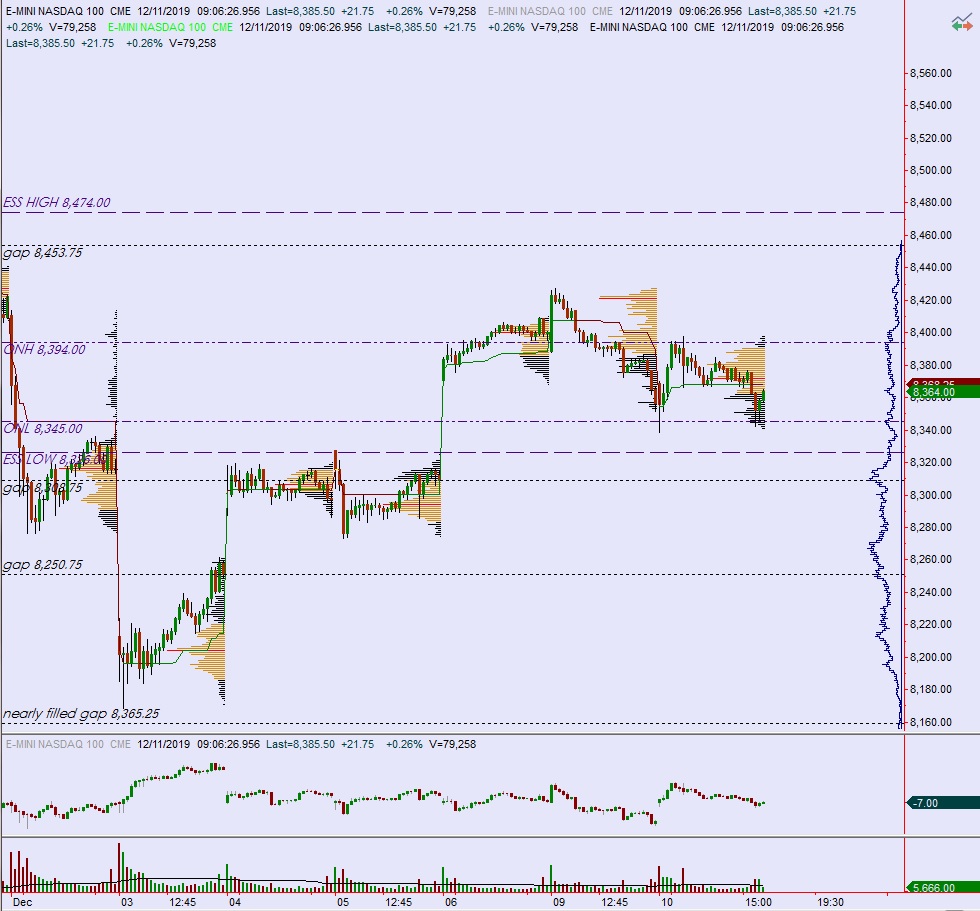

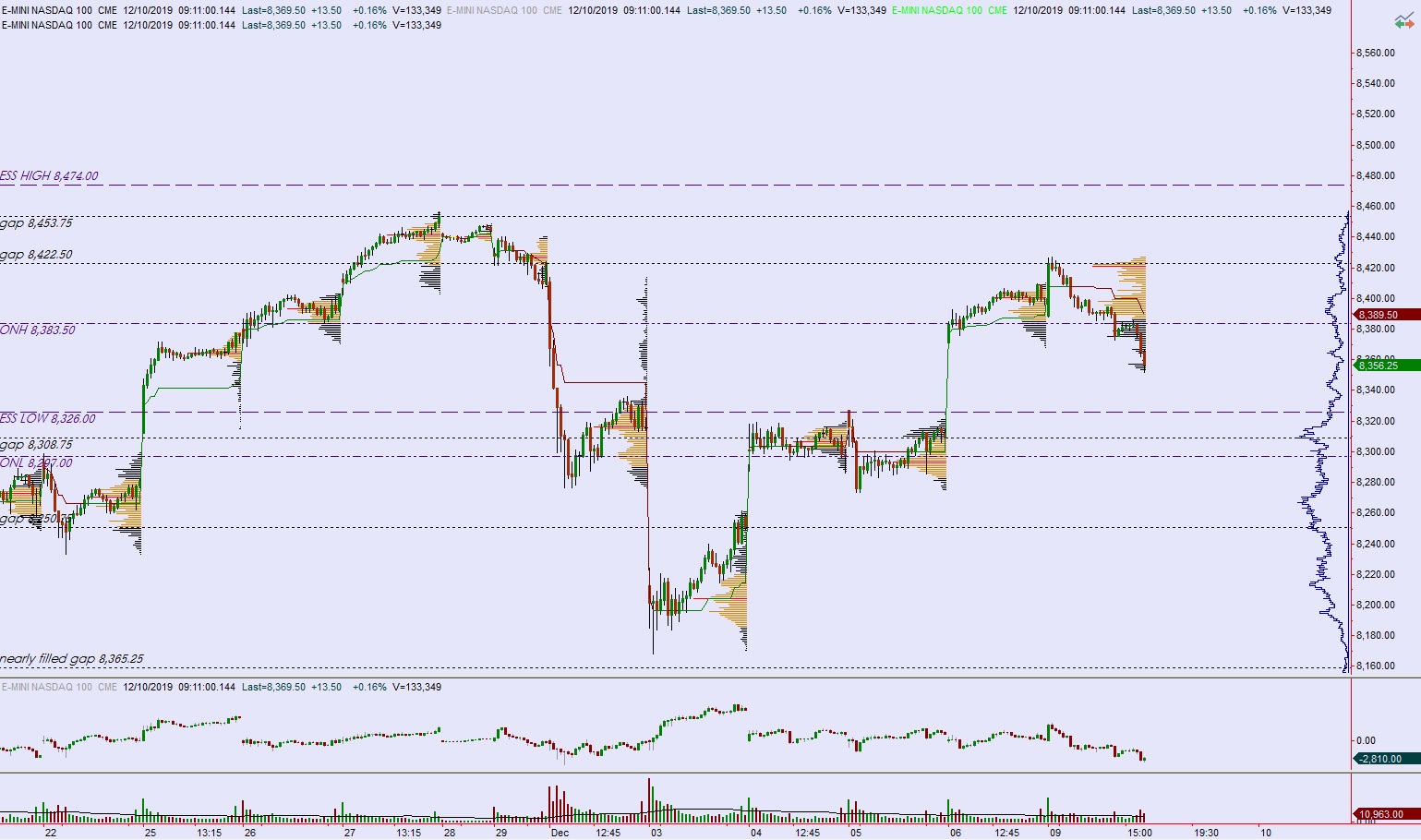

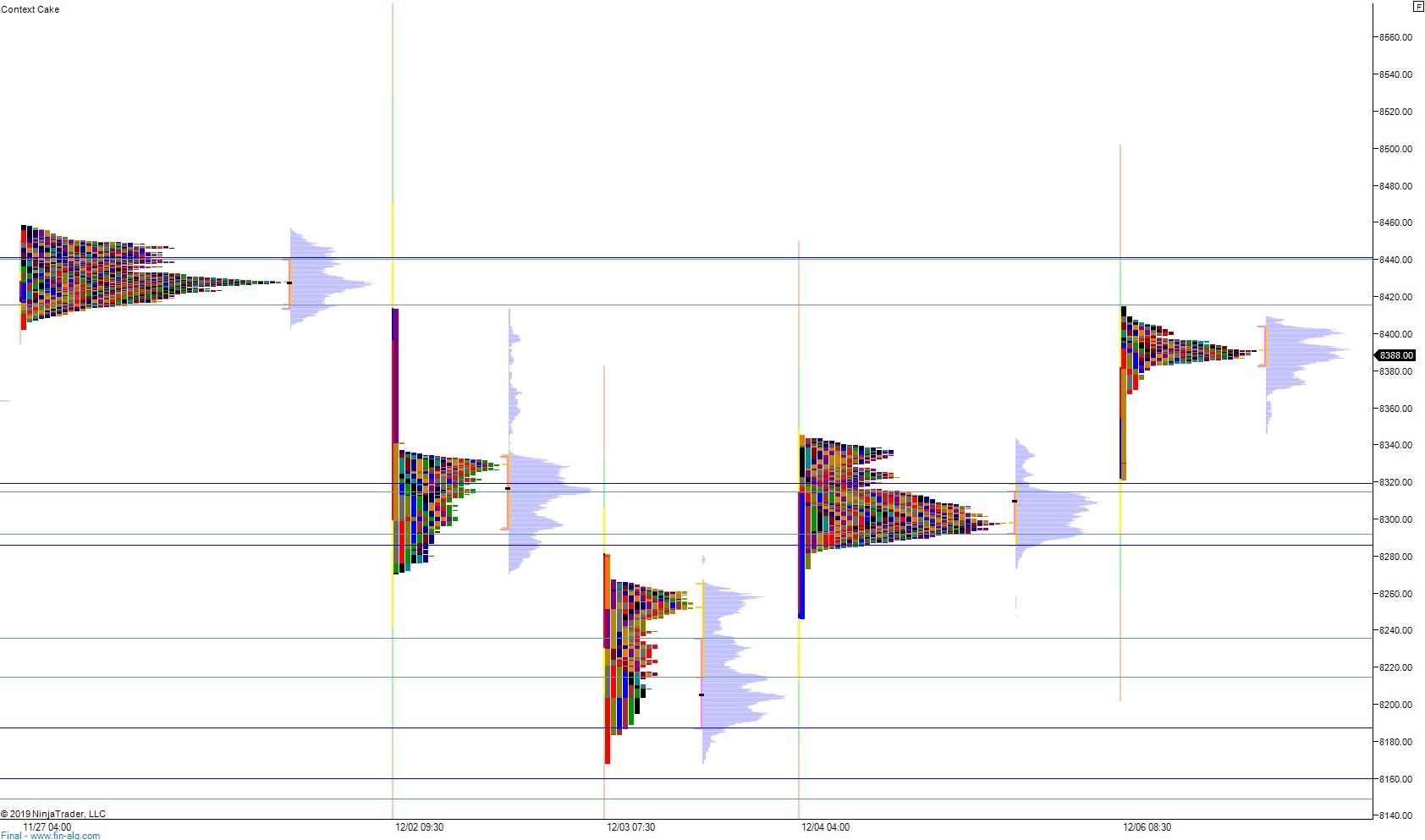

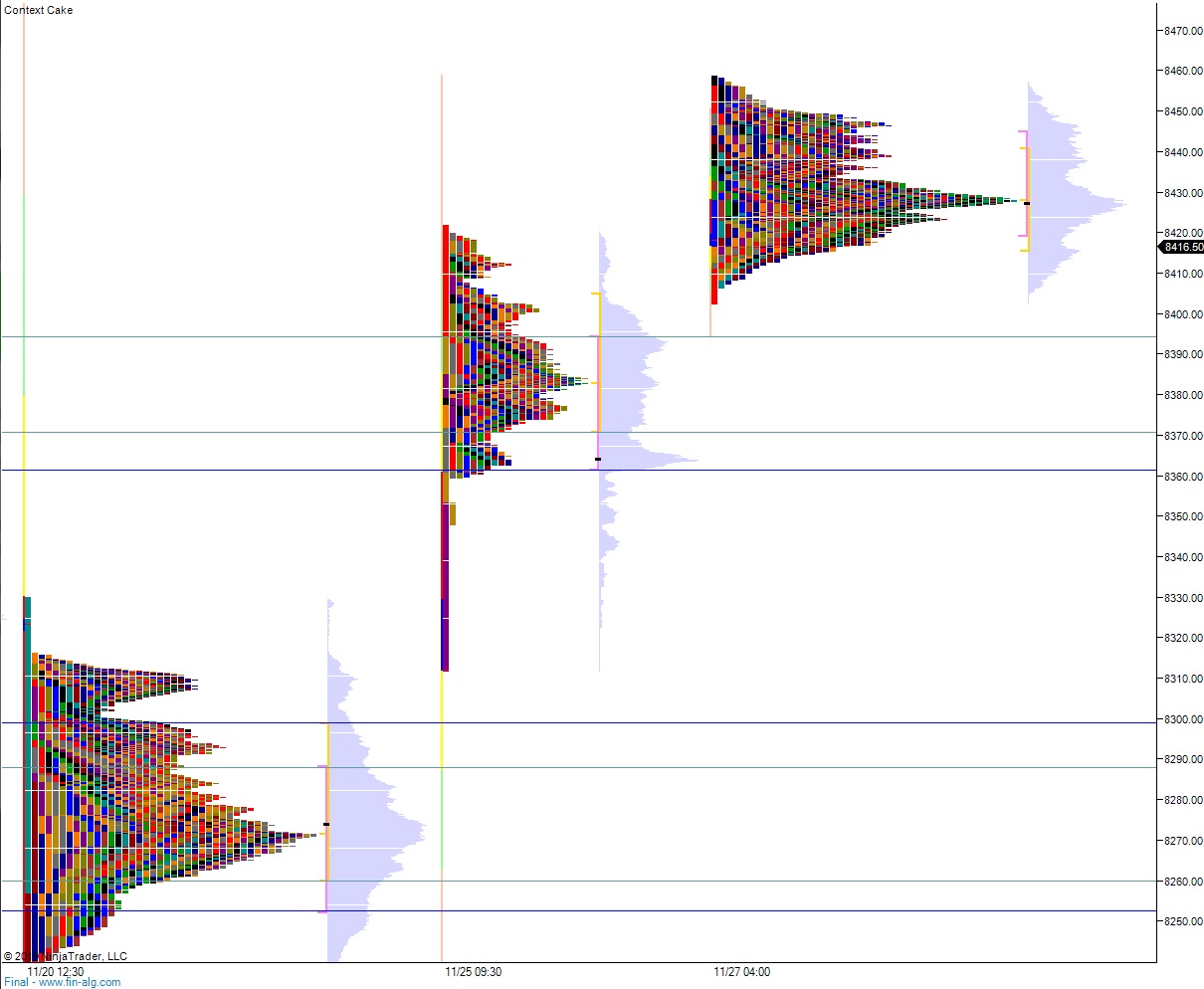

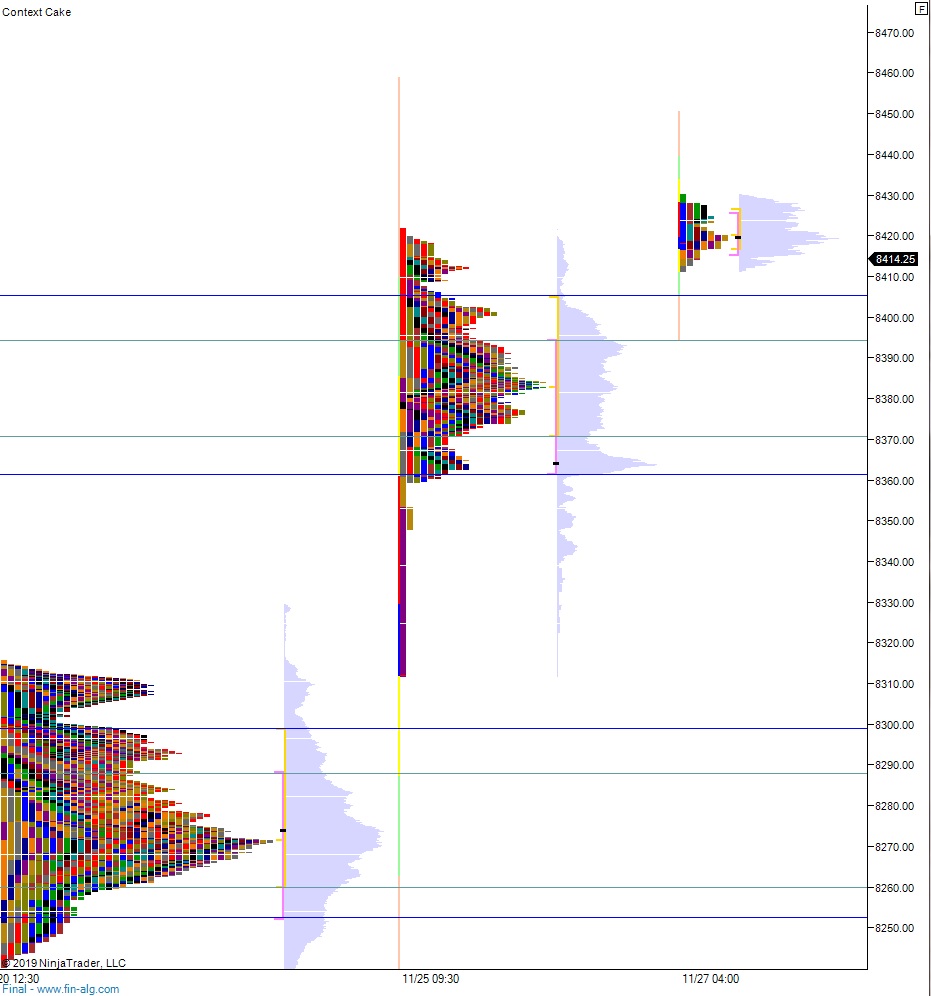

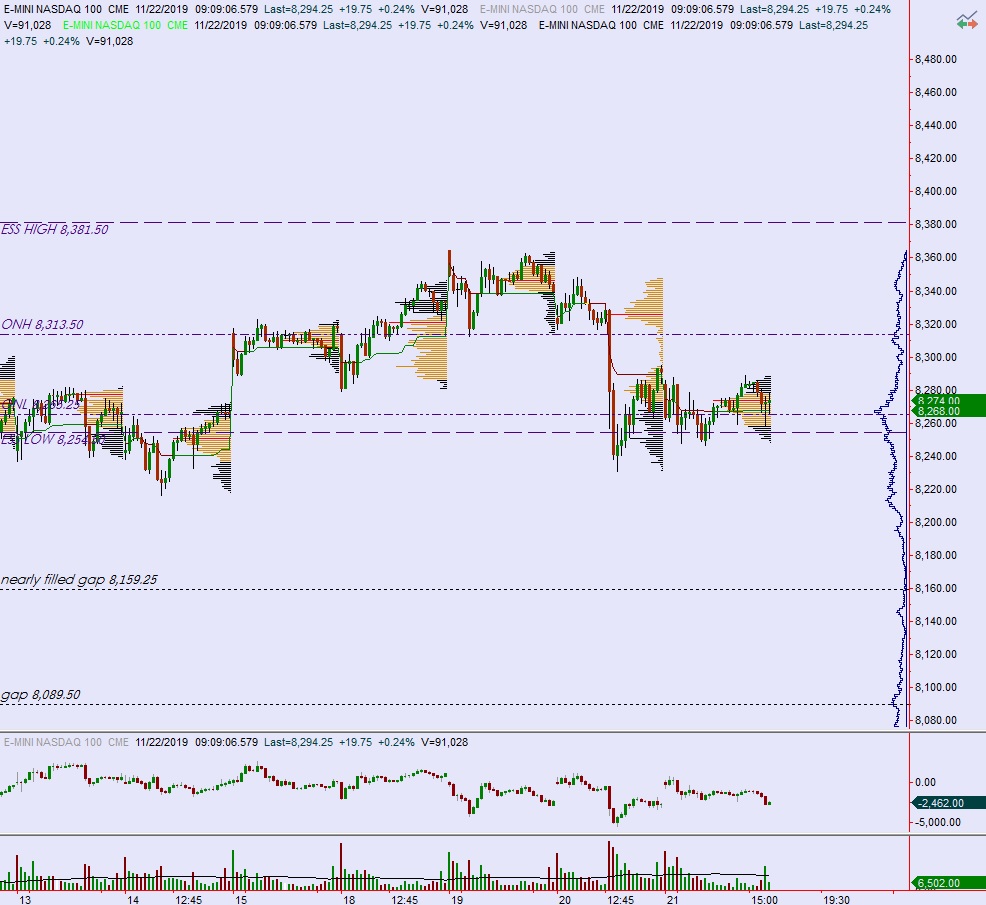

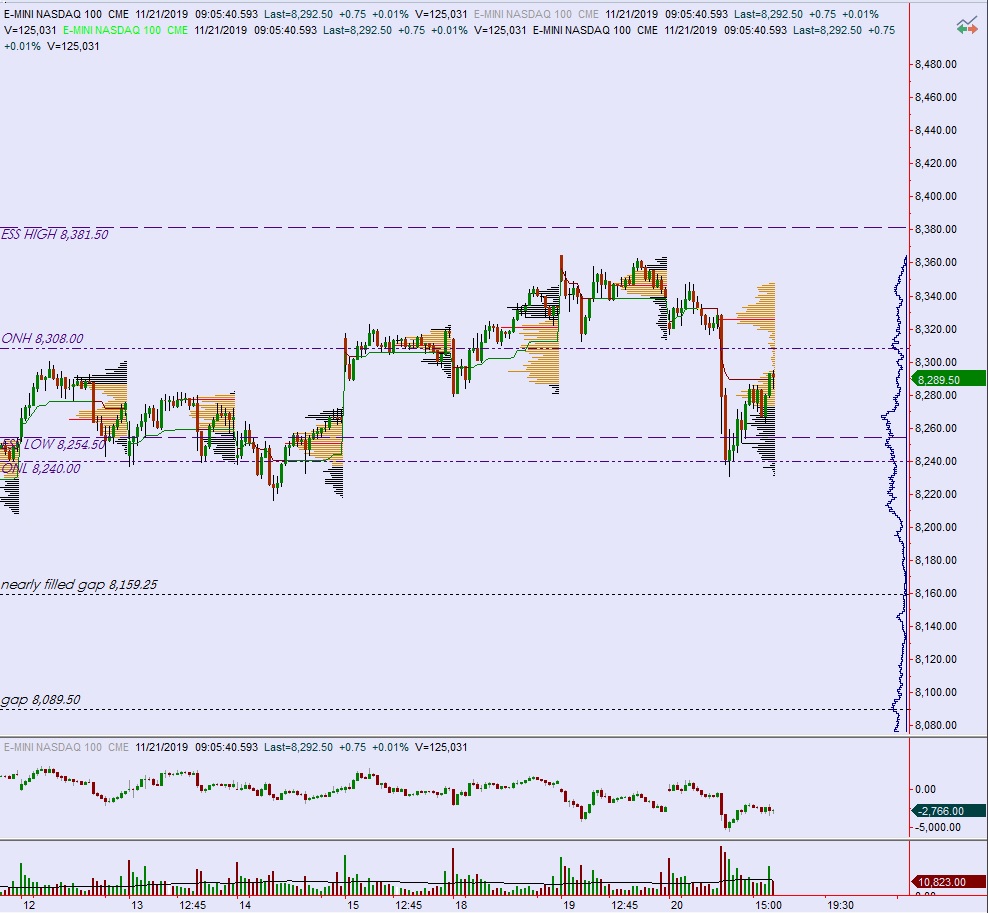

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated range on extreme volume. Price worked sideways-to-higher overnight, balancing along Tuesday’s midpoint for much of the globex session. As we approach cash open, price is hovering in the upper quadrant of Tuesday’s range.

On the economic calendar today we have an FOMC meeting announcement at 2pm followed by a Fed Chair press conference at 2:30pm.

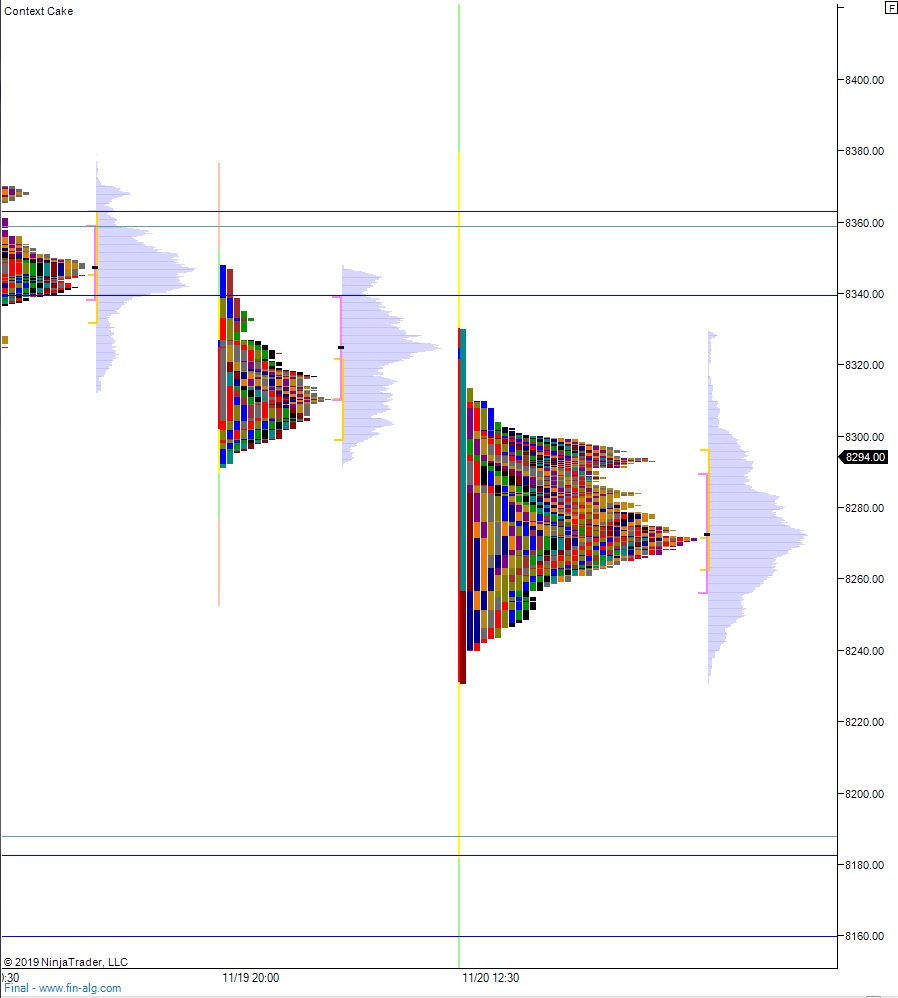

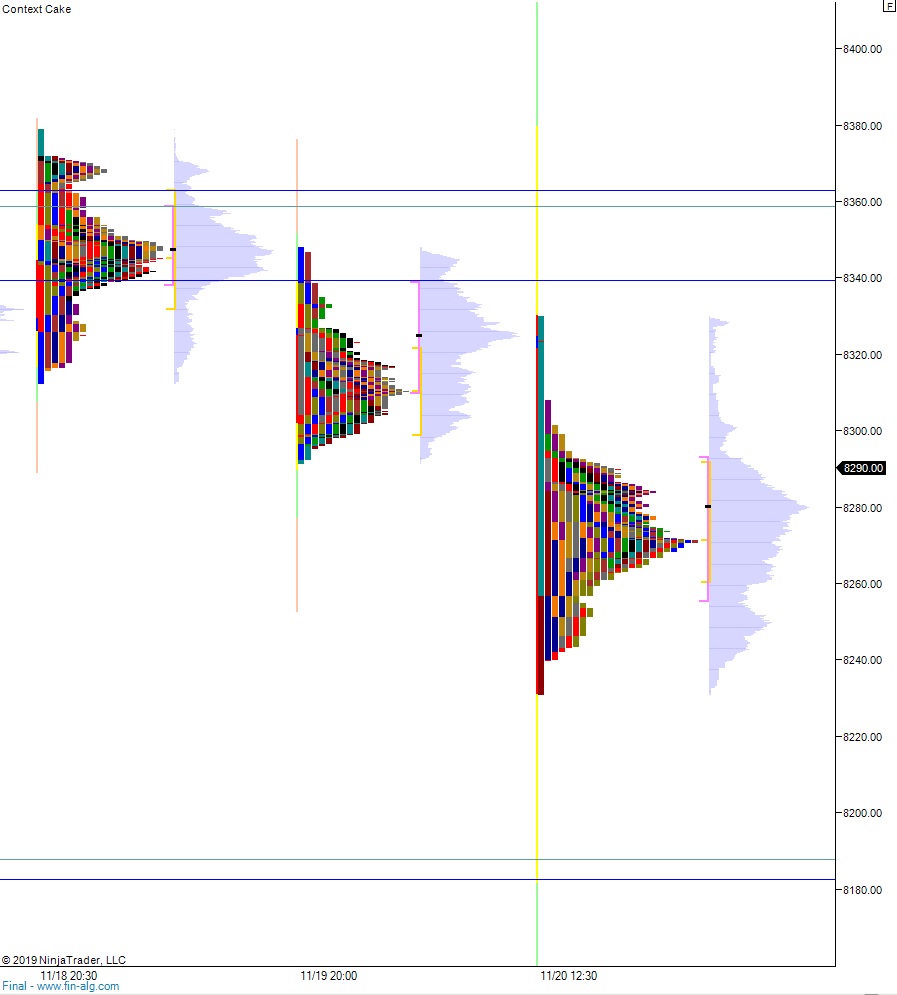

Yesterday we printed a normal variation up. The day began with a gap up that sellers quickly resolved after the open. Said sellers were met with strong responsive buying ahead of the open gap left behind last Friday morning. Buyers then worked price to range extension up, traveling up to the Monday midpoint before settling into a chop along the upper side of the daily midpoint. Late in the session sellers asserted themselves and returned price back down near the lows.

Heading into today my primary expectation is for buyers to drive higher off the open, taking out overnight high 8394 and tagging 8404 before two way trade ensues. Then look for the third move after the FOMC announcement to dictate direction into the close.

Hypo 2 stronger buyers trade up to Monday naked VPOC 8420 before two way chop ensues. Then look for the third move after the FOMC announcement to dictate direction into the close.

Hypo 3 sellers work into the overnight inventory and close the gap down to 8364. From here they continue lower, down to 8334.75 before chop ensues. Then look for the third move after the FOMC announcement to dictate direction into the close.

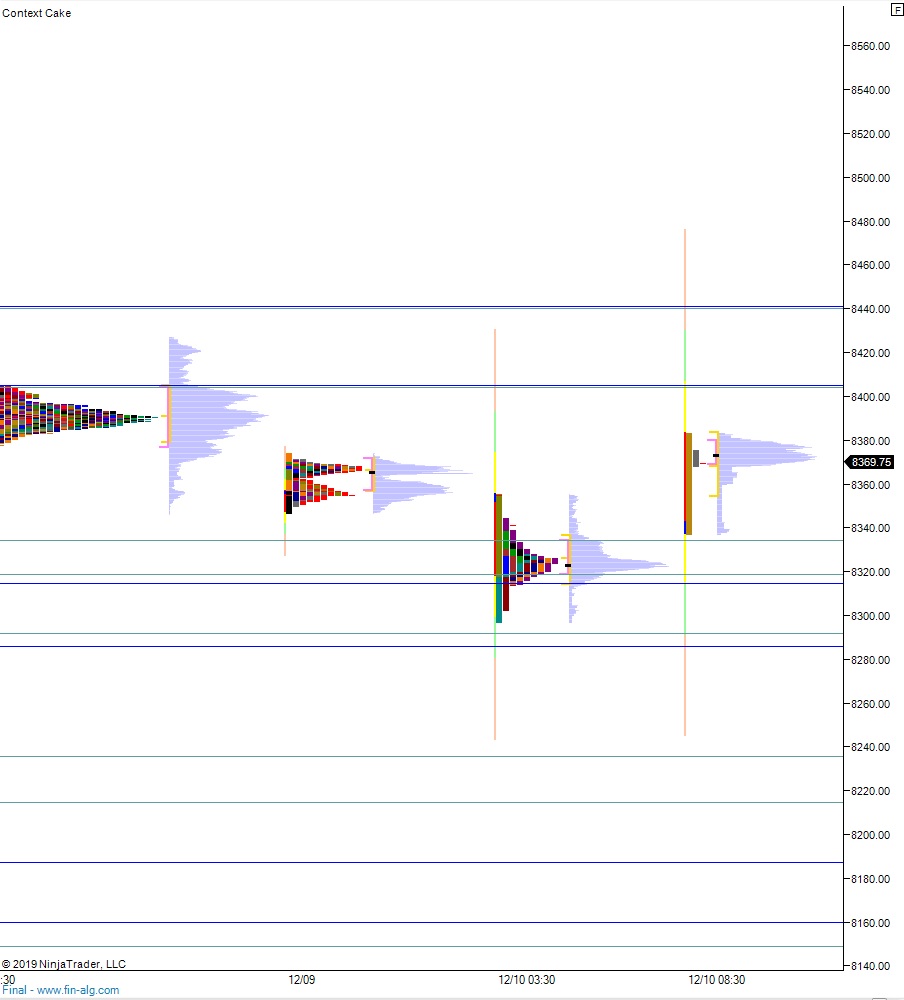

Volume profiles, gaps, and measured moves: