NASDAQ futures are coming into the first full week of active trade on the September front-month contract down a quick -100 after an overnight session featuring extreme range and volume. Price came into Globex Sunday evening gap down and mostly held balance until about 1:30am New York when sellers became initiative and drove price lower. Sellers traded down intot he 05/27 range and chopped inside of it until 3:30am when the first Americans started coming online and working price higher. As we approach cash open, we are back inside of last Friday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

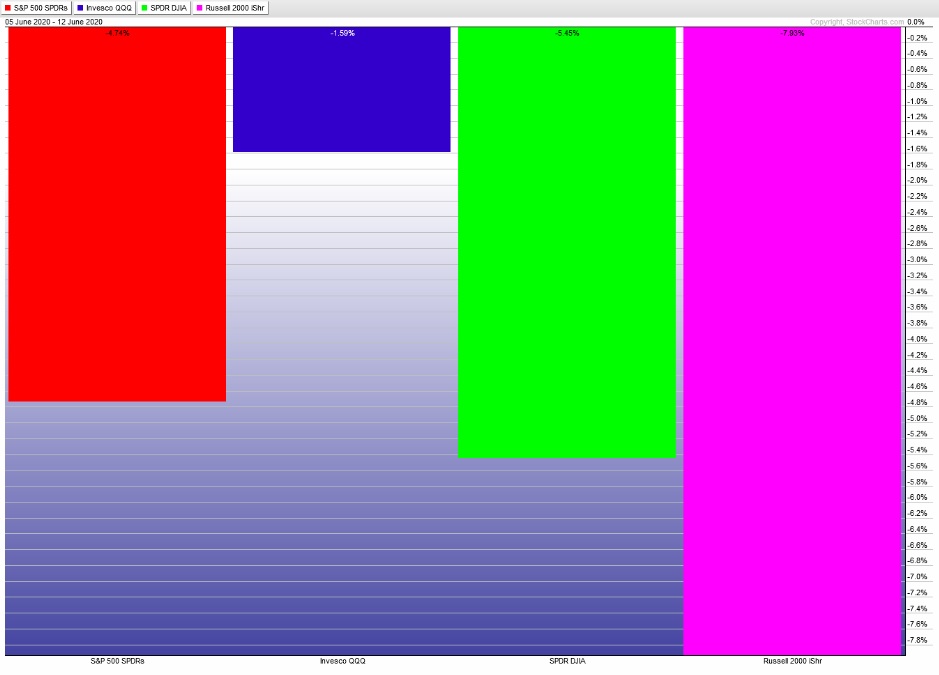

Last week kicked off without a gap. The NASDAQ found a bid early in the week and began working higher while the other major indices were flat. The sideways-to-upward action came to an end Thursday morning when a strong gap down was followed by a trend down. Friday was gap up across the board and sellers quickly erased that gap and achieved new lows by Friday afternoon. a late-Friday ramp returned price back near the respective midpoints of most indices Friday ranges before we called it a week. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap up above Thursday’s midpoint. After a brief open auction sellers stepped in and drove lower, closing the overnight gap and taking out the Thursday low by a few points. Buyers sharply responded here and sent price back up to the daily midpoint. Sellers defended the midpoint and worked down to a new daily low before responsive buyers again drove price back to the midpoint during a closing ramp.

Heading into today my primary expectation is for buyers to work into the overnight inventory and work up through overnight high 9585. From here we continue higher, tagging 9600. Look for sellers up at 9700 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 9368.25 setting up a move down to 9300. Look for buyers down at 9254.75.

Hypo 3 stronger sellers trade down to 9100. Look for buyers down at the 9096.75 open gap and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: