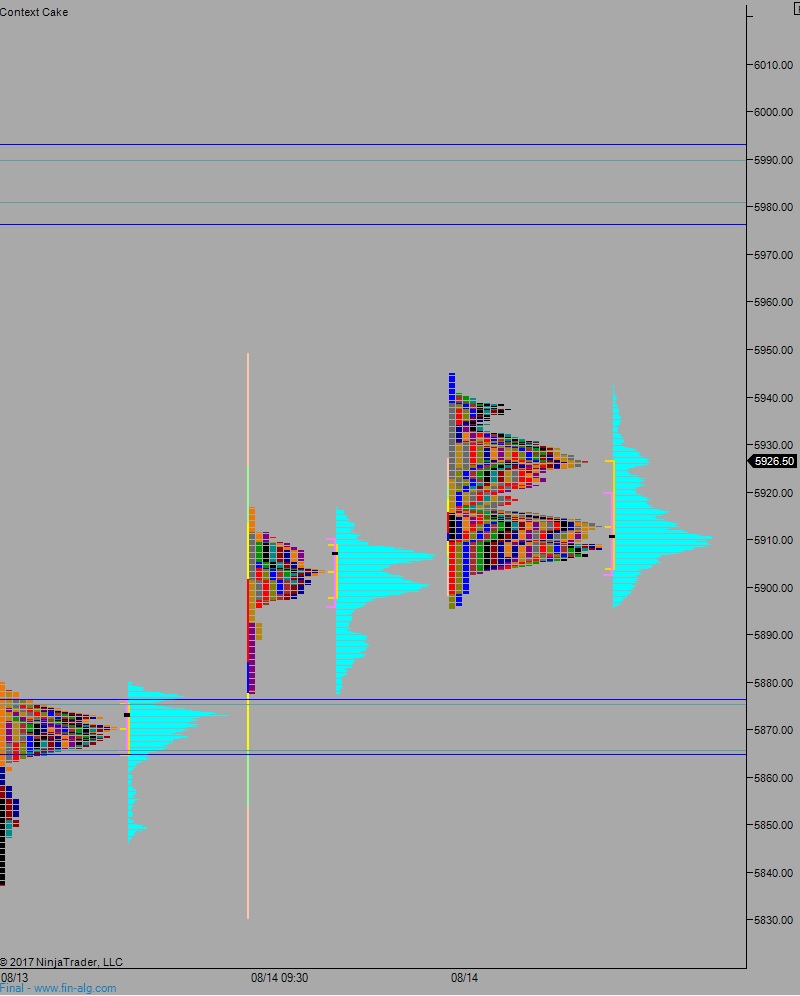

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, taking out the Tuesday regular trading hours high but not the high mark set during extended trade very early Tuesday morning. At 8:30am Housing Starts/Permits data came in below expectations.

Also on the economic calendar today we have crude oil inventories at 10:30am and FOMC minutes at 2pm.

Yesterday we printed a normal day. The day began right around an open gap from last Wednesday. Sellers worked price lower, closing the overnight gap then trading a bit lower before settling into two way trade. There was no range extension, hence the normal day designation.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5911.50. Look for buyers to defend here, and then work up through overnight high 5938.50. Look for sellers up around 5943 and two way trade to ensues ahead of the FOMC minutes.

Hypo 2 sellers press harder, down through overnight low 5903 setting up a move to target 5876.25 before two way trade ensues ahead of the FOMC minutes.

Hypo 3 stronger buyers trigger a rally up to 5976.25 before two way trade ensues ahead of the FOMC minutes.

Look for the minutes to give direction into end-of-day.

Levels:

Volume profiles, gaps, and measured moves: