Part 1 WoodShedder Time! Creating A Quantifiable Approach To Position Sizing

Part 2 Building A “Position System Simulator”

Part 3 Building Cover Sheet, Determining Probability of Results (Position Size Simulator Part 2)

Part 4 Adding To The Cover Sheet

Part 5: Setting Up The Calculations

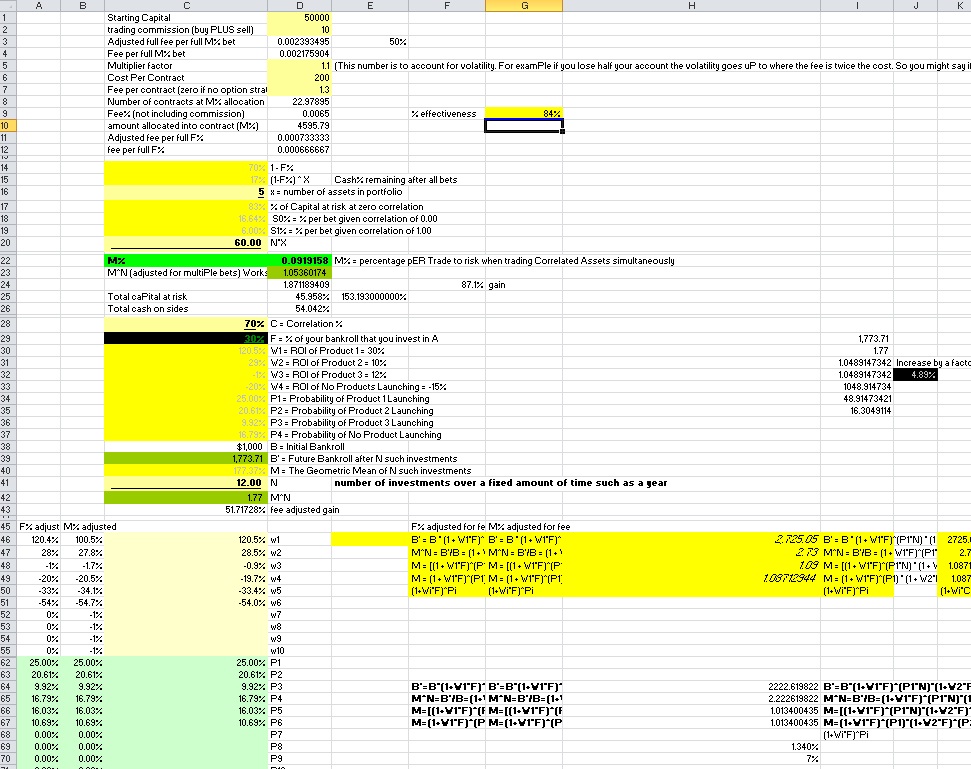

Since Woodshedder is semi-retiring from IBC, I decided it was a good time to kick off a more quantified approach in his honour(sic). While he quantifies the entire trading systems, I will be just setting up a spreadsheet that allows you to input either back tested quantifiable data, or looking at your history of results running a more discretionary system. The spreadsheet will then help you to determine position sizing.

There will be 2 spreadsheets, one is very close to complete, but requires some review to ensure I have not messed up a formula somewhere. This spreadsheet helps to determine “expectations” given a set of possible outcomes over a set amount of trades.

I will explain all of this stuff someday and how I use it another time. Upon development of this spreadsheet, I have come to the conclusion that such leverage even at a fraction of this, is insanely reckless, and can produce hugely volatile swings in your bankroll that are entirely unnecessary. There is a very good chance that even over 50 trades that the system could mean losing a very large percentage of your bankroll. Since people don’t live forever they won’t be able to withstand “infinite” bets in a given system. I accounted for fees, the value of correlation and multiple bets, but it still isn’t enough for my taste.

Unfortunately, the first spreadsheet with all it’s formulas of modified kelly criterion / optimal F%, doesn’t give me enough data. Especially since I recently have learned what drastic draw-down such a strategy can produce and how if you happen to get that drastic draw-down it can take significantly longer to ever recover (perhaps longer than your lifetime), it can provide severe psychological risks (going on “tilt” as they call it in poker), and such volatility actually often makes fees do more harm betting more, than if you had just kept your bet small to begin with and not had such volatile swings in which the fees then become a more significant issue.

And so, I want to know the probability of ending up down after a certain number of trades, up 100%, down 20%, 50%, up 50% and things like this.

The goal is to construct a system simulator that takes a given system. The system will be defined with:

W1=ROI for result 1

W2=ROI for result 2

W3=ROI for result 3

W4=ROI for result 4

W5=ROI for result 5

P1=Probability of result 1

P2=Probability of result 2

P3=Probability of result 3

P4=Probability of result 4

P5=Probability of result 5

I have gone beyond this for my “optimal bet size” calculator. You can see 10 “results” but it can list up to 15 events (I hid a few rows in excel that aren’t visible in the jpeg). I could get more precise based upon a strategy such as a trailing stop that had several possible exits. I do not want to go beyond 5 results for the simulator.

So after 5 possible trades are listed, the “simulator” will be able to determine the set of data I want to know given the bet size listed, which can be modified until it gives me the set of data I am comfortable with, and give me a much better idea of what a given bet size will accomplish.

The next post is coming in a few minutes that will get into more details about building the simulator that I speak of that I will be building in front of you, screenshots and all.

If you enjoy the content at iBankCoin, please follow us on Twitter

Next post http://ibankcoin.com/hattery/2013/07/24/building-a-position-system-simulator/

Kudos on the work.

In Wood’s honour I will comment that, based on the few sources I’ve read that address using a Kelly criterion of some kind, there seems to be no shame in reducing the position size, sometimes drastically, because there are just too many estimates in the calculations. It’s treated as an upper limit. But my personal takeaway was that a few people are way, way too big, while I was way too small.

Hello there, I found your site by the use of Google even as searching for a related subject, your site

got here up, it appears to be like great. I have bookmarked it in my google bookmarks.

I am no longer sure where you are getting your information, but

good topic. I needs to spend some time finding out much more or understanding more.

Thanks for wonderful info I used to be in search of this info

for my mission.

メンズ水着 楽天

ohhh… you better put the Samuri down, son.