Just finished my Sunday research, and the Strategy Session I just logged behind the paywall of Exodus is a banger. And since I have little incentive to privatize the information I create, and since many readers of the old humble Raul blog have a hard time grasping how to even use actionable information, I am going to share a few key tidbits from the report to public forum.

First the Executive Summary. When you open up Strategy Session this is the first thing you will see, Section I. I use roman numerals to give the report a serious tone, because believe me, it is. The Executive Summary is everything I analyze and compute concentrated down into as few words as possible. It is designed to give women of industry a quick snapshot of what to expect on the week. Here is this Sunday’s entry:

I. Executive Summary

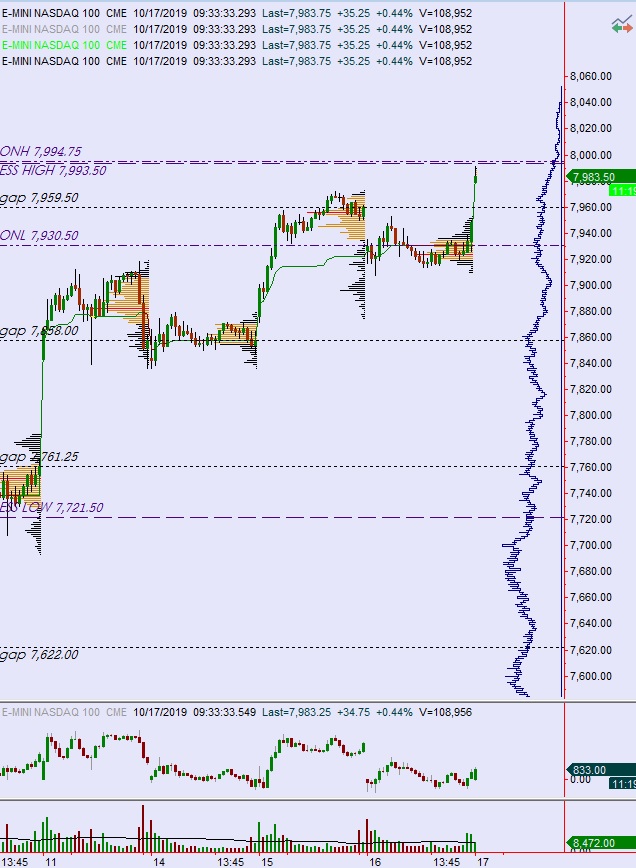

Rauls bias score 3.10, neutral. Equity prices continue to work higher, accelerating to the upside after Wednesday, with earnings out of Microsoft and Tesla (Wednesday AMC) serving as the catalyst, and then Amazon earnings (Thursday AMC) acting as the accelerant.

I don’t think most people understand what drives stock market behavior. Their first mistake is watching the news. Like literally, most people sit down and stare at a box that shows moving pictures and they expect to gain insight into why things happen. Really disturbing when you think about it. I hooked the antenna on the roof of Mothership to my 70 inch Samsung before the weekend because I had a large gathering and wanted my guests to have access to sporting events. I am inclusive host, and while I would rather slide my eyeballs along a sheet of ice than watch american college football, I knew there were going to be some adult males at my party and I wanted them to feel comfortable. There were actually seven different genders at my party and everyone had a blast. I digress. The antenna pulls in 60 digital channels essentially for free. And when the adult males were gathered around the television, I couldn’t help but notice the occasional talking head that would pop on the screen and feed quick news take. All useless bullshit. Fortunately the tevee was muted, and latino music was being played loudly, except for the occasional times when my nephew would interrupt my Google Play playlist to play The Jurassic Park theme song or his favorite hits from Guardians of The Galaxy. Wow I am really digressing. In any event, most people do not know what drives the stock market. I want to bring your attention to Section III of the report, which discusses an algorithmic cycles we are in the middle of and highlights which contextual world happenings we can actually quantify and objectively judge:

III. Exodus ACADEMY

Understanding the Overbought signals historical statistics

As I stated last week, the Exodus Mother algo (36-month) swung from oversold-to-overbought. This is about as bullish as the system can be, but unless you understand the historical statistics, you might be inclined to close out trades early, and historically speaking that is a mistake. When you look at the below data set, it is important you focus on what happens from Day 5 and beyond:

Most of the gains that have happened when this signal fires happen towards the end of the cycle.

Okay now pair that with our current market context—we have protests happening all over the globe, U.S. politics are heating up, including an ongoing attempt to impeach the President. But more importantly, pair our overbought signal with something far more palpable like the upcoming earnings announcements from Microsoft and Tesla (Wednesday AMC) and Amazon (Thursday AMC). These will be real numbers, objective results that the markets will immediately react to. These organizations are more important than any sovereign state or their politicians and protestors, and if these companies are growing their businesses, and the market reacts favorably, that is all that matters to us as speculators.

Removing my biases and said more simply, the earnings due out this week are likely to validate our trading signal.

But when we really step back and think about the big picture, it goes back to the Core Long-Term Bullish Thesis I laid out back in December of 2017 when I was on one. Nothing has changed since then as I continue to be on a proverbial one. In case you are too busy to take a trip back to December 2017, the quick-and-dirty is Moore’s Law of computing power, and the exponential growth curve associated with it, paired with innovations in AI, and then inter-spliced with Darwinian Evolution gives us a clear indication that we are not likely to experience another recession for the rest of my mortal existence, which I estimate to be another oh 80 years-or-so. In case you’re not too good at reading comprehension, this handy video might help you wrap your brain around what I am talking about:

When it comes to semiconductors, we have a very simple way of tracking the progress they are making and whether or not the developing facts on the ground support my thesis. The PHLX Semiconductor index is monitored closely as part of the Strategy Session, and this week’s entry cuts through all the other nonsense you will read about investing, finance, the stock market, stocks, trading, forex, fuck you, crypto, bull shit. Please read this excerpt from Section IV:

IV. THE WEEK AHEAD

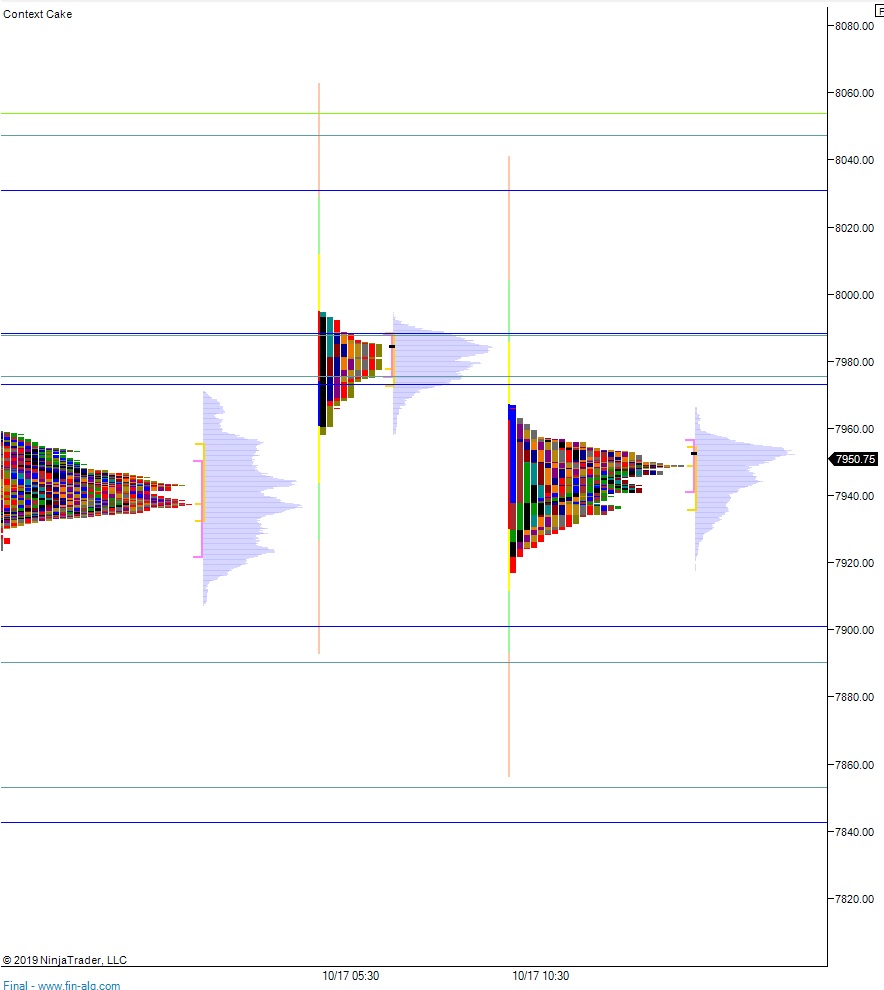

Semiconductors poked to a new high again, now looking like discovery

Semiconductors look like they may be entering another leg of discovery up. Watch for earnings out of Intel (Thursday AMC) to offer clarity on whether this upside can stick. If it does, this key contextual index is likely to lift the entire market.

See below:

The semiconductor index being at this key junction is everything you need to monitor. At least 30 inches of my screens, the lenses with which I view the entire world, will be dedicated to this index. No news needed, thank you.

That is all I wanted to say about the upcoming week and what my research is signalling.

As anyone whose read the old Raul blog over the years knows, Tesla is my largest investment by quite a bit. People often ask me, “Hey Raul, you’re always swooning over Elon Musk’s latest achievements and sucking the dicks of every electric transportation robot rolling off the Tesla factory floor, why don’t you own a Tesla?” I would like to address this now—my purpose during this blip of divine mortal existance is to extract as many Fiat U.S. Federal Reserve notes from the global financial complex as possible. Said fiat is to be converted into property as far north and at as high an altitude as my constitution will allow. Said funds will also be used to procure other real assets like cement, greenhouses, tractors, solar panels and batteries. Any excess reserves will be converted into bitcoin for the inevitable need to conduct “illicit transactions” once the demented Chinese seize control of the planet. If you think I intend to let some commies oppress me into their small box life you’re nuts. So for now, I don’t need a Tesla. My faithful Ford Focus, aka EL BURRO, is operating just fine.

Praise and Glory to Elon. Praise and Glory to The Leader. Praise and Glory to Tesla.

fin

RAUL SANTOS, October 20th, 2019

Exodus members, the 257th edition of Strategy Session is live. There are a few interesting tidbits that I left out of this spirited blog entry, go check it out!

Comments »