NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight until about 3:30am when sellers stepped in and drove price lower. That selling campaign lasted until about 5:30am and moved price down through the Tuesday midpoint. Sellers then reemerged and as we approach cash open, price is moving down near the 8500 century mark.

On the economic calendar today we have industrial/manufacturing production at 9:15am, business inventories and NAHB housing market index at 10am, crude oil inventories at 10:30am and the Fed beige book at 2pm.

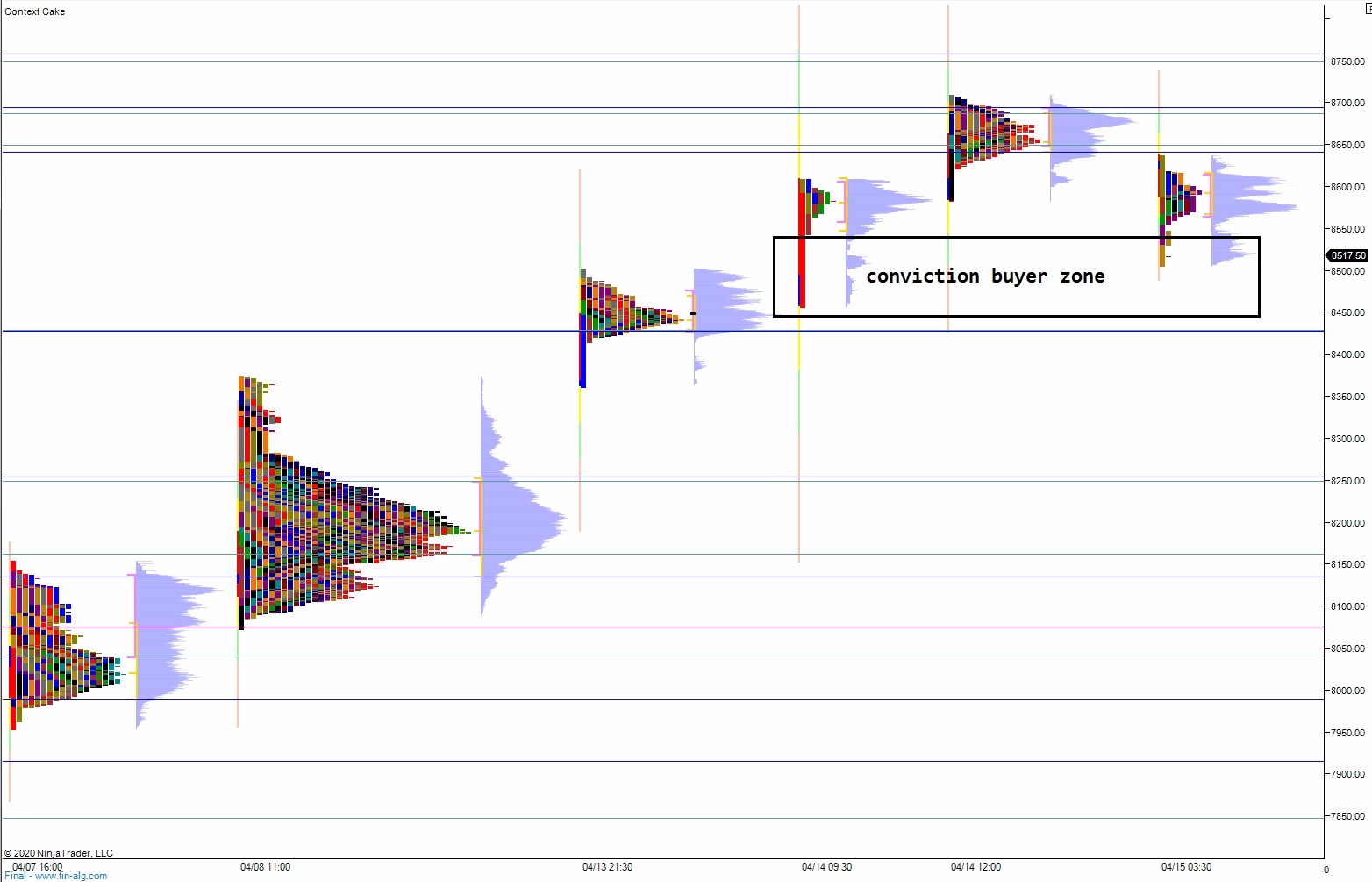

Yesterday we printed a double distribution trend up. The day began with a pro gap up and drive higher. This action closed the open gap left behind on 03/06 and after a bit of flagging/consolidation along the weekly ATR band price continued higher, eventually closing the 03/05 gap and ending the day near the highs. Of note, the daily VPOC never managed to shift up into the upper distribution.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the overnight gap up to 8695 before two way trade ensues.

Hypo 2 buyers stall out around 8650 and two way trade ensues.

Hypo 3 sellers gap-and-go lower, trading down to 8428.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: