Being an oil speculator requires thinking like an oil man. Oil carries more geopolitical risk than any other speculative instrument on the planet. Mining oil requires medium intensity work, it takes up tons of space and oil is the fuel of war.

Which is why (aside from the devastating climate change underway) I’ve always held such disdain for this crude blend of plants and animal bones. But by golly I have a job and that is to extract as many fiat american dollars as possible from the global financial industrial complex. Whenever the number on the screen shows a certain threshold of fiat american dollars in my ledger, they are withdrawn and converted into real assets—land as far north and at as high an elevation as my constitution allows. Greenhouses. Irrigation. Cement and steel and bulk minerals.

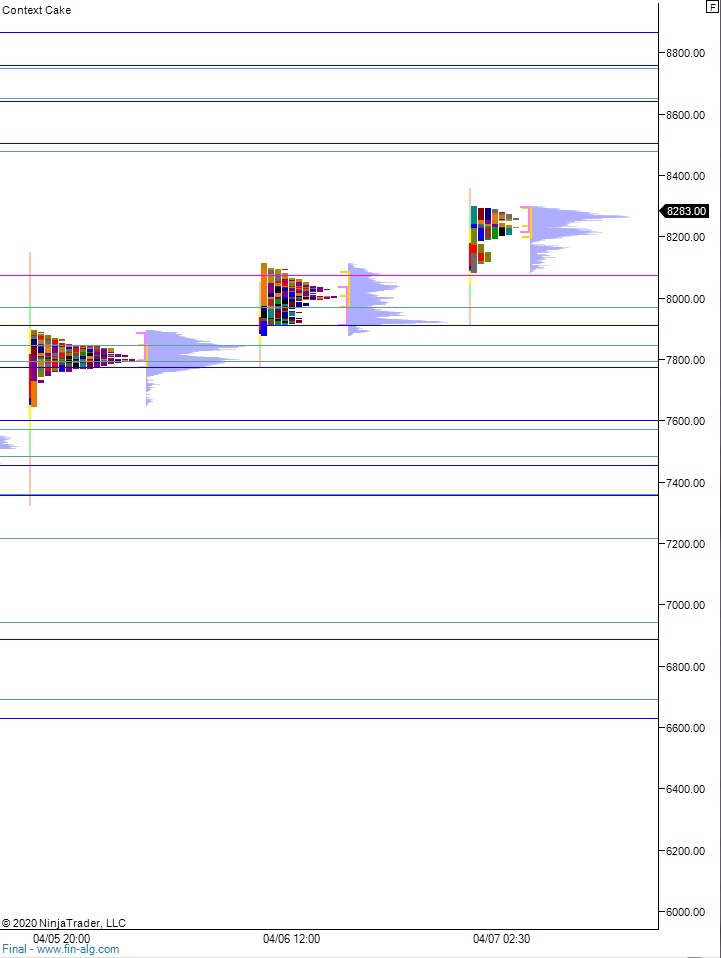

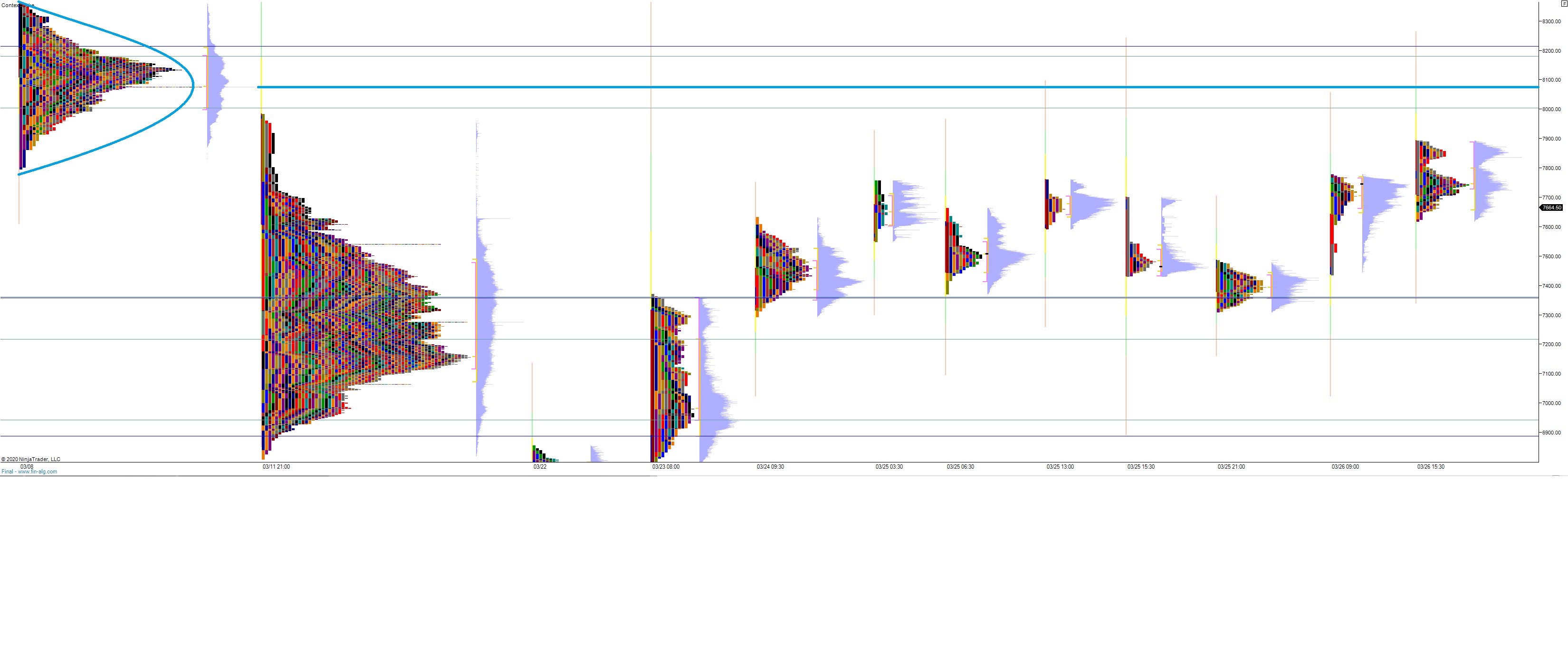

It would have been borderline negligent to not acquire a few position in oil these last few weeks. When I write something like this, a bold stance that borders hyperbole, I’d better have some data behind it. Therefore I support my line of thinking with a 20-year chart of sector performance. Energy sector was a brutal laggard well before the Valentine’s Day covid-19 massacre. But once the whole herd started to panic, babies were being thrown out with the bath water. Look at this chart, then lets pick these thoughts back up below this pornographic beauty:

When it comes to investing, or any form of exchange with humans really, it is important to do your best to place yourself into the mind of whomever you’re dealing with. Oil investing is a space dominated by religious zealots and ideologists. Muslims and Christians. Barbaric kingdoms. This is not where democracy exists. Democracy gave us the Technology sector. Religion and war gave us the oil sector.

When it comes to war, you have to have some reverence for the Chinese. Their population is obedient, even under authoritarian conditions that would have every snowflake in America, from the gay motorcycle-riding-babied boomers to the woke hipsters revolting. Those Chinese cooperate. Need a pipeline built? You want obedient subjects. Want to deal with the Russians? You better come correct.

The Russians don’t play.

“trust, but verify” – Russian Proverb

If I am going to invest in oil, I want to position alongside the only people I consider ruthless and obedient enough to fend off the religious freaks. It also has to be emerging markets because since the days of British colonialism there have always been less qualms over exploiting natural resources in foreign lands. That is why PTR is my play.

But the americans are a bunch of gun nuts, cowboys capable of surprising even the most elaborate communist plan. That is why I also took position in WES. These two tickers practically trade inverse of each-other, until they eventually don’t. Until the oil shortages start, and believe me they will, especially if we are plunged into another (inevitable) conflict.

It’s all very bleak, I know. Let’s leave oil behind for now.

Okay last thing I’ll say. I am going to accumulate more PTR soon. Both WES and PTR will be held for several quarters, and I may keep PTR for the rest of my life.

—–

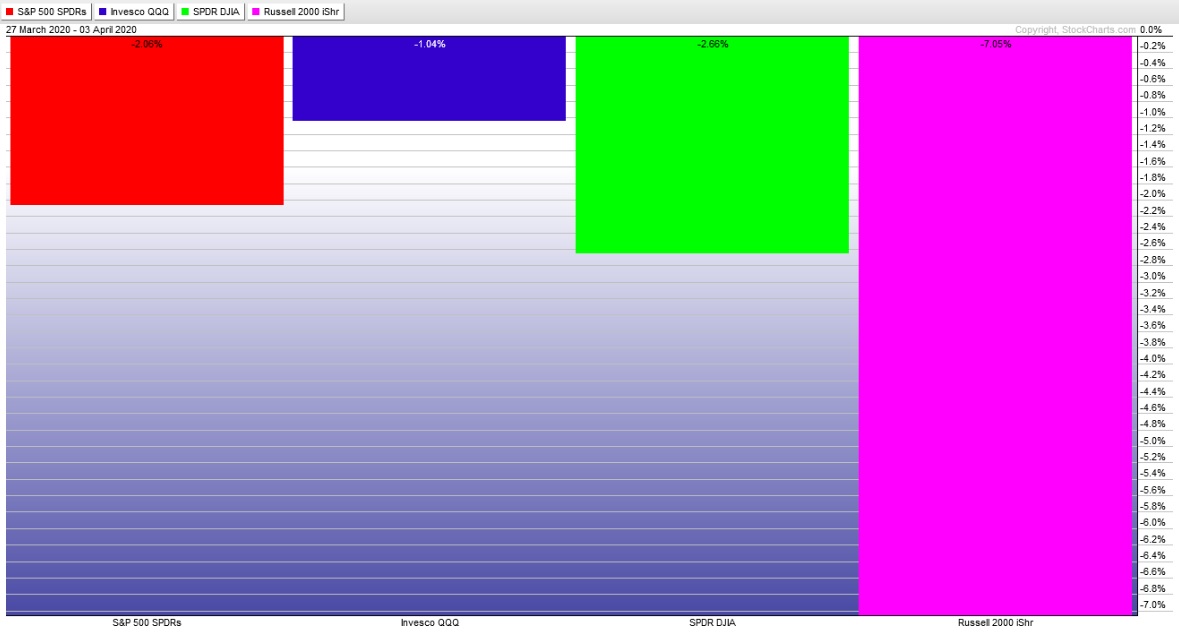

I have a disease. Unrelenting optimism. I am haunted with an endless stream of positivity that seeps into everything, including my perception of the stock market. I am still bullish.

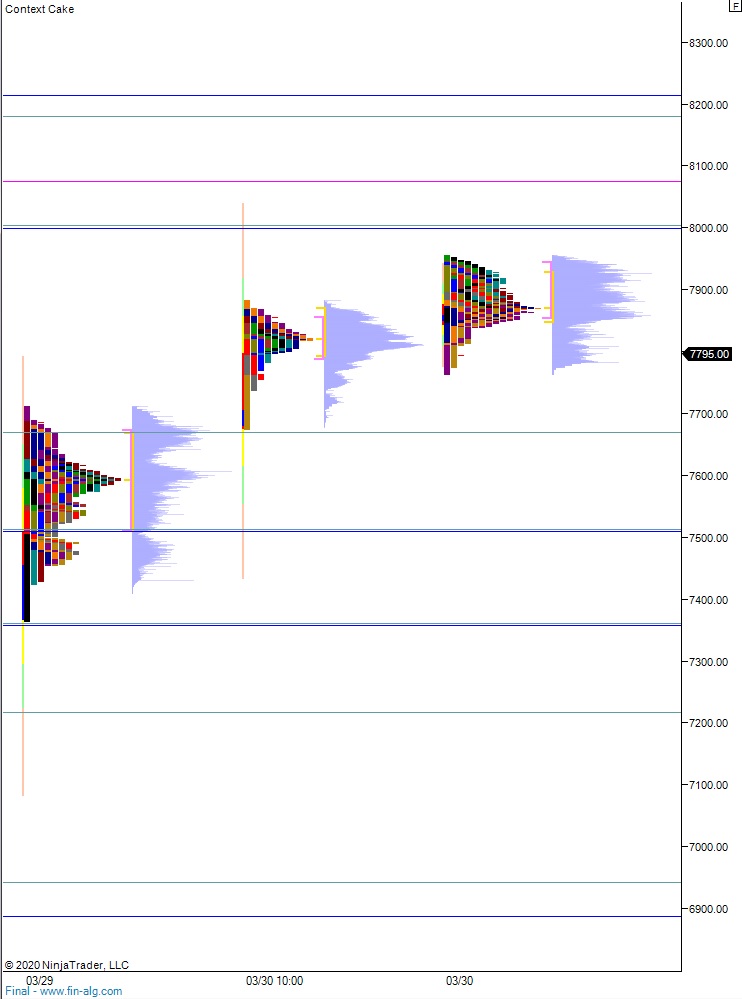

I am working with an interesting combination of system signals into the first full week of Q2. Basically I expect sellers to re-engage early in the week, pressing right into the FOMC minutes Wednesday afternoon. Then I expect the auction to reverse and rally into Good Friday. The way the sun shines come easter will awaken the resting optimist in others, triggering a rally that lasts the better part of Q2.

That is really how I feel.

So my plan is the same as it has been since I returned from the mountains at the end of February—accumulate more shares in our immutable institutions: Microsoft, Alphabet, Tesla, Costco, Walmart. One other change I need to make is swapping out my Goldman Sachs shares for Square. If I am going to lose @Jack to some vulture douche bag at Twitter, I need to retain some @Jack exposure via Square. Plus that new Goldman CEO buying pj’s right now is just in bad taste.

—

bearish to start the week, then bullish until otherwise noted,

Raul Santos, April 5th 2020

Exodus members, the 280 edition of Strategy Session is live. Go read the ‘why’ behind my forecast.

Comments »