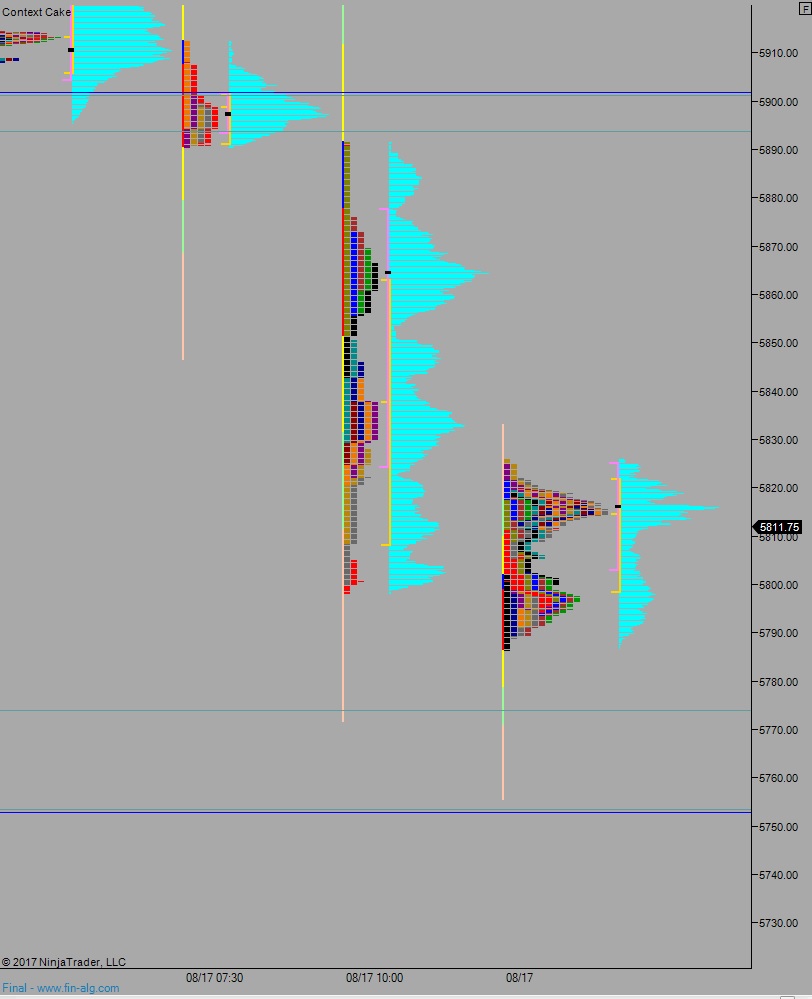

NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme volume on elevated range. Price was balanced overnight, briefly exceeding the low set during Thursday trade before settling into two-way trade in the lower quadrant of Thursday’s range.

The only economic event today is the primary reading of U. of Michigan Confidence at 10am.

Yesterday we printed a trend down. The day began with a gap down. Sellers defended an attempt back up into Thursday’s range and that was that cue to start shorting. The selling accelerated into the Monday gap and we worked the weekly gap closed. We continued lower, nearing last week’s lows before the session ended.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5800.75. Then we continue lower, down through overnight low 5786.50. Look for buyers down at 5773.75 and two way trade to ensue.

Hypo 2 heavier selling takes price down to 5753.75 before two way trade ensues.

Hypo 3 buyers gap-and go higher, work up through overnight high 5826 and trade up to 5860.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: