NASDAQ futures are coming into Monday with a slight gap down after an overnight session featuring extreme range on elevated volume. Globex kicked off with an interesting spike of sorts, higher by +100 then lower by -250 handles. The rest of the session was spent balancing along just below Friday’s low. Then around 6:30am when America woke up buyers drove price back up into the Friday range. As we approach cash open, price is hovering below Friday’s midpoint.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

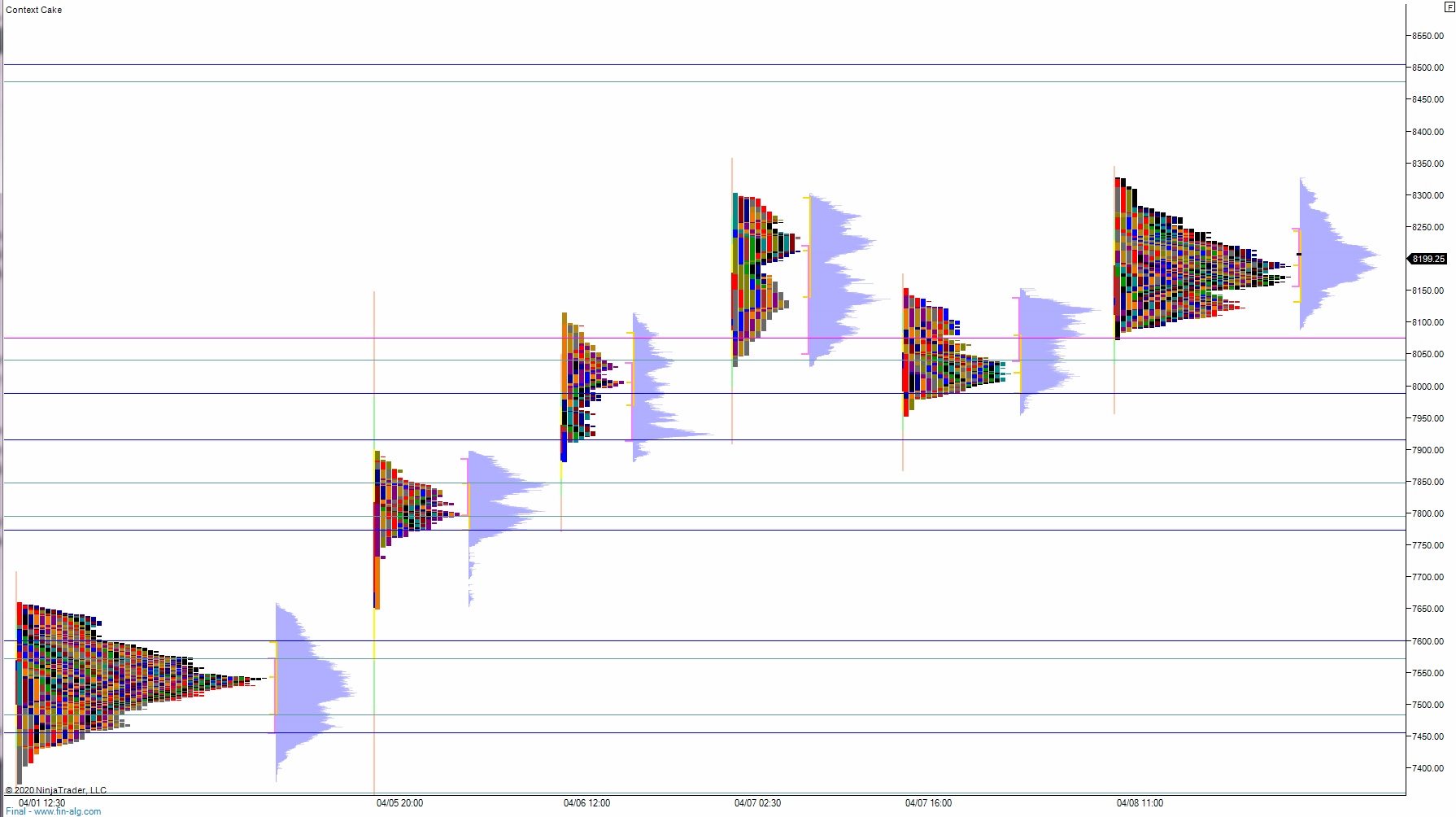

Last week kicked off with a pro gap up and trend day. That set the stage for continuation through Tuesday then a consolidation/flagging along the highs for the rest of the holiday shortened week (markets were closed Friday in observation of Good Friday).

On Thursday the NASDAQ printed a normal variation down. The day began with a gap up and push to new weekly highs before responsive sellers stepped in and close the overnight gap. Price was choppy from then on, walking over the midpoint and back below it before going range extension down late in the session. Eventually price mildly ramped back up to the midpoint and we ended the day there.

Heading into today my primary expectation is for buyers to close the overnight gap up to 8228.25. Buyers sustain trade above 8231.50 setting up a move through overnight high 8327.50. Look for sellers up at 8400 and two way trade to ensue.

Hypo 2 stronger buyers drive up to close the open gap at 8506.50 before two way trade ensues.

Hypo 3 sellers press down through overnight low 8073.25 and tag 8040.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: