Sitting here, on my velvet throne, I do my best to check my privilege.

My emotions were all over the place this morning. Been thinking about death all week. Not in a fatalistic sense. More as a way of putting a sway on the human psyche. We have a hard time letting go.

Renunciation, as the eastern mystics call it. There is a sect of Buddhism who specialize in mastering death. It’s a three step process. First you renunciate all worldly desires and attachments. All of them. Easier said than done. The female nipples, for example, exact a strong pull on salacious lads like yours truly. Boddichita is next. I feel like an ass even presenting these concepts in this setting—a blog whose sole directive is extracting fiat american dollars from the global equity complex—but let us continue . Boddichita is compassion for all living beings. Even murderers. Even viruses. Even your parents. Even total strangers you pass by once and never see again. This step is important because these mystics gain much strength from their training and if that energy is not channeled into working towards the common good, it can destroy the practitioner. Finally, non-duality. This is the dying part. There is an elaborate psychotechnology where the meditator works through all the phases of death, visualizing dying in the proverbial third eye of the mind, until the sense of me, of existence, is no more than an orb of light that is totally interconnected with everything.

Okay that was my crash course in hatha, trantra, rassayana.

Moving on.

Death. To meditate on it can seem depressing but it doesn’t have to be. It can put an urgency in your day. What would we do differently if we knew we only had a few days to live? Some people think they’d seek out some orgy but that is not the point of the exercise. The stoics liken it more to a soldier readying for deployment. Knowing they may never return. The point of taking the mind so close to death, as far as I can tell, it to de clutter the mind and find some clarity around your thoughts.

I’ve been taking a deep dive into the culture and politics that seemed to gel around San Fransisco in the mid ’60s. Reading fiction and non-fiction, watching the films, listening to the music, following the campaign trails, doing my best to understand what the magic was. How we seemed to set a high water mark for american living in that moment, and how it somehow gave birth to the internet, Big Tech and all these other institutions we almost take for granted today.

You’d be a complete dope to ignore all the LSD that was floating around…but my mind keeps wondering how many novel corona viruses were floating around the city back then. I’d guess at least six.

I am not a fucking conspiracy theory person. That is a rabbit hole that sucks in the weak minded. The folks who already feel somehow cheated by their fellow man, beast or fate. It fits their framework for why they were dealt a lousy hand.

Again, I need to check my privilege if this is to be a useful entry…

I have lived an extremely fortunate life. Born to an Italian immigrant who married a big tall American blonde, I popped out the womb in the summer, on my due date, at 6am. Born in the finest hospital in Detroit. In a private room with big windows overlooking the river. Treated to the finest Mediterranean diet, my foreign relatives insisted on bringing the family (the whole family) together every Sunday for dinners. Huge. We didn’t need church as an excuse to gather. It was a bunch of people in a foreign land doing their best to survive. At dinner I was exposed to the immigrant hustle. My street smarts grew exponentially thanks to wheeling and dealings of dear Uncle Raul, a fearless lad with swag that would make most rappers blush. Dearly compassionate Aunt Rauls taught me the traditions of southern Italy. If I didn’t kiss all my uncles and aunts Elder Raul would whip me with a poolstick.

Put big dinners aside. I was brought up in the finest private educational institutions money could buy. My friends come from the wealthiest families in the area.

Tight family. Good food. Solid education. Rich friends. Absurdly good looking.

I understand my perspective is from a position of privilege. Of course I don’t give much credit to conspiracy theories. Still, Bill Gates publishes his pandemic research in 2019 and all the sudden the whole world is taking a dry run at pandemic defense.

Fine. But fuck you if you cannot take information in an objective manner. You certainly won’t last long in the world of speculative finance. Maybe your skill set is more suited for accountancy or general labor. Heck, go be a lackey for some goddam republican, they live in a fantasy world so far from Occam’s Razor their heads bob like balloons on the ceiling.

Deaths. Viruses. Their existence before 2020. The greediness of man to think themselves immortal. Spending millions for a few more dicey hours of “life” inside an ICU. I get it. It is hard to let go. Of everything. Especially if your work isn’t done, but everything is going to be fine.

Markets, trees, societies, all here long before us. The same today. The same after we’re gone.

Rant. Over.

Raul Santos, November 29th 2020

And now, the 314th edition of Strategy Session. Enjoy.

Exodus Strategy Session: 11/30/20 – 12/04/20

I. Executive Summary

Raul’s bias score 3.43, medium bull. Strong Monday. A bit of continuation into Tuesday, then look for remarks from Fed Chairman Powell Tuesday morning to introduce some selling into the tape. Price is choppy through the rest of the week, chopping along as it digests several earnings reports. Then look for NFP Friday morning to provide direction into the weekend.

II. RECAP OF THE ACTION

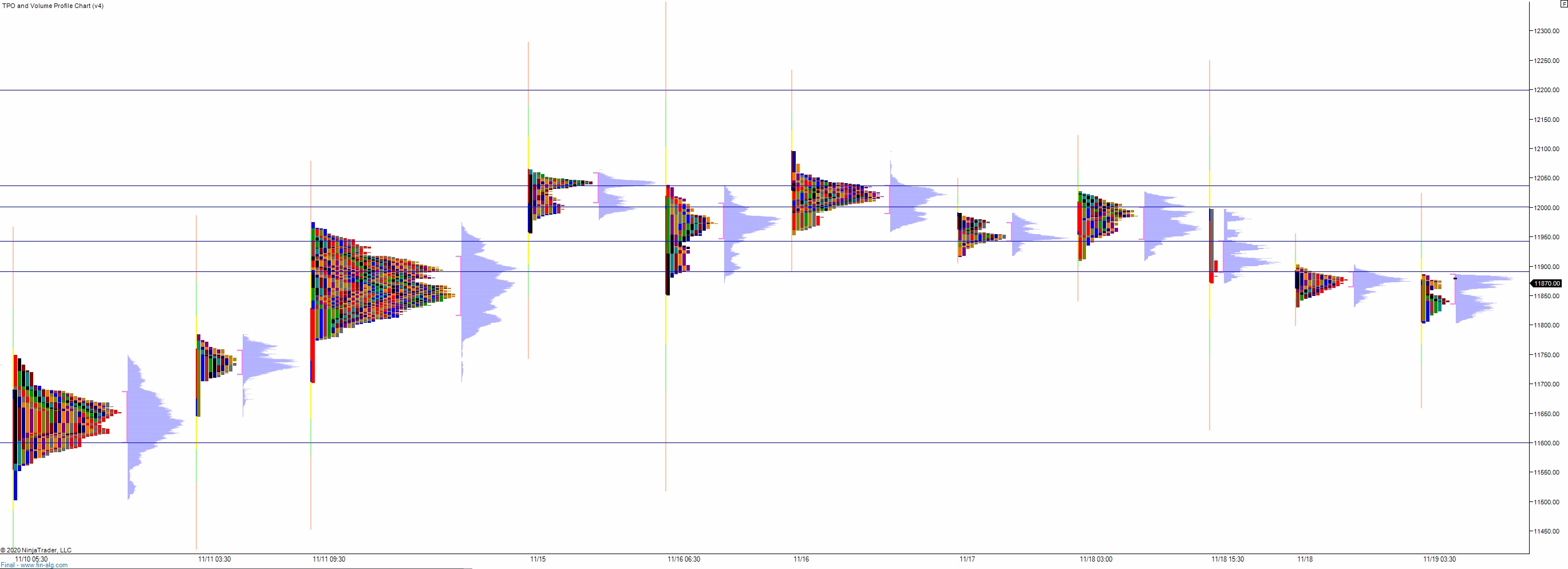

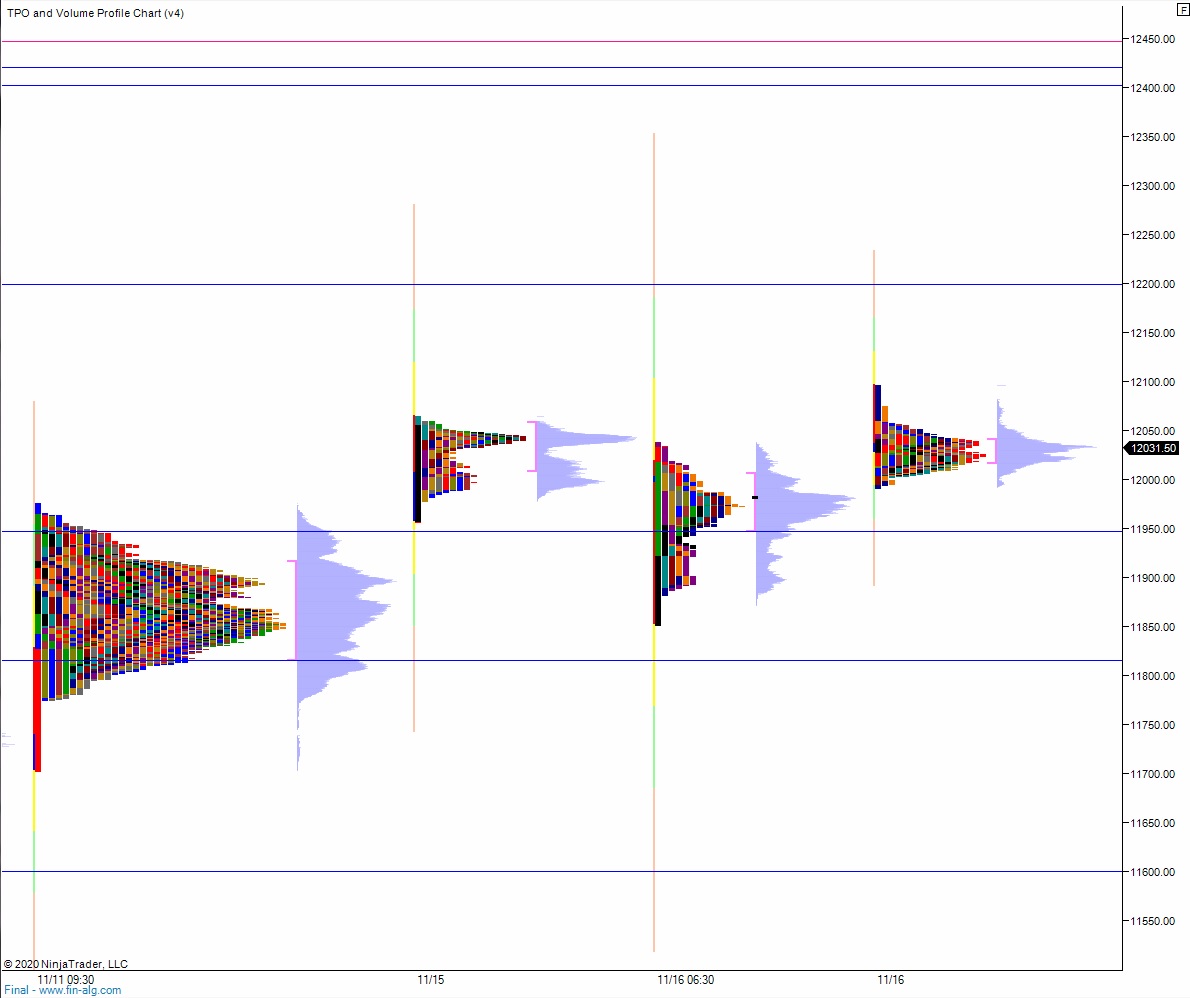

Sellers early Monday discover a strong responsive bid. The rest of the holiday week is spent rallying.

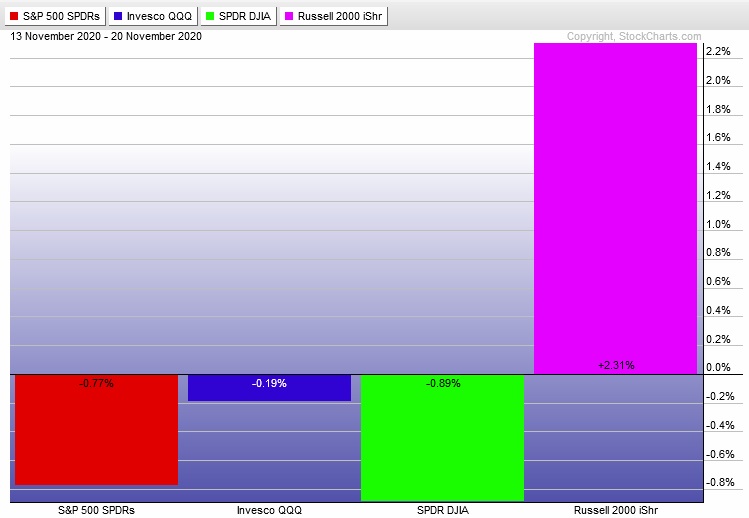

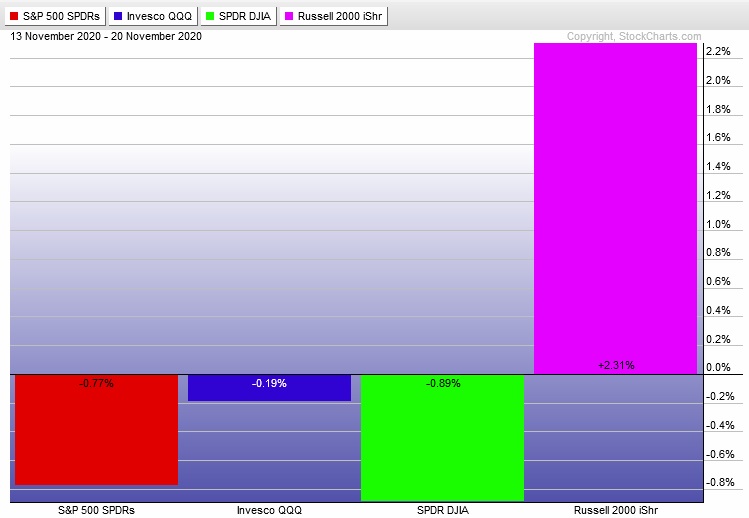

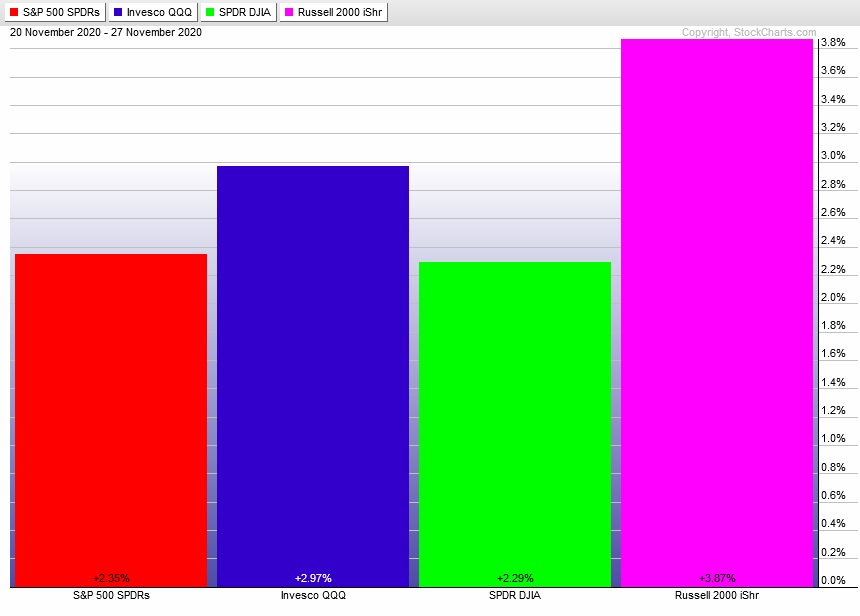

The last week performance of each major index is shown below:

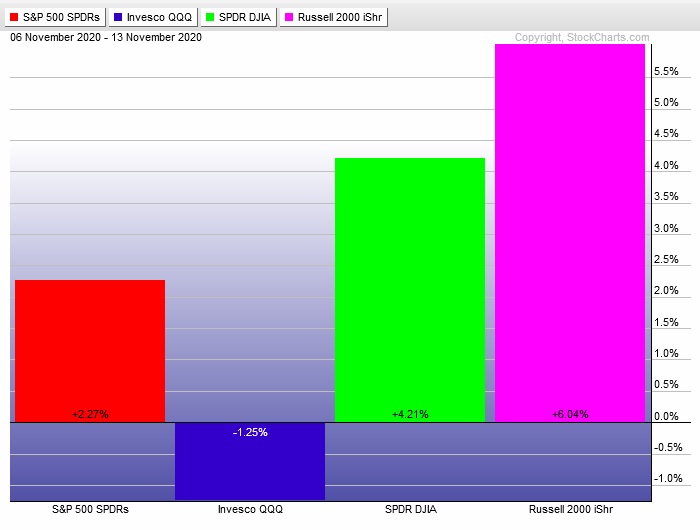

Rotational Report:

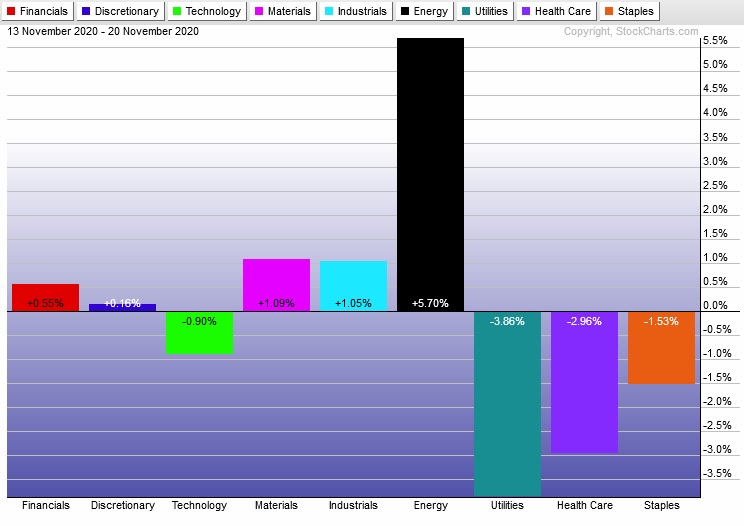

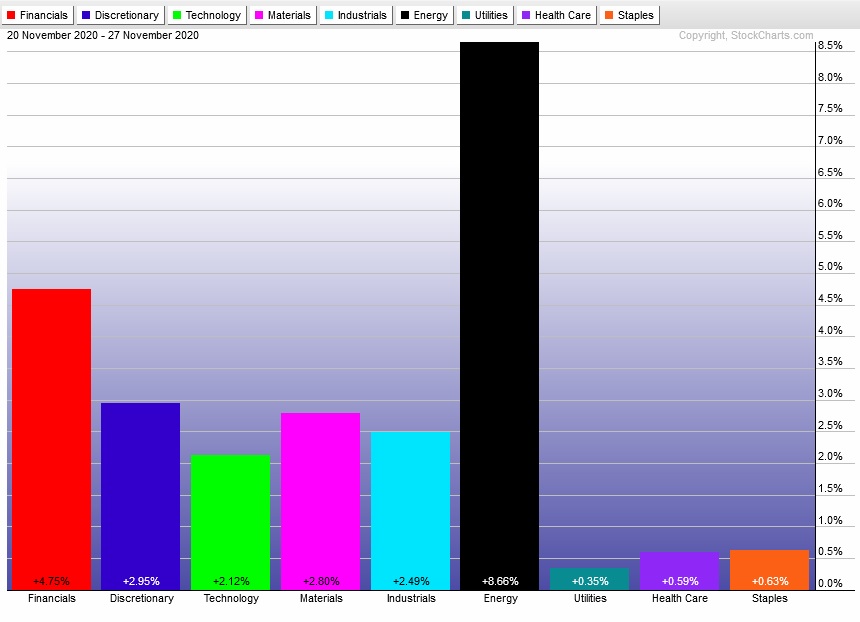

Energy really strong again and continuing to trade on its own planet—way out in front for a second week. Flanked by sketchy Financials. However, strength was broad and Utilities lagged.

slightly bullish

For the week, the performance of each sector can be seen below:

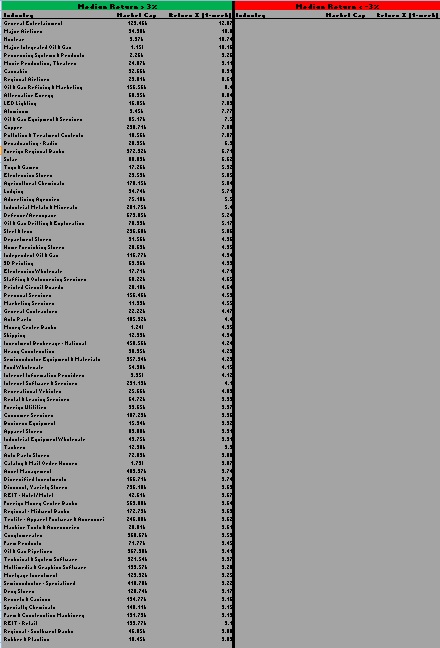

Concentrated Money Flows:

Industry flows muted skewed heavily to the buy side of the ledger.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Pressing the whole signal

Last week we took a close look at the statistics behind the bullish hybrid overbought signal. Now in hindsight, we can see the data-driven analysis worked out well. This is not always going to be the case. Just because something has historically happened with a statistically significant probability does not mean it will happen again.

If you’ve hung around the world of speculative finance for any amount of time then you’ve certainly read or heard someone say, “past performance is not indicative of future results,” usually it is some brokerage covering their ass.

But the phrase is important, to understand, viscerally.

Anyhow the hybrid overbought signal extends through Monday, close of business. Therefore our bias remains bullish through Monday.

Note: The next two sections are auction theory.

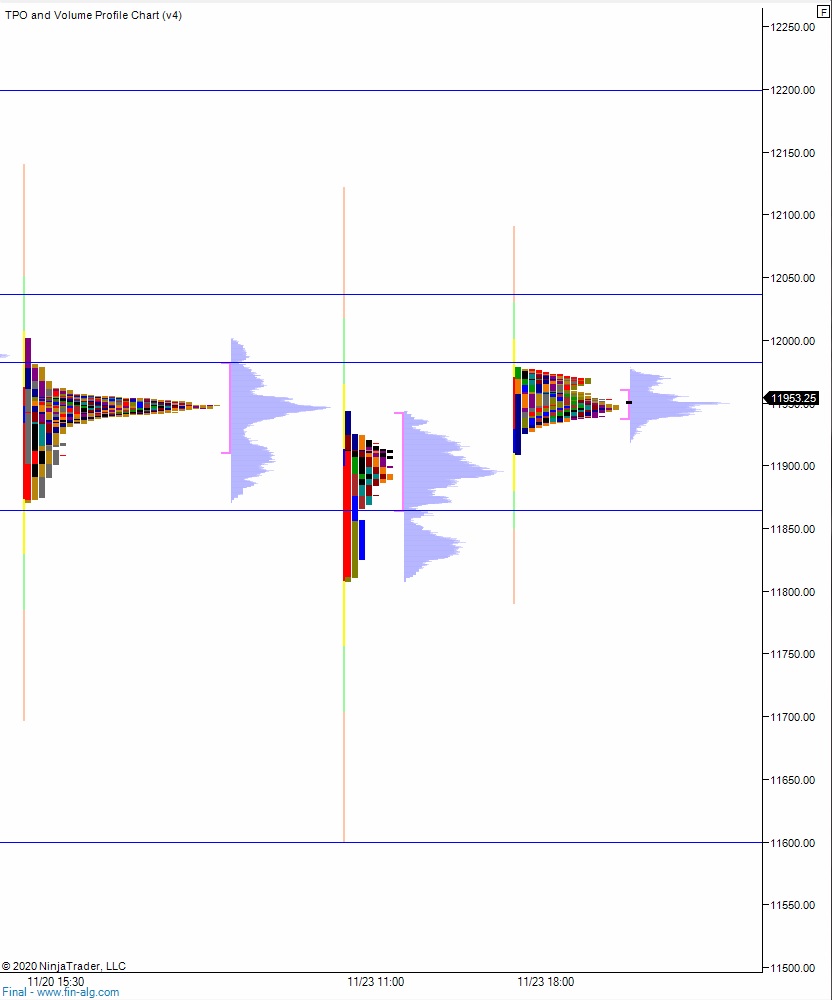

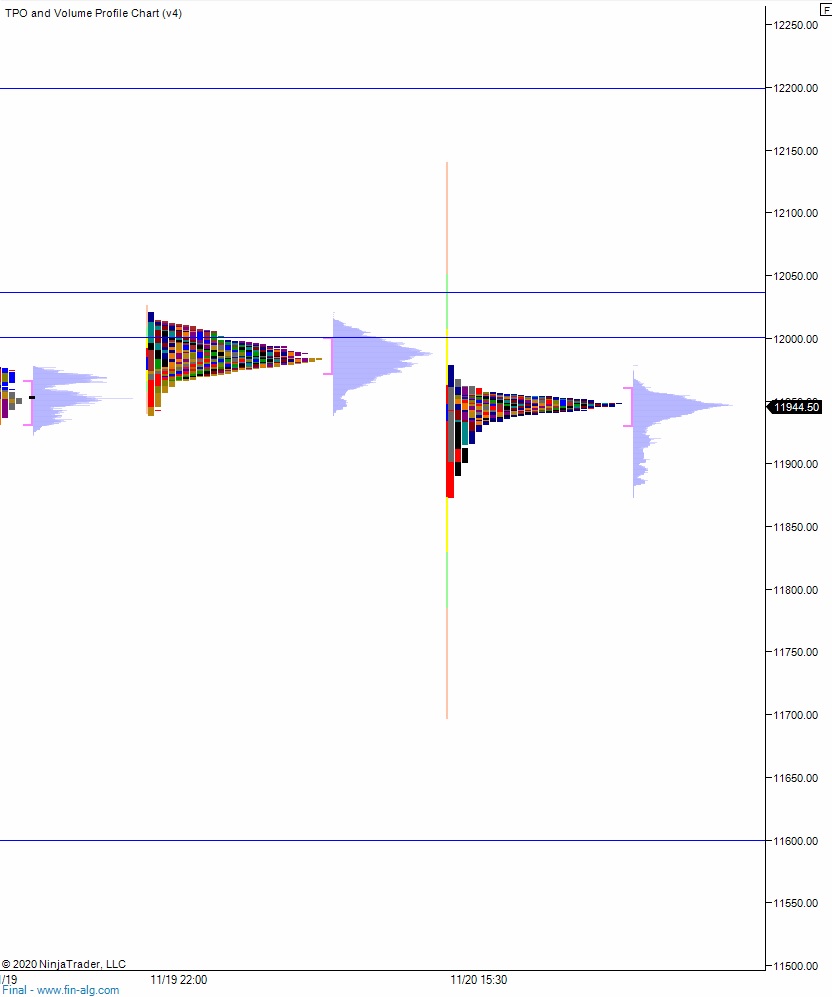

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Strong Monday. A bit of continuation into Tuesday, then look for remarks from Fed Chairman Powell Tuesday morning to introduce some selling into the tape. Price is choppy through the rest of the week, chopping along as it digests several earnings reports. Then look for NFP Friday morning to provide direction into the weekend.

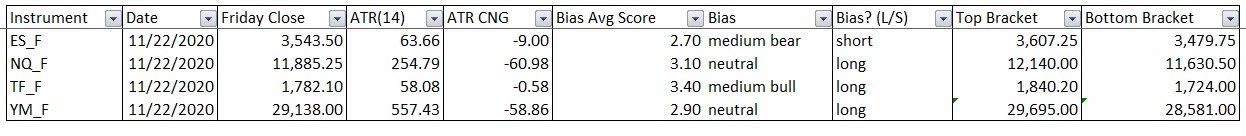

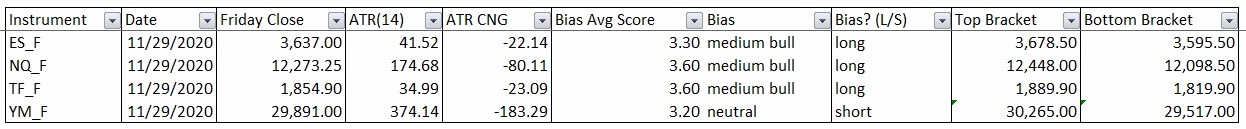

Bias Book:

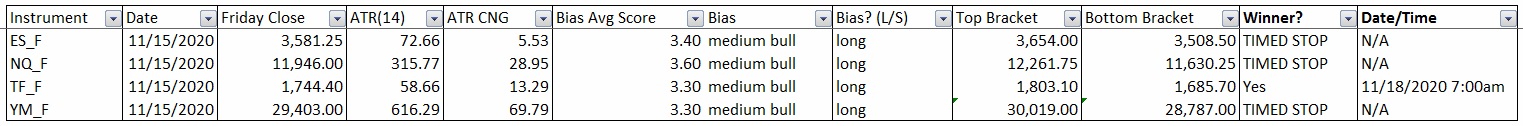

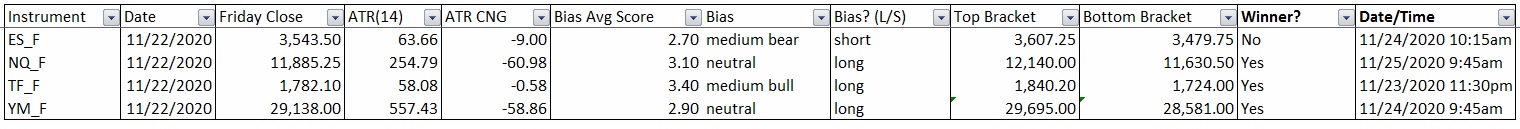

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

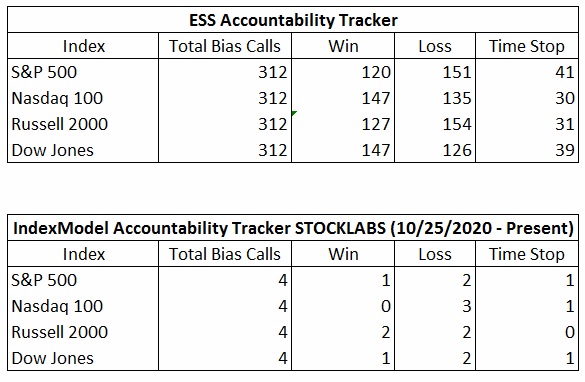

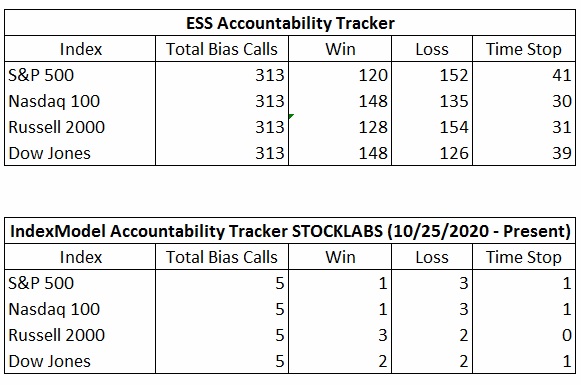

Bias Book Performance [11/17/2014-Present]:

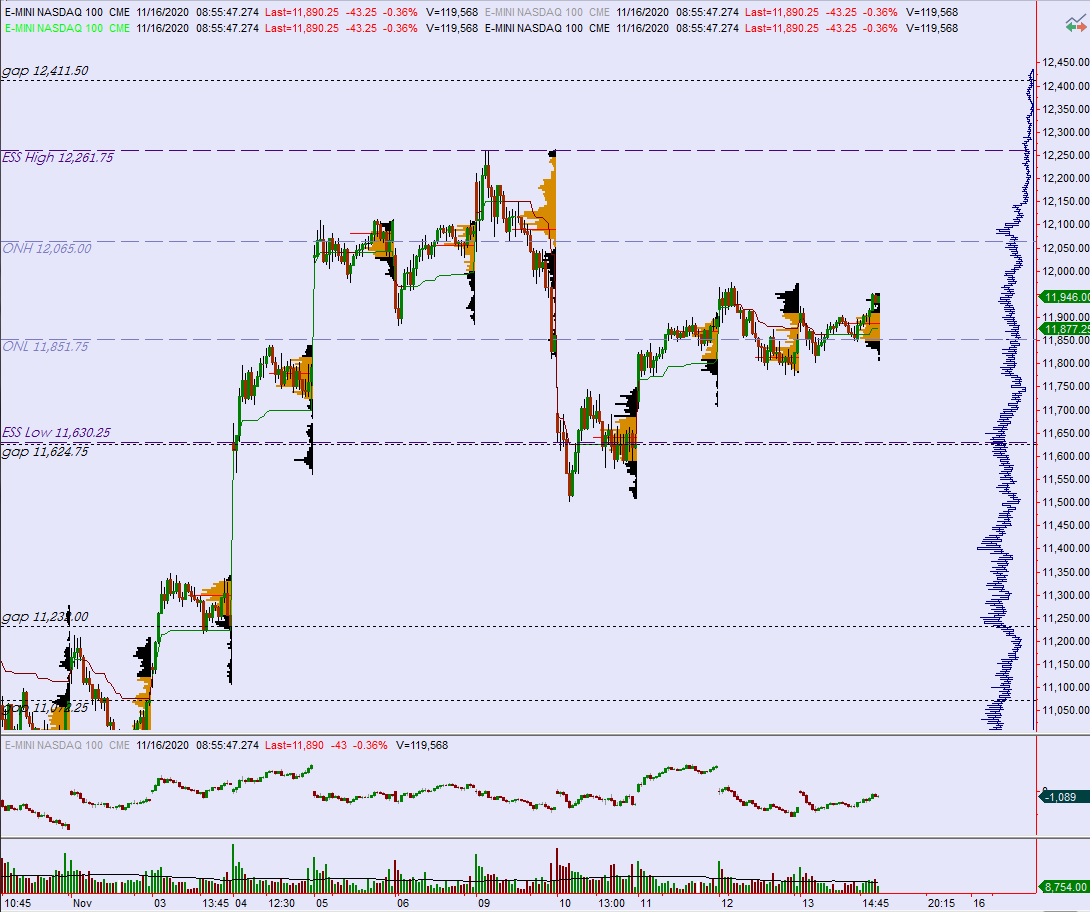

Semiconductors forms a wedge, potential failed auction in Transports

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports took out their old swing high in grand fashion last Tuesday only to display a bit of vulnerability a few short days later Friday. Bear in mind this index was closed Thursday in observation of Thanksgiving. The Friday candle print is therefore not carrying as much weight as we’d normally assign. However, when we look back at this chart in a few months, that nuance will not be apparent. It will just look like another price pattern where we make a new swing.

This breakout needs to be monitored closely. Bulls will want to see buyers step in soon and sustain this breakout. Otherwise we could see a swift reversal back down into that old range,

See below:

Semiconductors are working higher after the fourth major thrust of the most recent bull run dating back to May 2020. The manner in which the rally continues deserves to be monitored closely. We are in a steep ascent, the kind which occasionally mark peaks. For now discovery up continues and we remain bullish. But if this wedge breaks, the correction could be swift in the opposite direction.

We don’t know.

See below:

V. INDEX MODEL

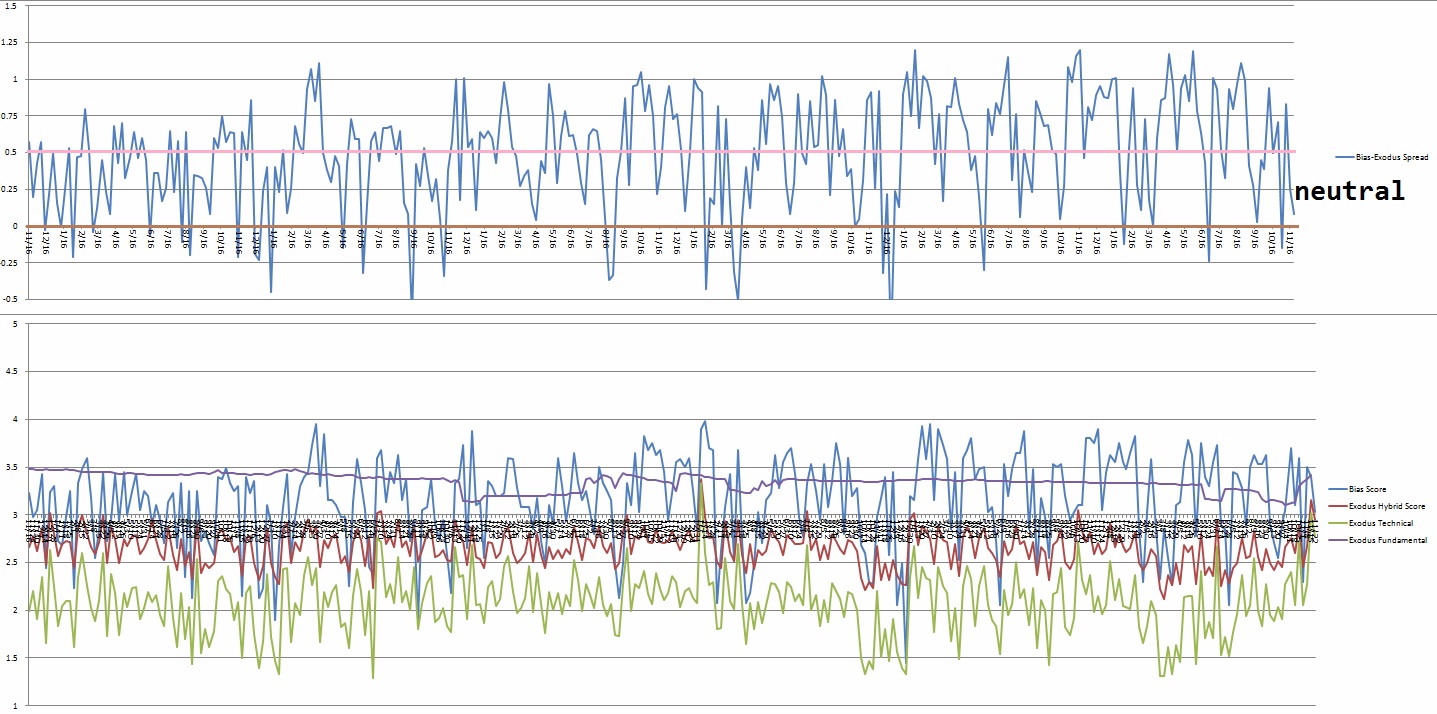

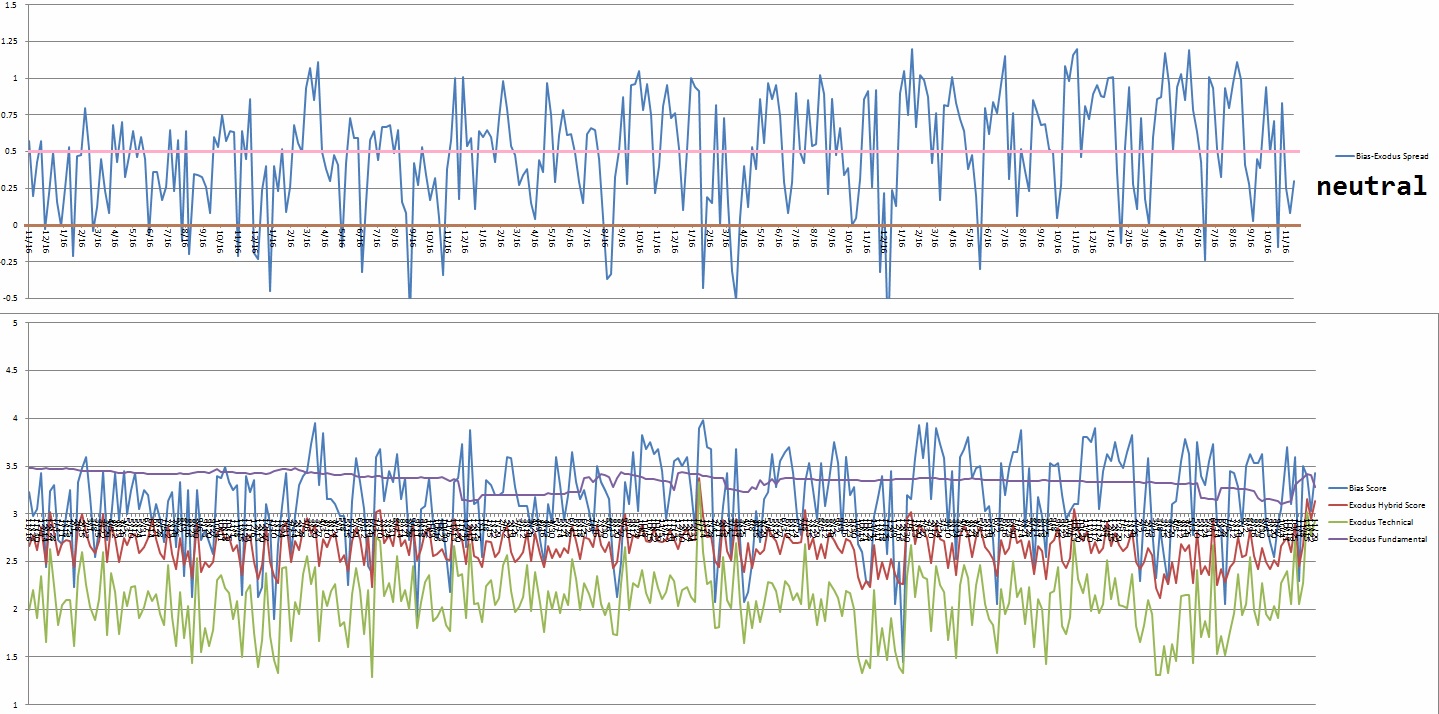

Bias model is neutral for a third consecutive week. No bias.

VI. Stocklabs HYBRID OVERBOUGHT

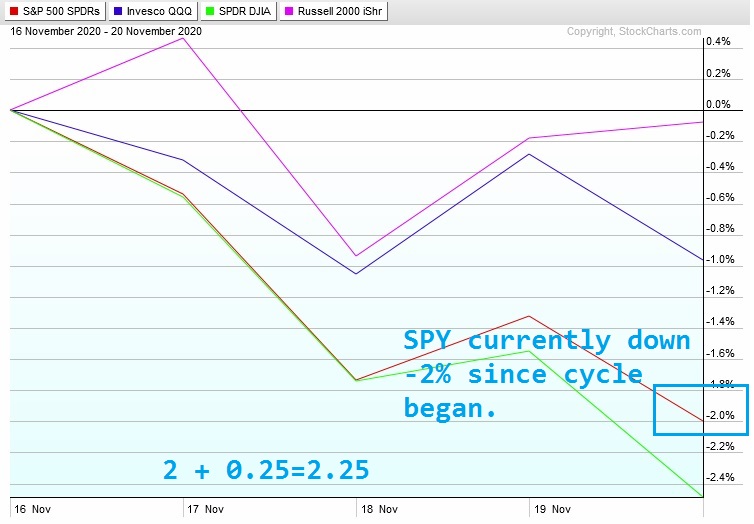

On Monday, November 16th Stocklabs signaled hybrid overbought. This is a bullish cycle that runs through Tuesday, December 1st, end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“It’s not a bad way to live once you let go of the idea that you deserve more.” – J.J. Abrams

Trade simple, live simple

Comments »