I am not one for excuses, especially when it is 7am and a cement truck is about to arrive. Because at that point the only option is to more work on me. Grieving over daylight savings is a popular plebeian pastime (PPP). But by-golly my sleep schedule is out-of-whack, and with my circadian rhythms off I figured it was best I withdrew myself from the NASDAQ 100 arena.

This is the benefit of being time rich and independent. Nobody can tell me I have to work. I love to work, and sometimes I work too hardt. This has not been a work-too-hardt week. First off it has become quite cold in the murder mitten.

And I welcome the cold. As any faithful reader of the old Raul blog knows, my primary objective is to extract as many fiat american dollars as possible from the global financial complex and use said dollars to acquire land as far north and at as high an altitude as my constitution will allow. Then to build. I come from a long line of builders and soldiers. We build and we fight and we fuck and we farm. Additional fiat american extractions will be converted into quonset huts and water-heated cement pads. Greenhouses and solar panels and lithium-ion batteries.

So I am big on conditioning my mind and this sack of fluid my soul occupies to handle the cold. Right now the inside temperature of Mothership is a brisk 52 degrees Fahrenheit. I am wearing finger-less wool gloves, shorts and a Nike heatgear tee shirt that is designed to wick any moisture off my body. This shirt keeps me from suffering from any sweat chills. I am barefoot like Honest Cato, of course. The only heat sources are a fire near by bed which I’ve kept lit this entire week, the flame below my soup stock pot and the the human mammal heat I generate via frequent jumping jacks and other calisthenic exercises.

What most millennials (and boomers) fail to understand is that the only escape from normalcy is to BE different. I choose to remove as many modern creature comforts as possible, instead focusing on stocking my coffers with homegrown jellies, gathering wood and foraging for food and stuff to sell on Craiglist like a beautiful trash panda.

Some would see a man such as myself, who hasn’t left the house in days and say, “That fucker has no ambition. Look at him, poking that stupid fire and reading books all day.” Little do they know I am constantly plotting, waiting, ready to strike with merciless tenacity when the right opportunity presents itself.

And it is nearly showtime. Or at the least, nearly snowtime. And humble Raul thrives in the winter.

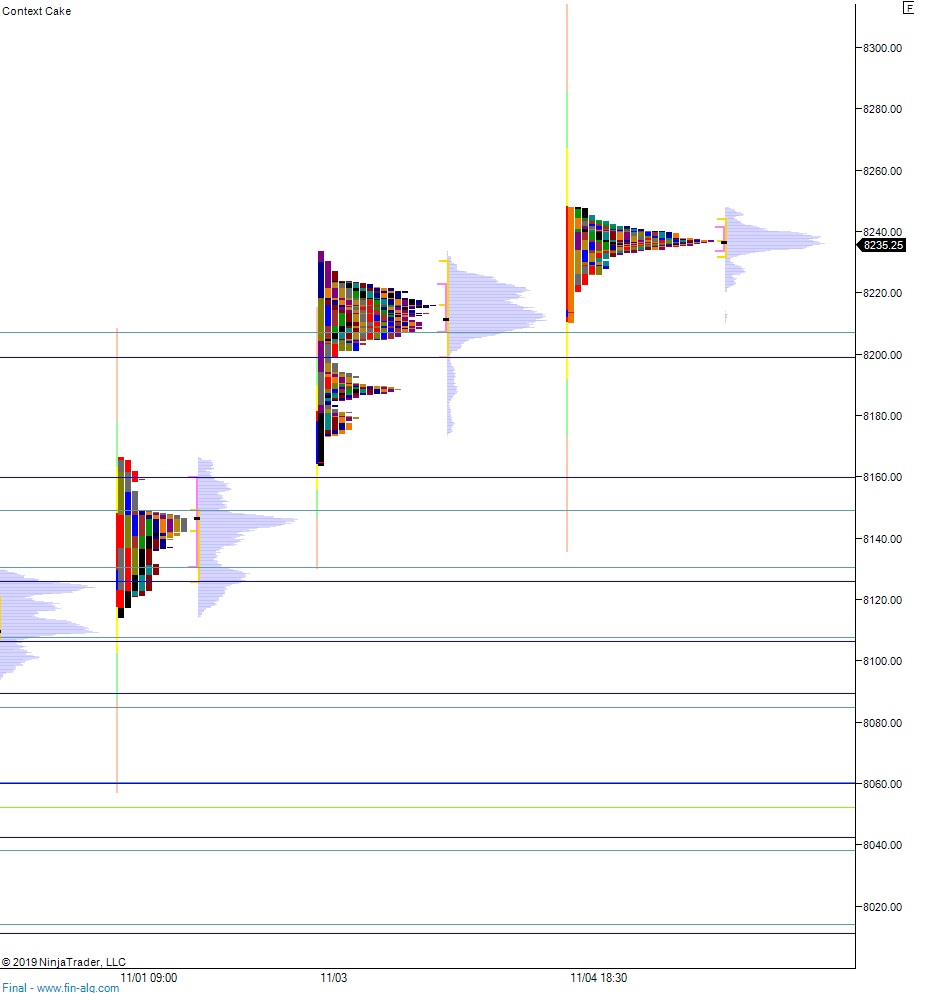

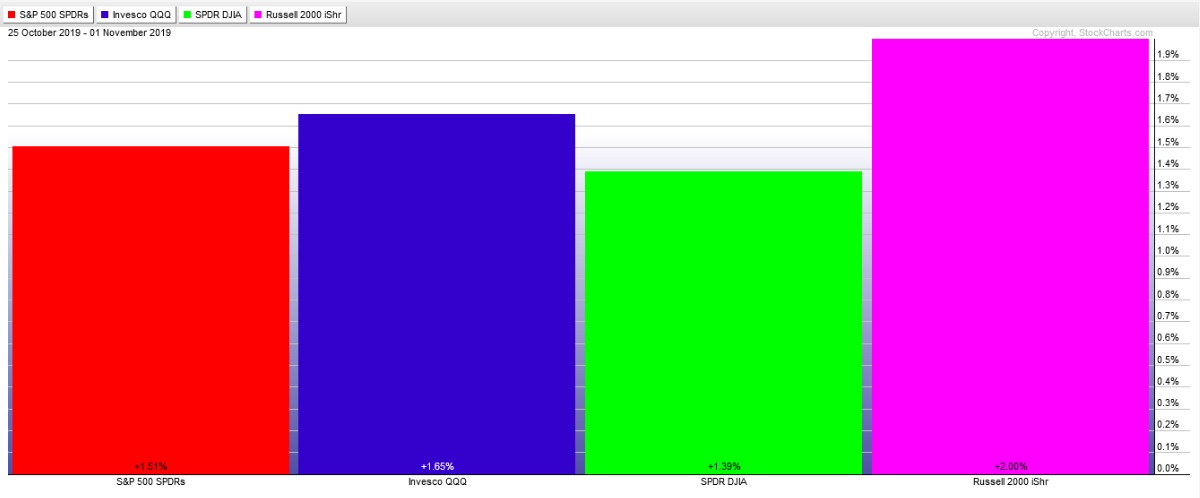

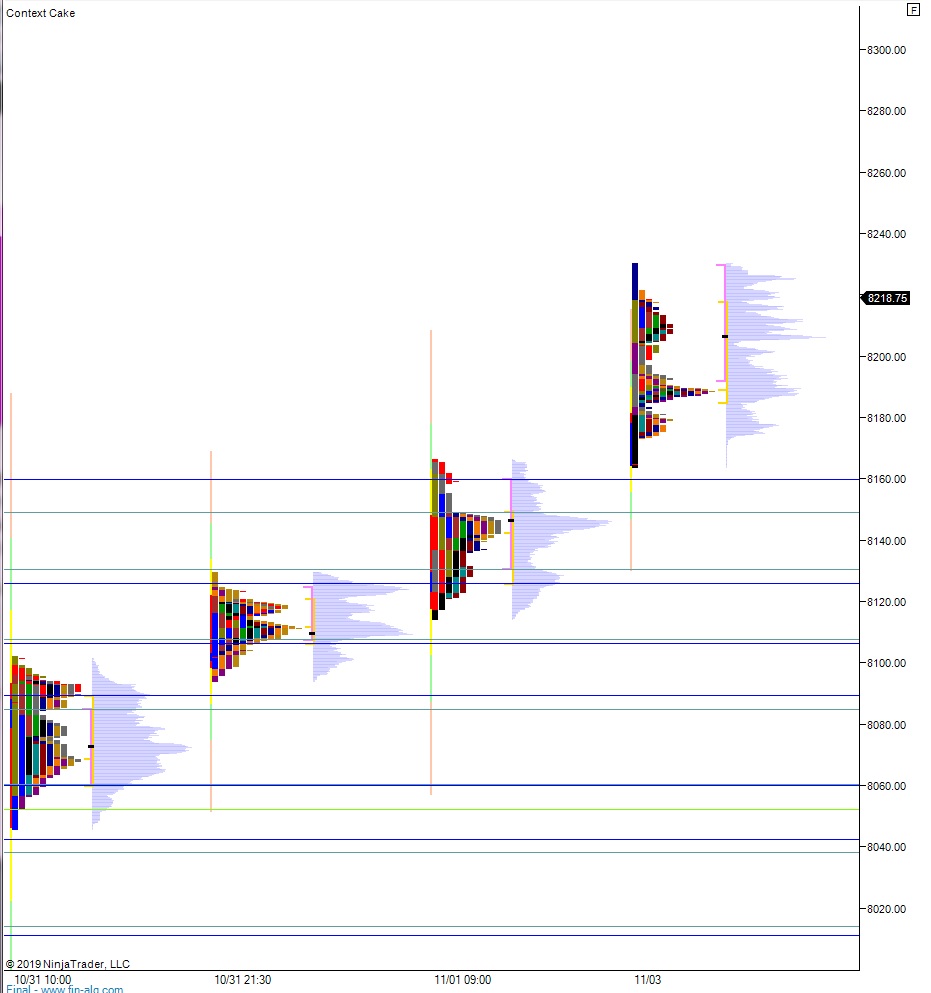

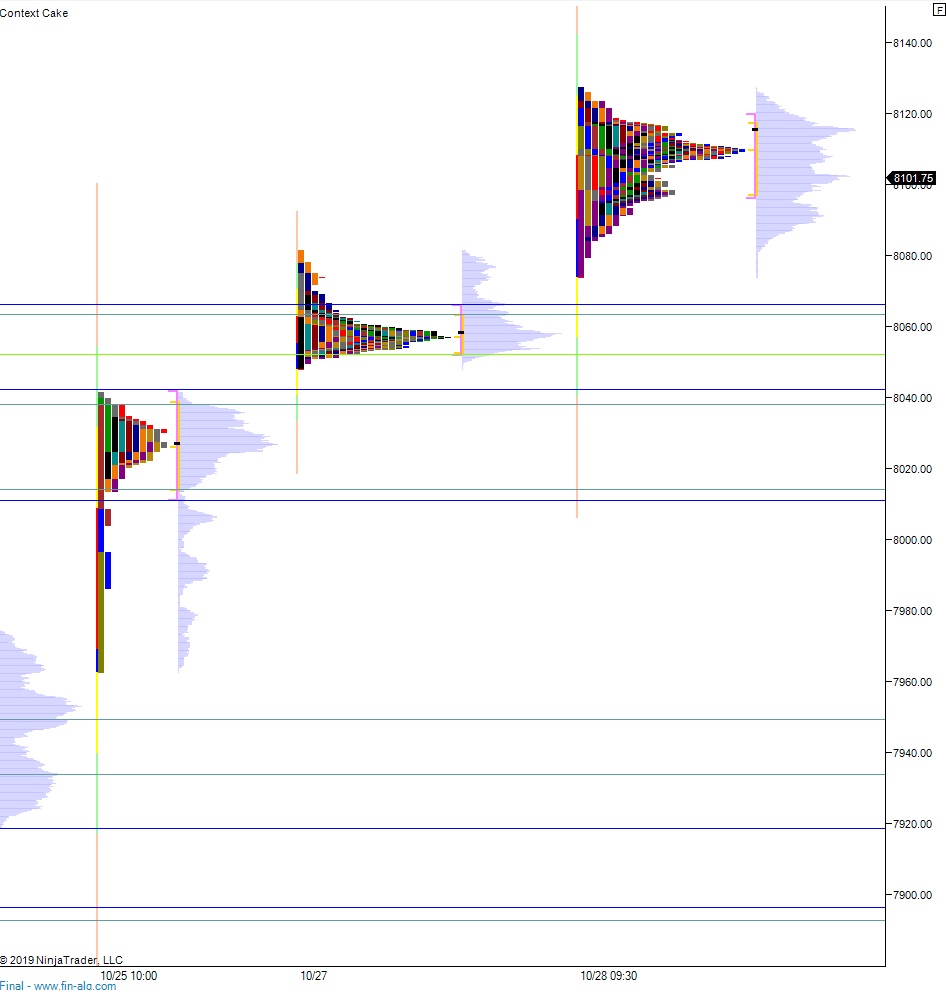

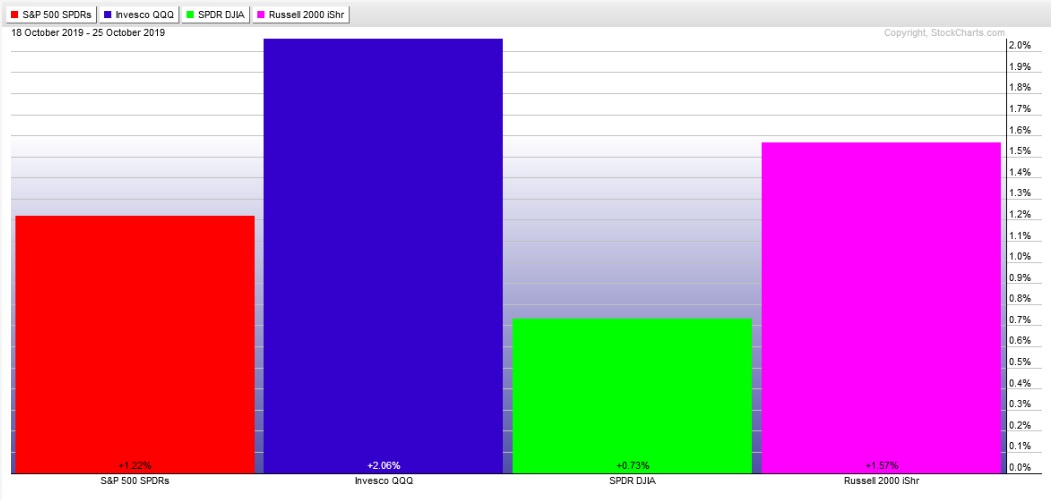

Plus the stock market is just prancing around up here at record highs. There is not much for me to do. I will not simply work for the sake of work, I know better than to do something for the sake of curing boredom or “appearing” productive. What matters most is the health of my mind and body, otherwise I will be in no condition to help the people around me. Work for the sake of work is not only a waste of time, but when it comes to trading it is a recipe for disaster. I have seen 20 year professional traders, legends amongst our ranks, drift away from their plans and suffer major losses during slow tapes.

None of us are immune. The best we can do is feel in-touch with our ourselves, prepare all our research, then trade our plan. In doing this we can be liberated from the monotony of W-2 employment. But what the heck am I going on about? Every time I preach this line of trading to a room full of people they just want to fire tickers at me, or talk about how profound seasonality is or talk big shit about their five thousand dollar in-the-money call option position in Apple. So I am done. Do whatever you want. I am off to do some dead lifts.

I will be back Sunday with an update on these super strong markets.

Good day and cheers to your weekend.

Raul Santos, November 8th, 2019

Comments »