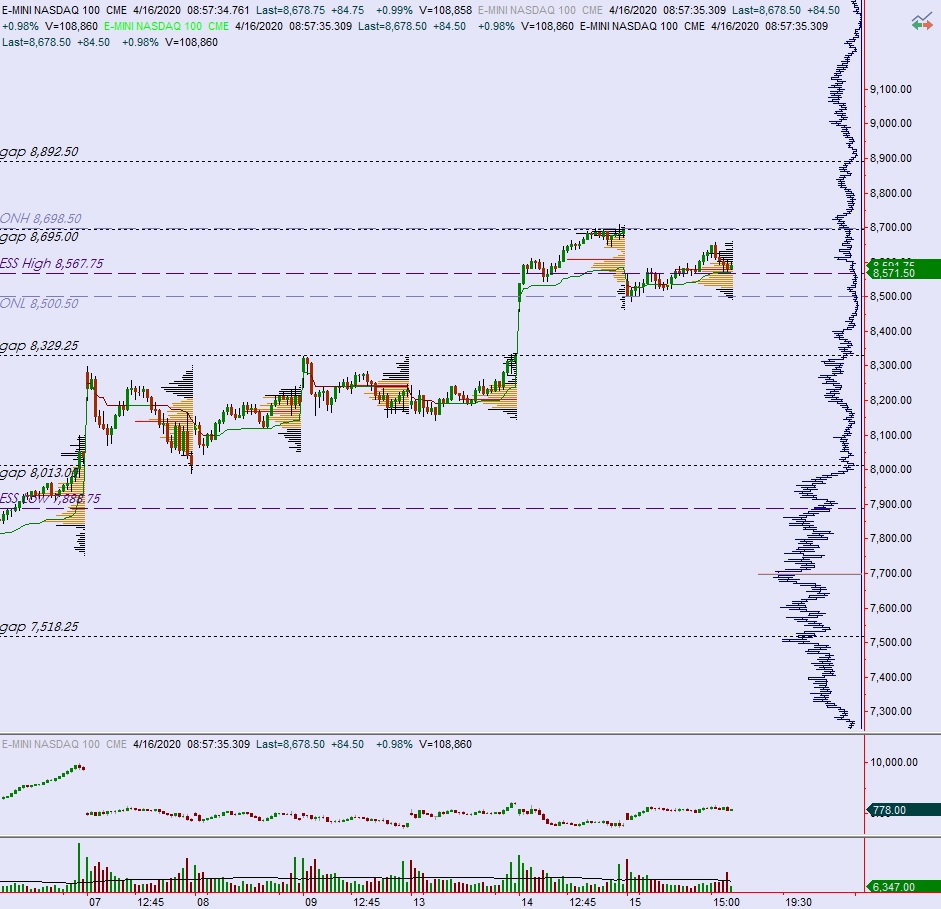

No morning NASDAQ trading report today. I appreciate anyone who followed along this week, it was a strong performance. I want to use my blogging window this lovely Friday, with NASDAQ futures bumping up against major resistance at 9k, to discuss a most critical component for obtaining consistent profitability—faith.

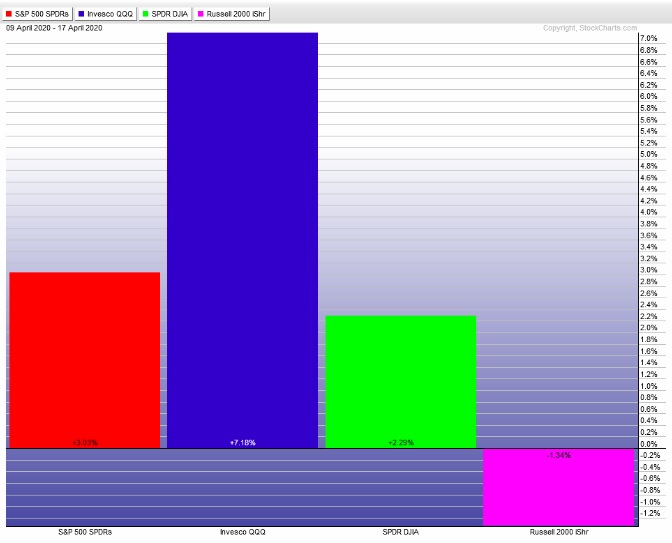

Faith is what makes you take the next signal from an algorithm after it suffers a major draw down. Readers of the Exodus Strategy Session know I trade every signal generated by the Exodus mother algo. Unfortunately, the algo flagged me into a 10-day index long on February 27th. That signal ran through March 12th. Then on March 12th the algo fired again, meaning I had to hold my TQQQ position until the end of March 26th. This resulted in about a -40% loss:

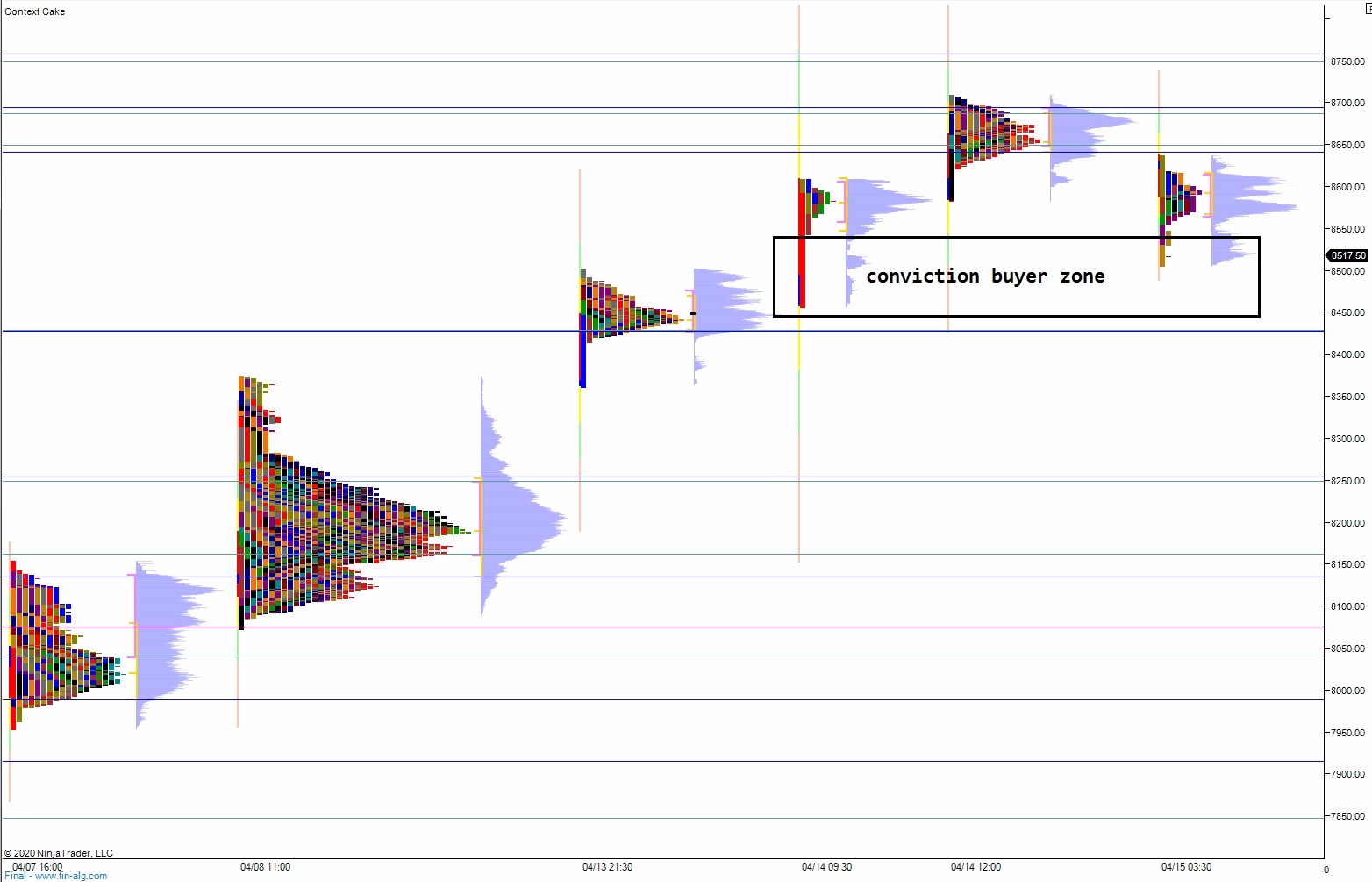

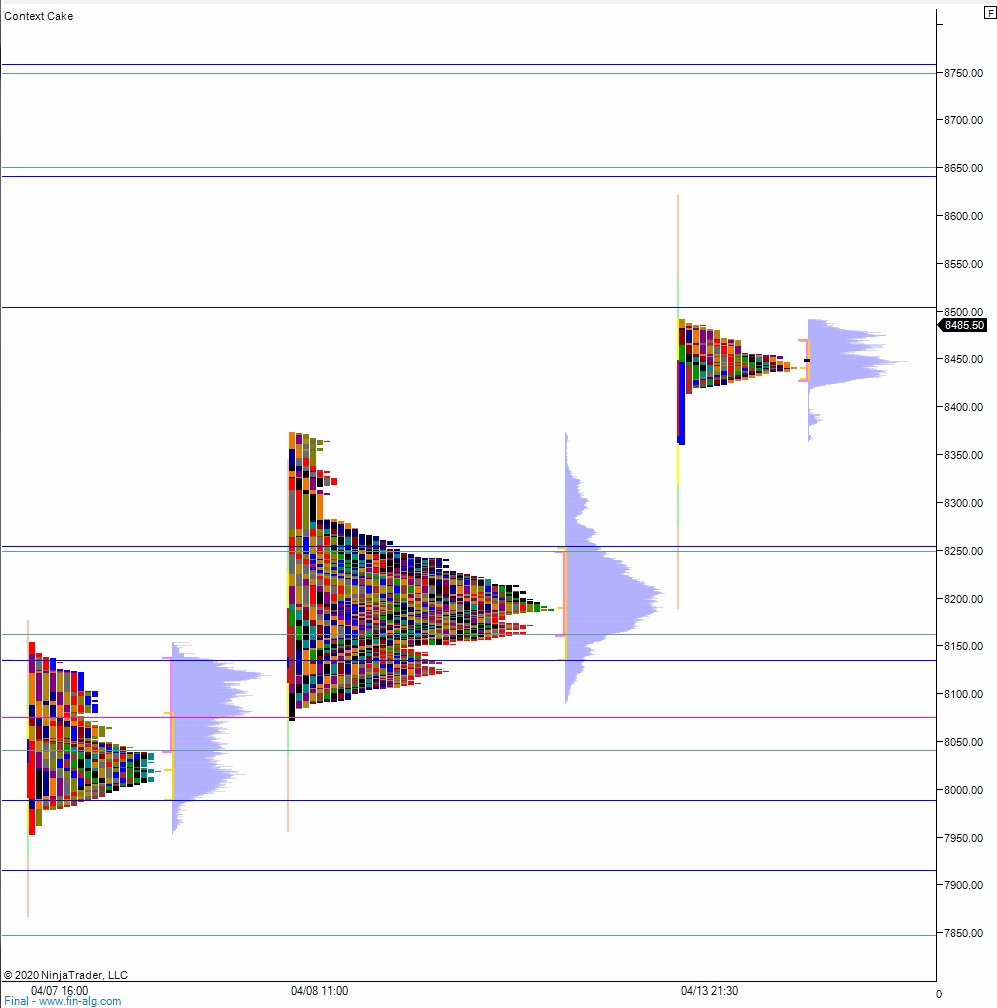

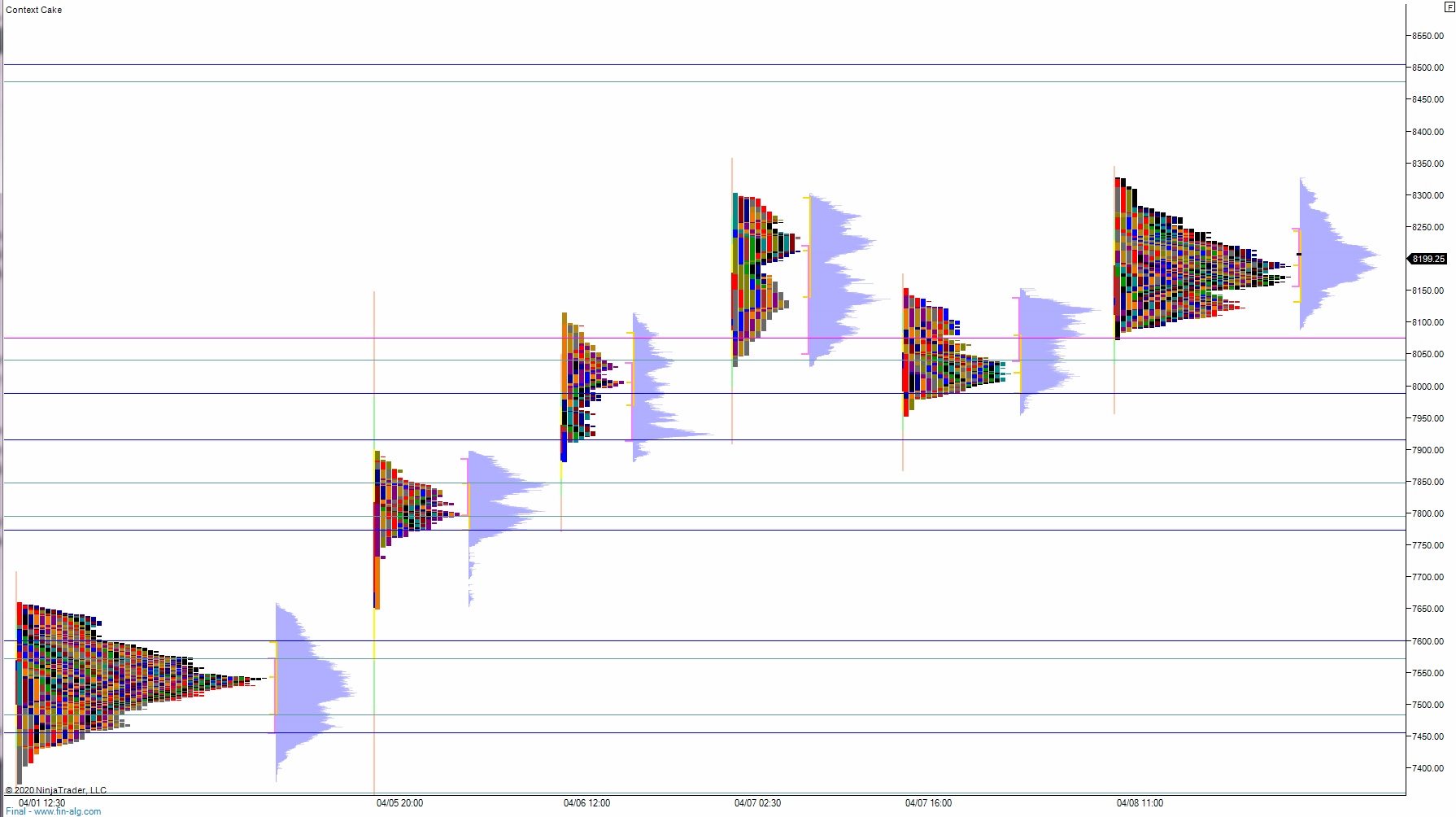

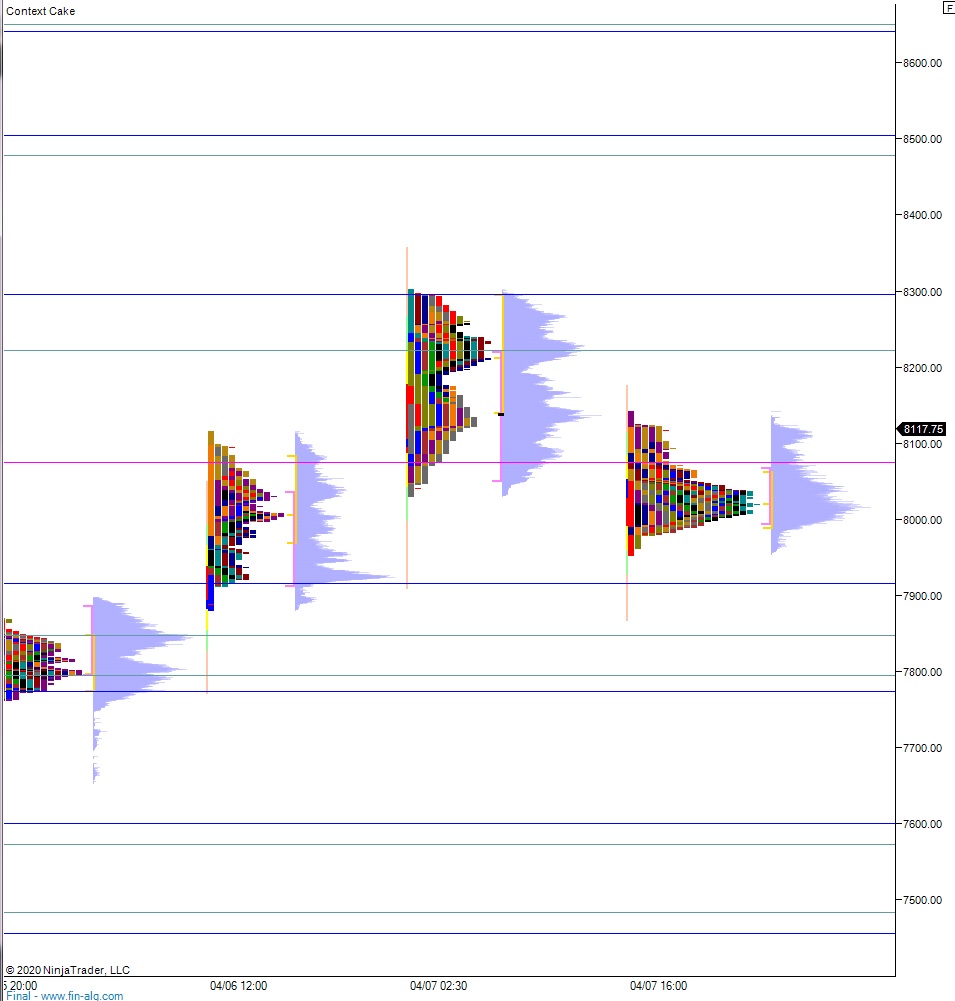

A lack of faith may have resulted in my passing up the next signal, which happened in close succession. The next signal triggered on April 1st, on the Fool’s Day. A superstitious man or perhaps someone who watches cable news may have been even more spooked and less likely to take the April one signal. That trade just closed out yesterday. The result:

You see? Back in the green, baby.

From preschool to eighth grade I was educated by pastors and church moms via the Lutheran parochial school system. I am privileged in this way, having usurped public schooling until college. My high school was a college preparatory school operated by Catholics. Nuns and brothers and priests. I was inside a theological brainwashing network for quite a long time. I witnessed hypocrisy so closely, it would make even a garbage man blush. I watched a pastor having an affair with the kindergarten teacher, both of whom were bound by matrimony. Racism. Lots and lots of racism from folks who huddled onto wooden pews 3-5x per week under the premise of divine love and the holy trinity—a belief that god is in everything via the holy spirit. Hating their own god, you see?

Fortunately my best friend, who you may know as ROBETO BREGANTE, was exceptionally bright at a young age and well versed on carbon dating and dinosaurs. He knew the scientific method and loved to challenge authority. We began debating the Christians, on everything, starting in about third grade.

By fifth grade we were both moved to another Lutheran school after our parents assumed we were being unfairly punished, to the point of pleasure, by our school. Such good boys we were, certainly they could pay a different group of pastors and church moms to treat us better. The next school was no safer from our logic, our data, our scientific beliefs. We were regularly kept at opposite ends of the chapel, and on more than one occasion I was made to sit in isolation in the janitor’s closed for the entire school day, about eight hours. One of the times I fashioned a noose from some rope I found in the closet. Just to work on my knot skills but boy did that spook them.

I could not be made to have faith in their King James Bible because I need objective means of believing something. This is what makes trading a better fit for me then judeo christian pursuits . I use massive spreadsheets and mathematical models to prove beyond doubt, via a statistical significance, that something is true.

I am grateful having flown so closely to the christian sun and for having elders that encouraged me to question everything, otherwise I may not have developed the critical thinking needed to thrive in our modern world.

When it comes to long-term investing, it lean on my christian foundations to understand how irrational human beings are. Christianity is the most successful business in world history. What did it do? Simplified religion. One god, one book. A few simple rituals. Defined SIN.

Okay now what entities most resemble christianity? Tesla, Google, Amazon, Microsoft and so on. You buy these names and you never sell them. You don’t use fundamental analysis like an idiot. You use blind faith. Just like the Christians.

That’s all I have time to say for now.

Cheers to never panicking out of your faith when the going gets tough.

Raul Santos, April 17th 2020

Comments »