NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring normal range and volume. Price was balanced overnight after briefly probing below the Tuesday low. As we approach cash open, price is hovering about 10 points below Tuesday’s midpoint.

On the economic calendar today we have crude oil inventories at 10:30am followed by an FOMC rate decision at 2pm and a Jay Powell press conference at 2:30pm.

After the bell we’ll hear earnings from two major NASDAQ components/movers, Apple and Facebook.

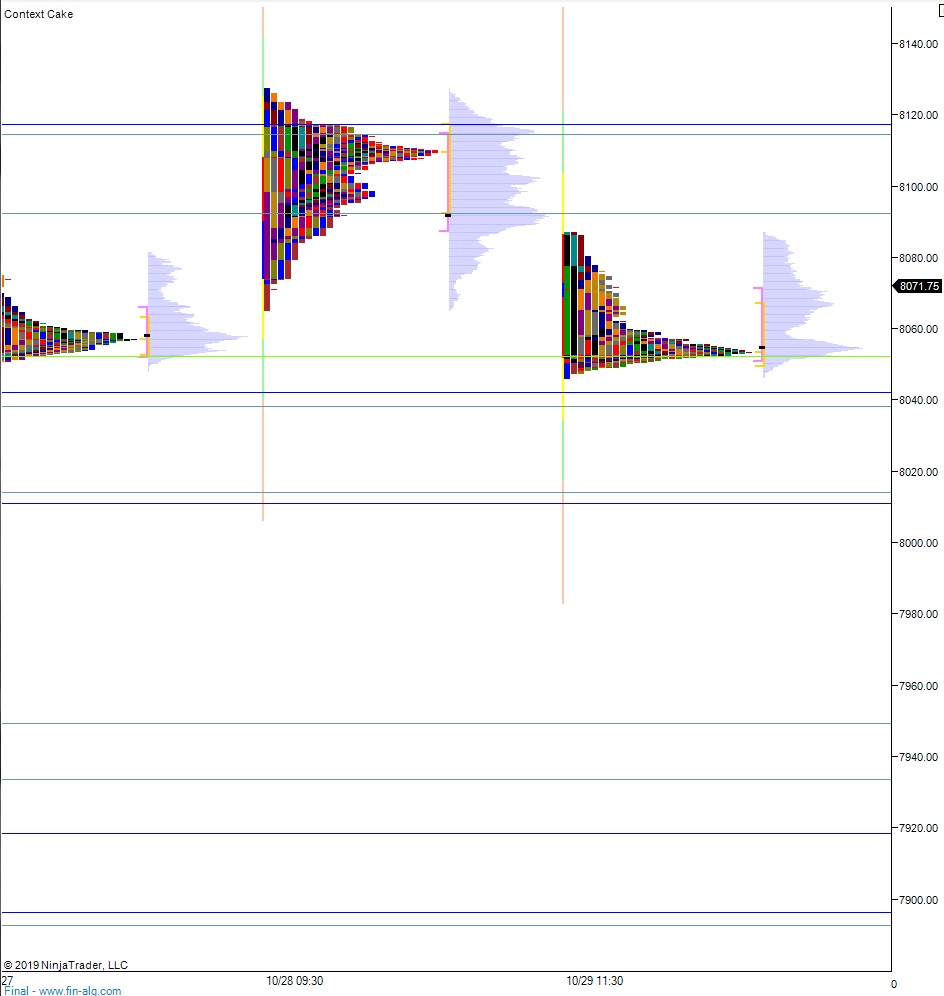

Yesterday we printed a normal variation down. The day began with a slight gap up. After a two way auction sellers stepped inand worked price down through the Monday low and into the gap zone left behind over the weekend. Sellers were not, however, able to close the weekend gap. Instead buyers stepped in and drove price back to the mid point. Sellers defended the midpoint and we ended the day near session low.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 8075.25 to set up a run to 8092.25. Then look for third reaction after the rate cut to dictate direction into the second half of the day. Then be aware of the likely volatility during settlement at as key earnings are released.

Hypo 2 sellers press into the overnight inventory and close the gap down to 8082.50 then continue lower, down through overnight low 8046.25 setting up a weekend gap fill down to 8034.75. Then look for third reaction after the rate cut to dictate direction into the second half of the day. Then be aware of the likely volatility during settlement at as key earnings are released.

Hypo 3 stronger sellers trade down to 8014. Then look for third reaction after the rate cut to dictate direction into the second half of the day. Then be aware of the likely volatility during settlement at as key earnings are released.

Levels:

Volume profiles, gaps, and measured moves: