NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight via a push lower around 10pm, a pull back up near Monday’s low that sellers rejected then a second push to new Globex lows around 6am. As we approach cash open, price is hovering near last Wednesday’s low.

On the economic calendar today we have existing home sales at 10am followed by a 52-week T-bill auction at 11:30am.

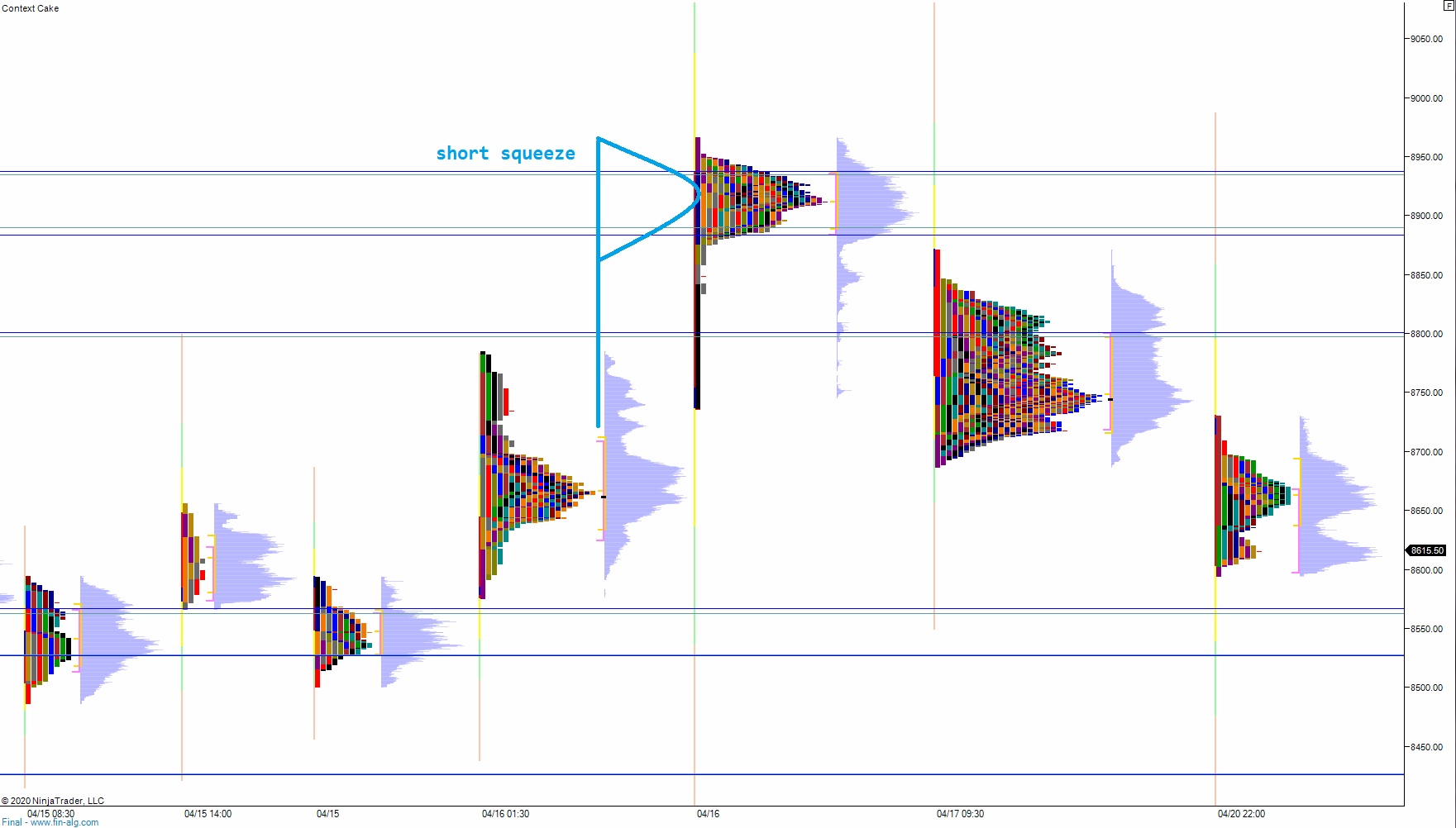

Yesterday we printed neutral extreme down. The day began with a gap down in range. Buyers resolved the overnight gap after an open two way auction and continued higher, going range extension up and holding highs until about 1:30pm. Price never took out last Friday’s high though. A first test back to the daily midpoint was supported by buyers but late in the afternoon selling accelerated and we pushed neutral, eventually closing on low of day.

Neutral extreme down.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 8690.75. Buyers continue higher, tagging the VPOC at 8742.75 on their way up though overnight high 8763. Look for sellers up at 8797.25 and two way trade to ensue.

Hypo 2 sellers press down to 8567.50 before two way trade ensues.

Hypo 3 stronger sellers trade down to 8532.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: