NASDAQ futures are coming into the second week of June with a slight gap up after an overnight session featuring extreme volume and range. Sunday evening kicked off with price drifting higher, eventually making a new record high and topping out around 9pm New York before making a gentle rotation lower that found buyers up in the upper quadrant of last Friday’s range. As we approach cash open, price is hovering in the upper quad of last Friday’s range, a few points above the closing print.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am followed by a 1-year note auction at 1pm.

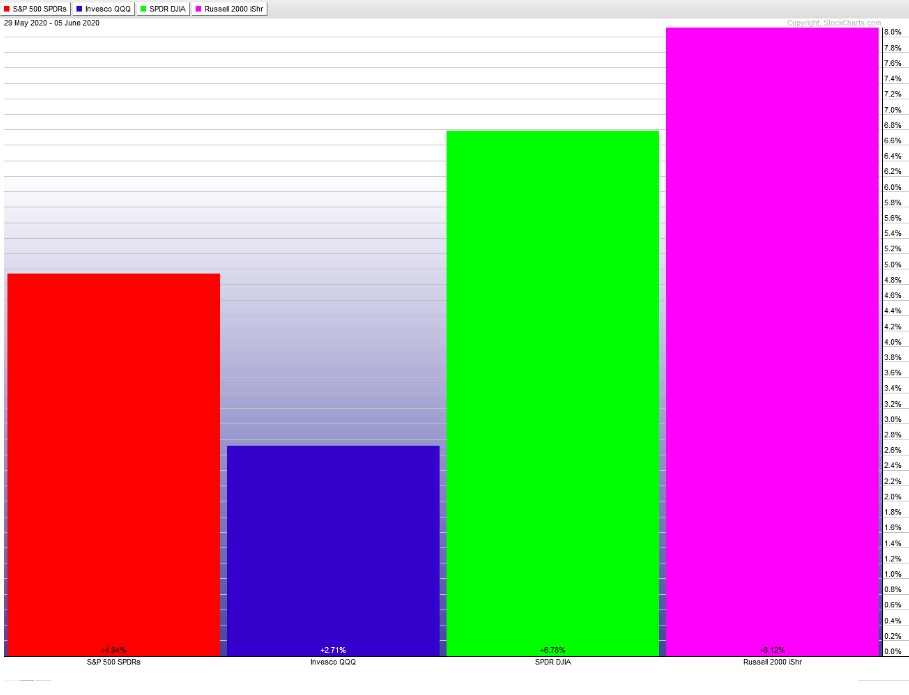

Last week the Russell 2000 charged out in front of the other major stock indices and continued to lead all week. The other indices short of chopped along until Friday then rallied hard. The last week performance of each major index is shown below:

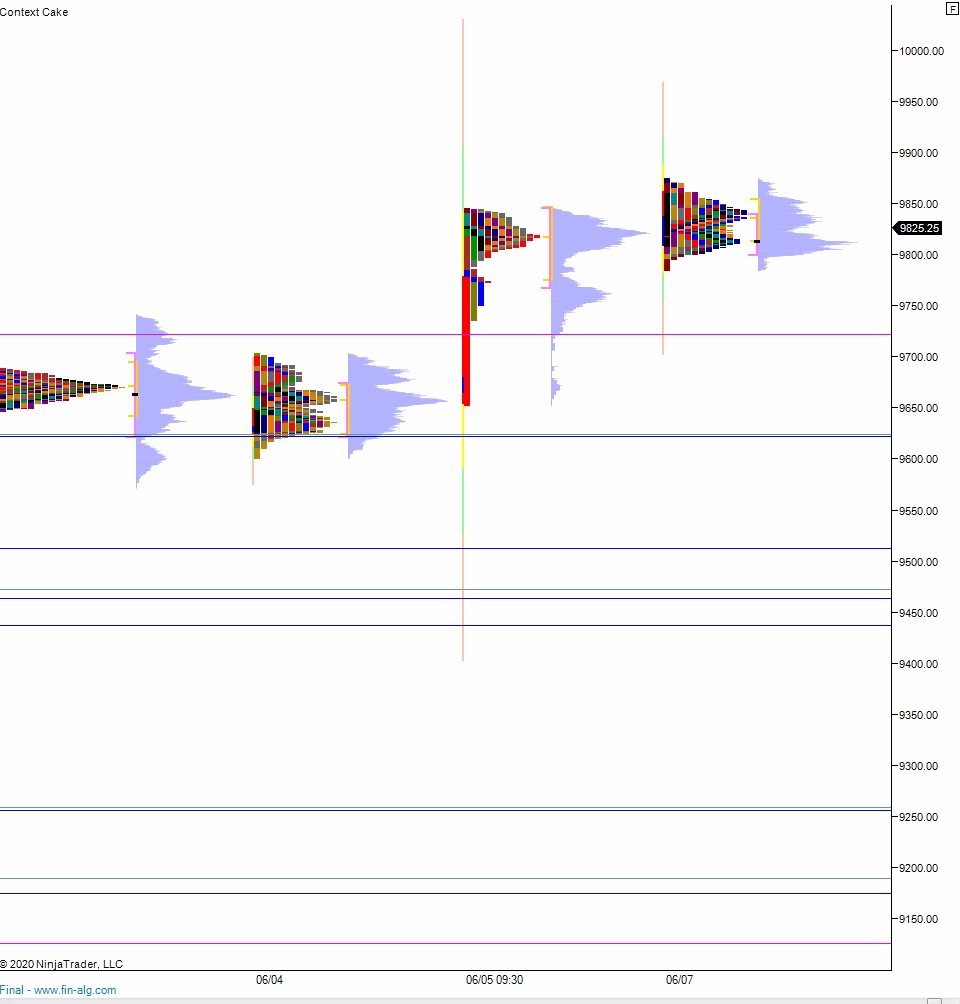

On Friday we printed a double distribution trend up, sort of. The day began with a gap up and after flagging along the highs for about an hour a second leg higher took shape. We then chopped along the highs into the week’s end.

Heading into today my primary expectation is for buyers to trade up through overnight high 9875.50 setting up a tag of 9900 before two way trade ensues.

Hypo 2 stronger buyers trade up to 9973.75 before two way trade ensues.

Hypo 3 sellers press down through overnight low 9785.25 setting up a tag of 9700 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: