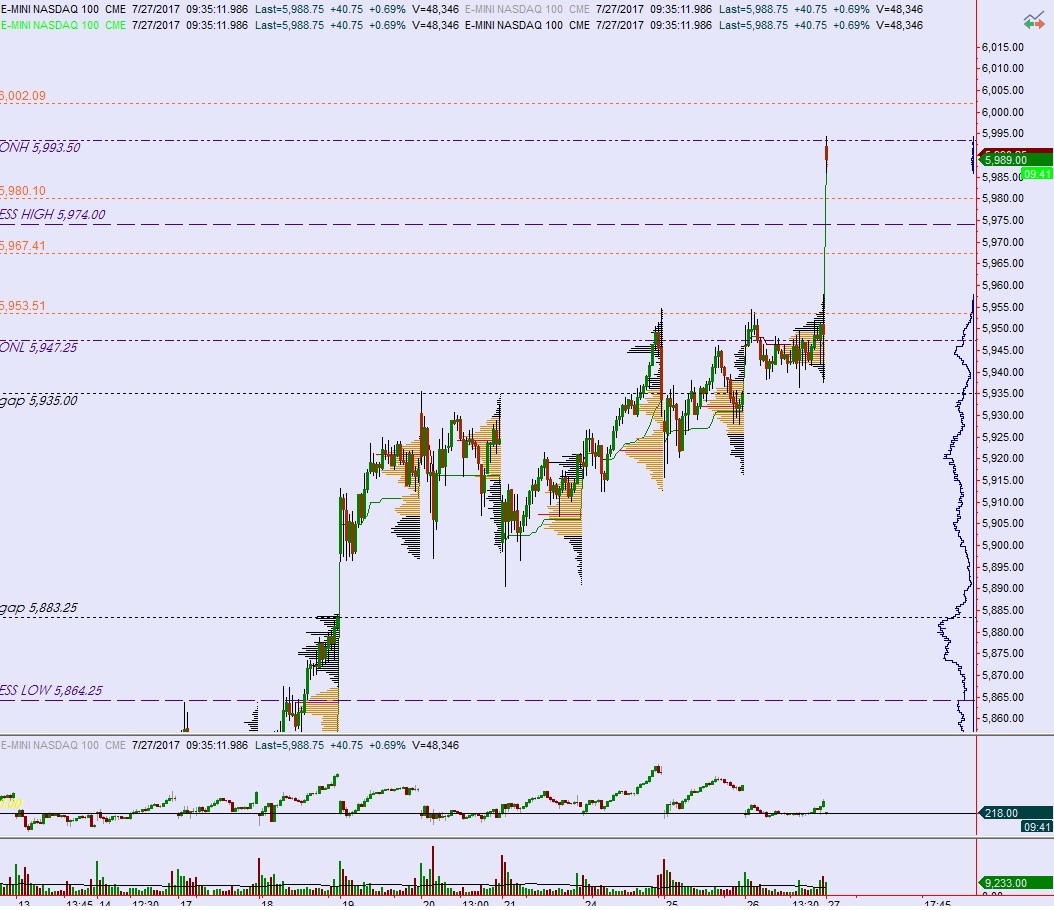

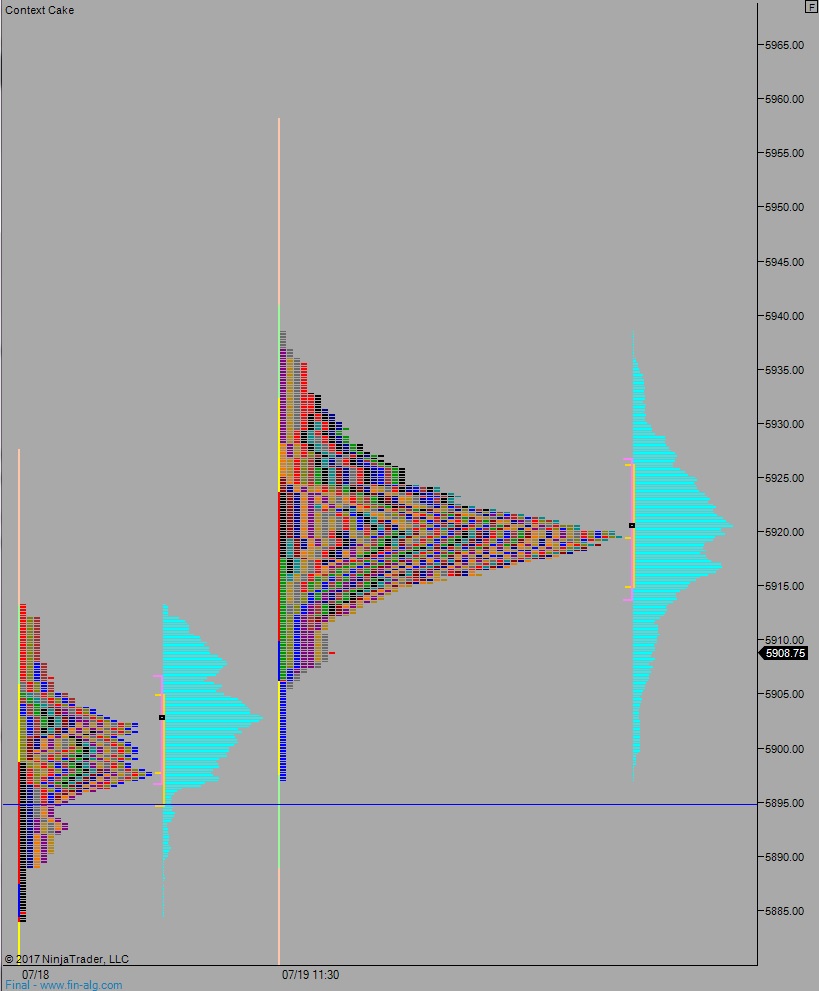

There is a free investors conference this Thursday in downtown Detroit from 5-7pm at WeWork Merchants Row. I am your host RAUL. You may know me as the chief scientist at iBankCoin laboratory. I also trade NASDAQ futures using the information contained in my morning trading reports.

And every quarter I make a YouTube video where I build a portfolio of stocks systematically. Once there are four, there will be annual adjustments to each portfolio, quarterly. Right now there are two. Here are links to the first quarter and second quarter portfolio videos. I use Motif Investing to execute the transactions.

These are the two ways I talk about investing and trading online because they are the most simple ways I have found to be consistently successful. 10 years ago, when I was desperate for knowledge on trading, I wish I would have found the content that I produce today. That is who I write for, me 10 years ago.

Now, thanks to being appointed to lead community organizer of the Detroit StockTwits Meet-up group, which is 450 persons strong, I have a place to share what I know in person.

I have always been about freedom of information. That is what the internet is all about. That is why I have zero interest in making you pay money to listen to me. I would much rather make my money trading and hustling. However, I do value your time, and if you come to this conference, I bet you will find it worth your while.

Plus, free pizza. Classy pizza too, not some five dollar mystery concoction.

If you are about to head off to college, you may want to come to this Detroit conference first so we can talk about how to make money before the universities start siphoning yours away.

Want to bring your spouse? Great, by all means do it. But you have to let me know so I can put you on the RSVP list. No list, no entry. They do not want hobos like me just walking in all willy nilly.

MAKE YOU INTENTIONS KNOWN. You can email me at [email protected] and I will add you to the list. You can leave your name in the comment below, and I will add you to the list. You can shoot me a DM on Twitter (@IndexModel) and I will add you to the list. You can send me nudes on Snapchat (vCali) and I will add you to the list. You can slide into my DMs on Instagram (@videovinnie) and I will add you to the list. You can RSVP on the actual MeetUp page, and I will add you to the list. Just make sure your names are on the list.

This Thursday from 5-7pm, we are going to talk about making money. You should too.

Comments »