Wanted to drop a quick blog tonight. I have not been doing much night blogging. Lately I read at night, sometimes consuming a hundred pages of fiction at a time. It keeps me off Twitter, but I wanted to drop a quick blog and share some observations I’ve made over these last few days while also touching upon some of my favorite ways to pass the time during a drawdown.

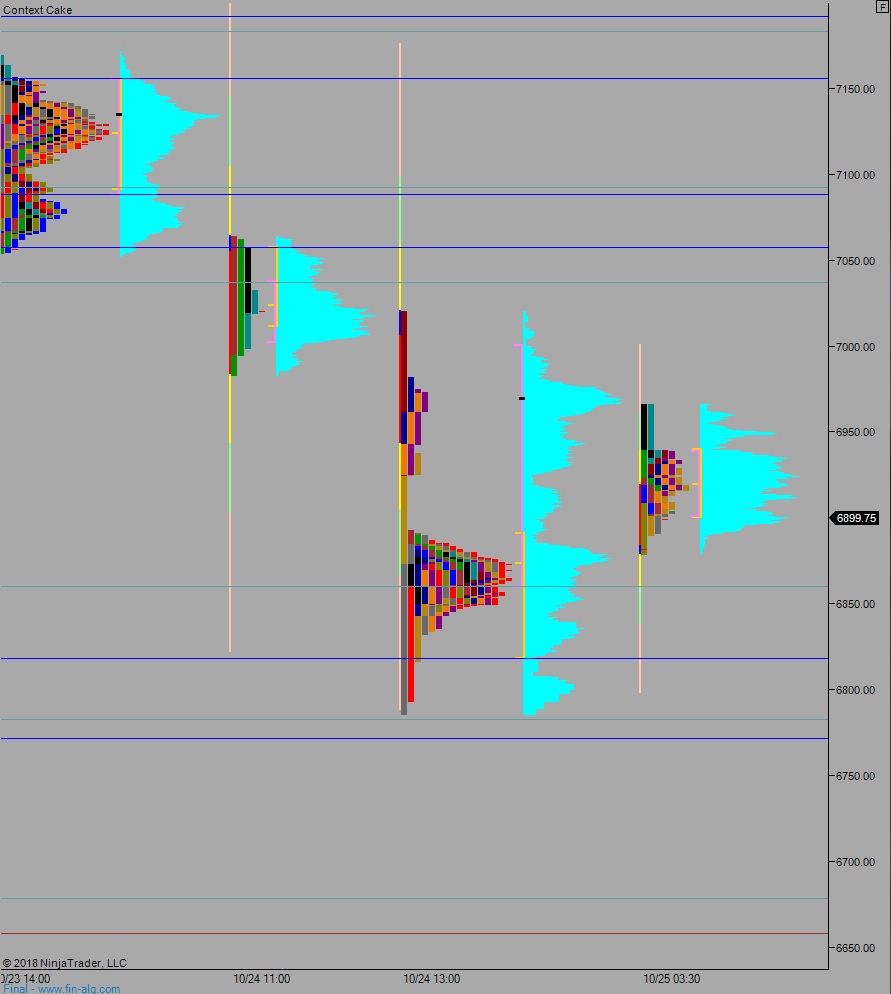

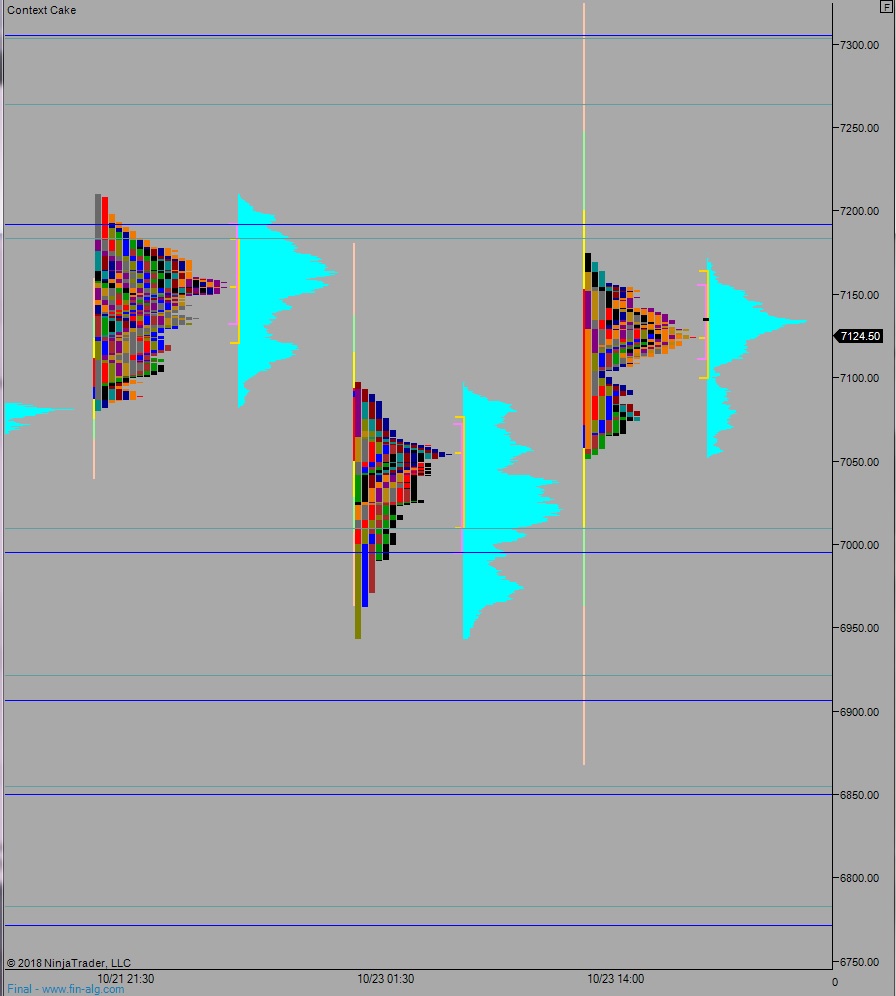

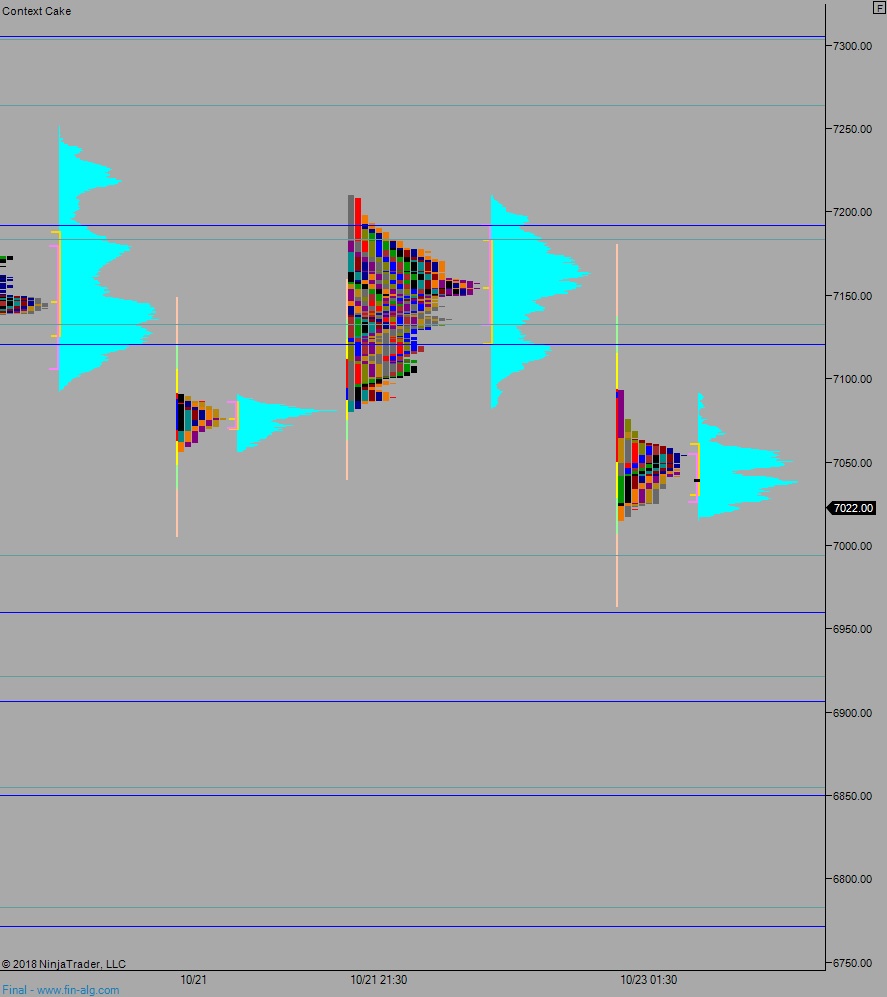

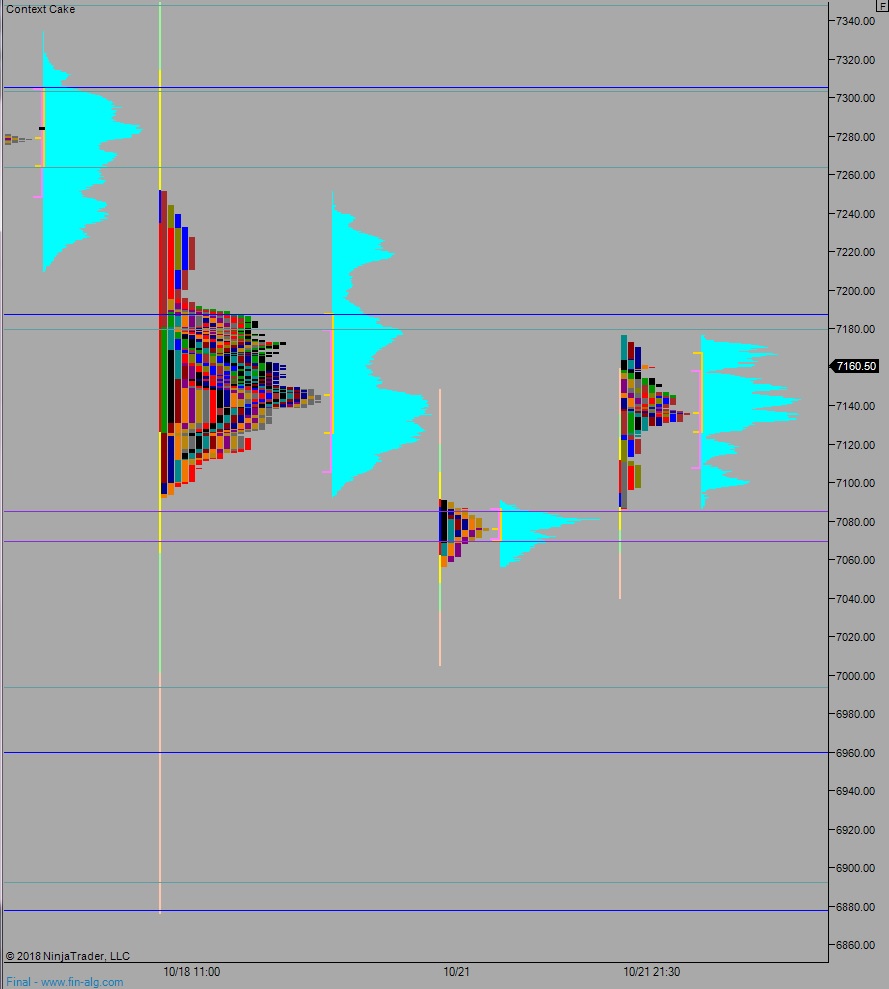

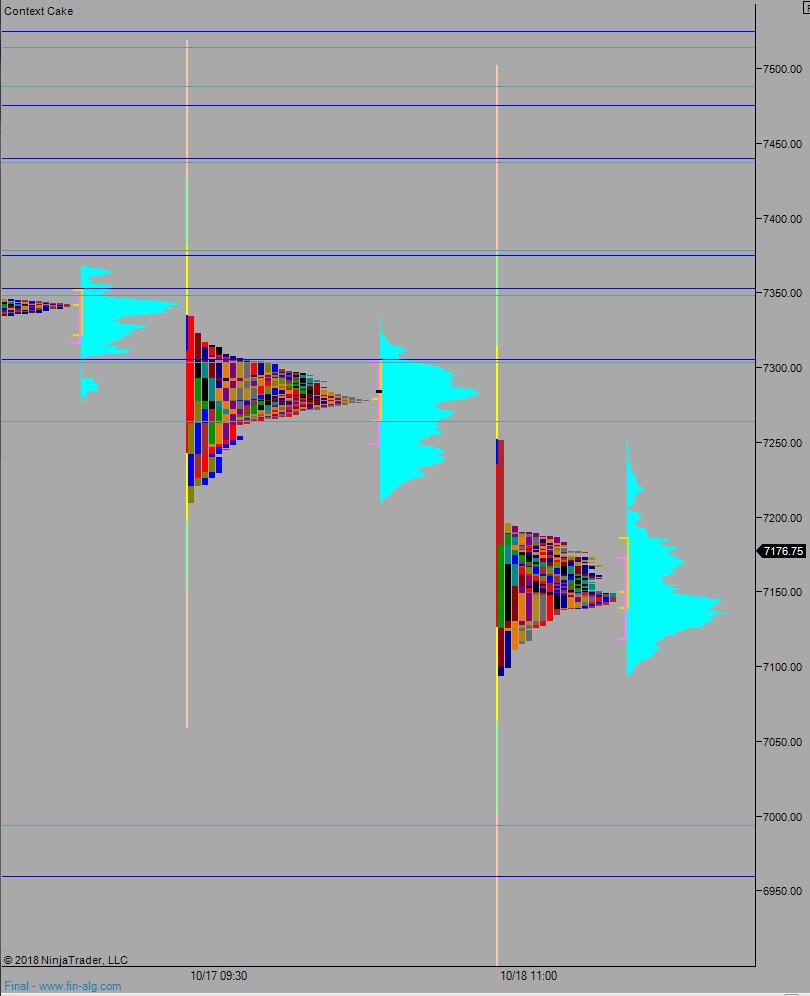

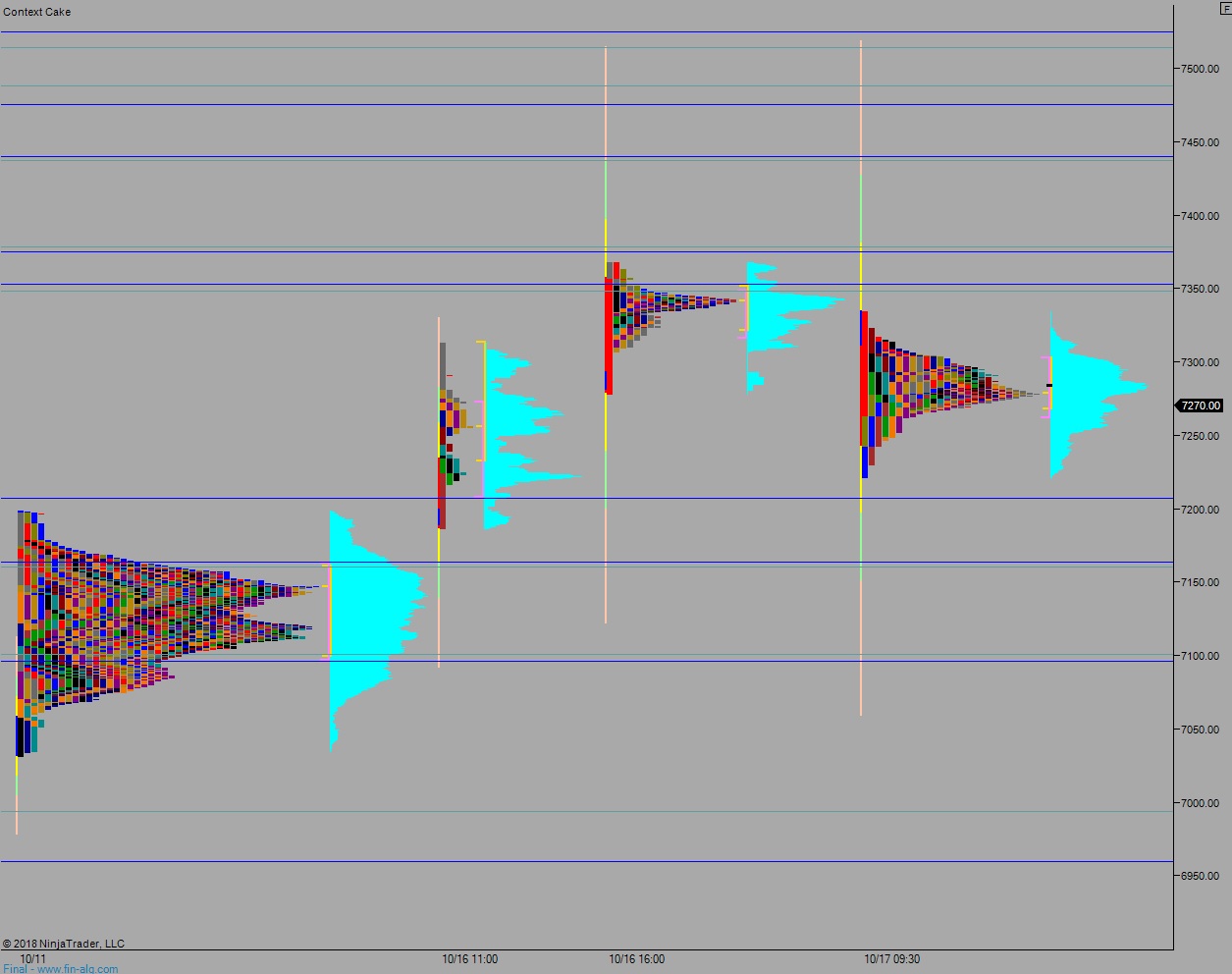

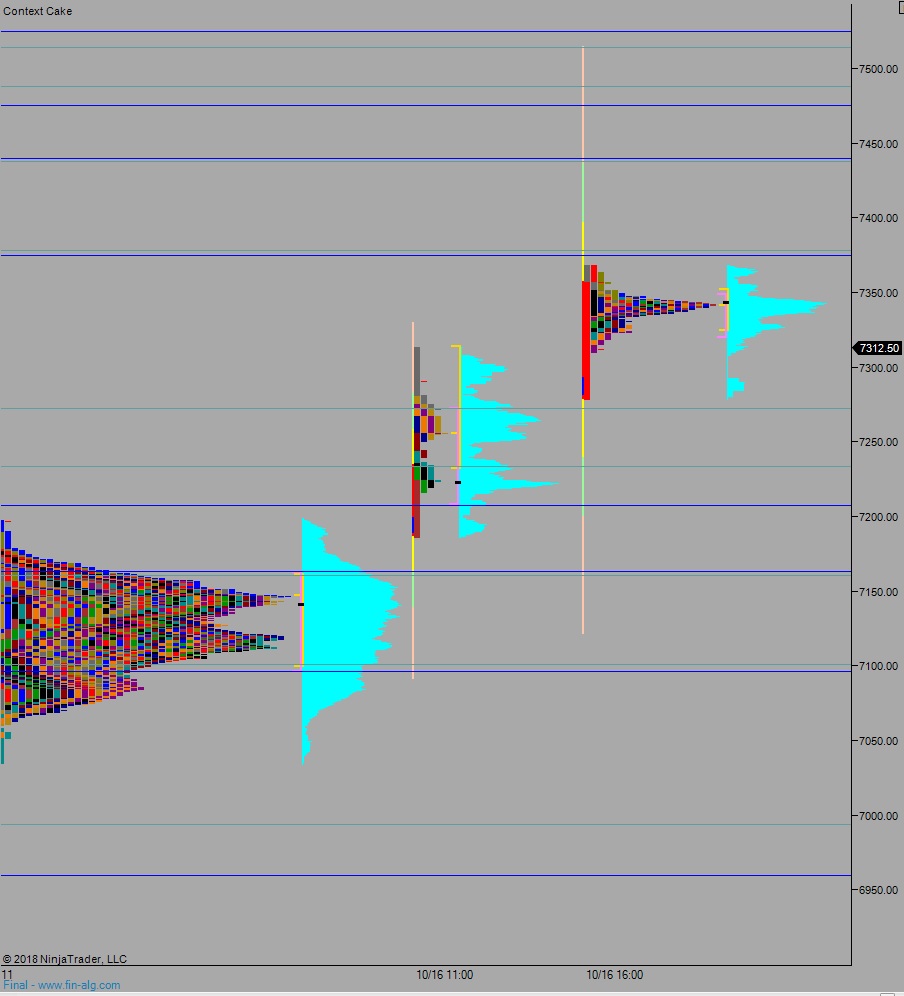

It has been tough being bullish since October 4th, especially since we nailed the turn lower one week prior. When I was on the right side of the action, betting short intra-day and carrying an SQQQ position trade, my visibility was much better than it is today. I have written extensively about failed auctions in the past, and we certainly are operating in failed auction condition on the NASDAQ futures. These false breakouts have lead to months of chop in the recent past, but the recent past has also seen them negated by a strong uptrend. Nevertheless, we again have failed auction conditions and that is good reason to be cautious:

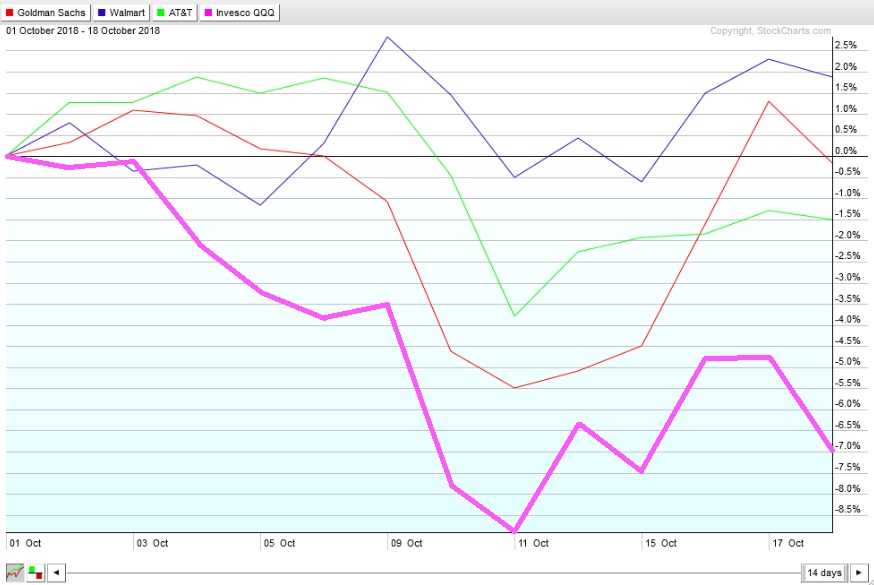

The Exodus hybrid oversold signal that triggered at close-of-business Thursday, October 4th is complete after ticking out 10 trading days. This signal is what turned me bullish right after being short biased during the first week of Q4. Here is the final performance of each major index over the course of the cycle, as represented by their most popular ETFs:

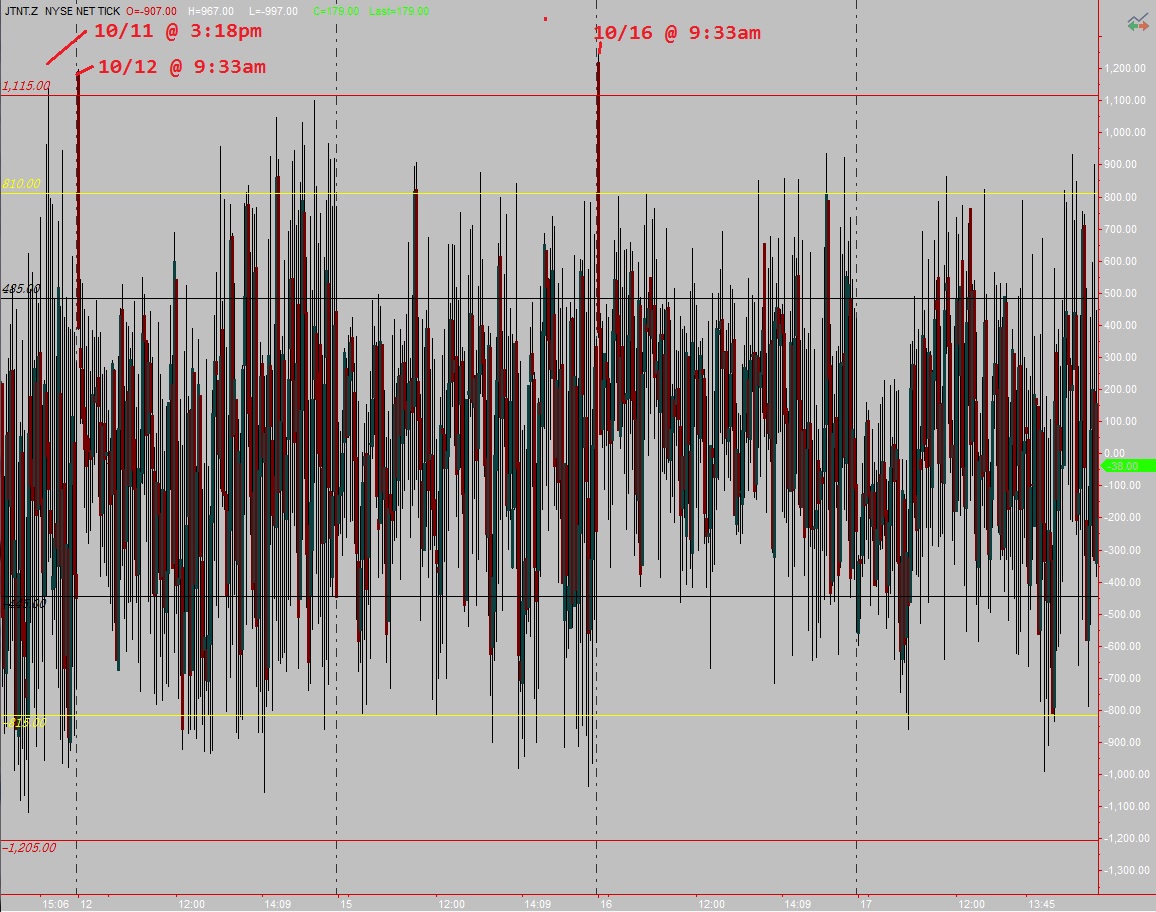

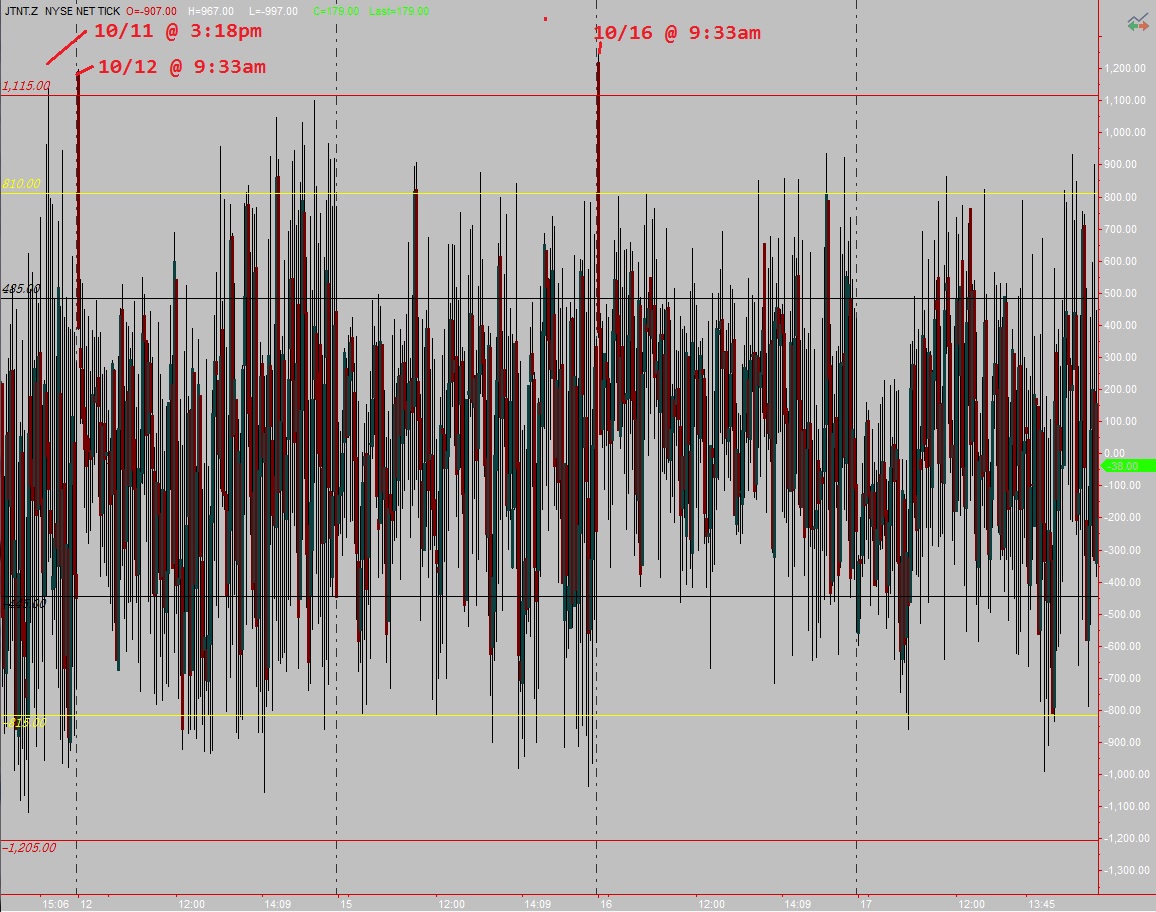

Party poopers. These are third sigma NYSE TICKS. I wrote about these many moons ago. Here is a link for more background. We had a series of third sigma positive NYSE TICKs these last few days. Those are bullish day of, bearish afterwards. They have had me super cautious:

Having a long bias has taken its toll on me these last few weeks. I just wanted to write an honest blog and admit that this has been a hard tape for me too. Trading is quite simple but it certainly is not easy. When I go into a drawdown I rely on some of the hardest learned lessons of trading. The ones no mentor can truly prepare you for. The battle for your mind, for your confidence. When I am going through a rough patch, it is my hard set risk parameters that keep me from blowing up. I am grateful to have established daily loss limits and weekly loss limits well in advance of being on the wrong side of the tape.

Losses are part of the game. It is important that you have routines to keep you from becoming trapped in a rut. I tend to back away from the markets and focus on other important matters. One of my favorites is cleaning. But not just normal cleaning. Deep dive cleans of furniture or appliances or part of the yard. I also kicked off my snowboarding ‘prehab’ program last week, which seeks to diagnose and correct major muscle imbalances in my body. This can significantly reduce the risk of injury when I am hurling myself down the sides of America’s steepest mountains later this year.

What else…I made a bone marrow soup today. What a primal experience. I rarely eat animal flesh. But humans were bone eaters for a very long time. Back when we were relegated to our proper place in the food chain, somewhere in the middle, we often ate what was left of an animal carcass after the apex preditors had their fill. That often meant eating bones and marrow. I think it is a fantastic idea to have these types of inputs. My very elementary belief is that by consuming the connective tissue around the bones, I will thus strengthen my own connective tissue, further preparing my body to be launched off of tree covered side hips high up in the air.

Anyhow, stay safe out there. Remember, the stock market was here long before us and will be here long after we are gone. There is no shame in stepping back to reboot the mind before stepping back into what I truly believe to be the most competitive arena in the world. High finance, baby.

Keep it simple, keep it tight.

Comments »