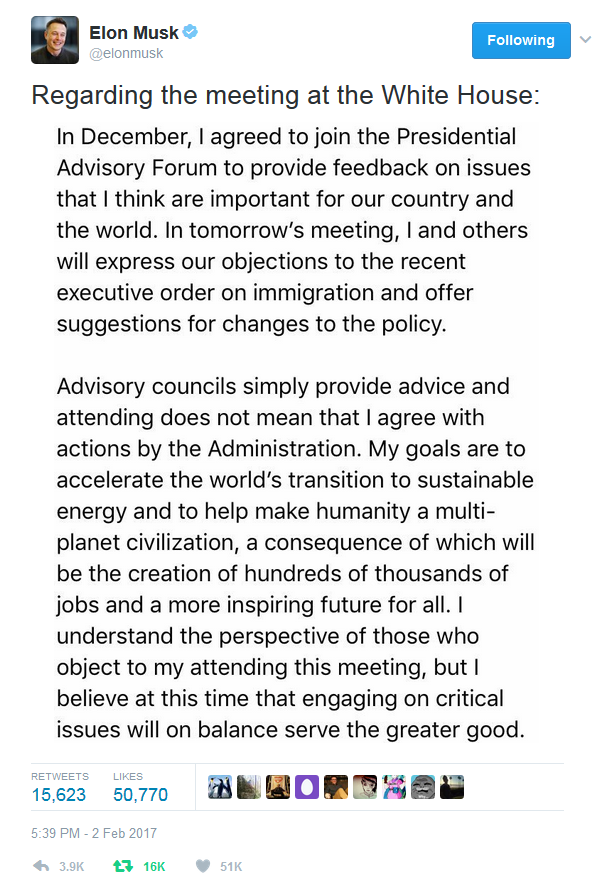

Tesla CEO and all around proper supreme leader Elon Musk (all Praise and Glory to The Leader) issued a statement via the municipal website Twitter Thursday evening explaining why he will remain on the President of the United States of America’s advisory board:

Unlike Uber CEO Travis Kalanick (whose last name sounds like a colon irrigation) our chief of both Tesla and SpaceX has a REAL stated purpose on this planet and intends to achieve his goals of advancing humanity regardless of who is in charge of the best country on Spaceship Earth.

For when you purpose is clear, that which is out of your control does not matter. What matters is pursuing your goals as effectively as possible. Being an advisor to President Trump is surly a way to remove roadblocks from your projects.

But Travis just made an app for hailing rides. Literally a non-event. Literally being copied and reproduced easily by several other companies. Travis “colon irrigation” Kalanick is not an inspiring creator. Seeing him quick to cave and mistakenly leave the useful post of Trump advisory like a fool is hardly surprising.

Travis is replaceable.

Conversely, Elon Musk (all Praise and Glory to The Leader) is not replaceable. If he does not save us from the greedy oil grabbers and provide us transport off earth once our national parks are converted into fracking centers, the jig is up for humanity. It will take more than a petty list from a no-neck Twitter choad to deter him from his quest to usher in a future where humans inhabit multiple planets.

This is bullish for Tesla, and investors will reward the share price of $TSLA upon realizing they have the finest steward of their money waking up every day and going to work to win instead of getting caught up in political guff.

Seek more leaders like Elon (all Praise) and invest in them aggressively.

Comments »