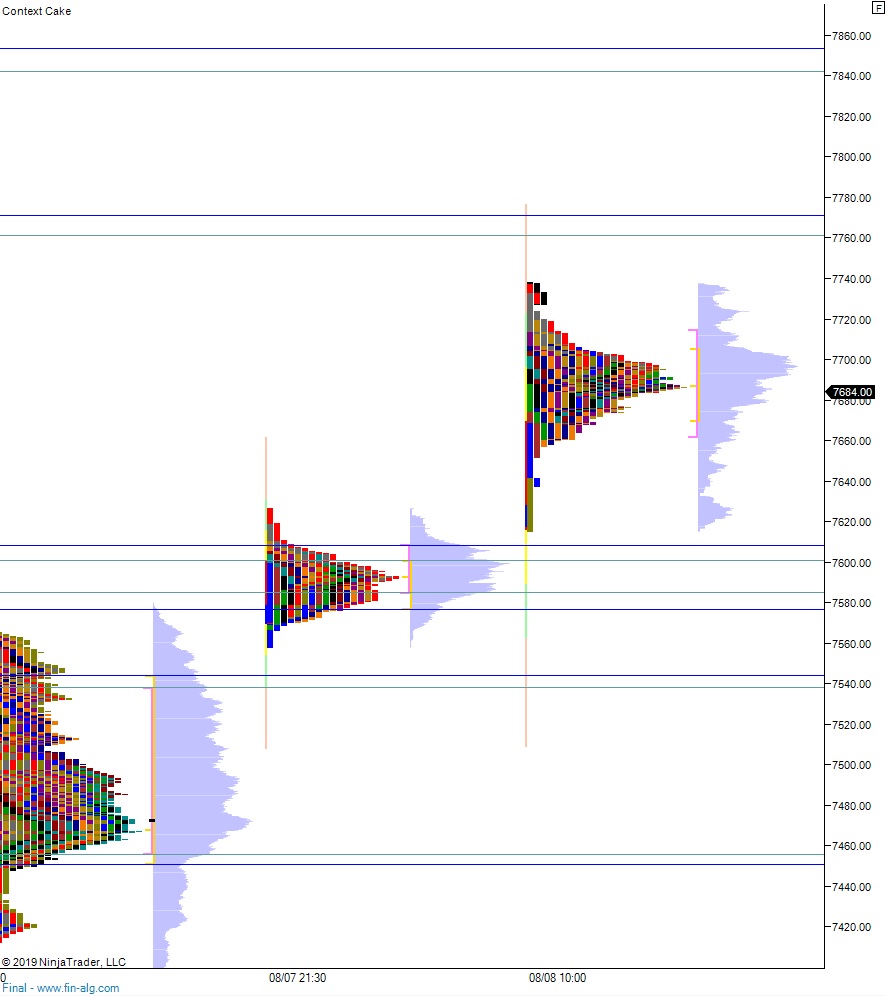

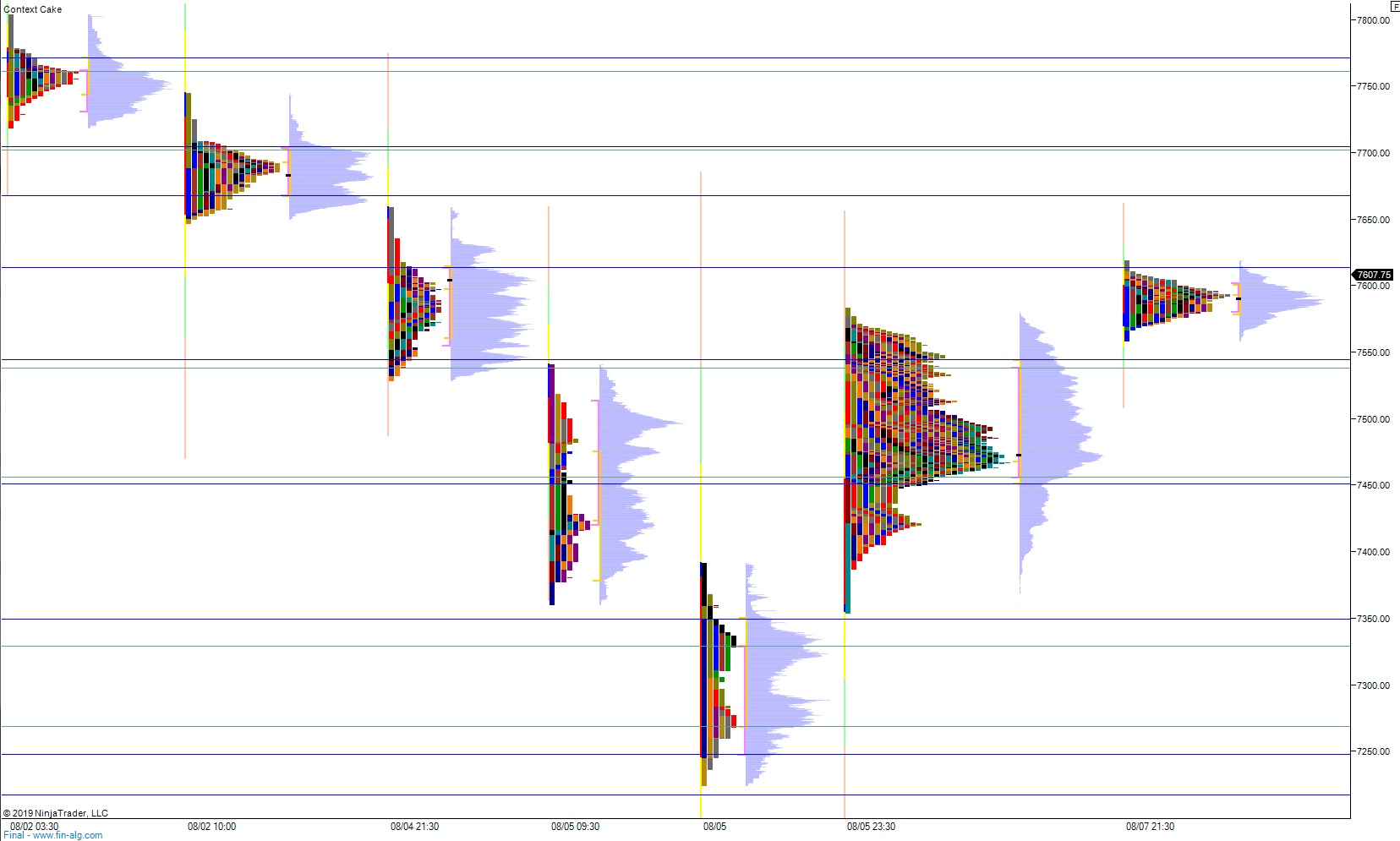

Exodus members, if there is one thing we should be concerned with, it is making money over the next five trading days. I made sure to highlight all the key factors to be aware of heading into month-end in the 249th edition of Strategy Session, which is live now inside Exodus. Be sure to check it out! Remember! Nobody pays me to do this work, it is simply the work I need to do to make fiat american dollars. Enjoy.

Comments »