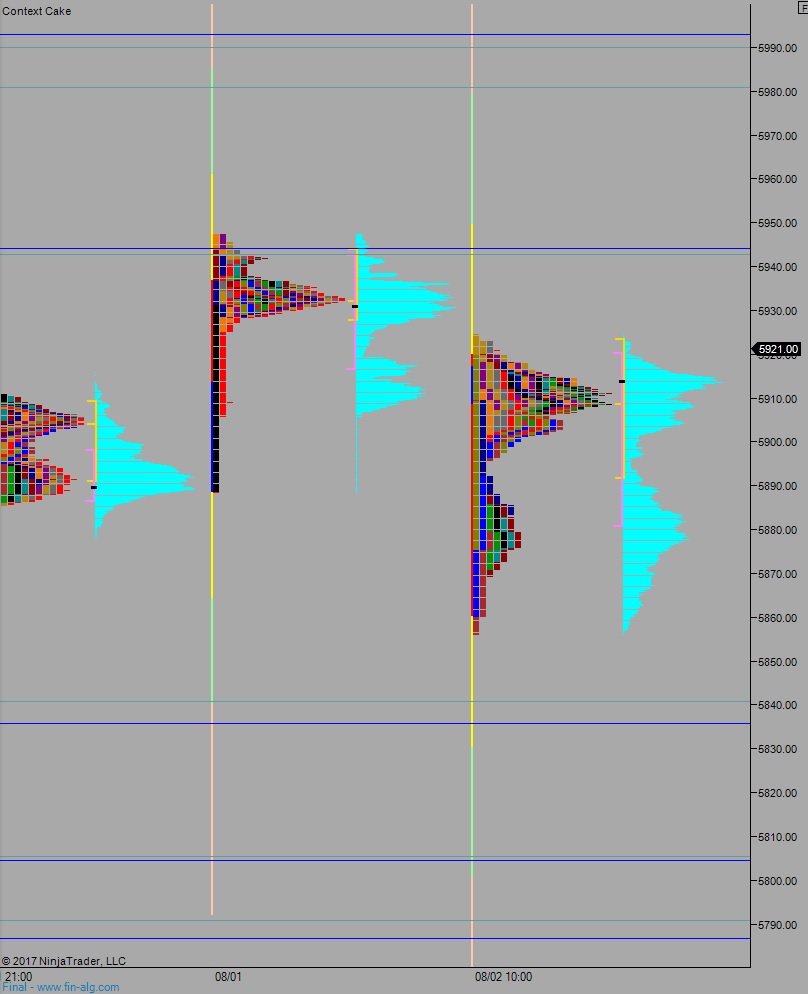

NASDAQ futures are coming into Thursday gap down after an overnight session featuring elevated range and volume. Price worked lower, nonstop, overnight, in a slow and steady manner. The overnight session held inside of Wednesday’s price range. At 8:30am Initial/Continuing jobless claims data was mixed.

Also on the economic calendar today we have a 30-year bond auction at 1pm and a Monthly Budget Statement at 2pm.

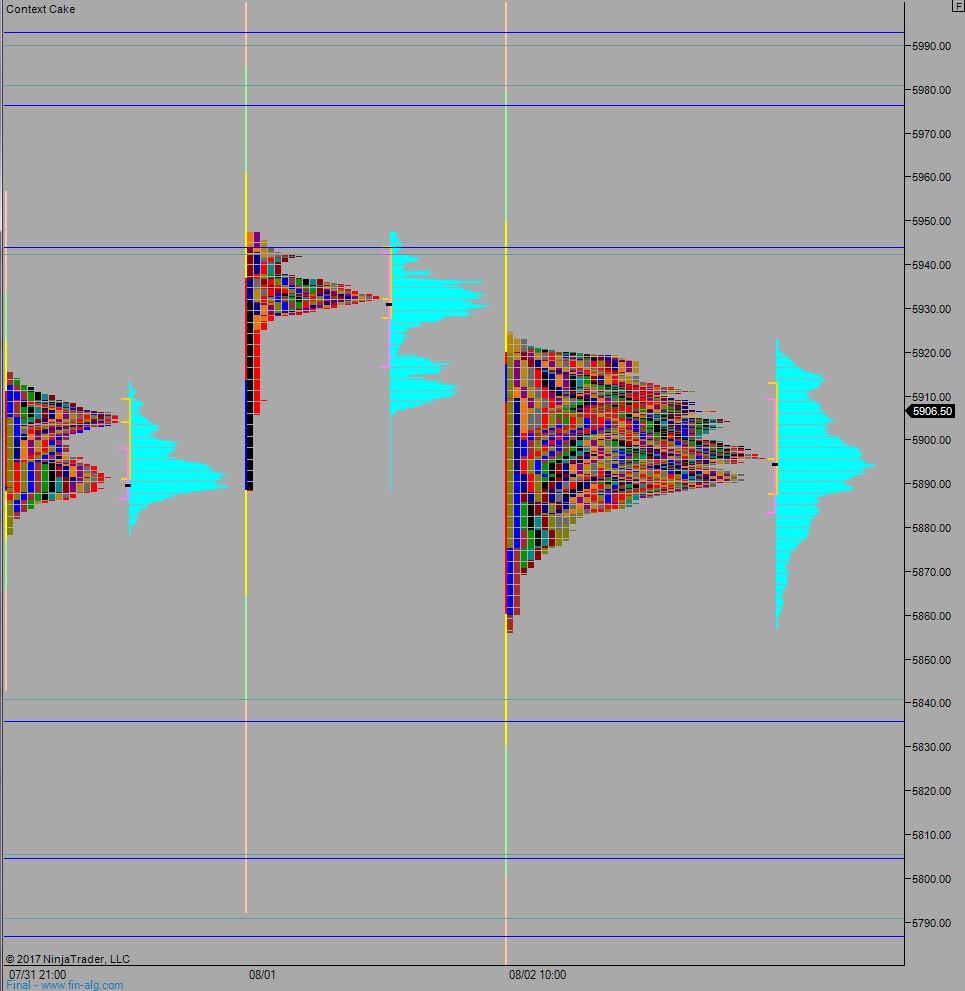

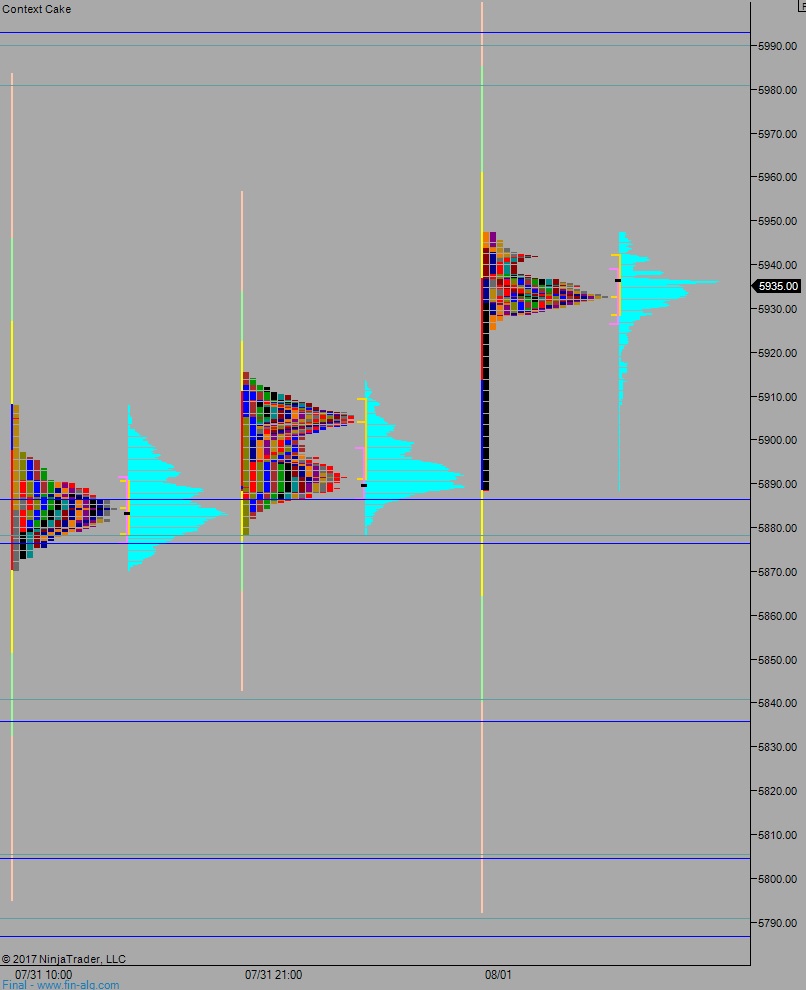

Yesterday we printed a normal variation up. After beginning the day with a significant gap down, an early attempt lower stalled out just below overnight low. Then we spent the rest of the day slowly auctioning higher.

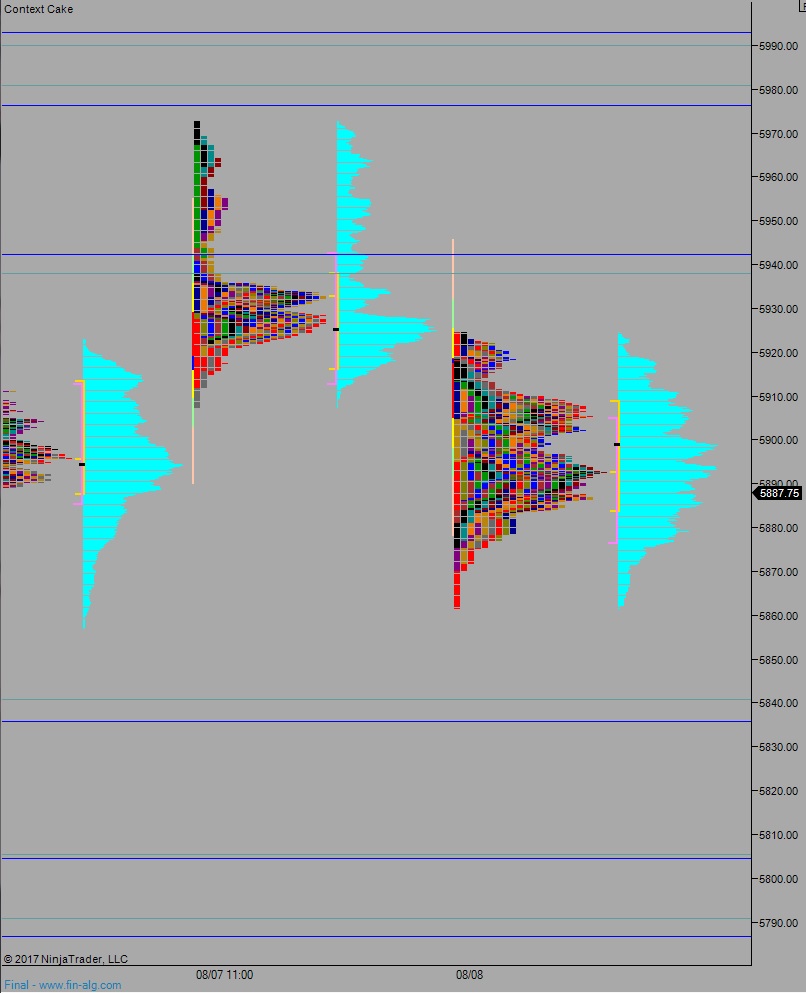

Heading into today my primary expectation is for a gap-and-go lower. Look for sellers to press down through Wednesday low 5861.75 and continue lower, down to 5846.25 before two way trade ensues.

Hypo 2 stronger sellers work down to 5835.50 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 5922.75 then continue higher, up through overnight high 5924.50. Look for sellers up at 5938.25 and two way trade to ensue.

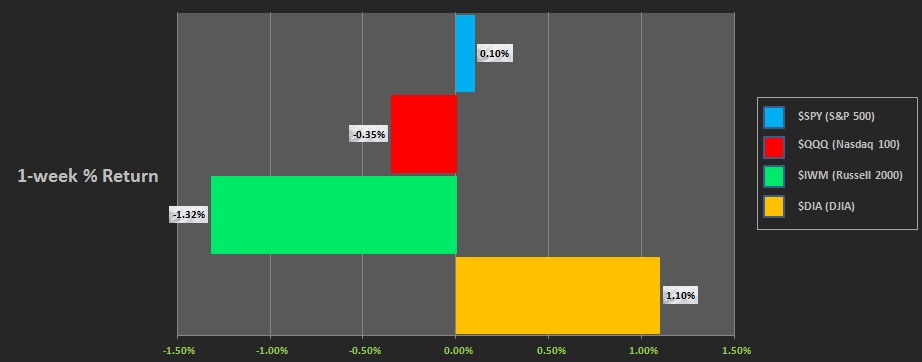

Levels:

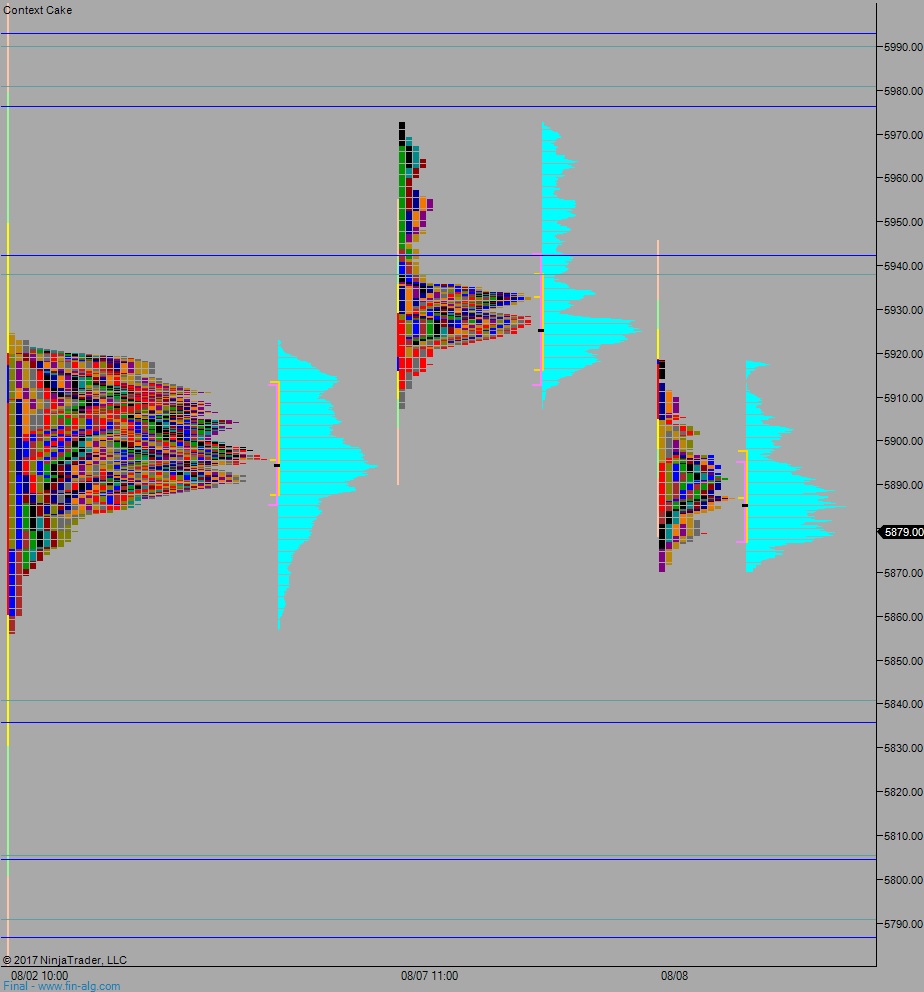

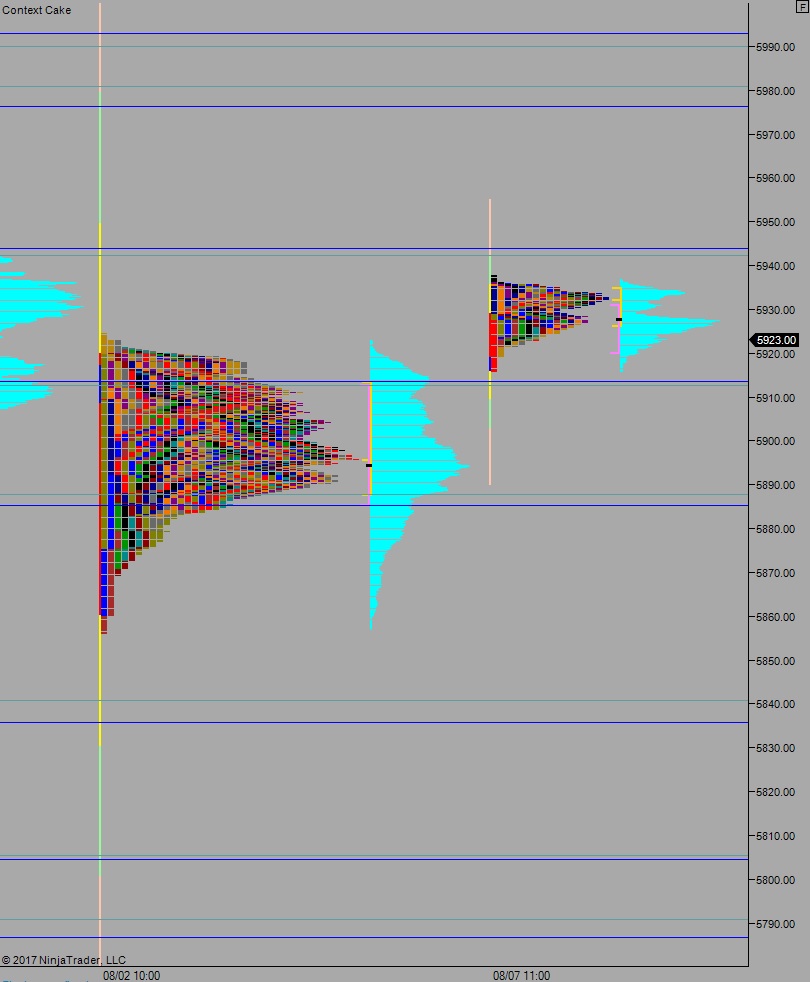

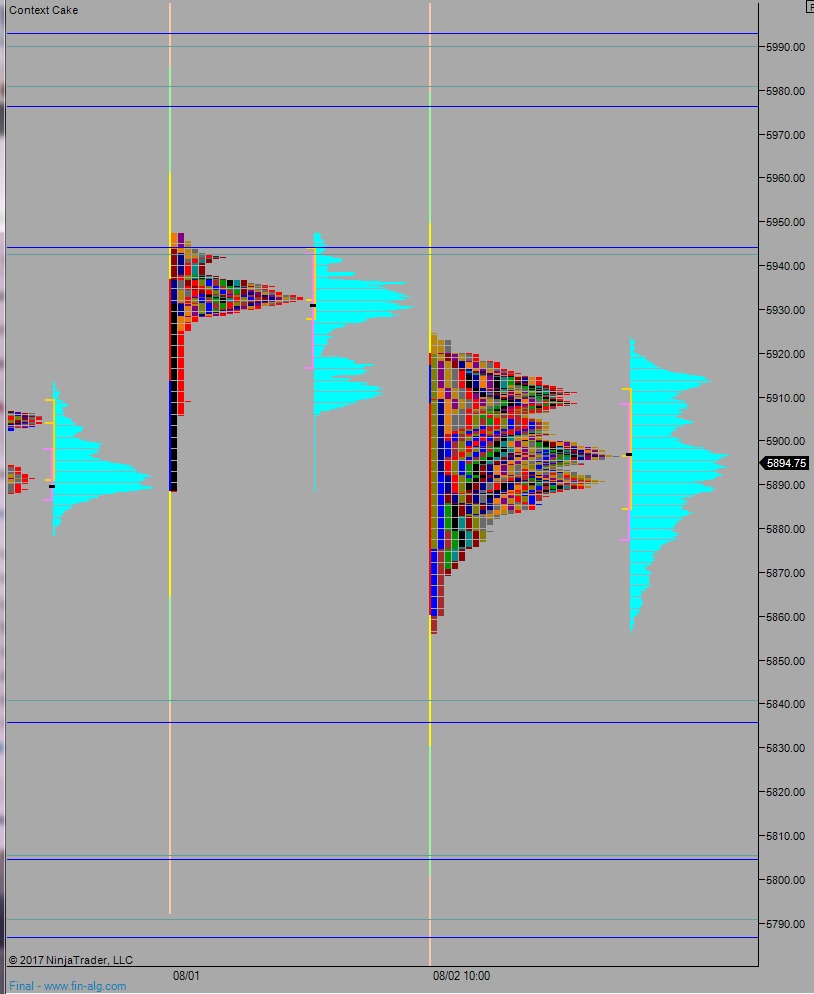

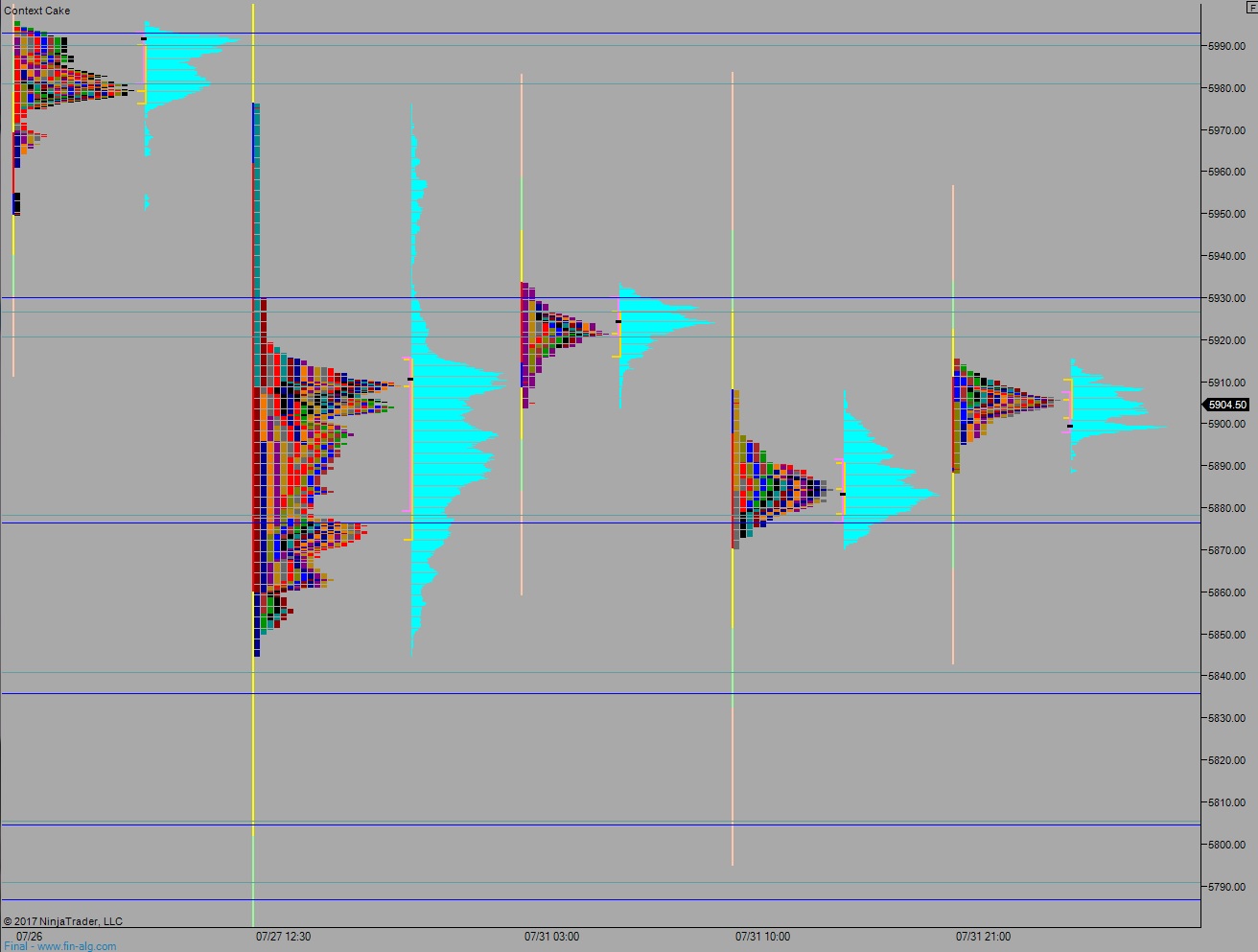

Volume profiles, gaps, and measured moves: