NASDAQ futures are coming into the first day of June with a slight gap down after an overnight session featuring extreme range and volume. Price was choppy overnight, initially selling down through last Friday’s midpoint before the auction reversed and came into bid. From there price reversed the initial selling and briefly poked up beyond last Friday’s high. We are off that high since about 4am New York and as we approach cash open price is hovering in the upper quadrant of last Friday’s range.

On the economic calendar today we have ISM manufacturing index and construction spending at 10am. Then 3- and 6-month T-bill auctions at 11:30am.

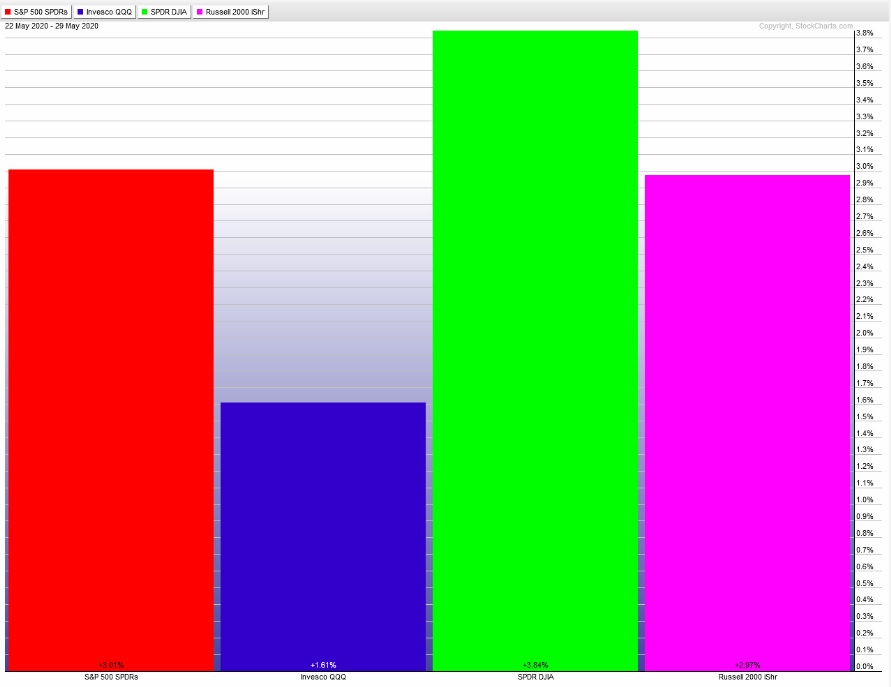

Last week was holiday shortened. We kicked off trade on Tuesday gap up across all major indices. Sellers immediately pressed down into the gap. The rest of the week featured a soft NASDAQ while the S&P and Dow were bullish divergent. The last week performance of each index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a slight gap down that buyers quickly resolved during the opening auction before a strong sell push moved in and took out Thursday’s low. We chopped along this low for a bit, briefly going range extension down before buyers worked price up through the daily midpoint. The majority of the day was then spent chopping along the midpoint. Two attempts lower by sellers were quickly absorbed, eventually setting up a ramp to neutral and a close of the week on the highs.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 9577. From here we continue higher, up through overnight high 9588.50. Look for sellers up at 9599.50 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 9600 setting up a move to close the open gap at 9625 before two way trade ensues.

Hypo 3 sellers press down through overnight low 9450.25 setting up a move to tag 9400 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: