I saw some feller on the Twitter this morning tweet that he was 100% cash in his investment portfolio. He was asking some other feller if he should feel okay about his position, because the other feller had tweeted something about how good trading is about being alone. Okay enough about it without sharing the original tweet:

I am not trying to put these fellers on blast without reason. I share these tweets because I think it is irresponsible to yourself and the people who are stakeholders in your well-being for you to ever, I repeat EVER, be 100% cash. Cash is not king. Wealth is owning capital goods. Stocks are liquid and really only to be sold as needed to fund purchases of even longer-term, less liquid assets like land and cement.

Land and cement and steel and wood that you can use to generate income. A place to charge Birds near an urban center. A greenhouse full of ornamental plants you can sell to girls in yoga pants with lots of disposable income. A workshop where you can crank out doohickeys to sell online. A garage to store your tractors and tools—tools that you can use to help people realize their building ambitions whilst making an honest gain.

Welcome to the gig economy. More and more people are waking up to the fact that serving a corporation for 30-40 years while it realizes its ambition is not a fulfilling use of brief human existence. The most natural state for a human to be in is either resting or engaged in sex. Anything beyond these two states is unnatural and unlikely to satisfy our core needs.

But of course we need “money”. But cash is risky. You’re better off having some liquid cash, some tradable inventory that you produce yourself, and stores of wealth/work like solar panels or batteries or art. You need mechanisms in place that passively produce income so people will leave you alone to rest and make love.

With that being said, my futures trading account goes to all cash every day. Any time I have a big run up in that account, I funnel it over my long term accounts and immediately buy stocks using FAITH BASED INVESTING. Faith based investing is the only way you will be able to tolerate the volatile nature of concentrated stock market investments.

Most americans are over-diversified. It is why they end up making modest improvements to their wealth situation but never meaningful, life changing gains. Which is fine if that allows them to fill their life with cheer and rest. If you are going to put 25-40% of your investment portfolio into Tesla, you better be fully committed the way a faithful person is to their god(s). Otherwise, uncertainty will lead to error and then guess what? You go 100% cash at an even worse moment than some jobber going all cash with markets at record highs. Without faith, the unfortunate outcome for most concentrated bets is the panic sell, that when looked back upon several years later on a chart looks really, well, unfortunate.

And that is all I had to say about investing and that set of tweets above.

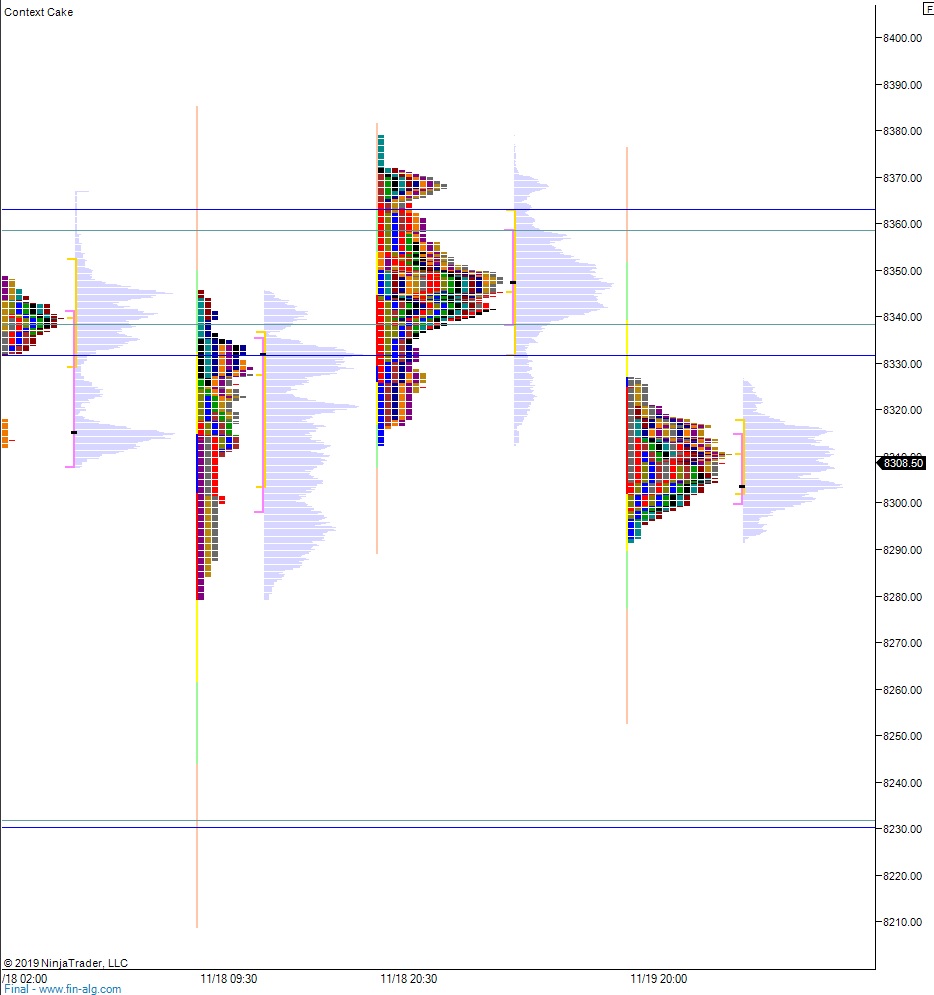

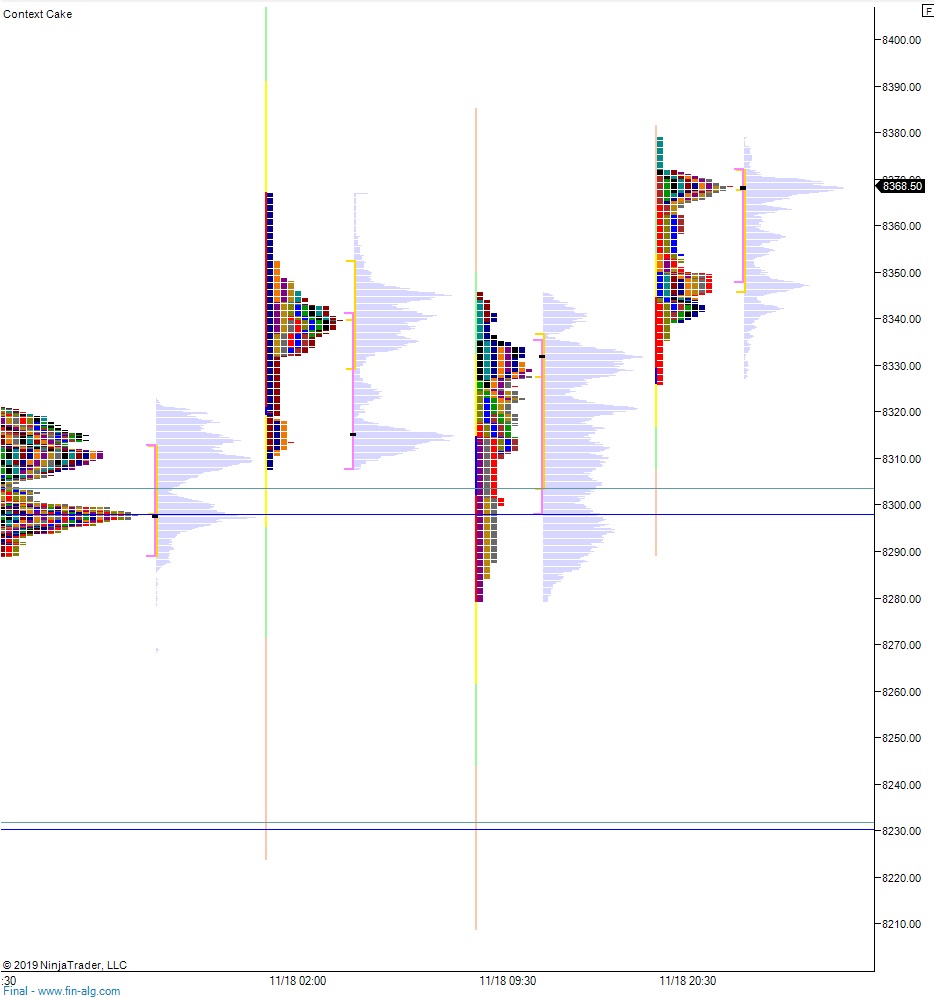

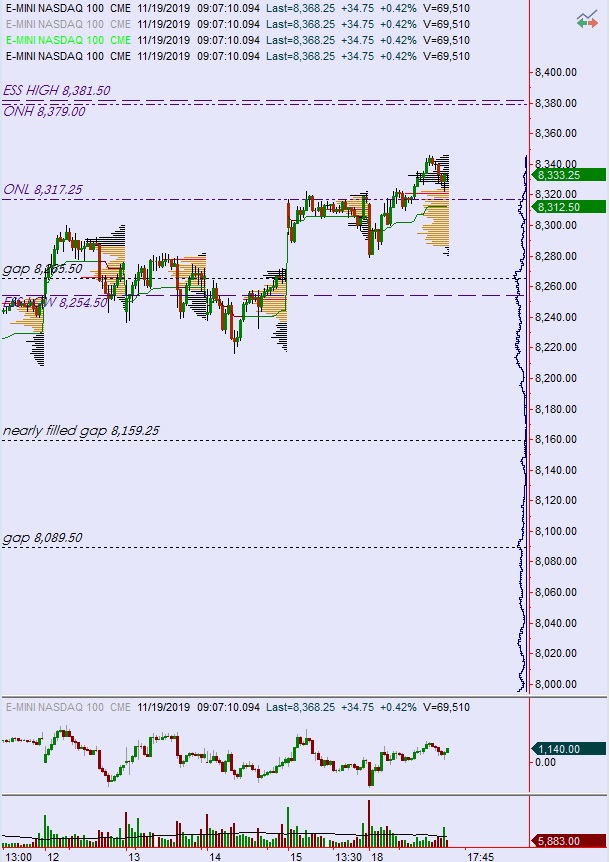

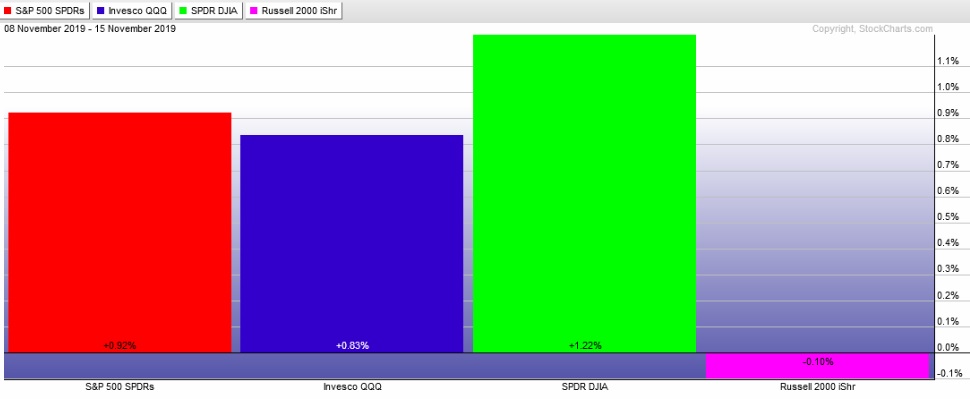

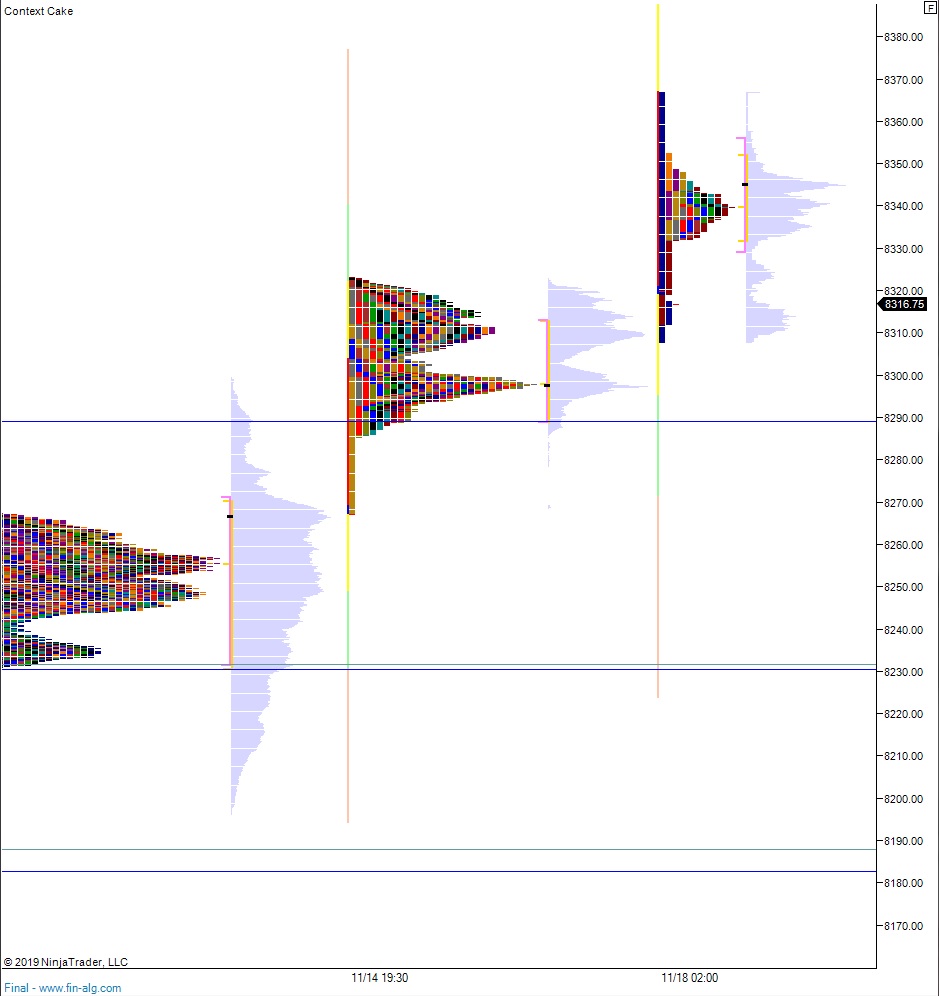

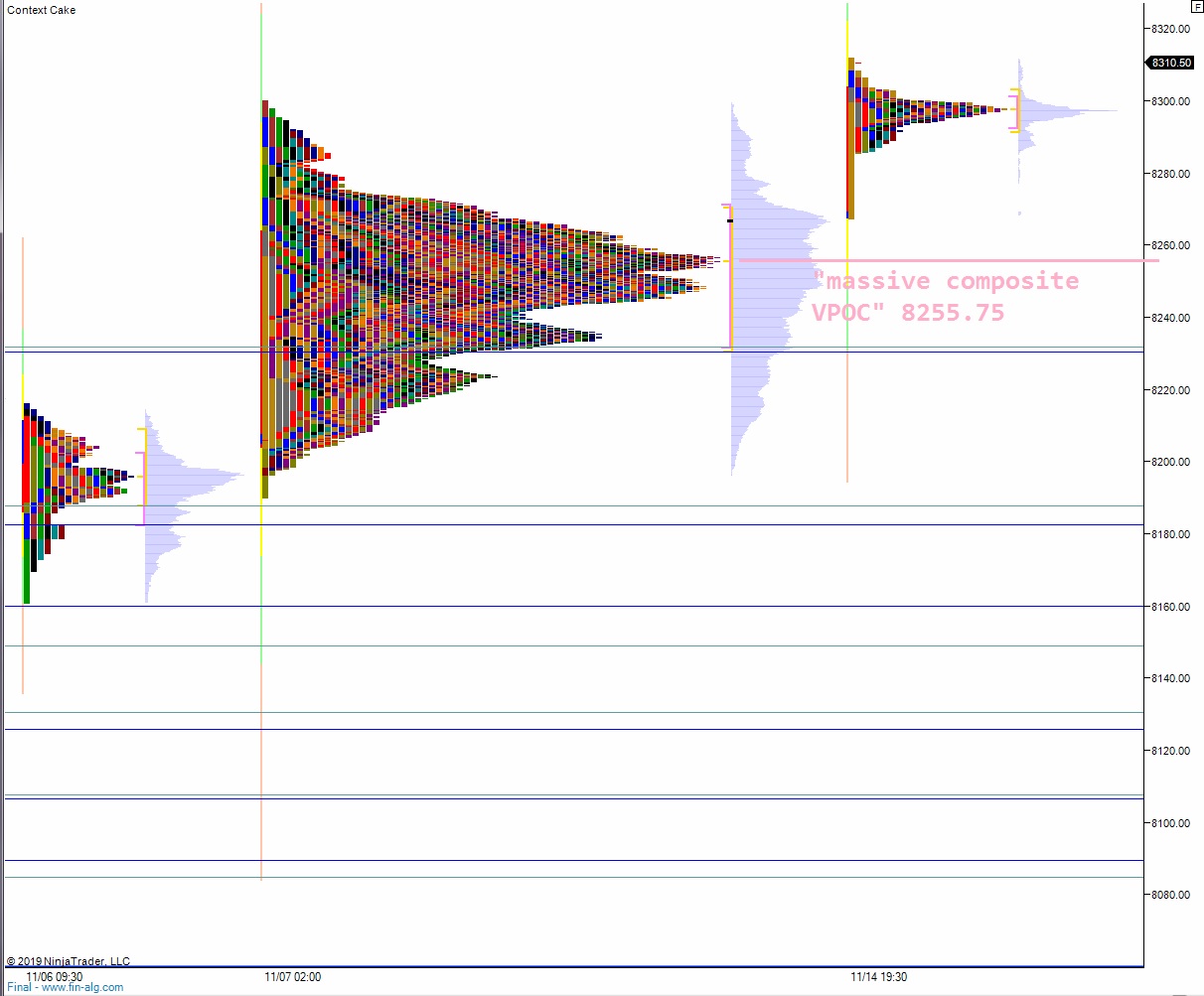

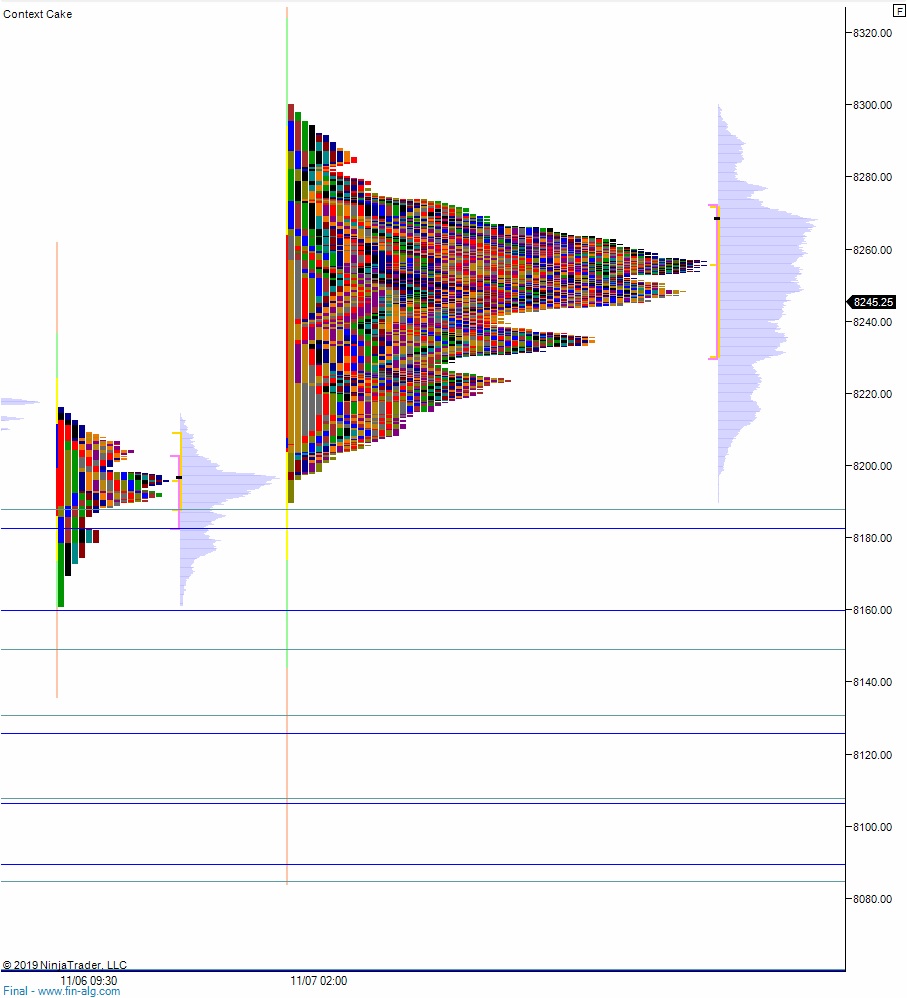

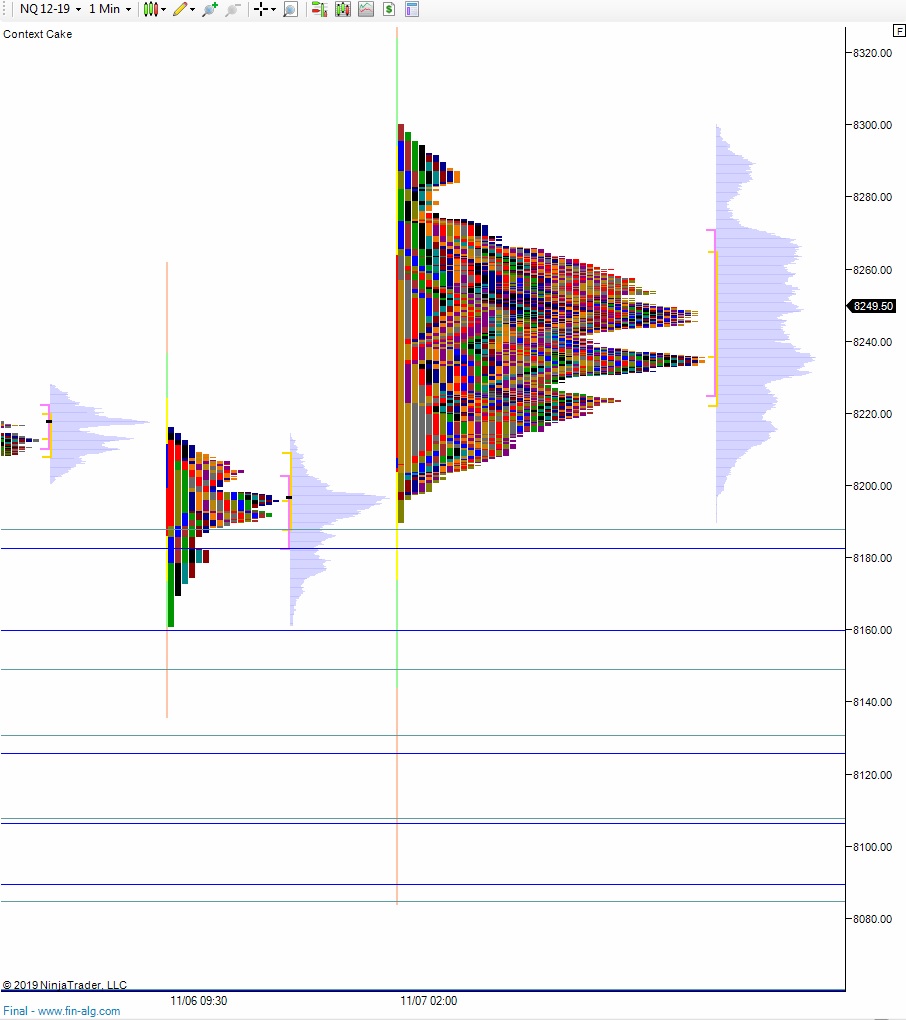

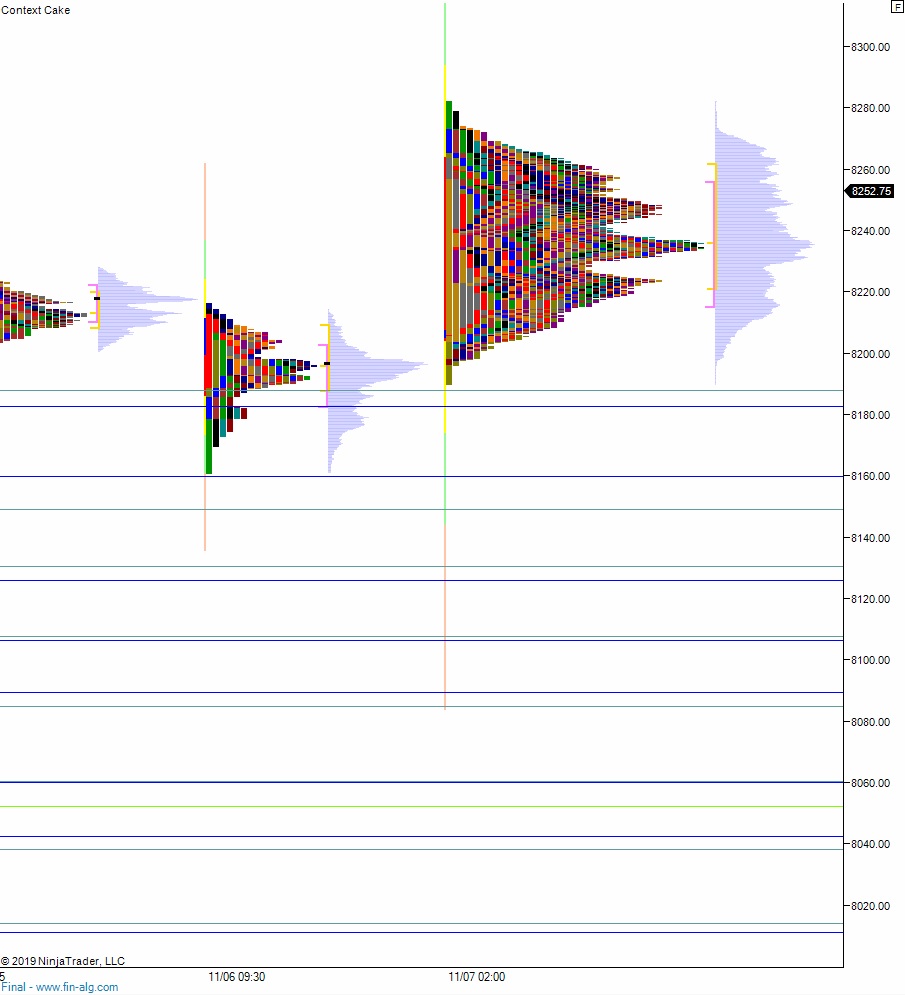

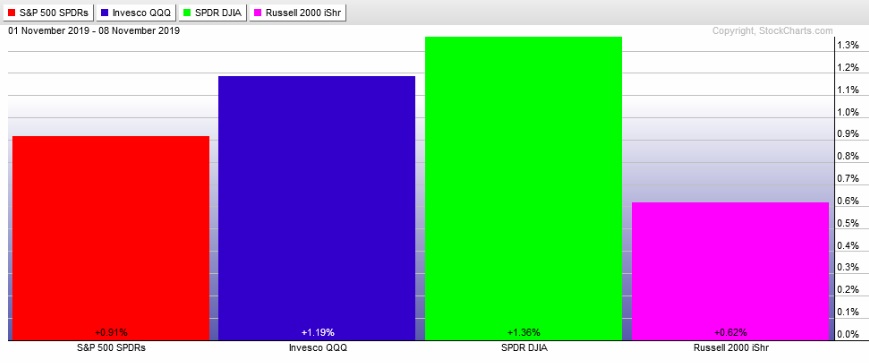

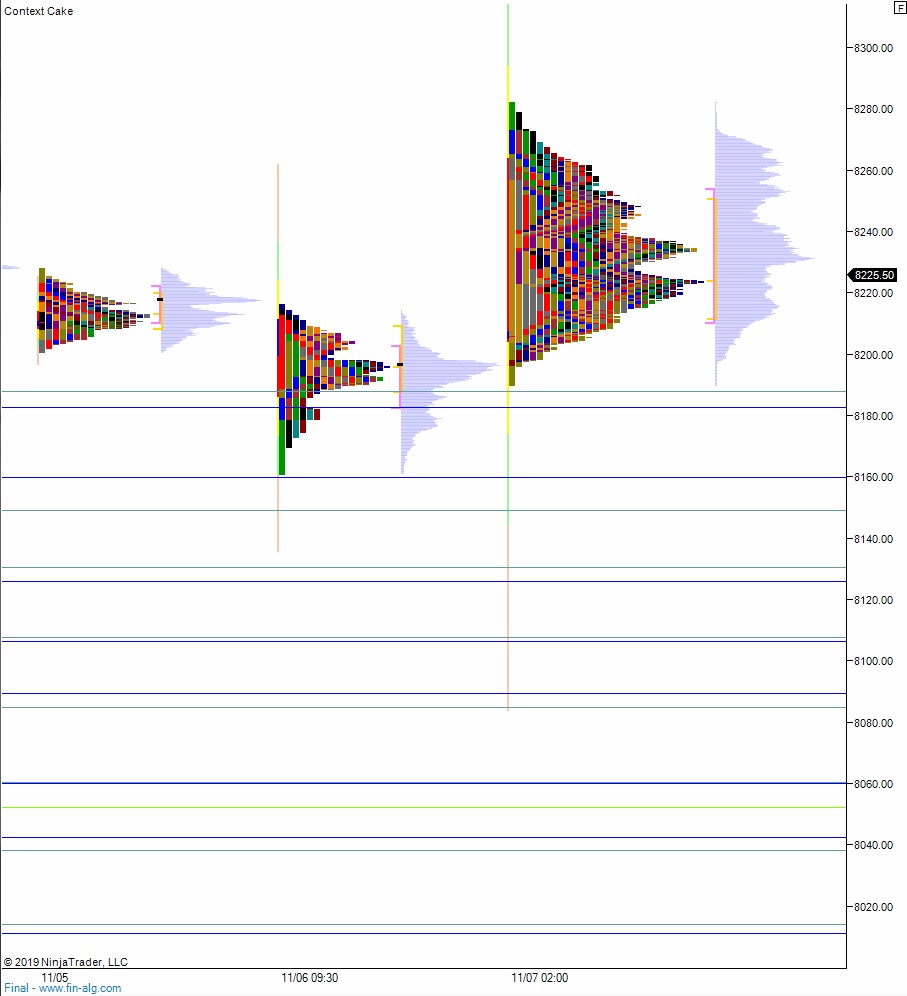

Models are bullish. They are registering their highest readings ever. My play is to only work the long side of the tape, intra-day on the NASDAQ futures. If we come into a day with a gap down inside range, you best believe I am taking a position pre-market and then continuing to accumulate into any early selling, with the goal of working the gap fill.

If we cross up through the daily mid, and there is still an overnight stat or range extension stat, I will be working that cross targeting either of those stats.

If we trade down into one of the market profile levels highlighted during my morning reports, I will be fading that move back higher.

Those are may three main moves. I’ve made my career on those trades. I’ve practiced those same three kicks, live, over two thousand times. Once I have done them 10,000 times, perhaps I will be approaching some sort of real mastery. Until then I remain a student.

Bullish until noted otherwise.

Raul Santos, November 17th 2019

Exodus members, the 261st edition of Strategy Session is live, go check it out.

Comments »