Good morning, I hope this message is receiving you in good health and safety.

Part of me is a provocateur of chaos. It is a wild streak that runs through me and as I become older and accumulate more greys in my mustache and beard I’ve developed healthier outlets for these energies.

I dig. I dig and dig and dig like some OCD psycho. I clean the same way. I’ll pull out the stove and vacuum up any old bits of food that have fallen into this mysterious cavern in my kitchen.

What my wild streak really wants to do is help these youths properly riot. Detroit filed one of the most peaceful protests in the country last night. No looting of any kind occurred. Which is a good thing. I am not here to advocate for crime, nor do I think it helps progress the important systematic problems faced by our black community. But these protestors all gathered in the wrong area to do any damage. Down on Jefferson where most every building was designed in the shadow of the 1967 riot. They are cement and windowless. You cannot cause much havoc here. Mayhem must occur up town a bit, where Brooklyn hipsters have carved out little store fronts selling 900 dollar watches and whatnot. These facades can be shattered, looted, lit on fire and so on.

As for overturning cars, a good lever bar will go a long way. Some Archimedean basics can immensely improve you ability to flip cars and bust up cement. Yes, a concrete saw is nice and can split a Buick clean in half, but these conditions call for run-and-gun style mischief and improvised tools.

Again, I do not condone this behavior but a wild streak exits in me that loves chaos. It is not something to be proud of. Thinking about it too much makes me sad. So I garden instead. A garden can be a protest in itself. We can resist the system by growing our own, nutrient dense food instead of buying all that poison at the store. We can live longer, organize, overthrow the patriarch via democracy. We can lean on the justice system to be better. We can boycott places out of business.

On Friday I could not trade I was far too disturbed. The nice thing about my approach to trading is that it does not require me to plot my extremely well developed butt down in front of the computer and stare at charts all day, every day. I go to cash by lunch most days, then I sashay around the yard making my playground more hedonistic and private. Then I made delicious food and take naps. I don’t have steel nerves all day, every day. I can trade well, quite well in fact, for about 2-4 hours a day. If I am maintaining my sleep and excercice and don’t have too many open projects, I can do this five days a week. Right now, it seems I can muster up the mental energy to trade one or two days a week.

Maybe this will change soon. Any long time reader of this here humble Raul blog (hRb) knows that June is MY MONTH. It always has been. It always will be. I look really good in a bathing suit. Like my skin is just slightly olive from having an Italian immigrant for a father, but I am tall and muscle-y because he married a big strong American girl. My mom could pry a cows mouth open and pull its tongue out. Anyways, I also have the perfect amount of body hair. Enough to cover my upper chest and belly a bit, but not so much that my forearm muscles are swamped out by a curly tangled mess. I also am a vegetarian so I don’t carry any unnecessary mass. All of my body is here for a purpose, to work and resist this sick society I find myself surrounded by. June is about being naked and that is part of why it is my month. I look really, really, extremely good naked.

Also June is a big month for gardening up here in the murder mitten, and I happen to be one of the most advanced garden designers in the country.

June is also my birth month.

You cannot beat me in June I guess is what I am trying to convey.

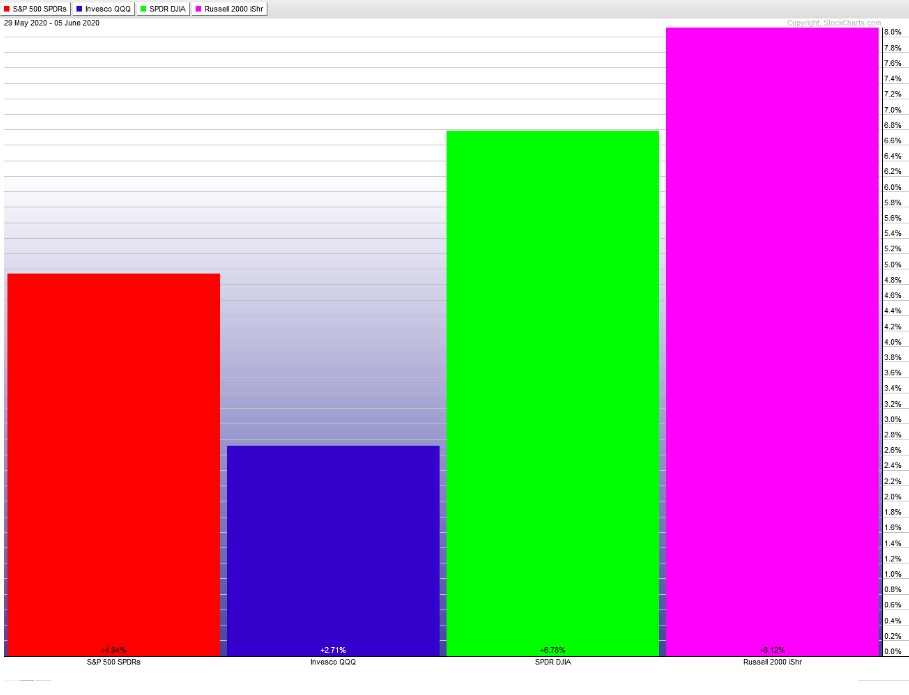

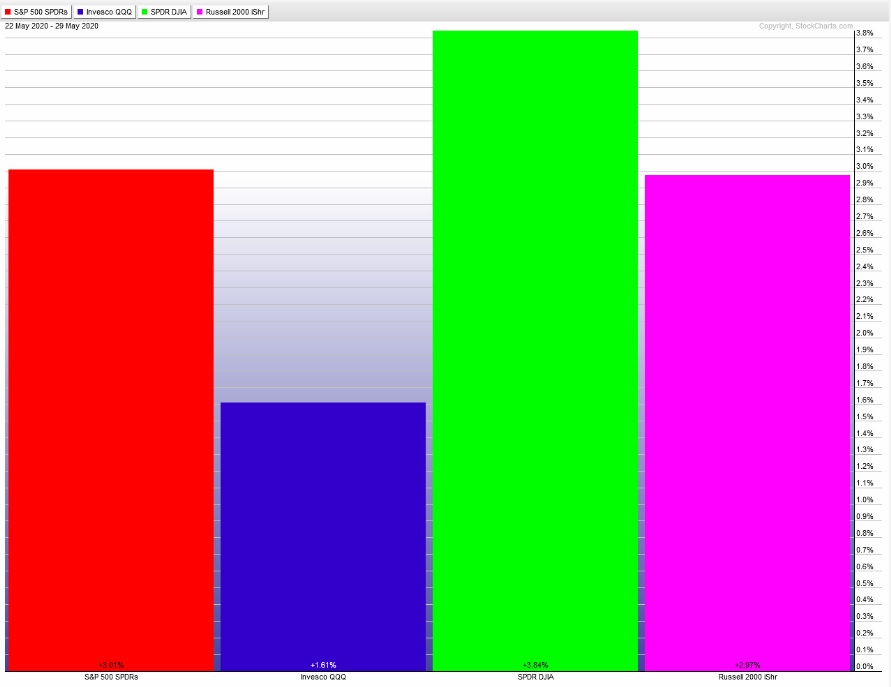

So when May ends so cleanly, on a Sunday, and June kicks of on a Monday, you have to imagine I am a bit excited. I am ready to work. Models are bullish until at least the end of Tuesday. From then onward, we improvise.

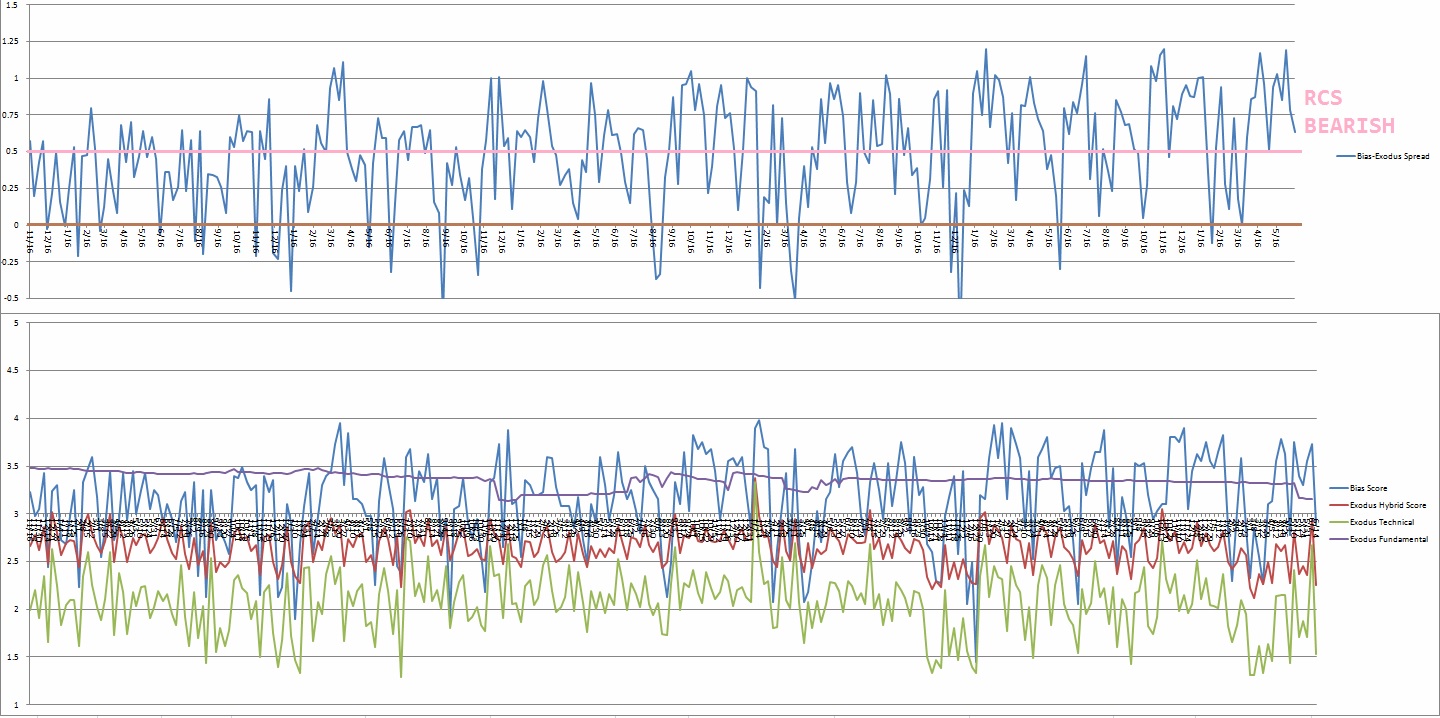

I just completed the Sunday research. The NASDAQ Transportation Index is telling a story. I am ready to turn off the news flow and focus back on cold, dead data.

Back to work.

Cheers,

Raul Santos, May 31st, 2020

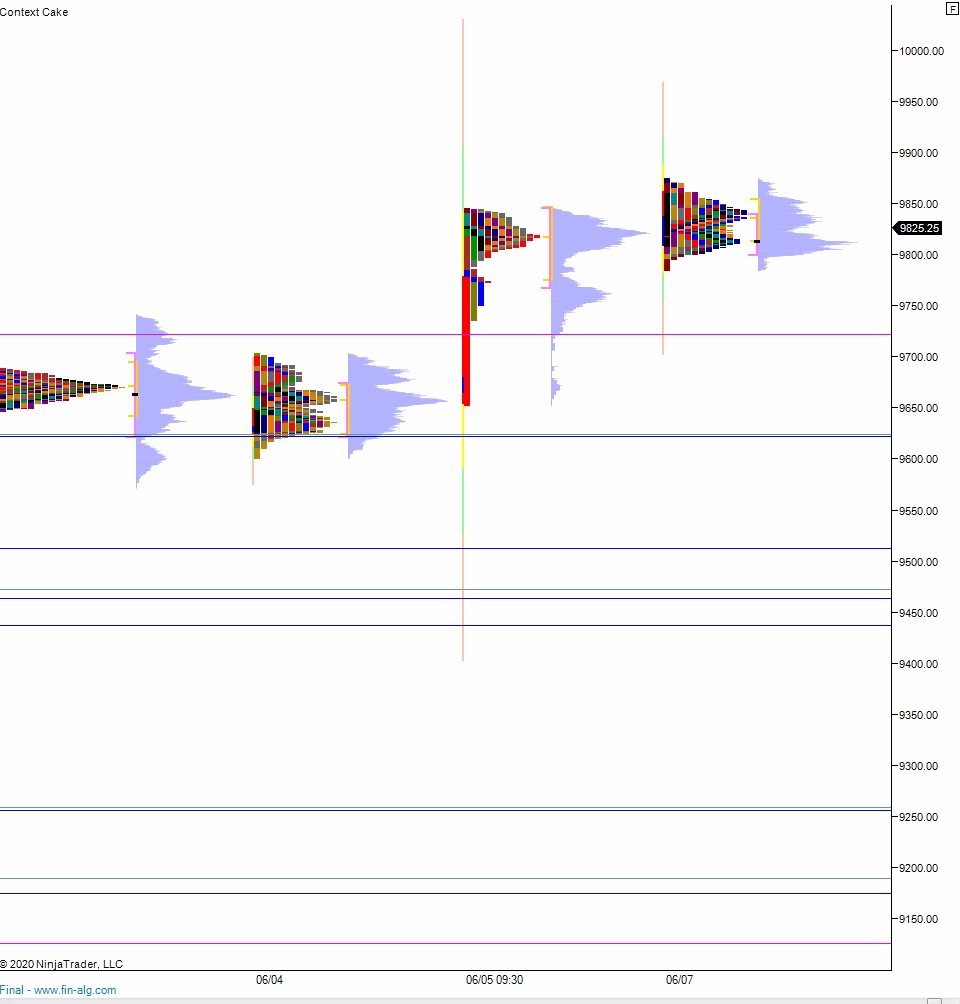

Exodus members, the 288th edition of Strategy Session is live, go check out that NASDAQ transportation index chart, and to a lesser extent the PHLX chart. Let me know if you have any questions.

Comments »