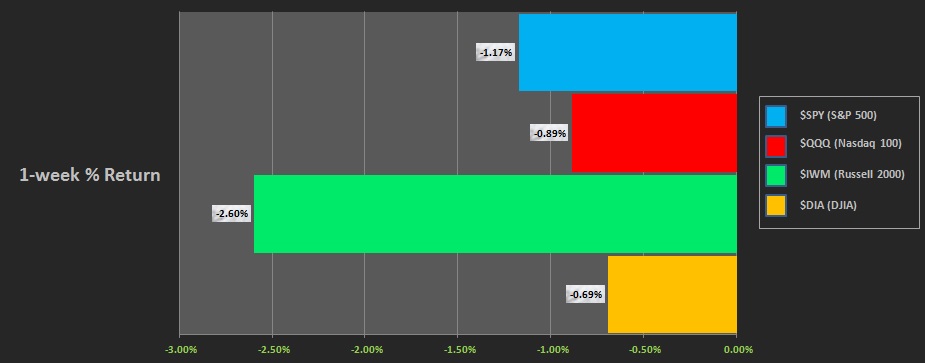

In what must have felt like a rather benign day for most, my investment accounts were attacked on all fronts, resulting in the largest single-day draw down so far in 2017. It is unlikely I am the only one who took heat. According to Exodus, nearly two-thirds of stocks were lower.

The majority of my losses came from the retail sector. Dicks, which was already my worst performing position in 2017, which was made to be an even bigger loser when I averaged down, reported an earnings miss and bleak guidance into year-end:

Dick’s Sporting Goods Q2 Adj. EPS $0.96 vs $1.01 Est., Sales $2.16B vs $2.16B Est.

Dick’s Lowers FY 2017 Guidance to $2.80-$3.00 from $3.65-$3.75 vs $3.64 Est.

Terrible guidance. Their margins are being crushed by heavy promotion, which they intend to continue doing in an effort to defend their market share. They are crushing their profits one ‘fire sale’ at a time, in a bid to compete with other behemoth retailers.

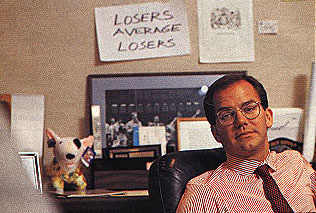

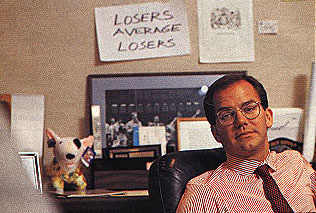

Side note to self:

The quantitative accounts both took hard knocks today also. Again on the retail front. In Q1 and Q2 the robots told me to buy Coach, can you believe it? The stock was up about +13% since the first buy at the end of March. Today, poof, all gains gone, down a quick -15% on the same pressures crushing DICKS, the margin compression that comes with aggressive promotion.

Retail truly is a rancid market. Unless your shop exists in a fragmented, perhaps even dangerous environment, retail is exclusively inhabited by juggernaut corporations who can use their massive scale scale to operate at perverted profit margins. Single digits.

There are bigger forces in play. 2017 is the year investor perceptions dramatically shifted into firm belief that Amazon will destroy most, if not all big league competition. Any legacy players left alive by Amazon will eventually be dismantled by Walmart. Walmart is up about +19% year-to-date.

And when investors lose faith in retailers like Dicks, they sell $DKS stock. When they sell their stock, the stock goes lower. When the stock goes lower, the company has a hard time tapping the financial markets for liquidity. When liquidity dries up, the company depends on free cash flow from operations. Listen, free cash flow always ebbs and flows. And when a company faces the inevitable ebb in free cash flow—without access to outside liquidity—they become a going concern.

A going concern usually dies.

This is how a corporation dies. Corporations can be immortal, but this is how they die. Amazon will probably be immortal. Robots and computers will handle most of their work for the next million years.

Did you know General Motors was a going concern once? It was in 2009, I remember it like yesterday. Deloitte and Touche, a company I was vying to work for put out the notice—General Motors was going to die. But they didn’t. Right when they were going to die, they were bailed out by the federal government. And now I just don’t know which corporations will be permitted to die…

But I think Dicks might die eventually. Could the stock rebound in the next two-to-five years? Sure. I think it could with the impressive market share they have and their move into private labeling, a tactic that worked well for Costco. $DKS will likely trade lower tomorrow. It could continue plunging. At some point it will stop, then it will take years to consolidate, in my opinion, before you see investors become confident in Dicks again.

So do I sell tomorrow, or stick with Dicks? For my money, I prefer to book the loss and consider different opportunities. Coach will be held, regardless, due to the nature of my passive, quantitative books. They are an experiment in completely letting go of human inputs and letting the robots control my fate.

But Dicks is a legacy position from a different way of thinking, of active management. Getting your hands dirty with charts and fundamentals, and subjectively gauging sentiment through hundreds of conversations about the business. The very methods that have castrated me in 2017 with Dick have also provided me winners like Tesla.

But there is one difference.

I know I would ride Tesla to zero and go down in flames right alongside Our True Leader, the pure one, Elon (all Praise and Glory to The Leader). I cannot say I feel the same about Dicks.

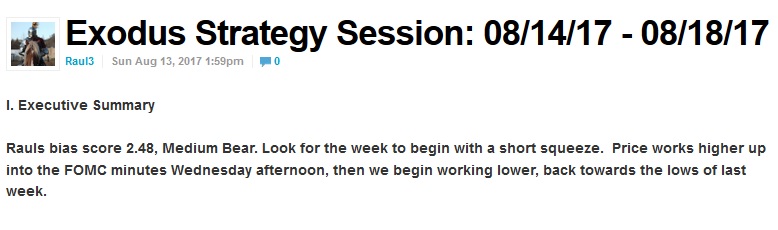

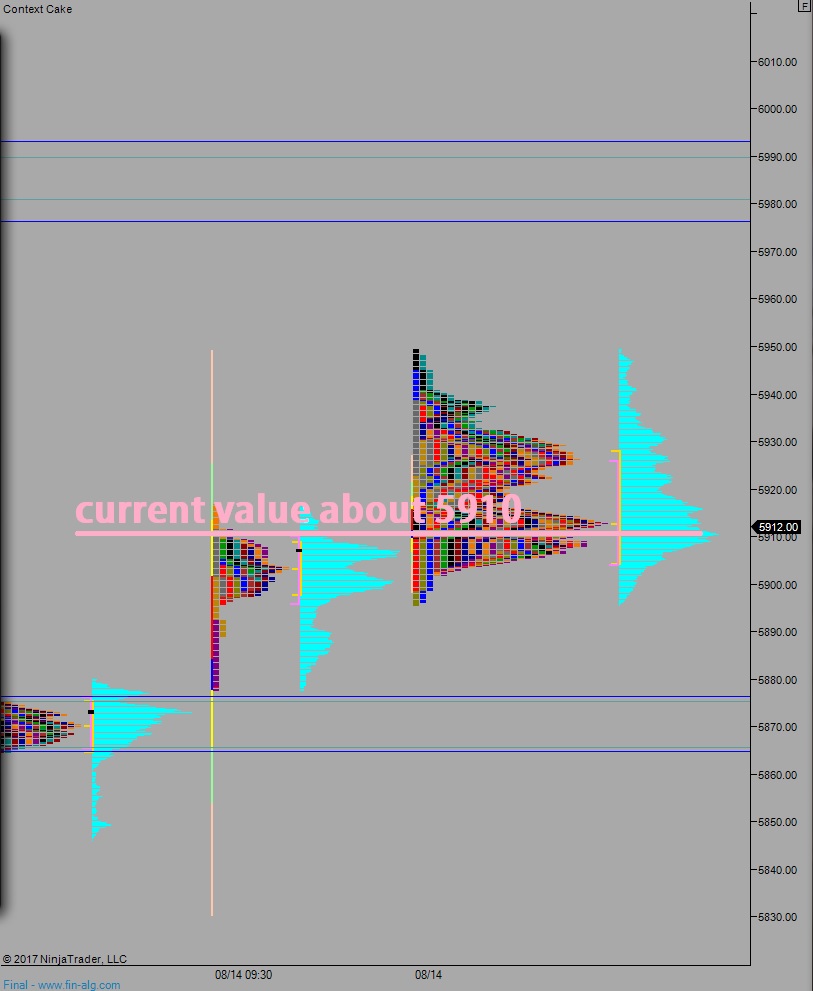

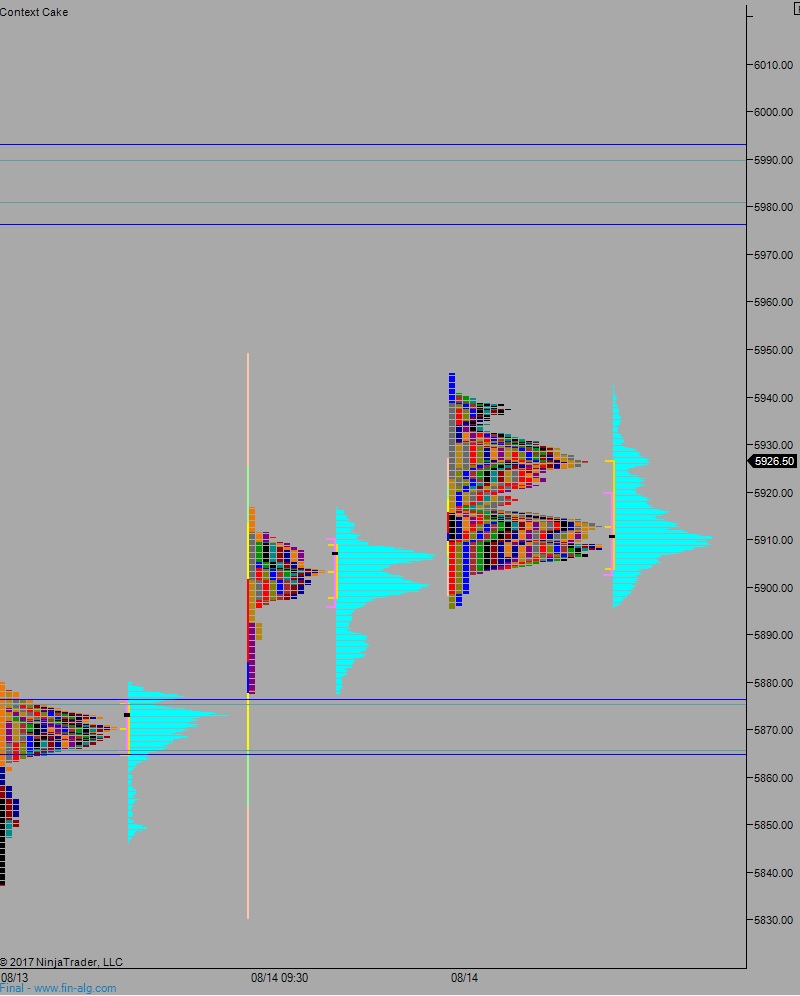

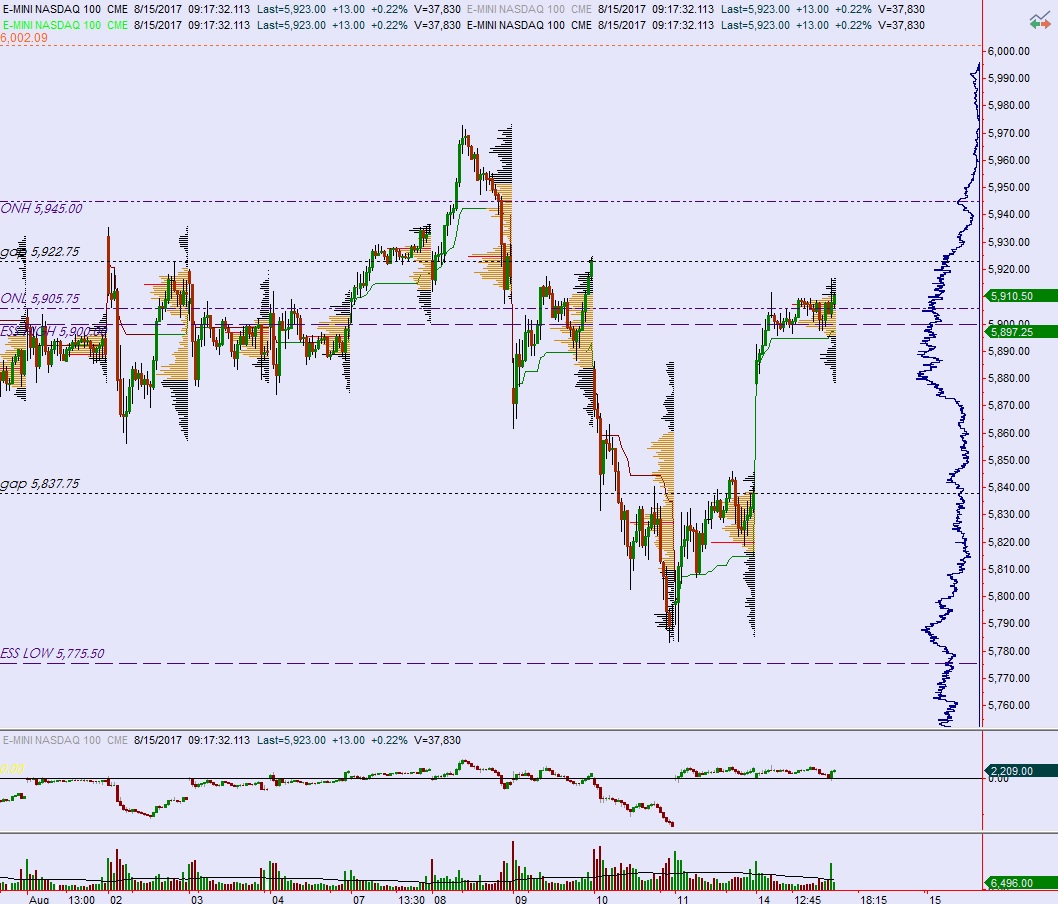

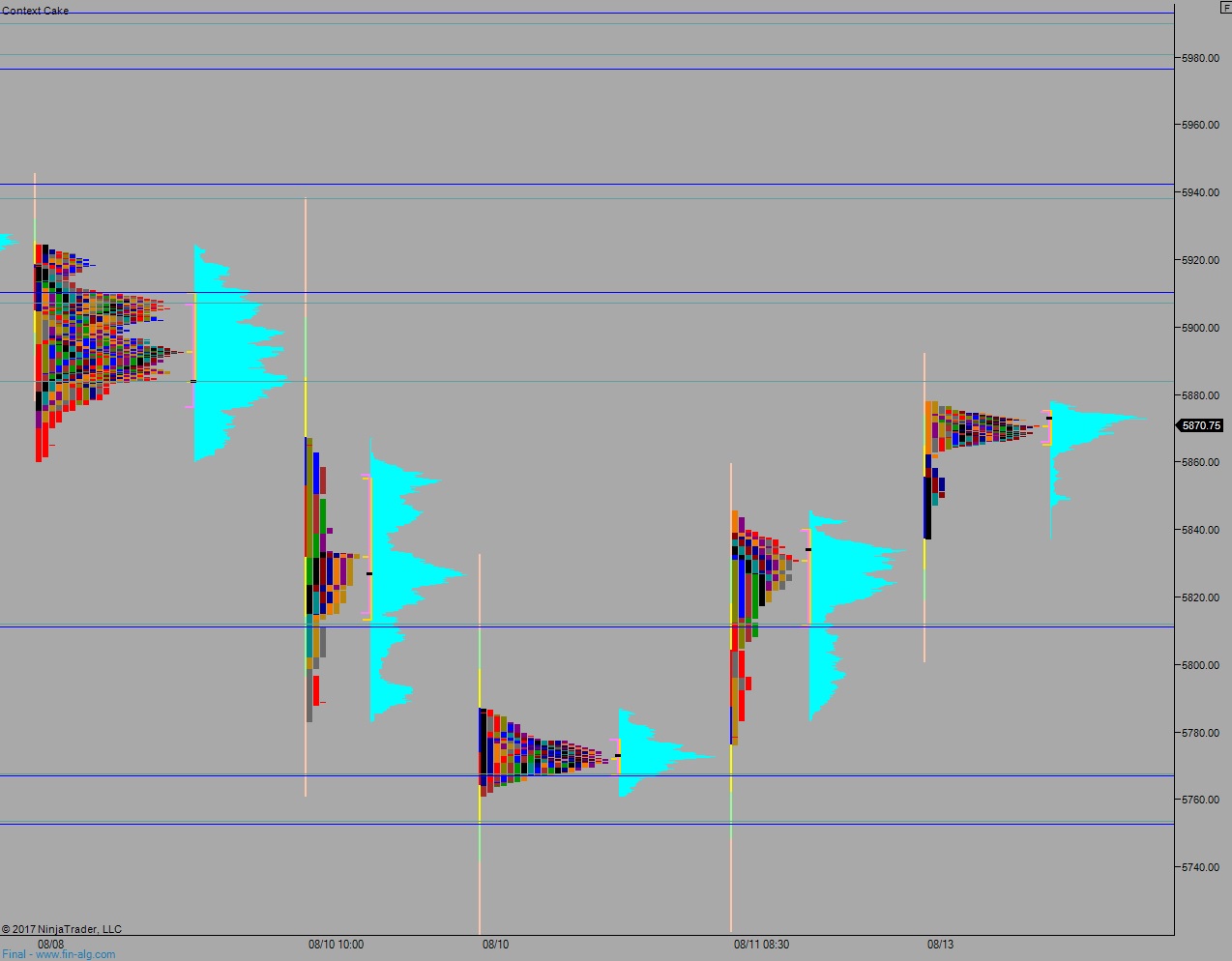

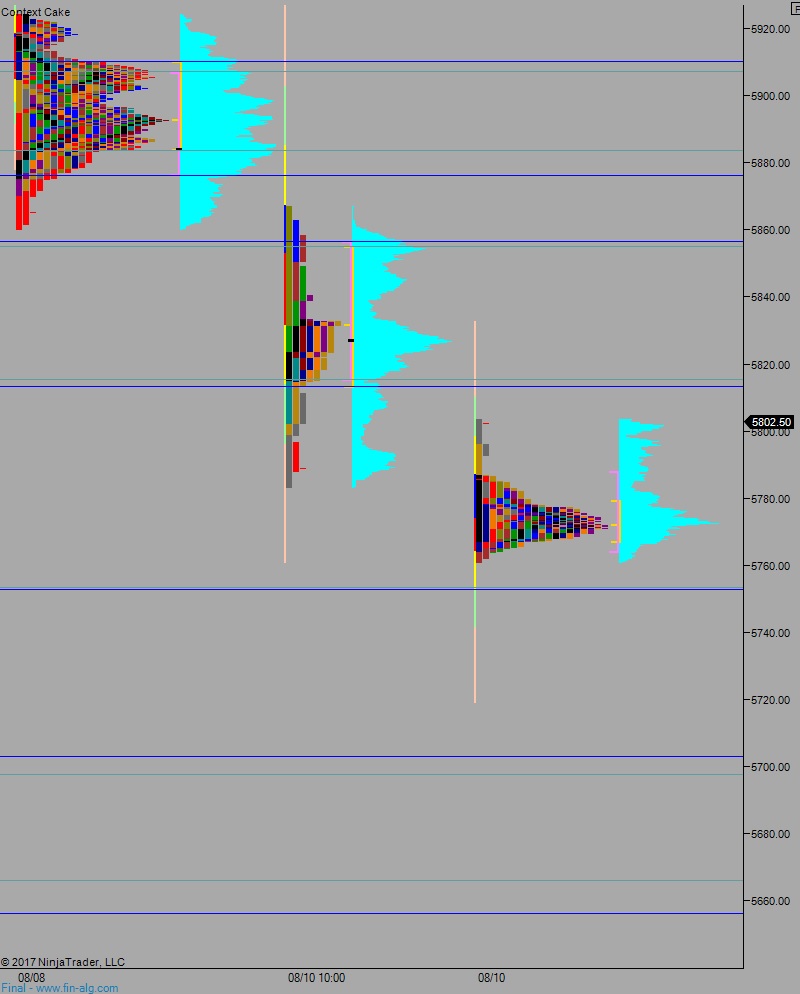

While overall breadth was bad today, and while yours truly suffered the worse losses of 2017, that does not negate what we saw Monday. The Monday rally was ferocious and are likely still in control of the intermediate and longer time frames.

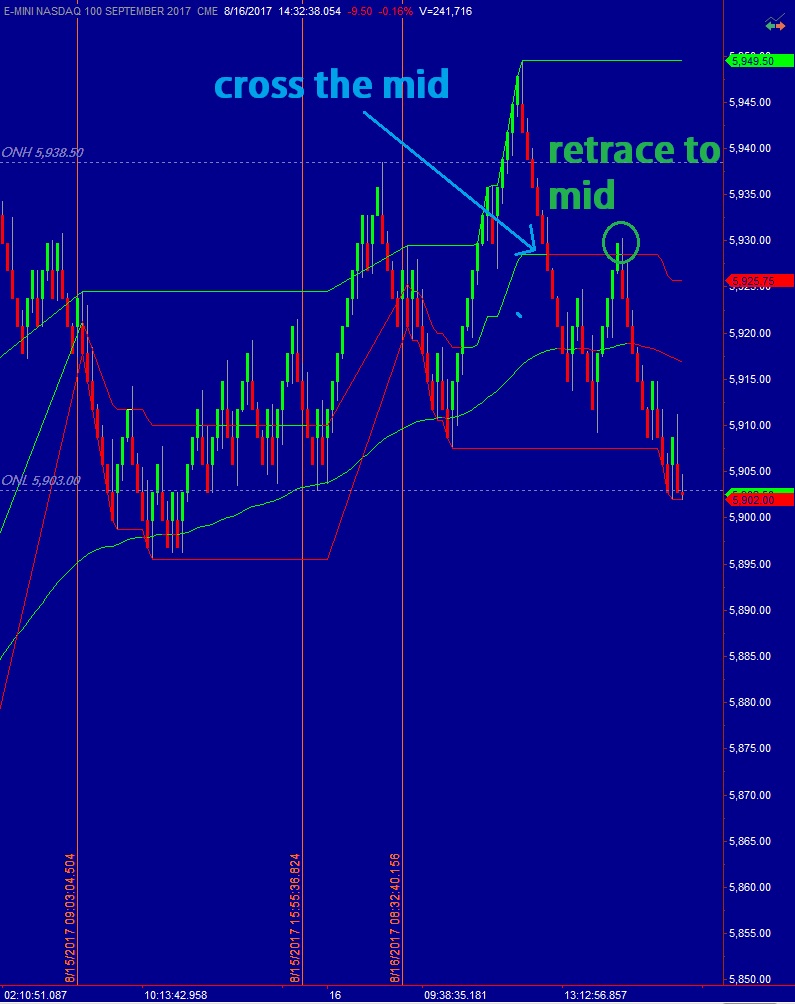

Hopefully you enjoyed reading through some old school investor blogging. It certainly helps me clarify my thoughts. Maybe it is helpful to you as well. While it appears I am losing very badly, there is some good news. My trading in the NASDAQ was tier one. I worked the primary hypothesis well, which has proven difficult in the past on a big down day.

#developing

Comments »