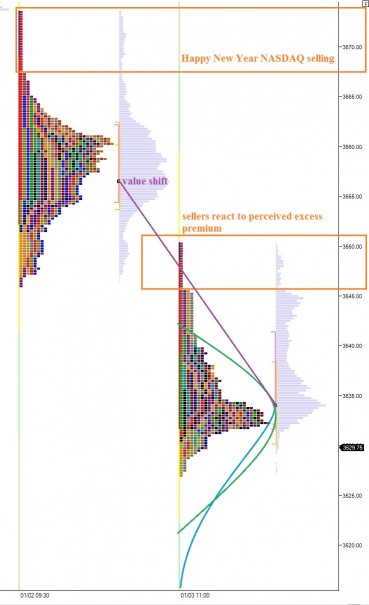

We never truly can say what the market should do, nor can we impose our will upon the market. We can however, through the lens of market profile with a side of auction theory, gauge the likelihood of continuation. This is why they keep me around, these guys.

I probably would have started locking in longs like many of you if I stayed at my trading terminal, the most aggrandized name for my bossed up PC. After all, what a pungent thrust, certainly it would be prudent to raise cash. I pulled a PTJ and headed to the gym an hour before the bell to avoid the angst.

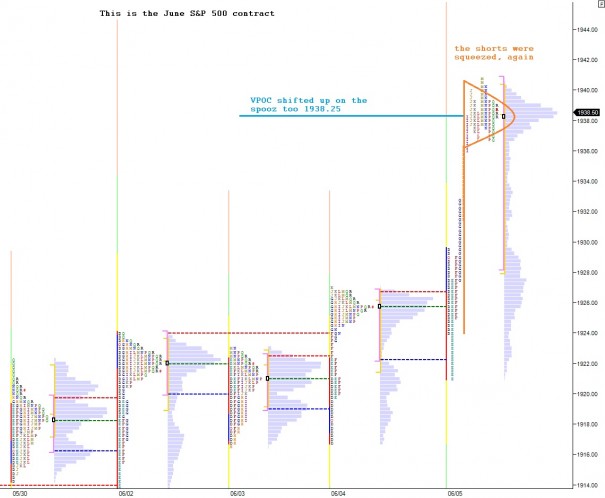

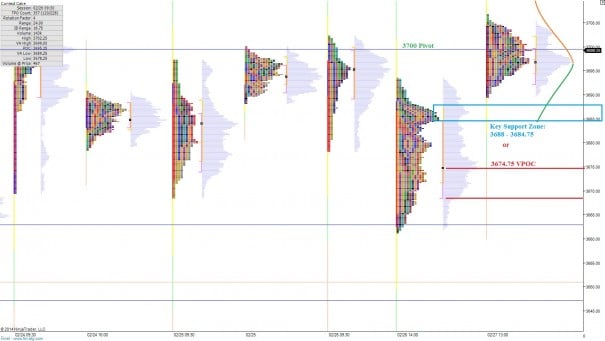

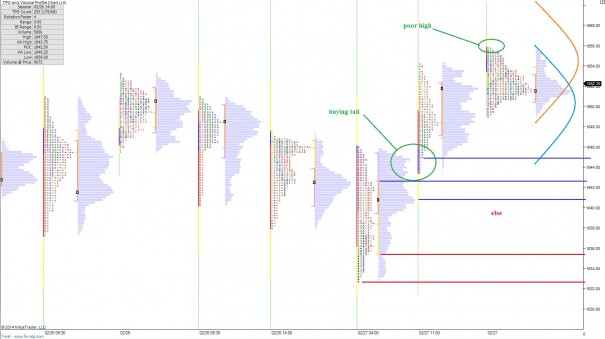

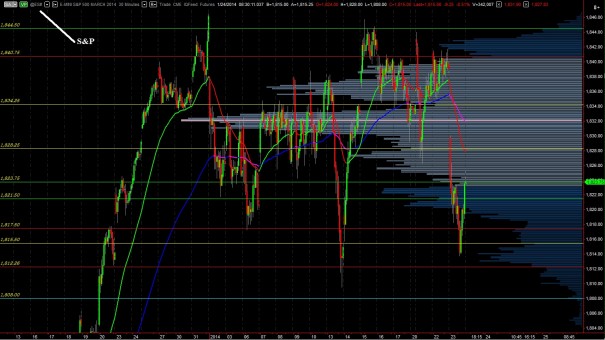

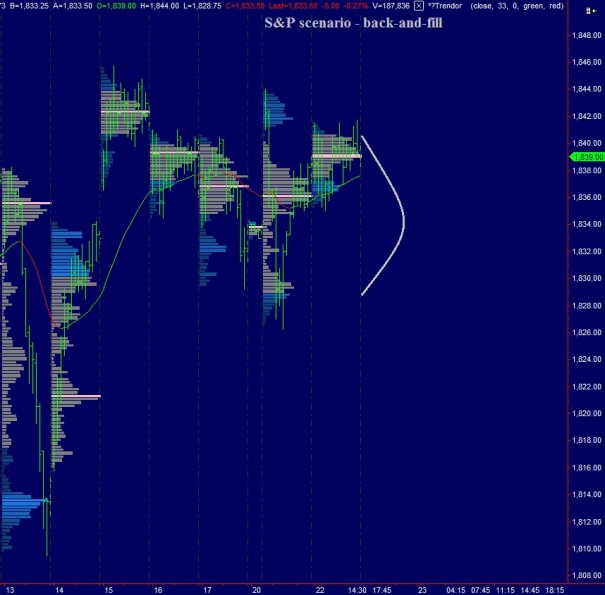

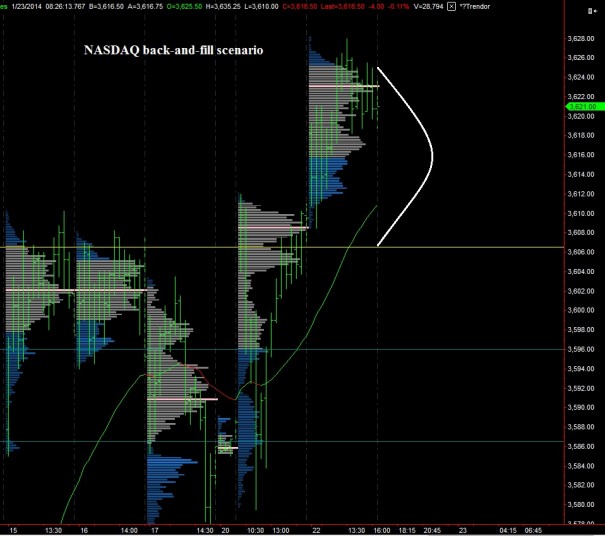

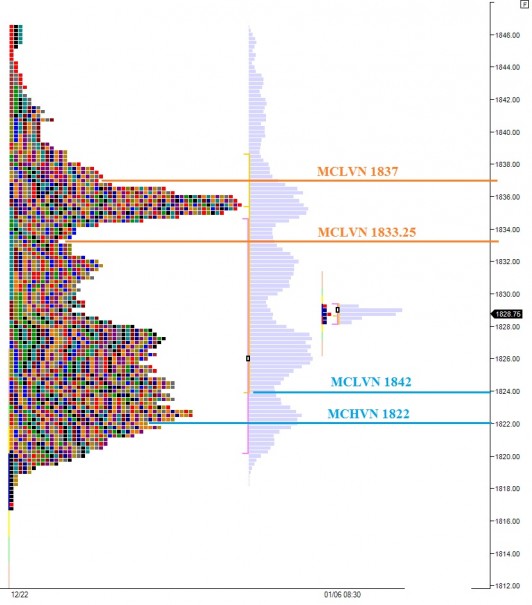

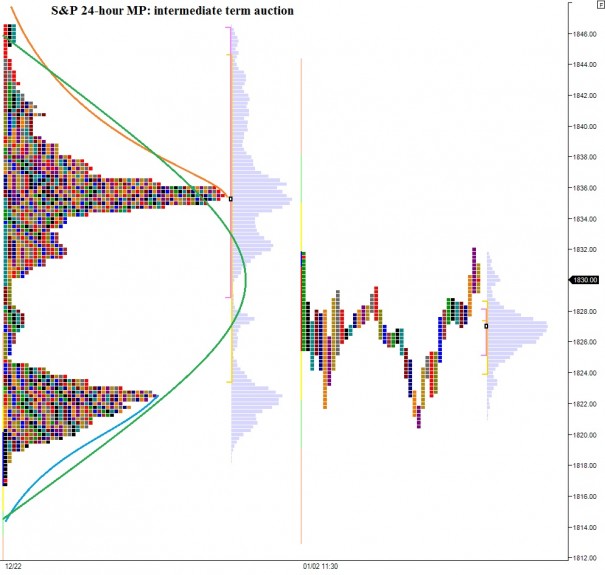

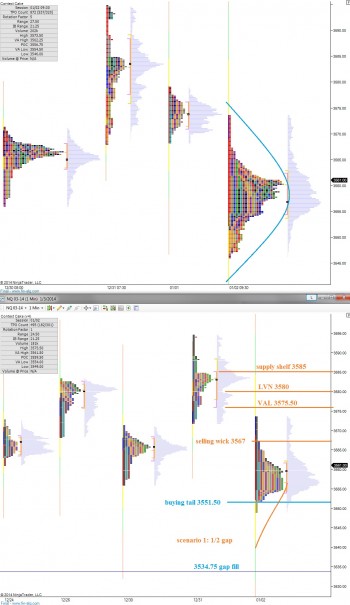

If you have clicked my blog title with haste, insistent upon reason and logic without all the 80’s bravado and unpalatable verbiage, then look no further than the following market profile bits, which I will discuss a bit further below:

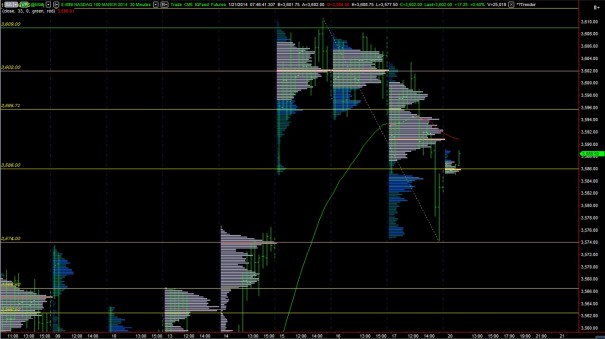

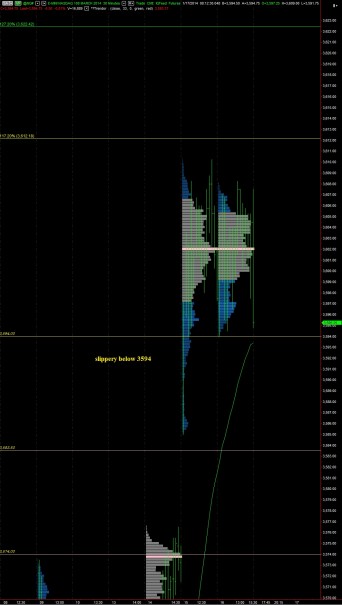

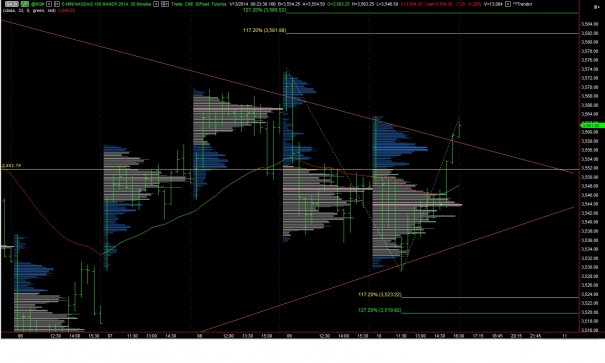

The P-shaped profile is known as a short squeeze. This is a temporary phenomenon in some cases, and when they occur in the context of a downtrend they often mark the end of the countertrend. The key is keeping your intermediate timeframe clear. Is this a downtrend?

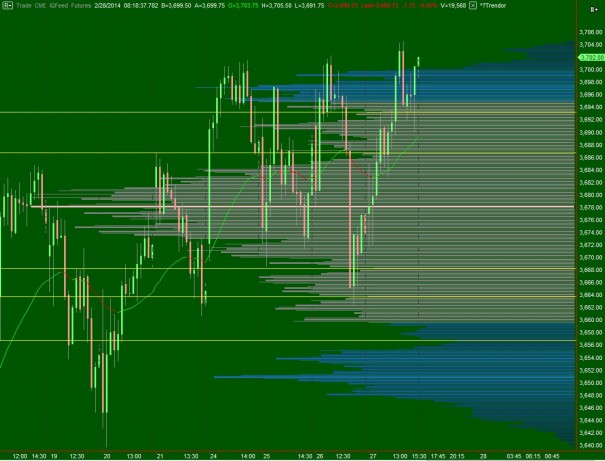

If you have ever been to a live auction then you have seen this action, or if you have been to a stingy charity event then you have seen the opposite action. An item is rolled out and the auctioneer begins their banter about starting bid. If no one bites then they drop the initial bid. Once we have interest the process begins. At the tight-pocketed charity event, after two or three hands are raised everyone starts looking around, afraid to raise their hands. The auctioneer starts using tons of filler noise, making it seem like the auction is still active when really it is dead.

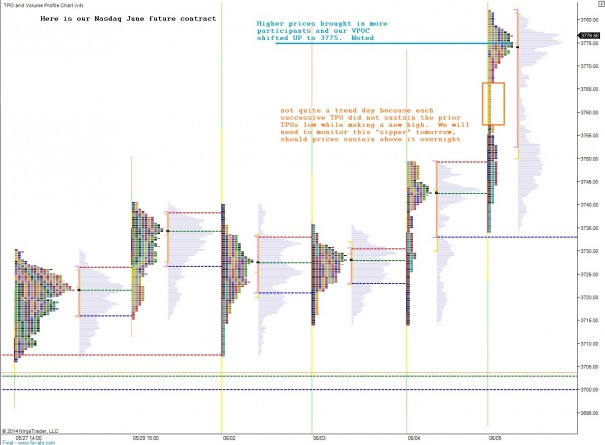

The opposite is when higher prices actually bring NEW participants into the auction. They have seen the activity and when it reached higher advertised prices it enticed them and they wanted to buy. The auctioneer is saying very little filler, and the price continues climbing.

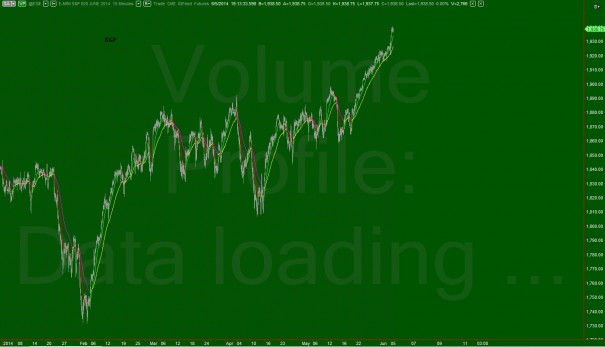

I see that rising VPOC as higher advertised prices generating buying interest. And even through these are not quite trend day profiles, I am pressing my longs into tomorrow as these contracts trade at all time highs.

Sleep well my little butter cups 😉

Comments »