NASDAQ futures are coming into Monday pro gap up, up a quick +100 after an overnight session featuring extreme range and volume. Price has been steadily ascending overnight, despite a bit of back-and-forth when the market tagged the 10,900 level. As we approach cash open, price is hovering at all-time highs, above 10,900.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am followed by a look at the Treasury budget at 2pm.

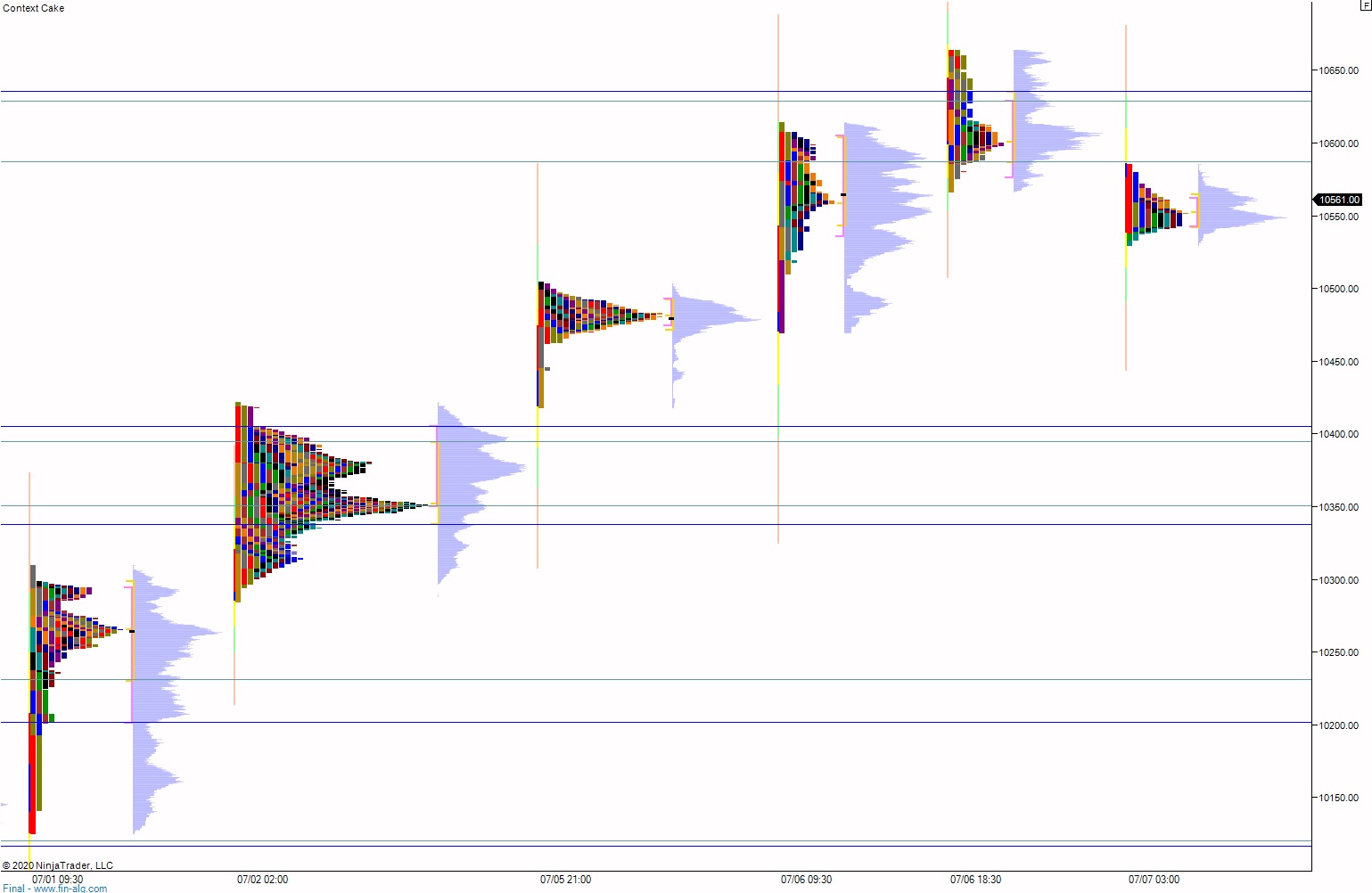

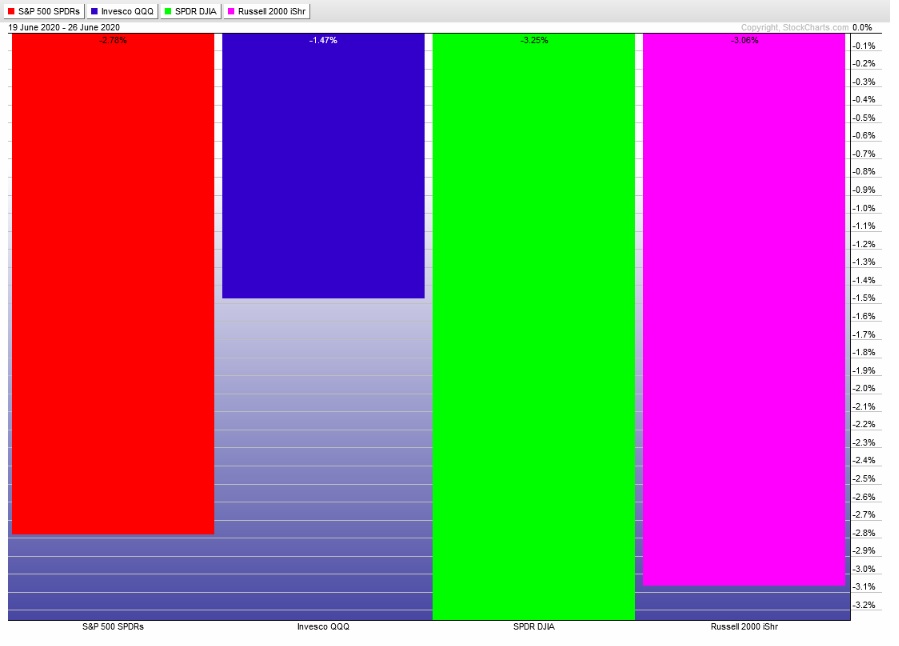

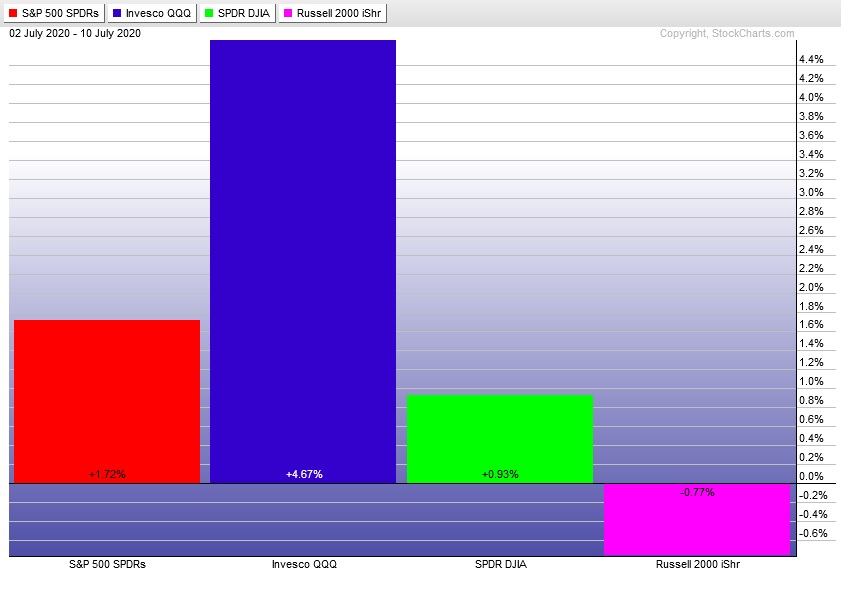

Last week started out gap up also. The NASDAQ took the gap up and ran with it, while the other major indices consolidated sideways through time. All major indices rallied into the weekend, with several ending on the weekly high. The Russell lagged behind. The last week performance of each major index is shown below:

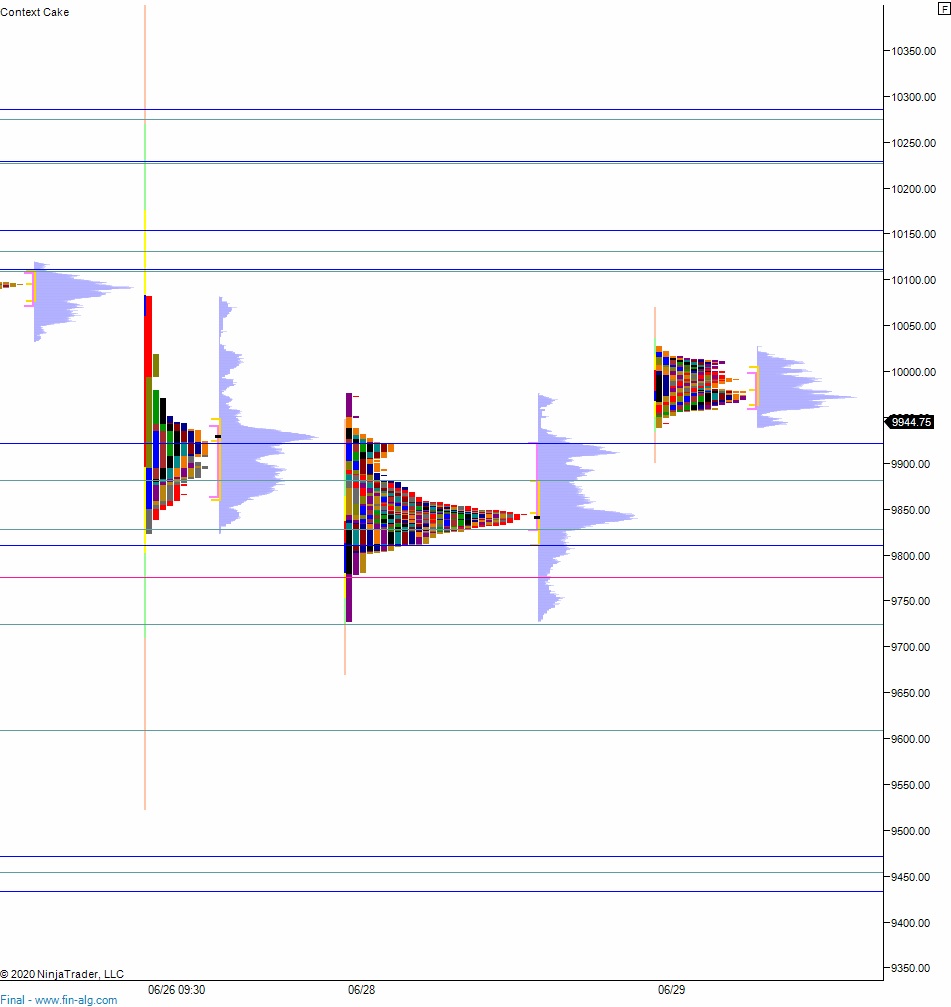

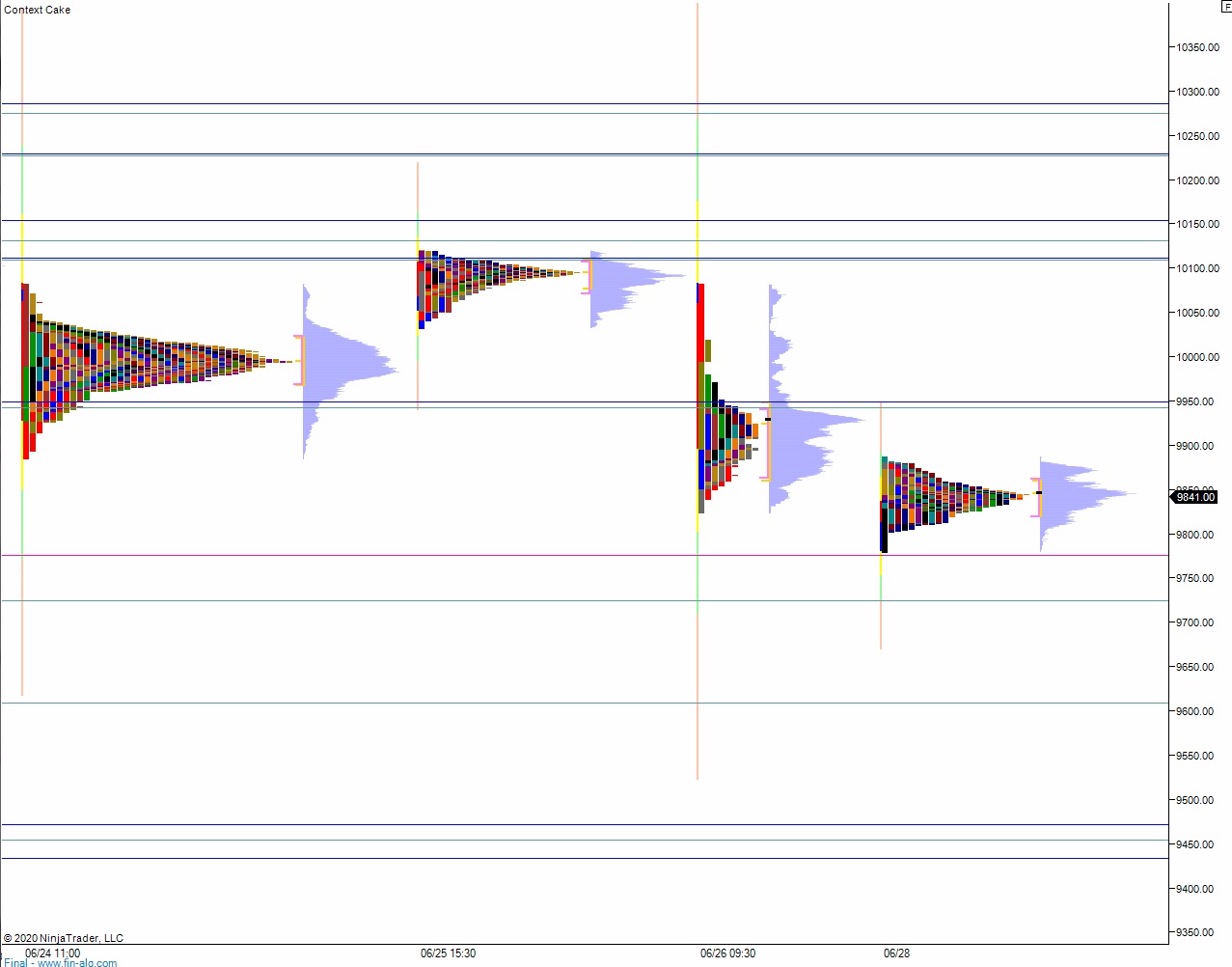

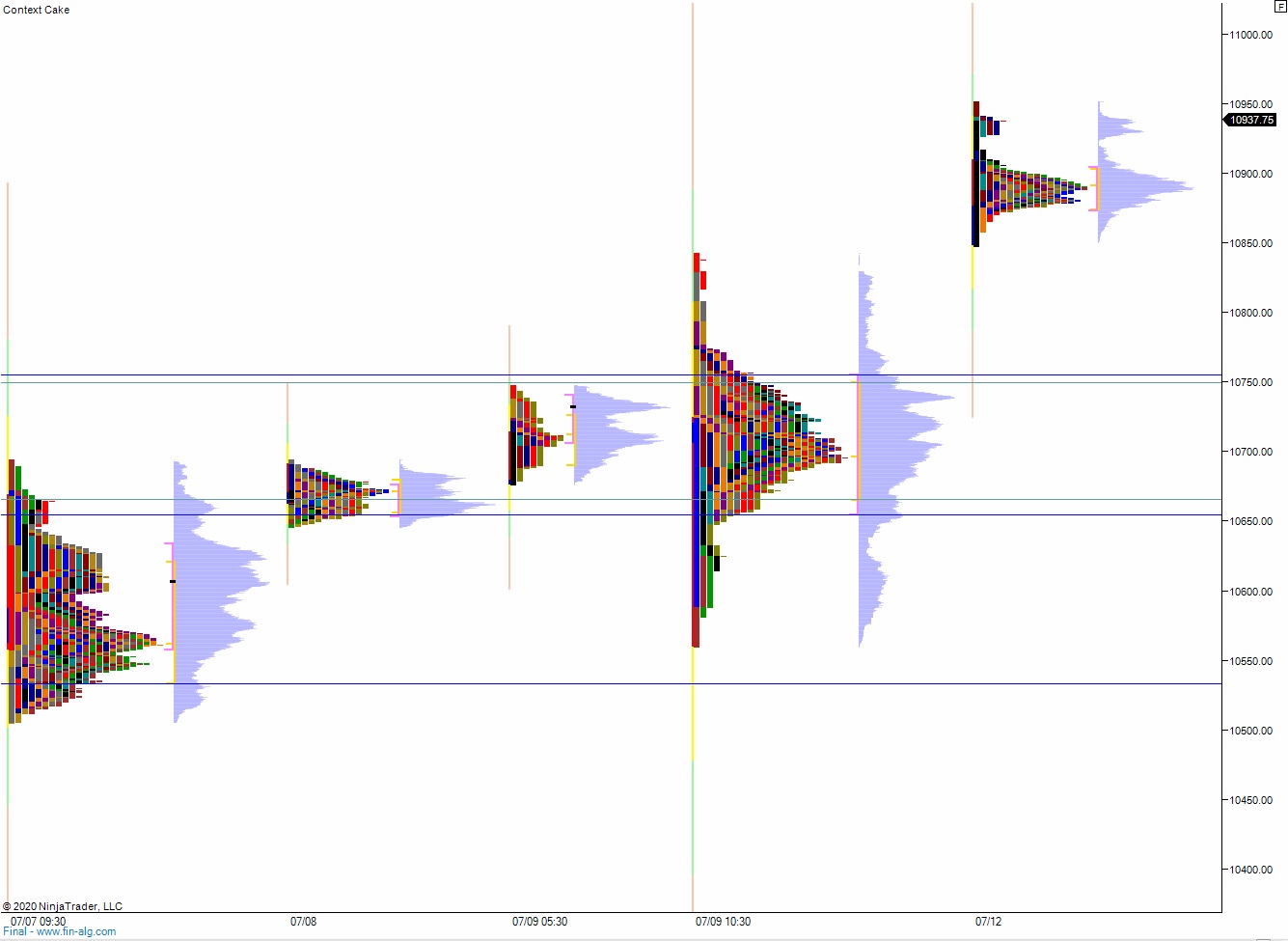

On Friday the NASDAQ printed a double distribution trend up. The day began with with a slight gap up followed by an open-drive down. Before the first hour was complete responsive buyers were on the scene, forming a sharp excess low along the Thursday midpoint. The rest of the session was spent campaigning higher—working up to a new weekly high by mid afternoon before ramping into unexplored heights into closing bell. We closed on session high.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 11,000 before two way trade ensues.

Hypo 2 stronger buyers tag 11,043.25 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 10,838.25. Sellers continue lower, trading down through overnight low 10,834.50. Look for buyers down at 10,775 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: