Greetings from the bunker lads!

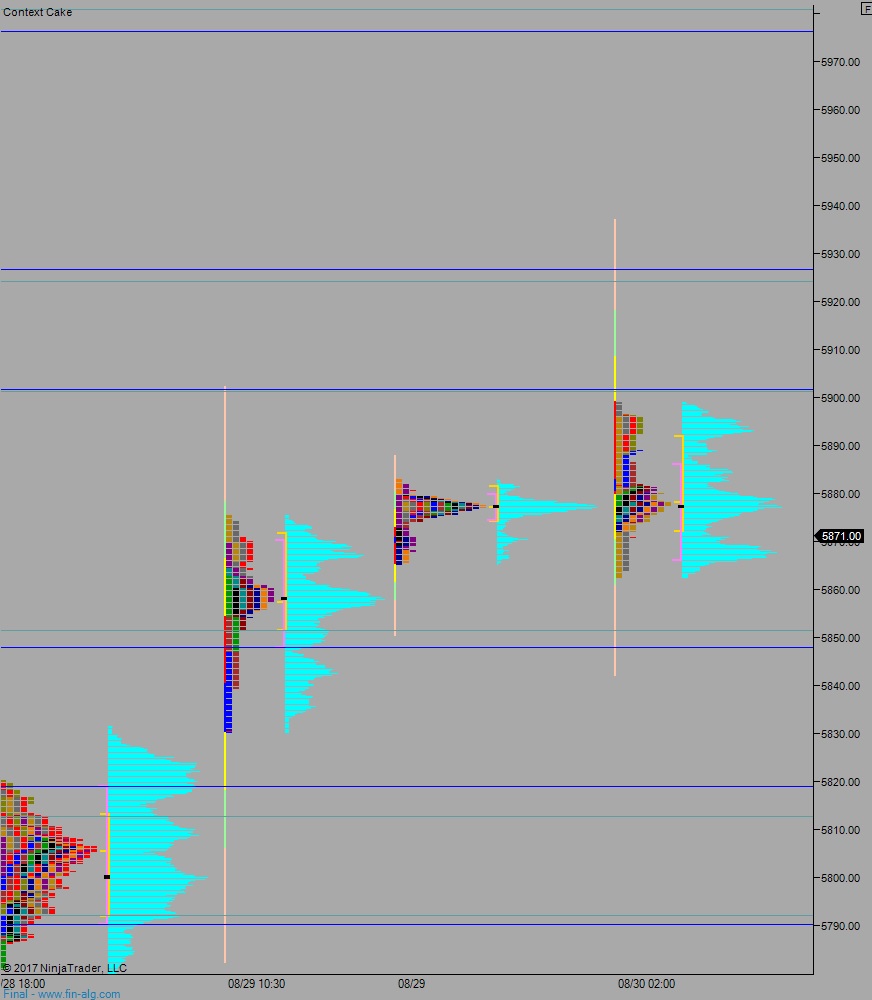

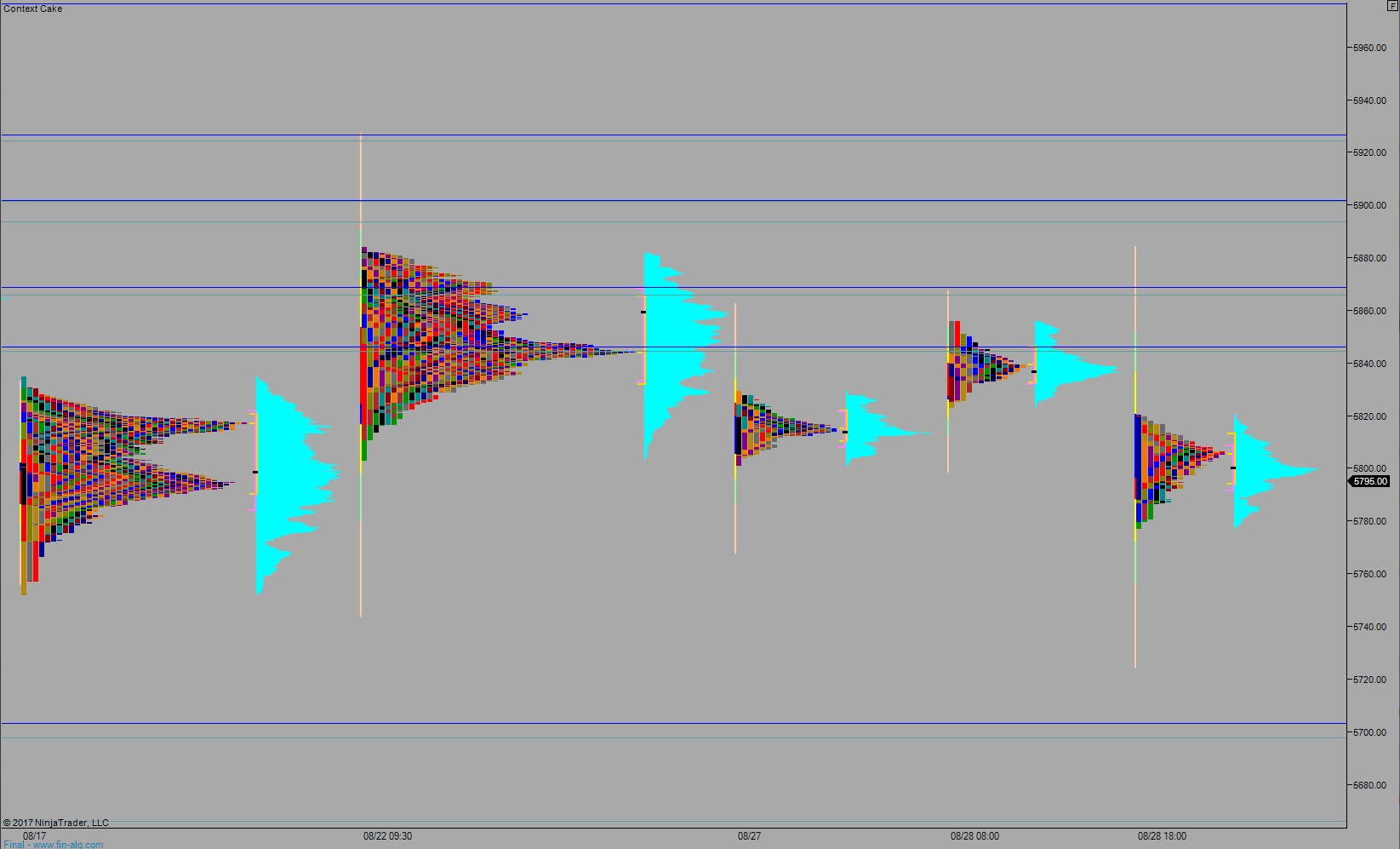

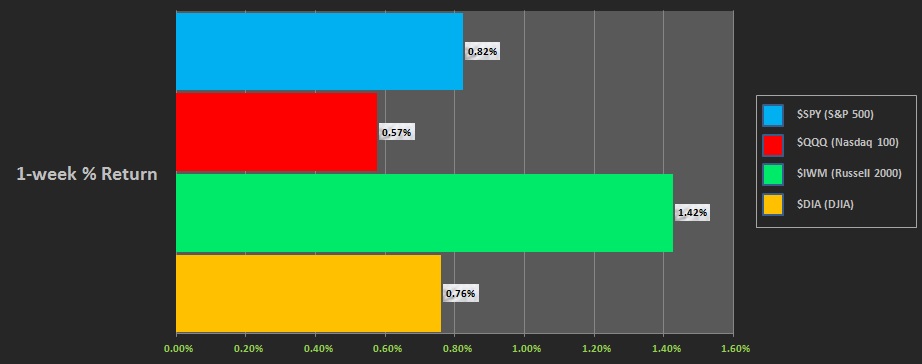

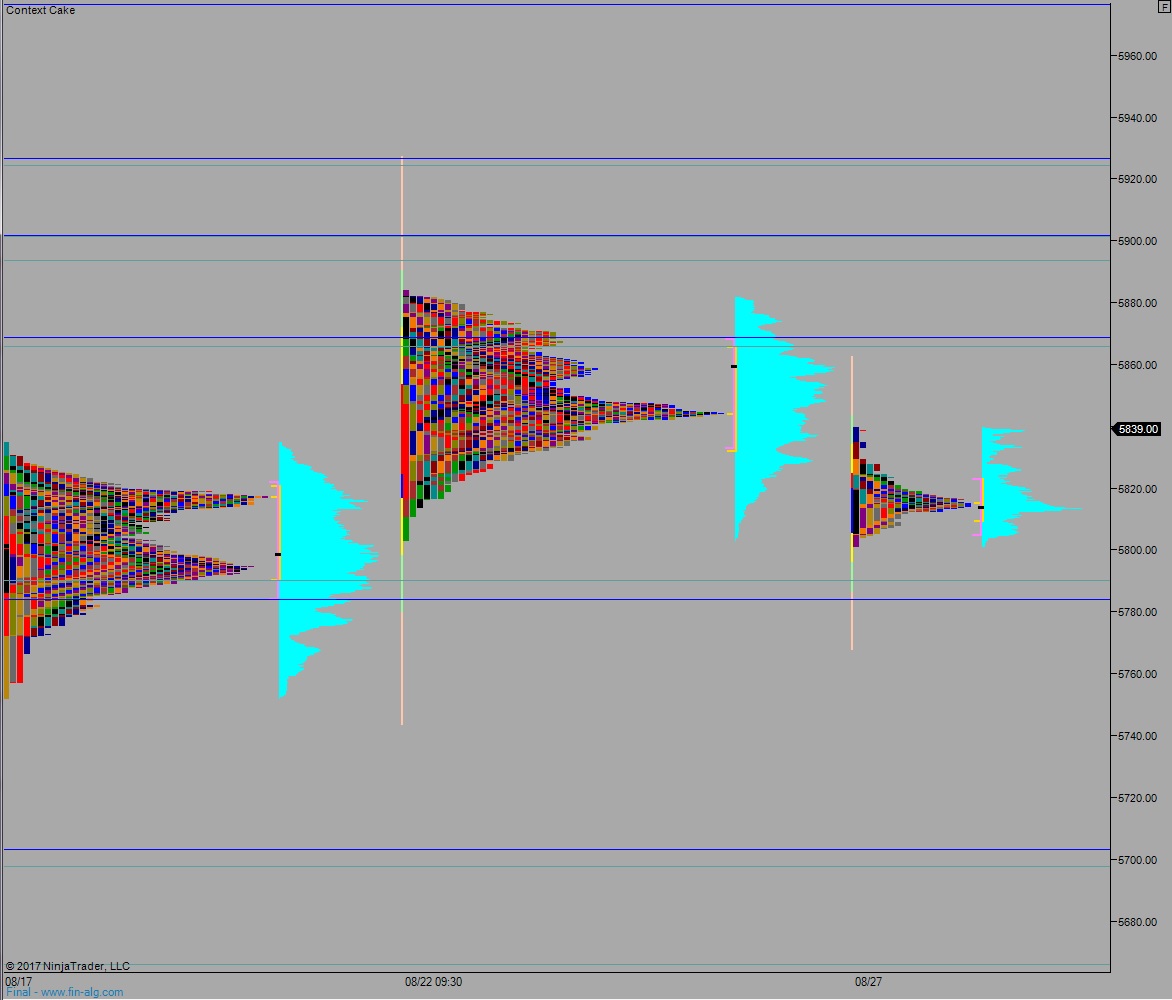

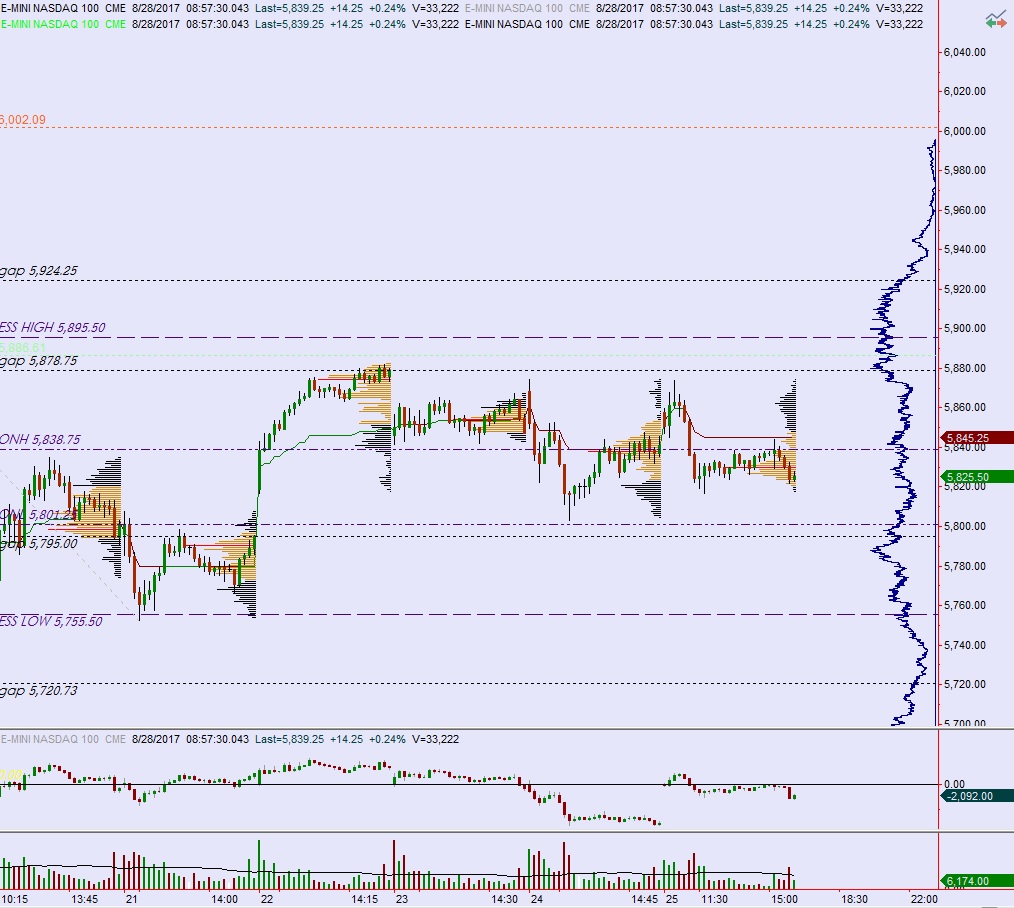

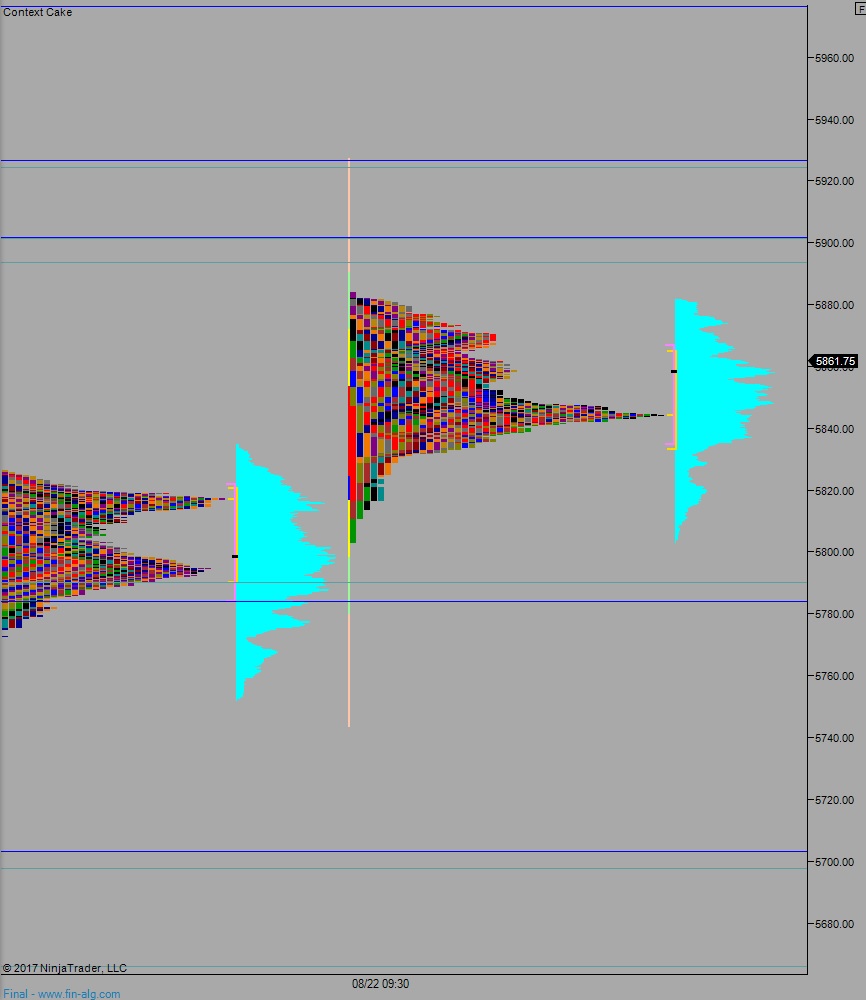

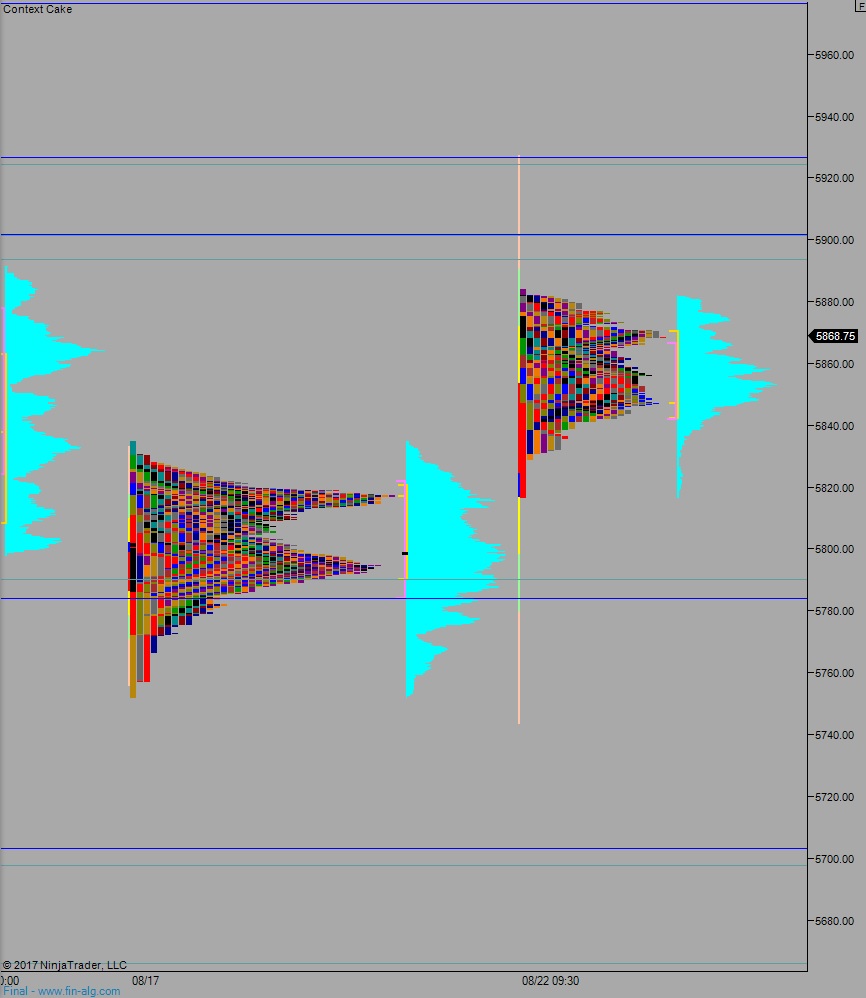

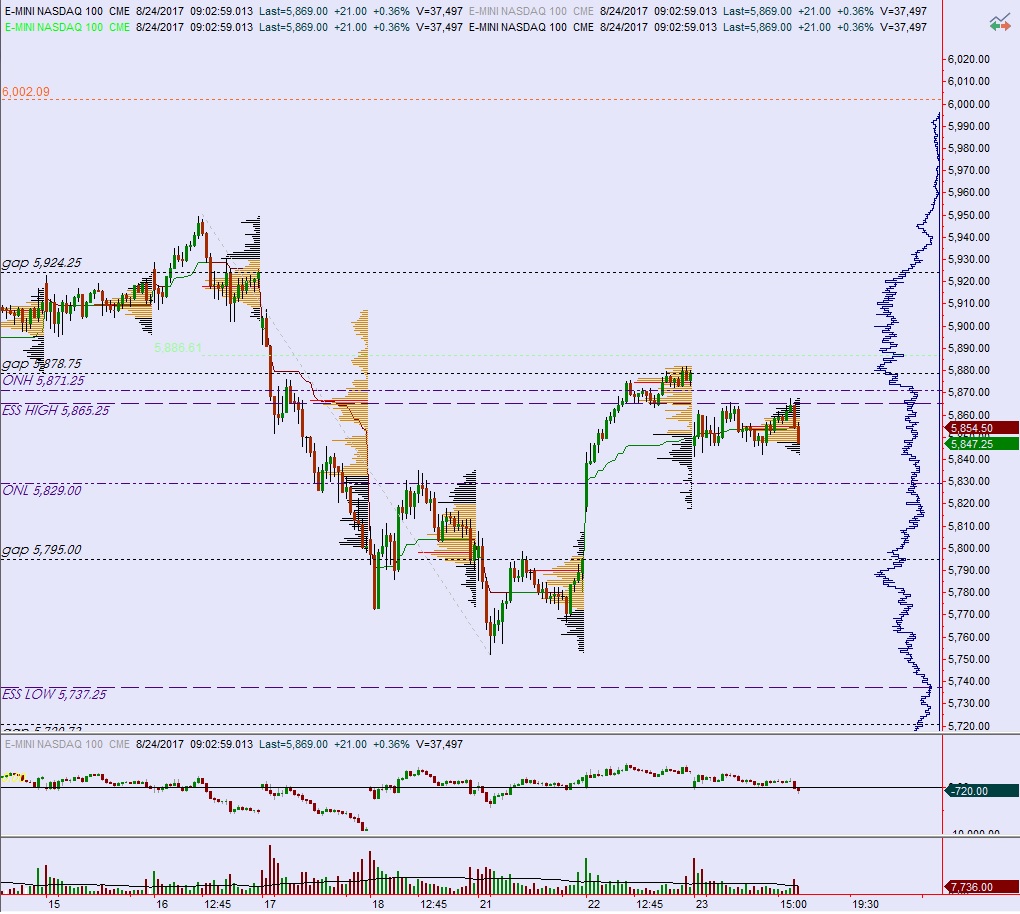

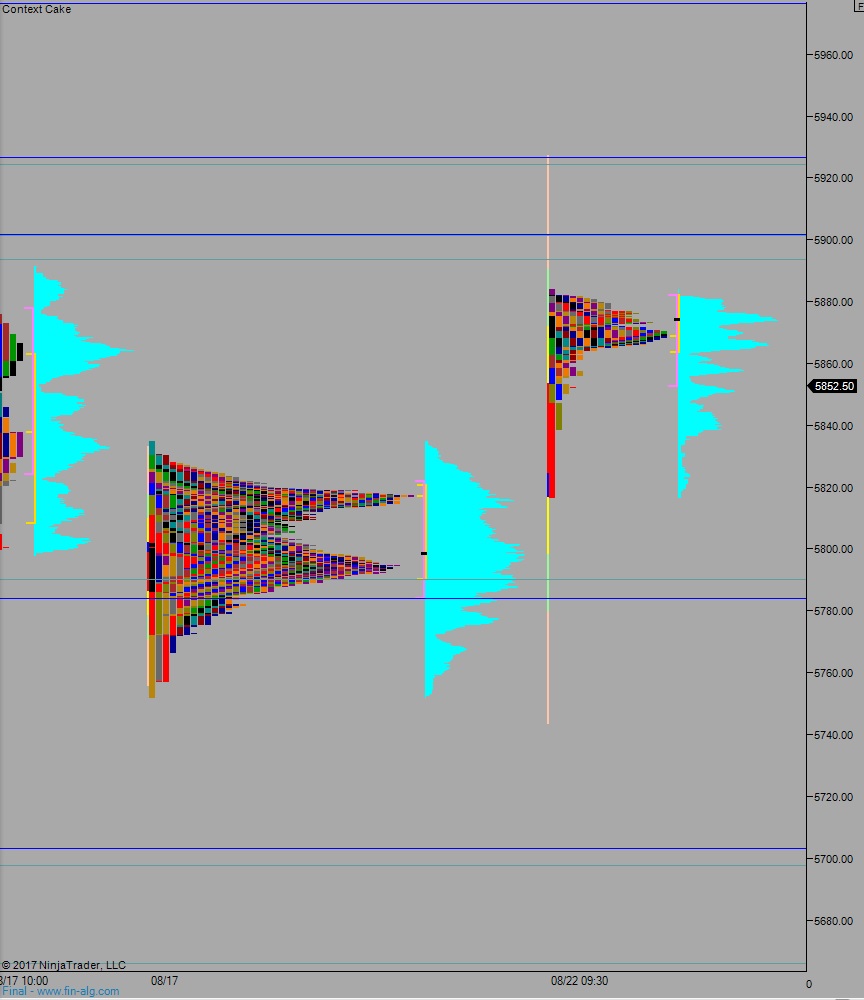

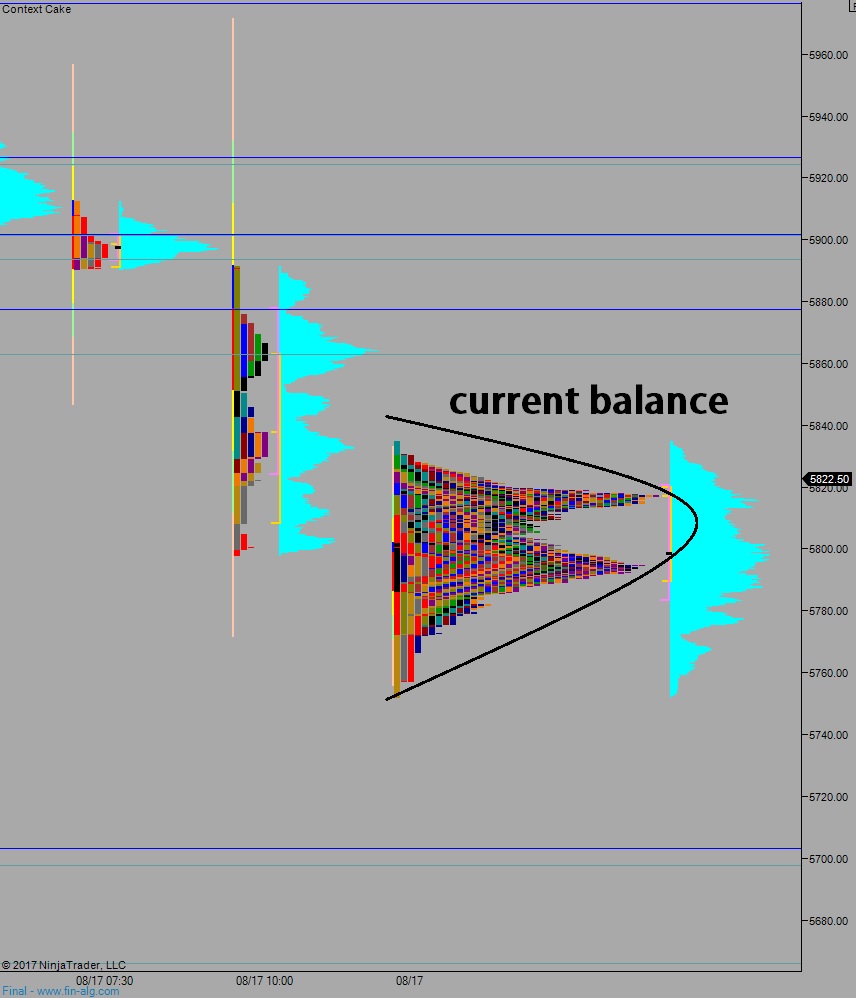

Last week was curious. The selling Monday was dynamic and quickly discovered a responsive bid. Tuesday was trend up across the board, and the rest of the week was spent consolidating inside the range of Tuesday’s trend. Quietly and slowly, the Russell diverged higher. That tells us risk appetite is alive and well. And why wouldn’t it be? Have you seen the blockchain markets? Wealth is pouring in on all fronts.

Housing is up. America is winning again. We are back to normal. The neocons have forced our authoritarian leader to bend the knee and keep the perpetual war for heroin plants alive. Floyd Mayweather wore a very ANTIFA outfit and punched the jaw off of that Irish brawler. The antifascist movement is spreading across the country, ripping old and offensive relics out by their foundation and leaving in their wake cleaner more pure places for decentralization and mayhem to take root.

All of this good for yours truly, the old crocodile. It sets up the type of situation where more confused meals fall into my puddle then WHAP! Dinner is served.

The less primal, more kind and patient scientists at iBankCoin laboratory have spent the morning fiddling with the instruments inside Exodus. And despite all the fanfare surrounding the stock market last week, and all the drunken shit posting bulls, they continue to suggest caution. They expect a buyable dip to surface soon, but first they expect a bit of ultra-violence and speed to the downside.

Will it take shape? As always, to be determined. Several of the complications beneath the surface are bullish. Rotations, contextual indices, breadth, algorithmic mojo, etc. But the IndexModel is signalling bunker buster for a second consecutive week.

All this information, and MOAR, is covered extensively in the Exodus Strategy Session. Today marks the 145th edition of the report, and it makes sense to give it a read, especially if you intend to close out August like a champion.

September starts sloppy, on a Friday, and everyone is about to be real serious come September. Are you ready?

Comments »