NASDAQ futures are heading into Wednesday flat after an overnight session featuring normal range and volume. Price briefly took out the Tuesday high before settling into balance. At 7am MBA Mortgage Applications had no impact on the tape.

Also on the economic docket today we have New Home Sales at 10am, Crude oil inventory at 10:30am, and a 2-year floating rate note auction at 11:30am.

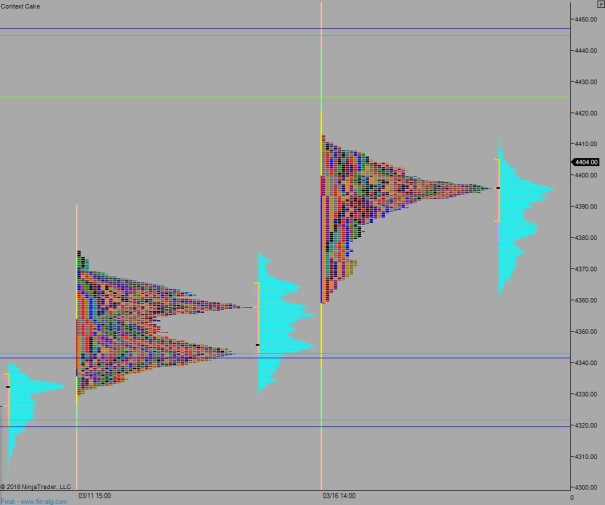

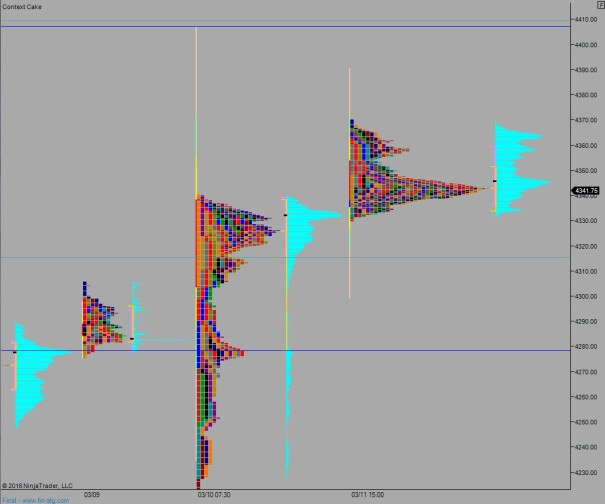

Yesterday we printed a double distribution trend up. Price opened gap down and a strong open drive worked price higher, closing the gap in the first 30 minutes. From then on price went trend up, slowly.

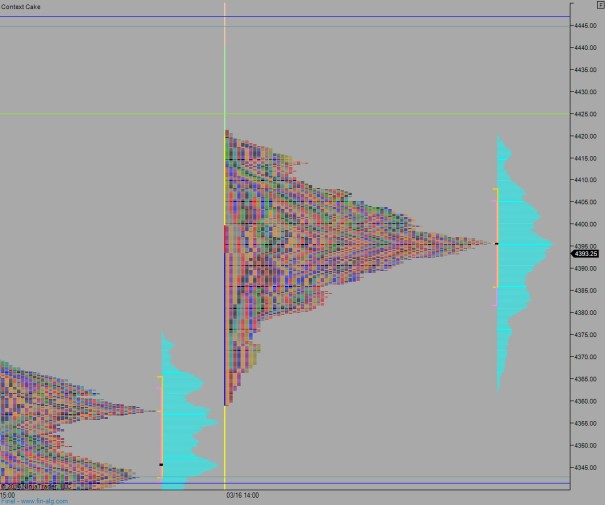

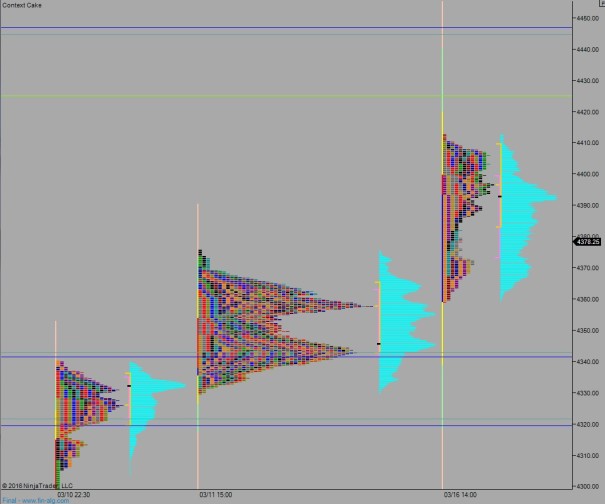

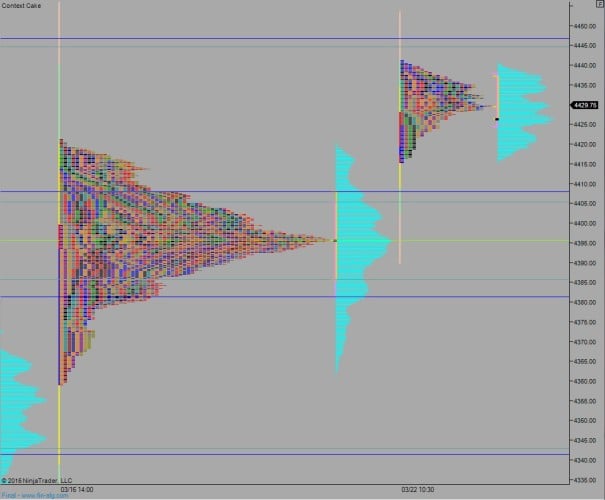

The action was directional enough to break us away from the massive value area that began building on 3/16 after the FOMC rate decision [see market profile below].

Heading into today my primary expectation is for sellers to push into the tape and take out overnight low 4422 setting up a move to test 4408 before responsive buyers step in and two way trade ensues.

Hypo 2 buyers push up through overnight high 4441.25 setting up a move to target 4445. Look for a continued move up to 4447 to close the open gap then responsive selling and two way trade ensues.

Hypo 3 sellers push down through 4408 and sustain trade below it setting up a move to target the massive VPOC at 4395. Trade gets choppy here, with responsive buyers the first go around, but any subsequent retests are likely to explore down to 4386.

Hypo 4 buyers sustain trade above 4447 and test 4452.50 before selling comes in.

Levels:

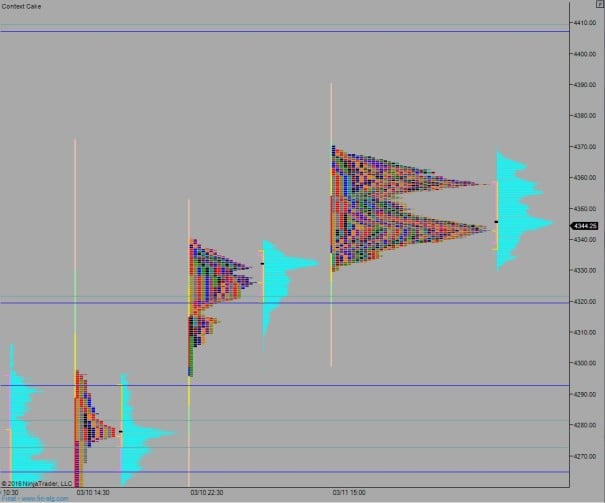

Volume profiles, gaps, and measured moves: