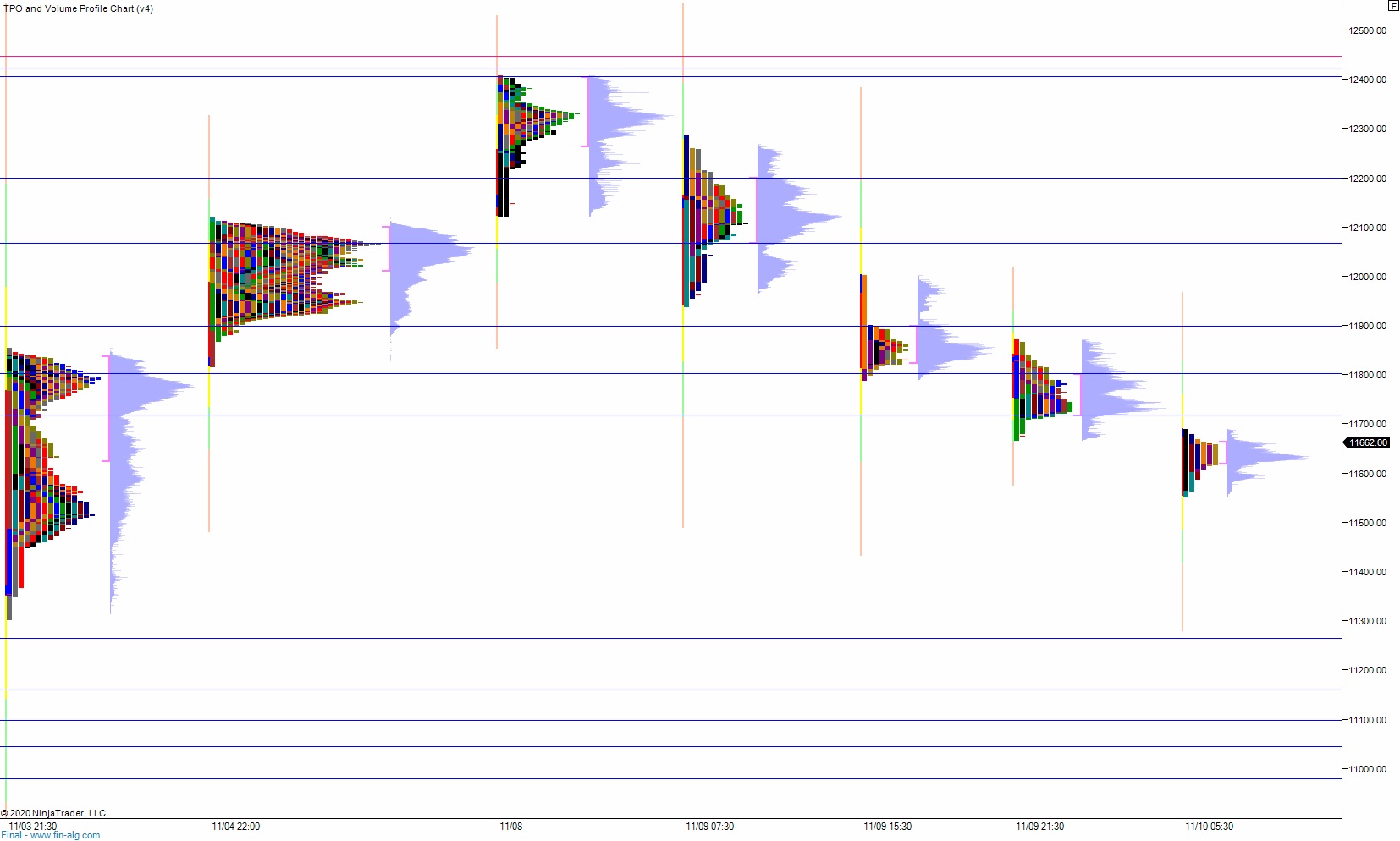

NASDAQ futures are coming into the second full week after the Presidential election with a big gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, steadily chopping lower for the duration of the Globex session. Around 6am a responsive bid stepped in just a few point below last Wednesday’s low. As we approach cash open, price is hovering in the lower quadrant of last Wednesday’s range.

On the economic calendar today we have JOLTS jobs openings at 10am followed by a 10-year note auction at 1pm.

Yesterday we printed a normal variation down with a liquidation drop at the end. The day began with a gap up to near last week’s high. The open two-way auction formed a wide range before buyers stepped in and worked a bit higher, trading a few points beyond the 09/03 high, briefly tagging the 09/02 range (current all-time high session) before falling back down through the daily midpoint. From then onward action was choppy, chopping below the midpoint before working to a new low of the day in the afternoon. Price was steadily rotating lower until a sharp liquidation move downward took shape during the closing bell. We ended the session near the lows.

Heading into today my primary expectation is for buyers to work into the overnight inventory and not close the overnight gap but close the gap left behind on 11/4 at 11,791.25. Look for sellers to defend 11,800 and for two way trade to ensue.

Hypo 2 stronger buyers trade a full gap fill up to 11,861 then continue higher, trading up through overnight high 11,901.50 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, trading down through overnight low 11,553 on their way to tagging 11,500. This could trigger a liquidation down to 11,300.

Levels:

Volume profiles, gaps and measured moves: