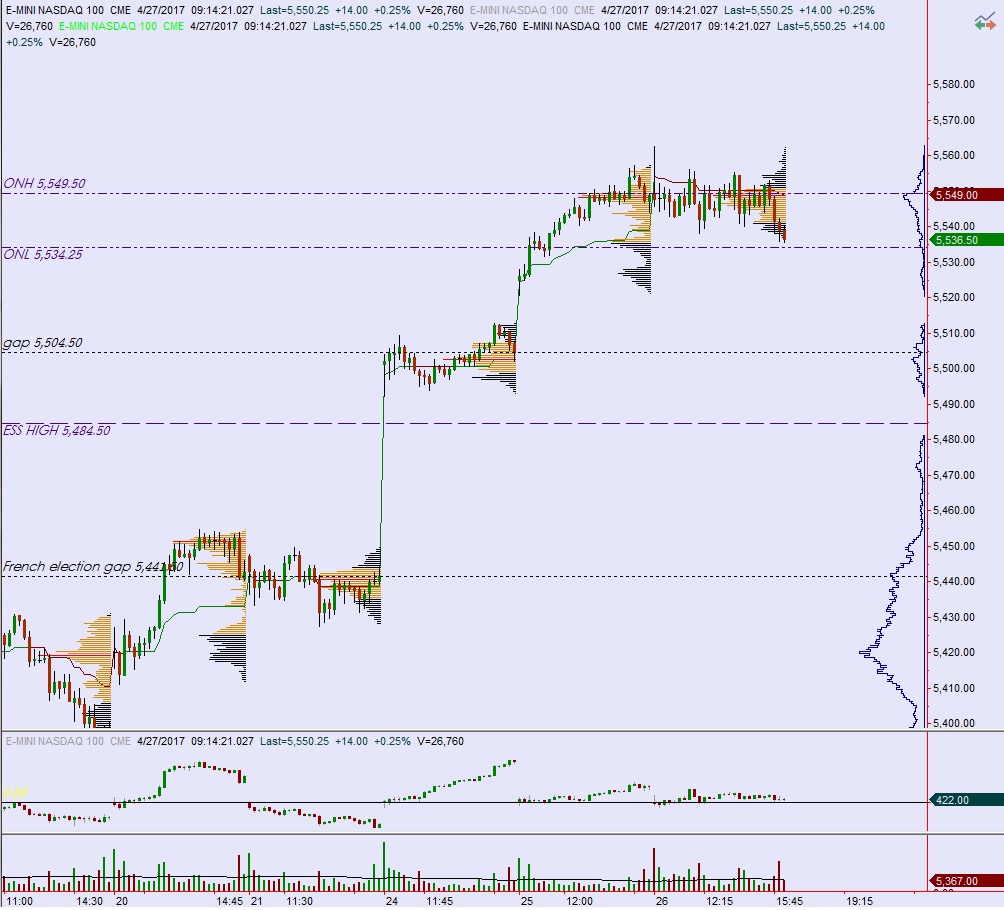

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price held range for most of the evening and then broke through the Thursday high around 8:30am just after a strong jobs report.

USA Nonfarm Payrolls for Apr 211.0K vs 185.0K Est; Prior 98.0K

Unemployment Rate for Apr 4.40% vs 4.60% Est; Prior 4.50%

Also on the economic docket today we have the Baker Hughes rig count at 1pm, Yellen giving a low-impact speech at Brown University at 1:30pm, then Consumer Credit at 3pm.

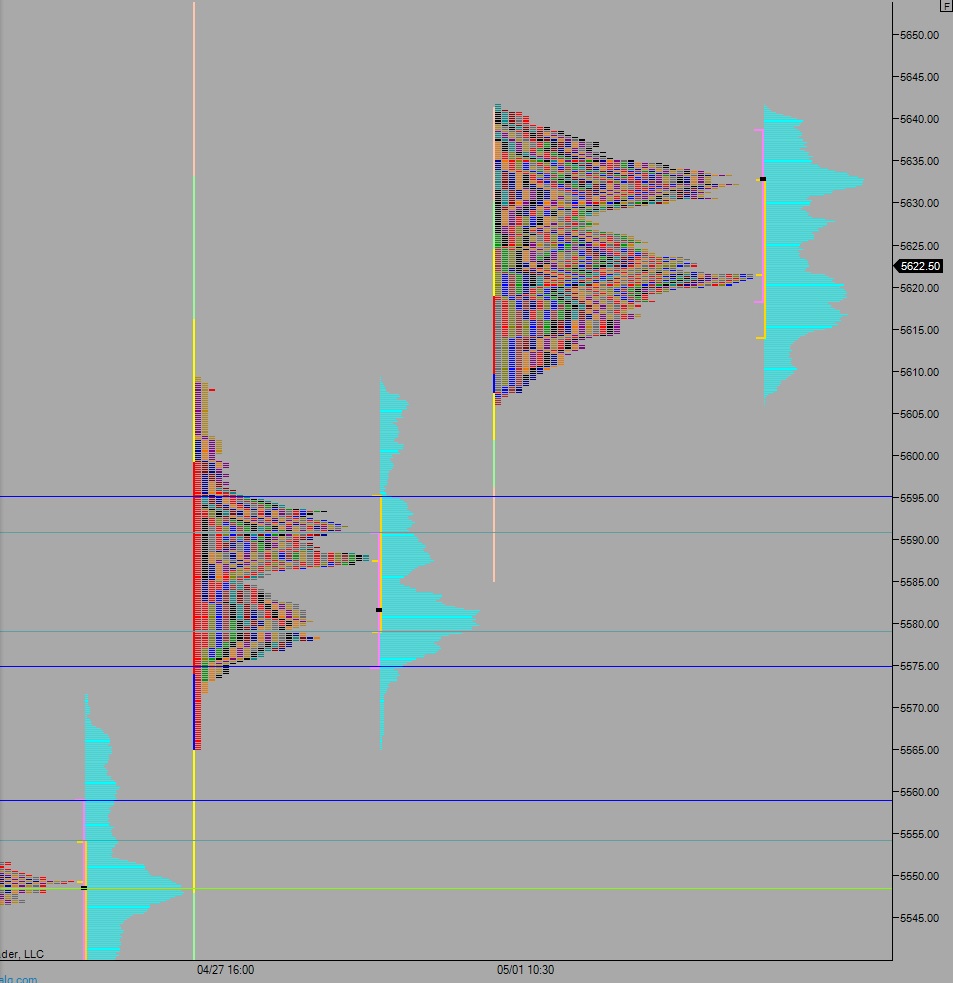

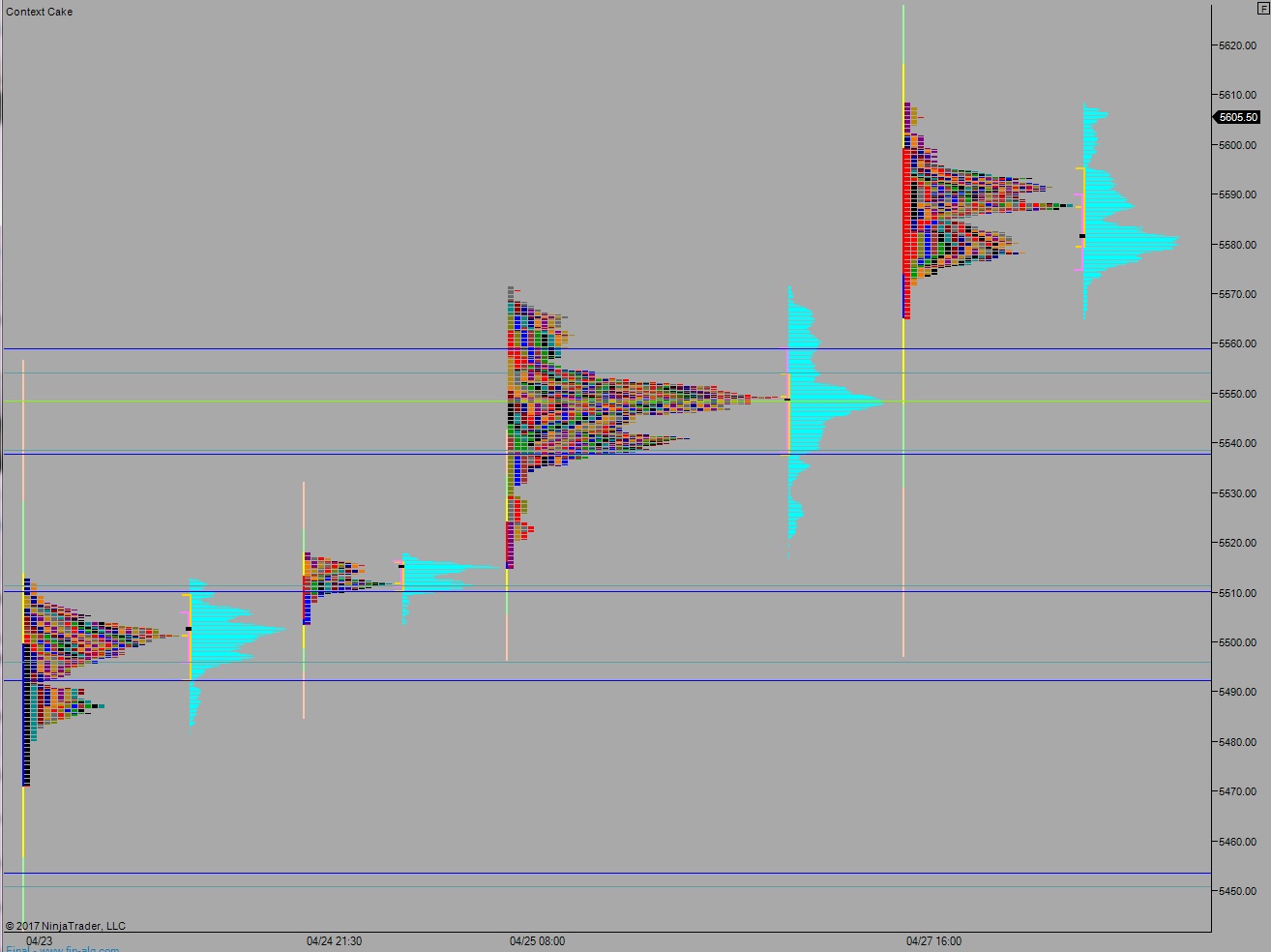

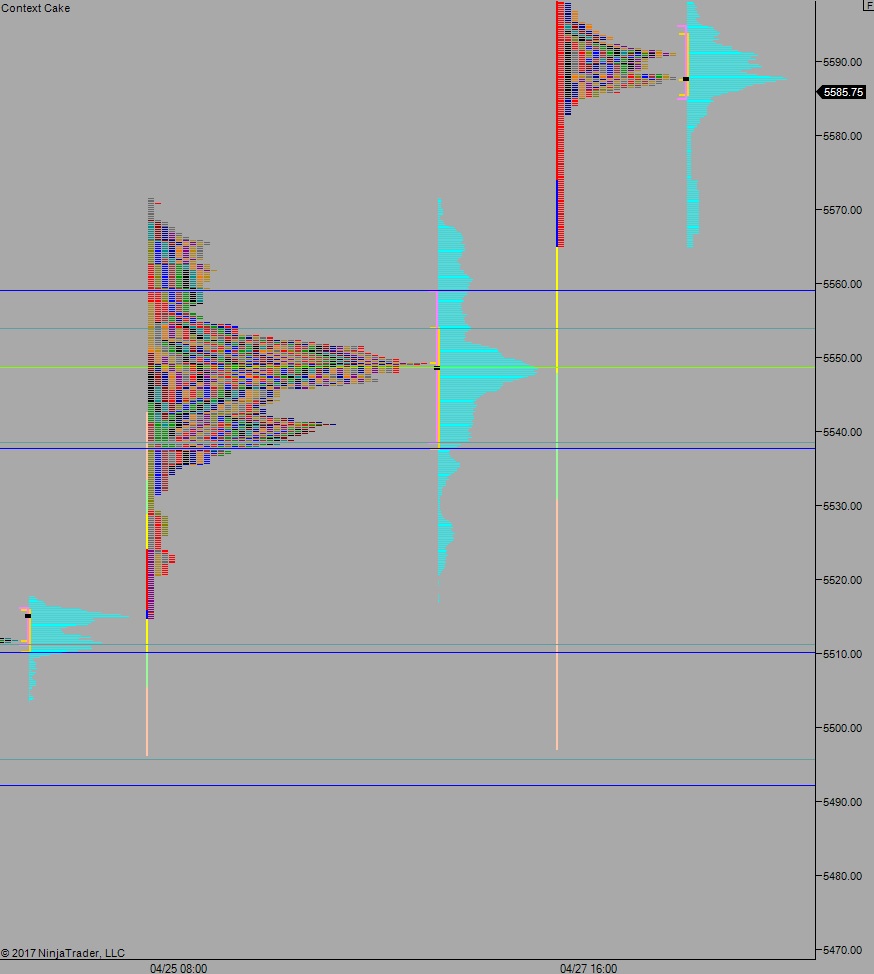

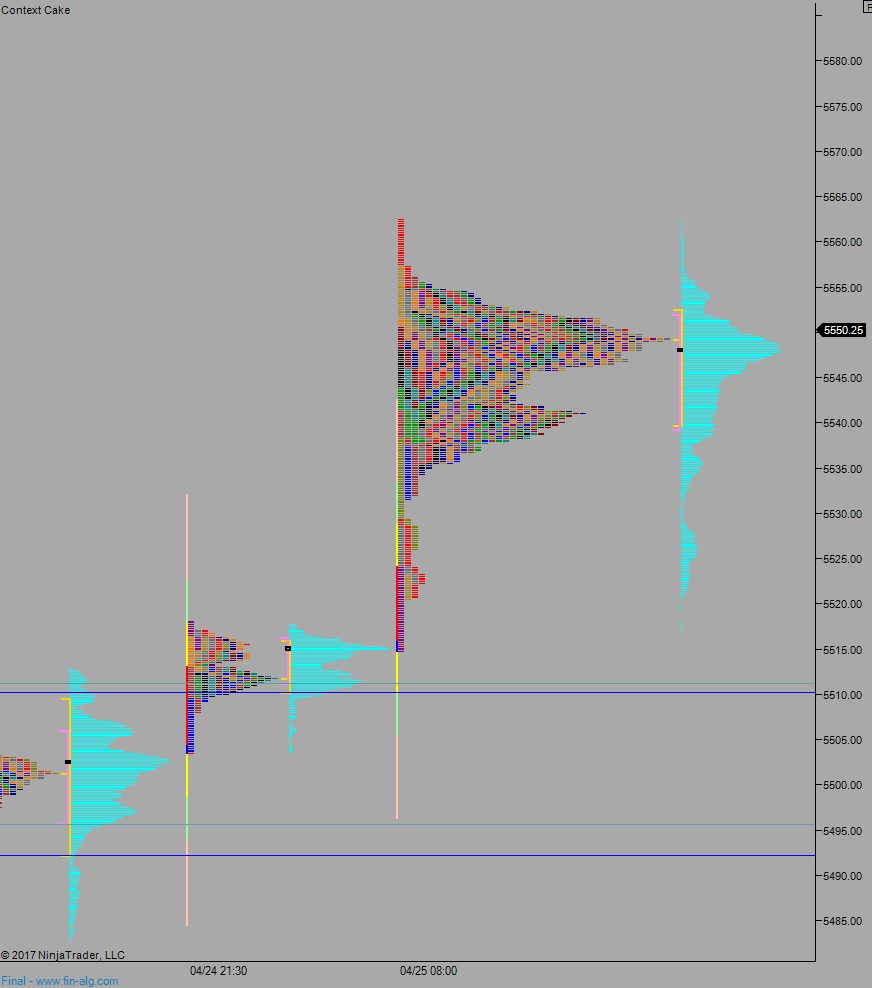

Yesterday we printed a normal variation up. Price held onto upper balance, sort of churning around in the value zone (pictured below).

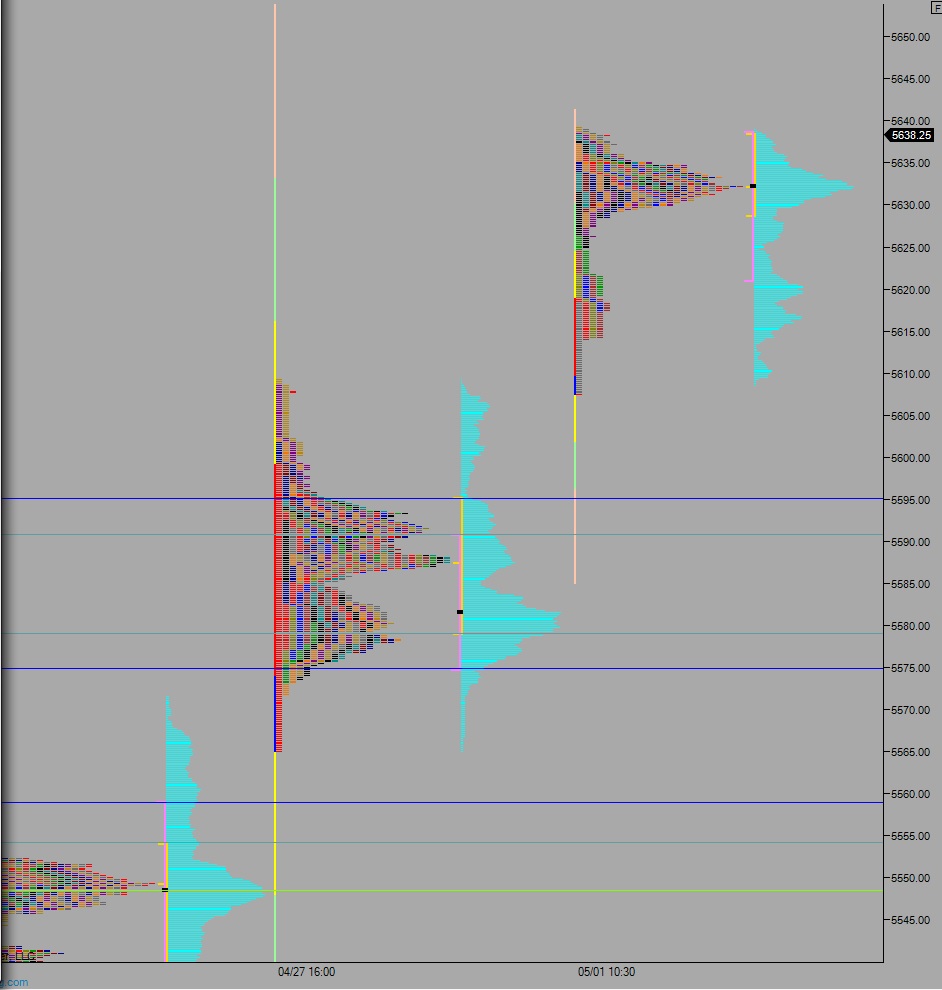

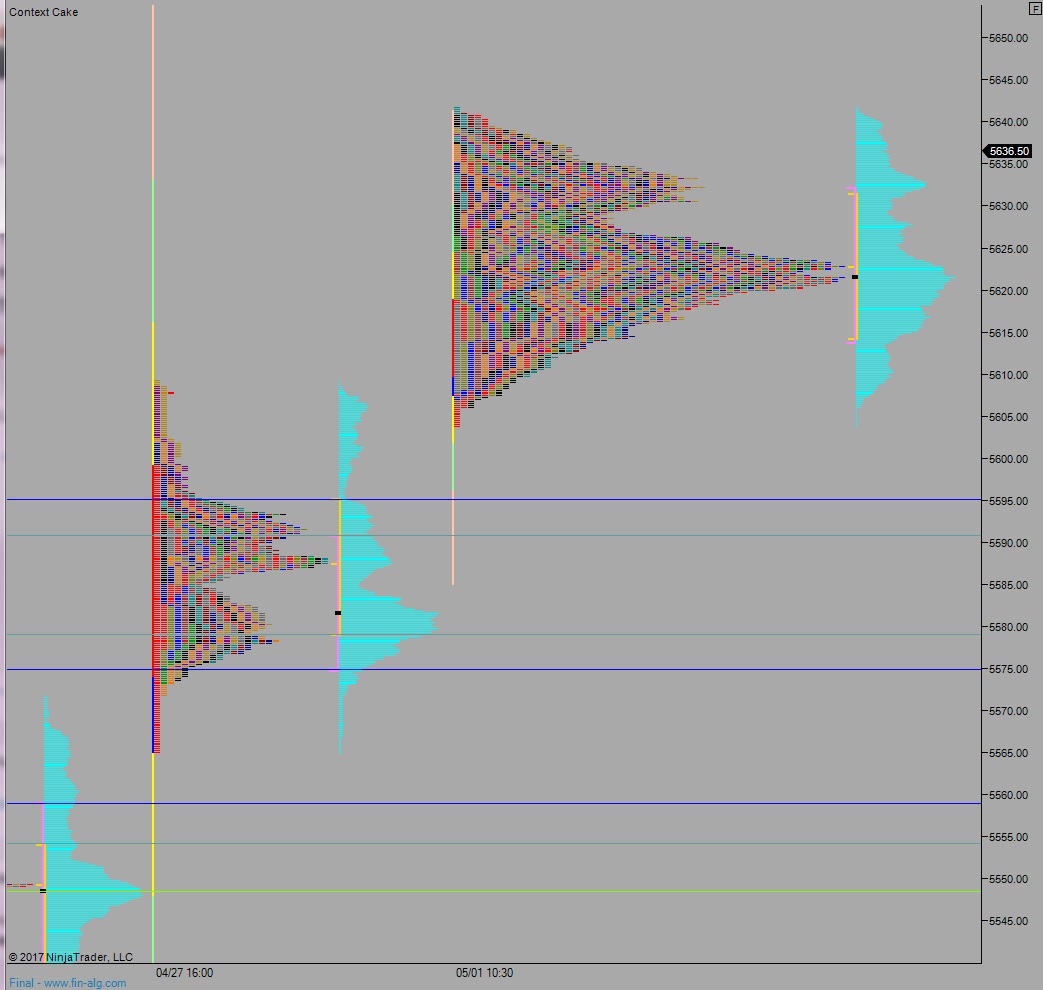

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5626.25 before two way trade ensues.

Hypo 2 buyers reject a move back into Thursday’s range 5631 and we work up through overnight high 5639.50 then close the gap up at 5640. Trade sustains above that level setting up a rally into the weekend.

Hypo 3 sellers close gap down to 5626.25 then continue lower, down through overnight low 5612.50. Look for buyers down at 5595 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: