The selling continues this afternoon, with sellers continuing their blitzkrieg campaign with a 2pm algorithmic shock wave. A block trade like the one we just experienced at 2pm is a way of starting a siphon—the algo sucks on the tube with the intent of motivating atmospheric pressure to move liquid(ity). Once it starts the flow, a force of equal or greater value must arrive to stop the force.

There’s nothing wrong with sell algos, they just receive more criticism then buy algos. They are both attempting the same feat.

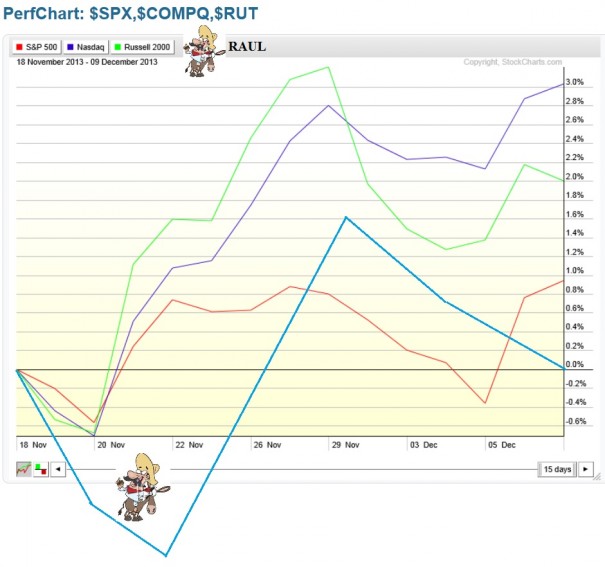

Keep the context of our market in mind. It is mid-December, we have had a huge run, correlations are low, the long term trend is higher, risky assets continue seeing cash inflow, and sellers just controlled their first week since mid-summer.

With that in mind, and despite my extensive coverage of the indices, I think it is important to keep your focus on individual setups and how they are behaving.

My book is going out 95% long after purchasing OWW today at the top tick. I have other names of interest, including LEDS basing just below one dollar.

My AMZN YOLO lottery ticket was a loser. I risked the entire premium because it was a lottery ticket. It had a moment of hope early on, but could not breach recent overhead supply. The trade needed more time than one day. I realized this soon after taking the trade, and was discussing how TSLA would have been a more prudent YOLO…if there is such a thing.

I never grabbed ENPH yesterday. Instead I just watched it and commented on it. Now I cannot buy it and it can likely go much higher. I simply lack to conviction to assume nearly 20% more risk.

My book of stocks spun donuts in the mud this week even though I have winners among my ranks. Here’s the book, largest-to-smallest:

BALT, OWW, FSLR, GRPN, TSLA, YELP, RVLT, YGE, Z, LO, WBMD, GOGO, CREE, F, and my bane MJNA.

Final word of on the market – this looks like discouragement phase, where the market makes an earnest attempt to steal away your favorite shares. Review your risk plans, make adjustments where necessary, and stick to them. Do not assume gains are guaranteed.

Comments »