We are accustomed to seeing stocks trade up after brief periods of being down. Today we saw a titanic move higher in China related stocks, with the $FXI up 5.6%. Leaders included $BABA $BILI $BEKE $NTES and many others. But China, like so many things in Asia, is complete fake, made of straw. All Chinese rallies are to be sold. To think not is to pretend.

We also saw strength in retail names like $M, $AMZN, $W and $JWN. The core consensus the consumer is still consuming and stagflation is nonsense, as per Powell.

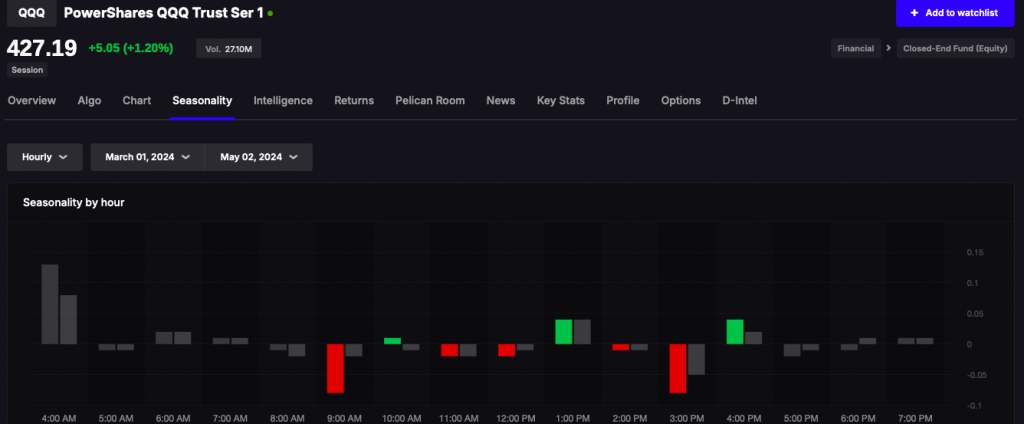

In general, it was a very risk appropriate day, as high beta stocks jumped more than 2.6%. But we saw a little weakness into the final hour. As a matter of fact, this trend is persistent and we measure it inside Stocklabs.

Sell the open, fade the close. This makes for a miserable tape for those who prefer to adjust towards the end of the day. You are quite literally buying into a vat of nothingness, sellers dominating the tape and lethargy rules dominion. Then you get the open dip at 9:30 and next thing you know your buy the close, sell the open gambit is a disaster. This calls for a change in buying patterns.

Everyone is waiting on $AAPL earnings and I am not excited for them, due to their lack of innovation and momentum. The simple fact of the matter is, the great Apple run happened but now it’s over.

Some notable earnings winners in the AHs include: $SQ $PCTY $BKNG $DKNG

downside action in $NET $AAON $EXPE $COIN $FND

If you can, avoid all earnings plays, unless you have some insider trading information that you can act upon without going straight to jail. Pro tip: avoid using options for your schemes.

I ended +88bps, 19% cash with a pretty conservative allocation.

If you enjoy the content at iBankCoin, please follow us on Twitter