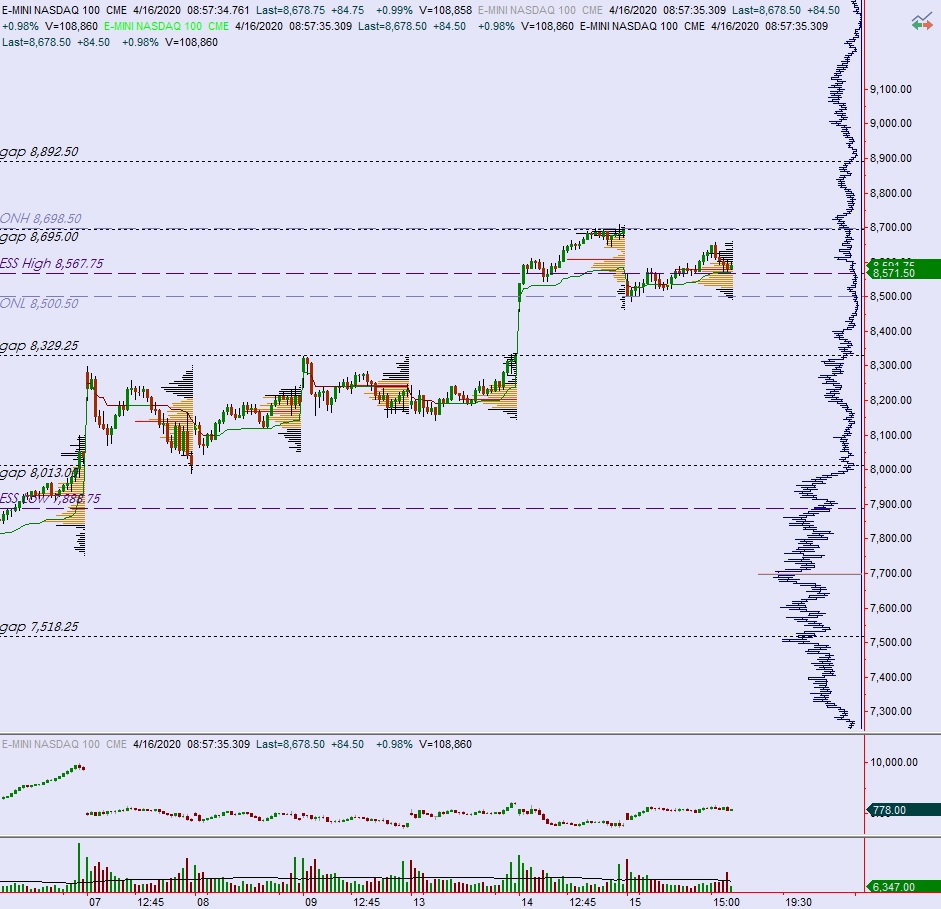

NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price was balanced overnight until about 1:30am New York when price spiked higher and took out the Wednesday high. From then-on we balanced above the Wednesday high until a slew of economic data came out at 8:30am (initial/continuing jobless claims slightly worse than expected, building permits better then expected and housing starts worse than expected) sending price spiking a bit higher, making a new high on the Globex session but stalling a few points below last Tuesday’s high. As we approach cash open, price is hovering above the Wednesday high.

On the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am.

Yesterday we printed a normal variation up. The day began with a gap down near the Tuesday low. If you recall, Tuesday was a trend up. We spent the day slowly working higher, but unable to fill the overnight gap. Instead the low volume node separating the two distributions that formed Tuesday acted as resistance. We ended the day tapping on the midpoint from above.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 8698.50 and continuing higher, up to 8748.25 before two way trade ensues.

Hypo 2 stronger buyers trade up to 8800 before two way trade ensues.

Hypo 3 sellers to work into the overnight inventory and close the gap down to 8591.75. Look for buyers down at 8583.75 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: