NASDAQ futures are coming into the first week of the new President on the wings of a COVID vaccine announcement from Pfizer. The news has sent several major indices limit up in pre-market trade while the NASDAQ is up a modest +130. As we approach cash open, price is hovering just below all-time highs.

Also on the economic calendar today we have 3- and 6-month T-bill auctions at 10am followed by a 3-year note auction at 1pm.

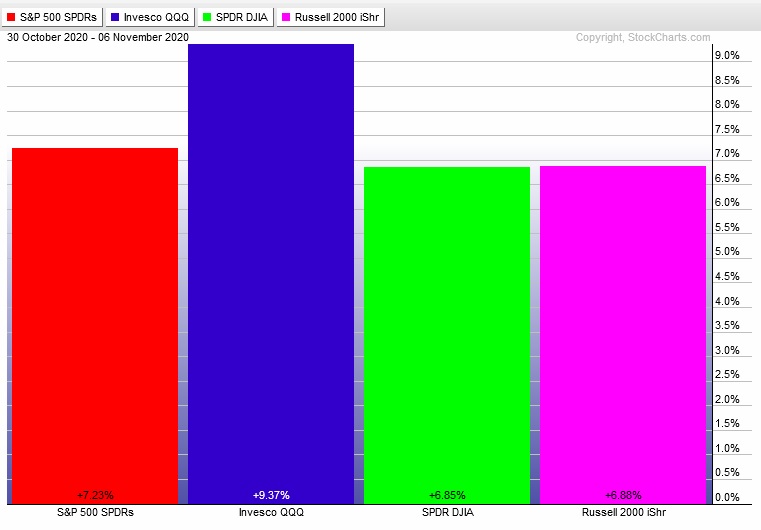

Last week kicked off with a gap up. Sellers were active through about 2pm Monday then the rest of the week was a strong rally with breakaway gaps on Tuesday, Wednesday and Thursday. Friday had some early selling but it was eventually reversed and we closed out the weekend on the highs. The last week performance of each major index is shown below:

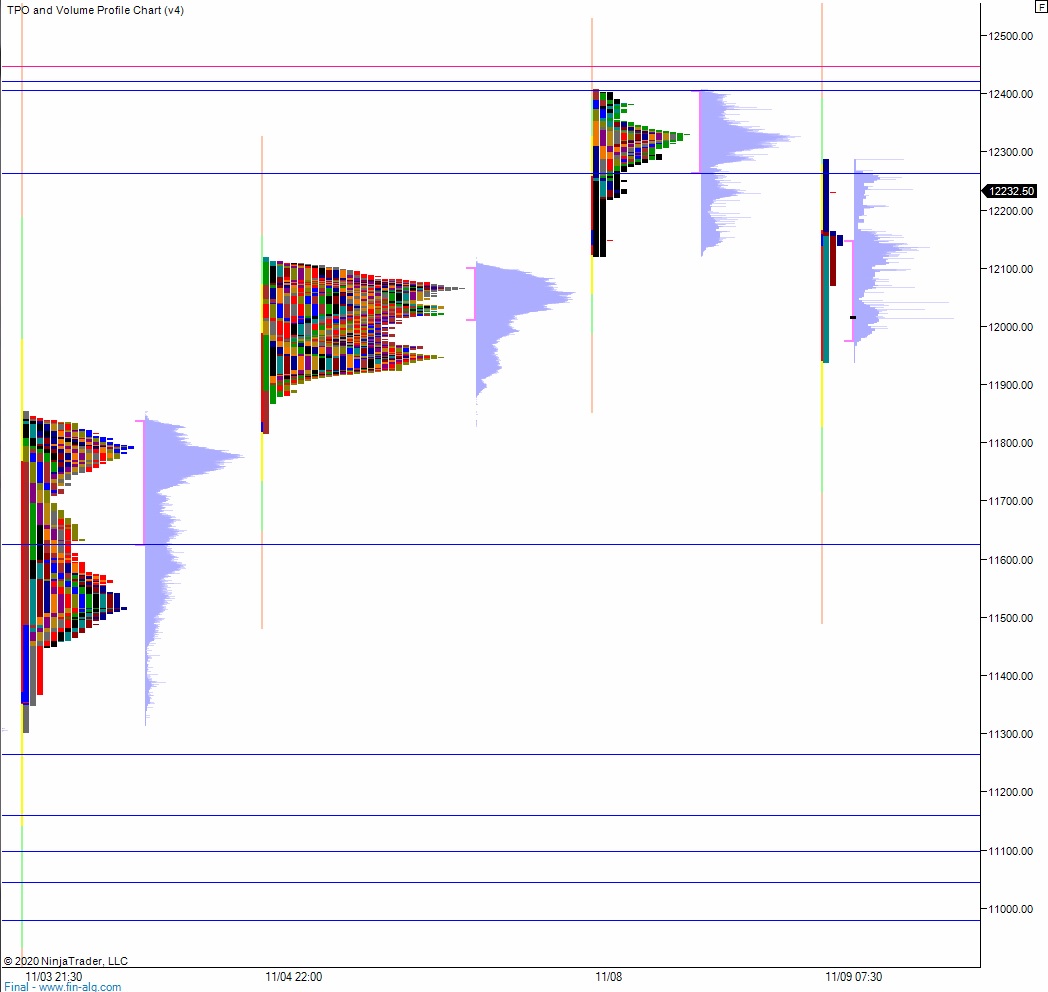

On Friday the NASDAQ printed a normal variation up. The day began with a gap down and drive lower. The sellers pressed into the gap zone below Thursday’s range before a responsive bid stepped in and returned price back up to the highs. We ended the day near session high.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 12,408.75 and probing beyond the high water mark 12,446.50. Look for sellers up at 12,500 and for two way trade to ensue.

Hypo 2 sellers press down to 12,200 before two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 12,090. Look for buyers down at 12,000 and for two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: