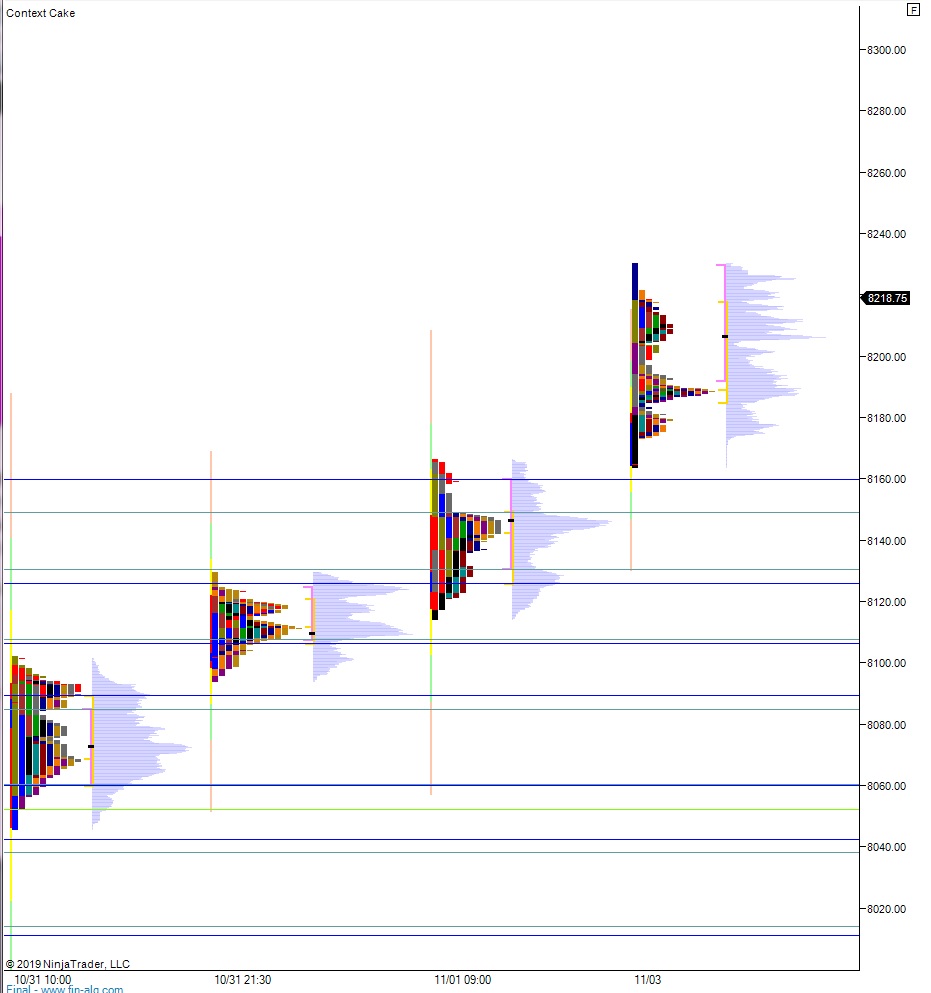

NASDAQ futures are coming into Monday pro-gap up after an overnight session featuring extreme range on elevated volume. Price drove higher overnight, discovering higher record prices throughout the globex session. As we approach cash open, price is hovering above 8200 up at record high prices.

On the economic calendar today we have durable/factory goods orders at 11 am followed by 13- and 26-week T-bill auctions at 12:30pm.

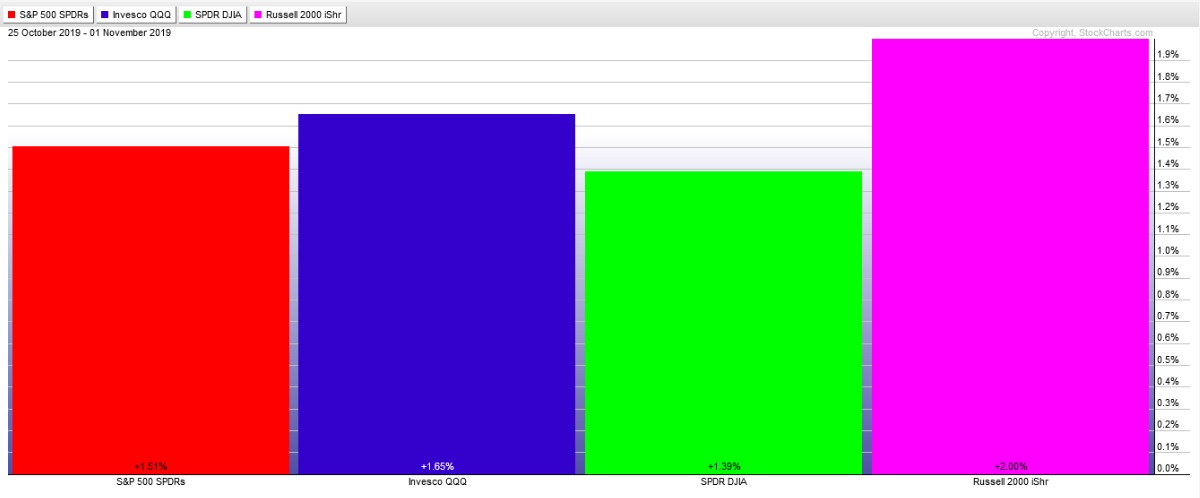

Last week also kicked off with a gap up Monday. Then Monday featured a slow grind higher all session until settlement, when price spiked lower and erased most of the intra-day gains. Tuesday saw sellers continuing to pressure the tape, eventually climaxing with a sharp move lower Wednesday morning. This formed an excess low, closed the Monday gap and served as the low-of-week going forward. After making time for several hours Wednesday the Fed cut interest rates by 25 basis point as was expected, this introduced buying into the market. Thursday was choppy before Friday saw price work to new highs. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap up and drive higher. Sellers stepped in before the market could establish an early range extension up and sellers pressed RE down. They were unable however to reclaim the Thursday range. Instead buyers stepped in and worked price back up through the daily midpoint. Then, late in the session buyers worked us to a new high-of-day (neutral) and closed out the session on the highs (neutral extreme).

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to close the gap at 8159.25 and take overnight low out by a few ticks 8158.50 before two way trade ensues.

Hypo 2 buyers gap-and-go higher trading up to 8246.75 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 8246.75 setting up a continued discovery of open air above. Look for resistance at 8250 and 8300.

Levels:

Volume profiles, gaps, and measured moves: